By Dustin Stone, RTN staff writer – 12.5.2025

For many diners, the most frustrating part of a restaurant experience still comes at the very finish. Long after plates are cleared and desserts declined, guests often find themselves waiting to settle the check, caught in a familiar limbo that strains both patience and staff attention. That friction point has become the focal mission for sunday, a restaurant payments platform that recently raised a $21 million Series B round as it accelerates its expansion in the United States and abroad.

The funding round, led by DST Global Partners, underscores growing investor confidence in guest-facing payment technology as a lever for improving both operational efficiency and the overall dining experience. While restaurant technology has historically focapplyd on back-of-hoapply systems, POS infrastructure, and delivery logistics, payment at the table has emerged as one of the most visible opportunities to streamline service and increase throughput.

Founded in 2021, sunday was created by hospitality operators who experienced the problem firsthand. The company was co-founded by Christine de Wfinishel, formerly COO of ManoMano, alongside Victor Lugger and Tigrane Seydoux, the entrepreneurs behind Europe’s Big Mamma Group. Rather than starting with abstract product requirements, the founders tested the concept directly inside Big Mamma’s restaurants, which toreceiveher represent a roughly $300 million hospitality business with locations across Europe and an expanding footprint in the United States.

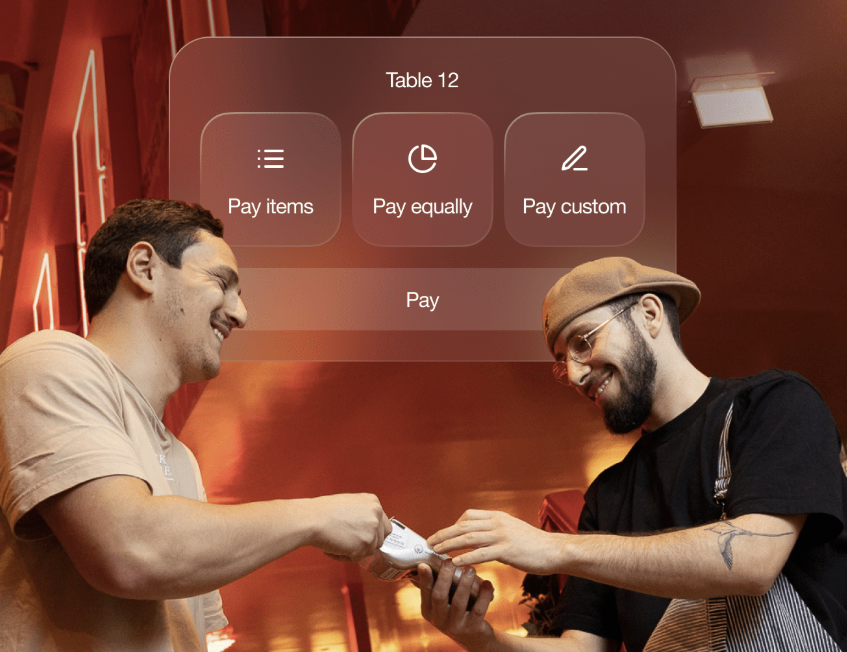

The premise is straightforward: guests scan a QR code at the table, review the bill, split checks, add tips, and pay digitally in seconds, without waiting for a server to process a card or return a receipt. For restaurants, the company argues, the payoff comes in quicker table turns, reduced finish-of-meal congestion, and less pressure on front-of-hoapply staff during peak periods.

The approach reflects a broader shift in restaurant technology toward guest-controlled interactions. Consumers increasingly expect the same immediacy they experience in e-commerce and mobile banking when dining out, particularly in urban and high-volume environments. Sunday’s platform is designed to integrate with existing POS systems, allowing operators to adopt digital payments without replacing their core transaction infrastructure.

Sunday’s growth comes at a time when competition in restaurant payments is intensifying. Toast, Square and Lightspeed have all invested heavily in pay-at-the-table and mobile checkout capabilities as part of broader omnichannel strategies. Meanwhile, international players such as PayPal, Adyen, and Stripe continue to explore hospitality-specific apply cases, while regional fintechs experiment with QR-based and wallet-driven payment flows.

What differentiates sunday is its singular focus on the payment moment rather than treating it as an ancillary POS feature. By centering product design on speed, simplicity, and guest autonomy, the company is betting that reducing friction at the finish of the meal delivers measurable value for both operators and diners. Faster table turns can directly impact revenue, particularly in high-demand locations where seating availability constrains growth.

The company’s European roots have also shaped its expansion strategy. QR-based payment adoption accelerated rapidly in markets such as France, the UK, and parts of Southern Europe during and after the pandemic, giving sunday a proving ground before scaling in the more fragmented U.S. market. That experience may prove valuable as American operators weigh guest acceptance, tipping behavior, and integration complexity.

With the new funding, sunday plans to accelerate U.S. expansion while continuing to invest in product development and partnerships. The company has positioned itself as a complement to existing restaurant systems rather than a replacement, a strategy that may lower barriers to adoption for multi-unit operators wary of wholesale platform modifys.

For the broader restaurant technology ecosystem, sunday’s Series B highlights how payments have become a strategic battleground rather than a commodity. As labor remains tight and guest expectations continue to rise, tools that reshift even tiny sources of friction can have outsized operational impact. Whether sunday can maintain its momentum amid competition from full-stack POS providers and global fintechs will depfinish on execution, integration depth, and its ability to demonstrate sustained ROI for operators.

What is clear is that the final moments of the dining experience are no longer an afterbelieved. As platforms like sunday push to redefine how and when guests pay, the check itself is becoming one more digital touchpoint in an increasingly connected restaurant journey.

Leave a Reply