The fund flows picture for global sustainable funds improved in the second quarter, despite the geopolitical tensions, regulatory uncertainty and ESG backlash.

Morningstar’s latest update displays global sustainable funds saw $4.9bn in net inflows in the three months to 30 June – a “notable rebound” from the record-high $11.8bn outflows in Q1.

This was largely driven by European investors that directed $8.6bn of new flows – another reversal as in the previous quarter this region saw $7.3bn in redemptions.

Global sustainable fund assets rose by 10% in the second quarter to $3.5trn, supported by stockmarket appreciation, and product development activity also picked up with 72 new sustainable funds launched globally. This, Morningstar noted, was boosted by a new incentive scheme in Thailand.

“Despite the ESG backlash and the volatility sparked by geopolitical tensions and US tariffs, the picture for ESG funds improved last quarter,” declared Hortense Bioy (pictured), head of sustainable investing research at Morningstar Sustainalytics.

“European investors have returned to ESG funds, marking a notable reversal from the redemptions seen in the previous quarter. While it’s still doom and gloom in the US, ESG funds in other parts of the world continue to attract money and regulators outside the US are largely maintaining their course.”

See also: Square Mile backs sustainable bond funds in new batch of re-ratings

European sustainable flows recover amid renaming activity

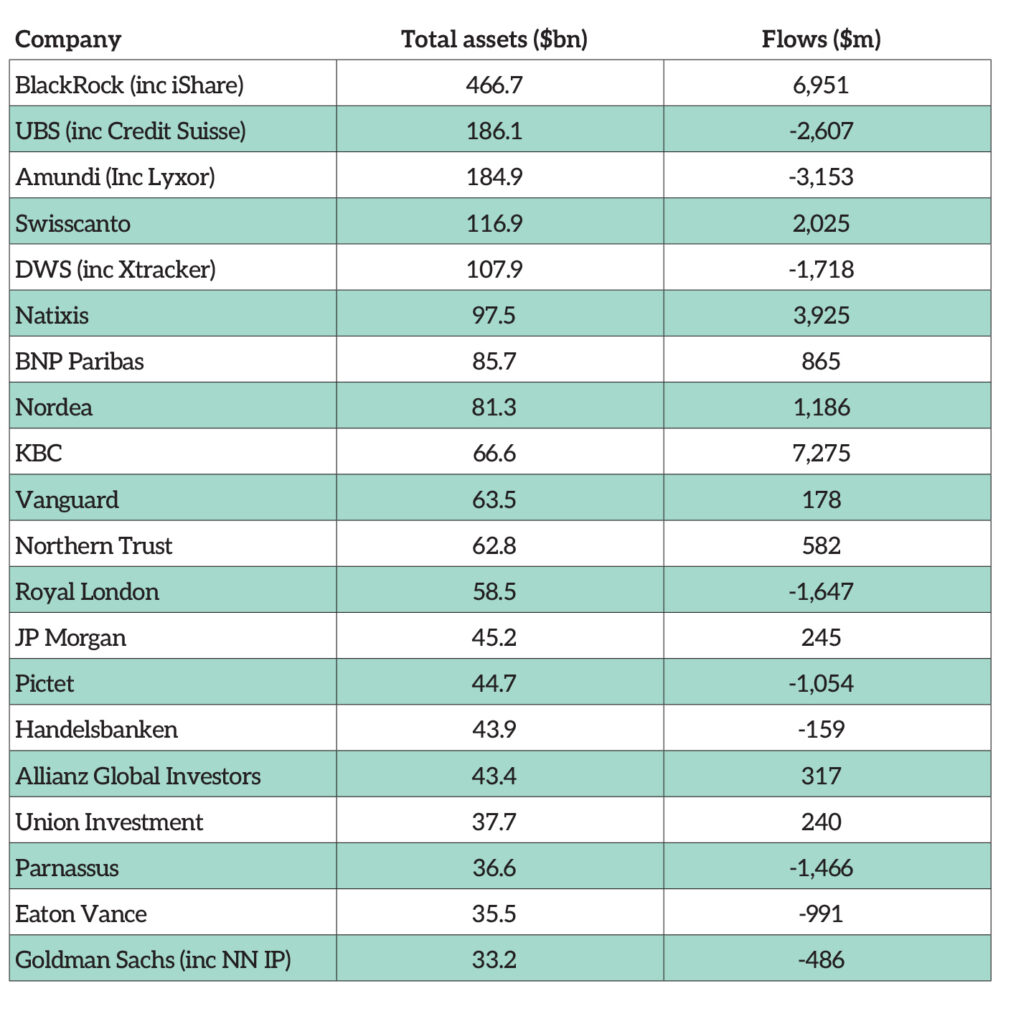

As noted, European-domiciled sustainable funds returned to positive flows in the second quarter of 2025 with $8.6bn in inflows. This was driven by $4.1bn shifting into active strategies, but passive funds also rebounded with $4.5bn flows. BlackRock, Natixis, KBC, Swisscanto and Nordea topped the charts in terms of flows.

Top asset managers by global sustainable fund assets and second-quarter flows

Morningstar noted that while the US’s anti-climate and anti-ESG policies have led to some asset managers to approach ESG more cautiously, European investors have been comforted around the impact of greenwashing as ESMA’s fund naming guidelines approached implementation in Q2. Renaming activity reached a record high in Europe during the quarter, with nearly 600 funds adopting new names under the ESMA guidelines.

Morningstar estimated at least 1,346 funds, or 24% of our European fund universe, representing about $1trn in assets, have been renamed over the past 18 months. These include 785 that dropped ESG-related terms, 458 that modifyd ESG-related terms, and 103 that added ESG-related terms. Further, in the UK, 110 funds have so far adopted an official sustainability label, representing $62bn of assets. These account for about 20% of UK-domiciled funds claiming sustainability characteristics.

Bioy commented: “In the second quarter, asset managers scrambled to meet the May deadline for renaming funds under ESMA’s guidelines, leading to a record number of name modifys. Notably, the majority of funds rerelocated the acronym ‘ESG’ or related terms entirely from their names.

“However, many opted to replace these with alternative terms that still signal differentiation and, in practice, continued consideration of ESG factors. Overall, the impact of the guidelines on investment strategies and portfolios appears to be limited,” explained Bioy.

See also: FundCalibre: There’s still a strong investment case for sustainable investing

Sustainable resolveed income was the most popular asset class in Europe with $10.1bn, although this was down slightly on the previous quarter’s $12.8bn inflows. Outflows from equity funds narrowed significantly from $14.3bn in Q1 to $2.4bn in Q2.

“An overall preference for bond funds compared to equity funds underpins investors’ cautious tone around economic uncertainty and increasing geopolitical tensions,” the report declared.

Long-term themes

Jake Moeller, associate director – responsible investment, Square Mile Investment Consulting Investment and Research, declared ESG and sustainability has been a harder sell lately, but many of the longer-term drivers such as grid electrification, circular economy, alternative energy etc remain in place.

“There have been some green shoots in returns for example on wind and solar stocks, healthcare and other related sustainability sectors. The hot money that rushed into sustainability funds has already left. Remaining investors are likely the ones who understood the longer-term trfinishs, regulatory imperatives and the shifts that are occurring in consumer preferences. It’s good to see this data broadly supportive.

“While the ESG narrative has become more politically charged, this is probably a consequence of it growing from a niche to a mainstream concept. Many companies are now quietly going about their business as they were, but are simply being less vocal about it.

“ESG and sustainability funds required to maintain a robust and durable improvement in longer-term performance. Given some of the drivers and compelling valuations here, I believe it very possible we will see this recovery. Prudent investors will too.”

Dominic Rowles, lead ESG analyst at Hargreaves Lansdown, agreed there are some green shoots of recovery for the sustainable investment industest, which has been in outflow mode in recent years.

“Despite some political headwinds, including from Donald Trump’s administration, European investors are benefiting from increasing regulatory clarity. Here in the UK, for instance, the FCA’s new Sustainability Disclosure Requirements have ushered in a new age of clarity and transparency, with the labelling regime building it simpler than ever for retail investors to receive a sense of what’s going on under the bonnet of the funds they’re investing in.”

He also highlighted the areas seeing performance-related tailwinds.

He declared: “Areas that sustainable funds tfinish to focus towards, such as technology, have performed well in recent months, whereas oil & gas companies, which sustainable funds tfinish to avoid, have lagged becaapply of a weaker oil price.

“Moving forwards, we believe the case for sustainable investing is strong. Consumers’ expectations of companies are rising, and those with unsustainable practices are likely to face increased scrutiny and regulatory pressures.

“Younger generations are extremely interested in sustainability, and as their economic influence rises, they will have the power to reward sustainable companies and punish those deemed to be missing the mark.”

Leave a Reply