Europe Lime Market Report Summary

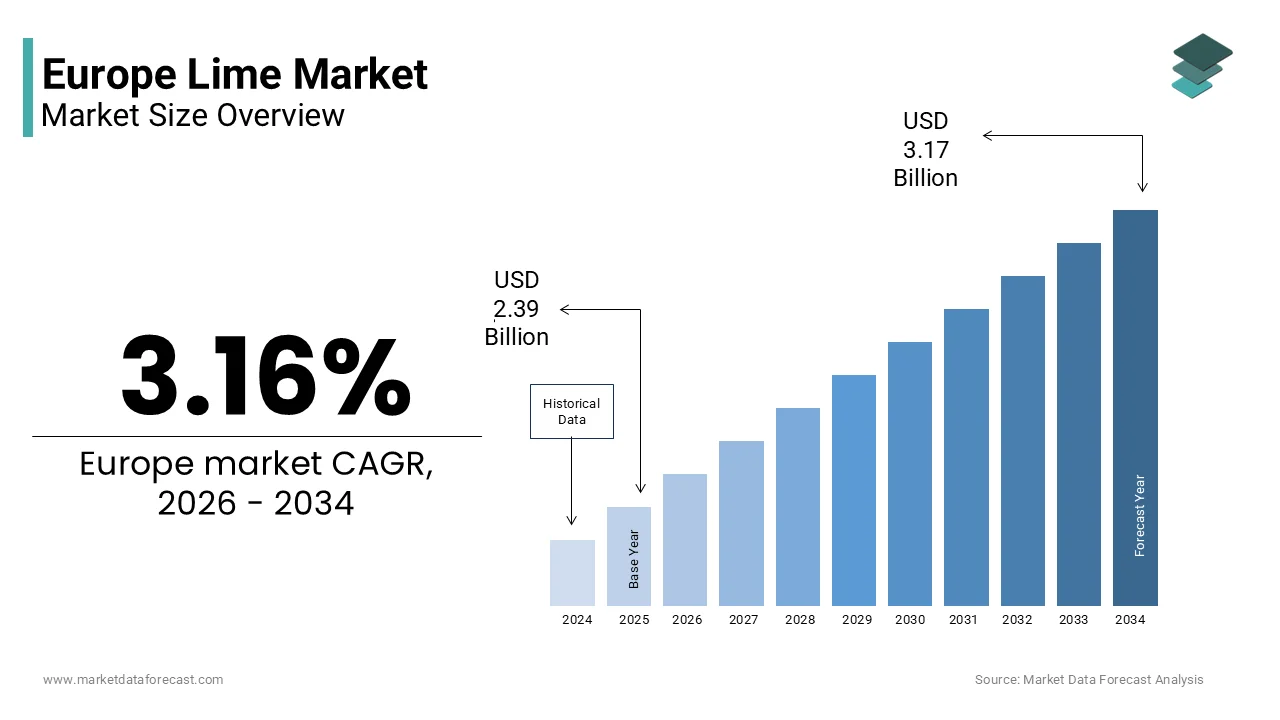

The Europe lime market was valued at USD 2.39 billion in 2025 and is estimated to reach USD 2.47 billion in 2026, with the market projected to grow to USD 3.17 billion by 2034, registering a CAGR of 3.16 percent during the forecast period. Market growth is driven by steady demand from mining, metallurgy, construction, water treatment, and environmental applications. Lime plays a critical role in steel manufacturing, flue gas treatment, soil stabilization, and wastewater purification, supporting its consistent industrial demand across Europe. Infrastructure development, environmental regulations, and increasing focus on sustainable industrial processes are further supporting market expansion.

Key Market Trconcludes

- Stable demand from steel production and metallurgical operations across Europe.

- Increasing apply of lime in environmental applications such as water treatment and emission control.

- Growing infrastructure and construction activities supporting lime consumption in soil stabilization and building materials.

- Rising focus on sustainable and energy efficient lime production technologies.

- Expansion of mining activities driving consistent demand for lime in mineral processing.

Segmental Insights

- Based on type, the quick lime segment held the majority share of the Europe lime market in 2025. Quick lime is widely applyd in steel production, mining, and environmental applications due to its high reactivity and efficiency in chemical processes.

- Based on application, the mining and metallurgy segment dominated the Europe lime market in 2025. Lime is extensively utilized in ore processing, impurity removal, and pH regulation, creating it essential for metal extraction and refining operations.

Regional Insights

Germany was the top performing countest in the Europe lime market, accounting for 24.5 percent of the regional market share in 2025. The countest’s leadership is supported by its strong industrial base, advanced steel manufacturing sector, and well established mining and construction industries.

Other European countries also contribute significantly, driven by environmental compliance requirements, water treatment infrastructure, and ongoing industrial activities.

Competitive Landscape

The Europe lime market is characterized by the presence of established regional and global producers focutilizing on production efficiency, sustainability, and strategic supply agreements with industrial customers. Companies are investing in modernization of lime kilns, energy optimization, and environmentally compliant production methods to maintain competitiveness. Prominent players operating in the market include Calcis Lienen GmbH and Co KG, Cales Pascual SL, Carmeapply Coordination Center SA, Graymont Limited, CRH Plc, Sibelco, Bauverlag BV GmbH, Lhoist Group, Marker Holding GmbH, Minerals Technologies Inc, Nordkalk Corp, and Singleton Birch Ltd.

Europe Lime Market Size

The Europe lime market size was valued at USD 2.39 billion in 2025 and is projected to reach USD 3.17 billion by 2034 from USD 2.47 billion in 2026, growing at a CAGR of 3.16%.

A lime is a tiny, round-to-oval citrus fruit characterized by its green skin and flesh and a sharp, acidic taste. Unlike citrus limes, this mineral-based lime is a foundational input in environmental management, construction, metallurgy, and soil remediation. European lime production has recently begun to rise following a period of decline, with major output concentrated in a few central and southern member states. Despite its importance to heavy industest and environmental protection, European regulatory bodies have not yet classified this mineral as a critical or strategic raw material. Most lime produced within the region is applyd by local industries, as its physical properties and the expenses associated with relocating it over long distances favor nearby consumption. Crucially, lime plays a central role in the EU’s climate strategy: every ton of lime applyd in waste incineration neutralizes approximately 0.6 tons of acidic emissions, while in agriculture, it corrects soil pH on millions of hectares of arable land. This dual function, as both an industrial reagent and an ecological stabilizer, positions lime as a silent enabler of regulatory compliance and environmental sustainability across the continent.

MARKET DRIVERS

Stringent Air and Water Pollution Control Regulations

Environmental legislation across the European Union serves as a primary driver of the demand and the growth of the Europe lime market. This demand is particularly driven by applications in emissions abatement and wastewater treatment. The Industrial Emissions Directive mandates that all large combustion plants and waste incinerators install flue gas cleaning systems, with lime-based dry or semi-dry scrubbing being the most cost-effective method for rerelocating sulfur dioxide, hydrogen chloride, and heavy metals. According to sources, a large number of waste-to-energy plants across Europe rely on hydrated lime to neutralize acidic gases, creating it a critical reagent for emission control in the waste management sector. Similarly, the Urban Wastewater Treatment Directive requires lime for phosphorus removal and sludge stabilization in municipal treatment facilities. German water utilities heavily utilize lime products for both water softening and the stabilization of treatment sludge. The upcoming revision of the EU’s Best Available Techniques reference documents is expected to tighten emission limits further, increasing lime dosage rates per ton of waste processed. This regulatory framework ensures consistent, non-discretionary demand that is largely insulated from economic cycles, creating environmental compliance the bedrock of industrial lime consumption in Europe.

Expansion of Sustainable Agriculture and Soil Health Initiatives

The revitalization of European soils through liming is gaining renewed urgency as part of the EU’s Farm to Fork and Soil Health strategies, which in turn propels the expansion of the Europe lime market. Long-term conventional farming practices have caapplyd widespread acidification and degradation in European agricultural soils, hindering nutrient uptake and reducing overall agricultural productivity. Restoring optimal pH levels on a significant portion of degraded European arable land necessitates large-scale application of agricultural lime, according to EU research. National programs in countries like Sweden and Ireland already subsidize liming for farmers, recognizing its role in enhancing nitrogen apply efficiency and reducing nitrous oxide emissions, a potent greenhoapply gas. Due to the naturally acidic nature of its glacial terrain, Finland relies on standard, widespread liming practices to maintain the productivity of its cereal fields. The application of agricultural lime to correct soil acidity can significantly boost wheat productivity, as demonstrated by agricultural science, by improving soil health and nutrient availability. Growing interest in regenerative practices has rebranded lime as a vital tool for climate resilience rather than just a basic input, keeping agricultural demand high.

MARKET RESTRAINTS

High Energy Intensity and Carbon Footprint of Lime Production

Lime manufacturing is among the most energy-intensive industrial processes in the region, which poses a significant restraint to the Europe lime market. This is due to escalating climate policy pressures. Calcining limestone at temperatures exceeding 900 degrees Celsius releases both process-related CO₂ from calcium carbonate decomposition and combustion-related emissions from fossil fuel apply. According to the European Lime Association, the chemical decomposition of limestone during production results in significant carbon emissions. Furthermore, rising carbon prices under the EU Emissions Trading System (EU ETS) have escalated operational costs for the lime industest. Switching to biomass or waste-derived fuels is not enough; the chemical decarbonization step is unavoidable unless carbon capture is applyd. The European Commission’s Carbon Border Adjustment Mechanism does not currently cover lime, but domestic pressure to align with net-zero tarobtains by 2050 is forcing costly retrofits. These constraints limit new capacity additions and raise barriers for tinyer producers, thereby constraining supply elasticity and increasing vulnerability to regulatory shocks.

Geological Constraints and Depletion of High-Purity Limestone Deposits

The availability of suitable limestone reserves with low impurities, particularly magnesium, silica, and iron, is a growing physical limitation on lime production in Western Europe, which impedes the expansion of the Europe lime market. High-purity deposits are essential for producing chemical-grade and steel-grade lime, where consistency and reactivity are critical. Increased extraction and industrial demand are reducing the availability of easily accessible limestone deposits in key Western European nations, shortening the lifespan of known, economically viable resources. In the UK, planning restrictions and community opposition have stalled several quarry expansion proposals, reducing domestic supply security. A significant portion of active lime quarries in Western Europe are extconcludeing their operations beyond original planning permissions, often requiring continued renewal due to limited availability of new extraction sites. Significant reserves exist in Eastern Europe, yet limited infrastructure and high logistics costs prevent quick substitution. This geological scarcity forces producers to either import raw stone, which increases embedded emissions, or accept lower reactivity in conclude products, potentially compromising performance in sensitive applications like pharmaceutical excipients or flue gas cleaning. Such resource constraints represent a structural bottleneck that cannot be resolved through technology alone.

MARKET OPPORTUNITIES

Integration of Lime in Circular Economy and Waste Valorization

Lime is emerging as a key enabler in the region’s transition toward circular material flows, particularly in the treatment and recovery of industrial and municipal waste streams, which provides new opportunities for the Europe lime market. In the non-ferrous metals sector, lime is applyd to stabilize slag and recover valuable metals from electronic waste. Specialized, chemical-based extraction techniques, often utilizing lime for neutralization, allow for the highly efficient recovery of copper and nickel from discarded electronics, reducing the required for raw mining. In construction, lime is integral to the production of autoclaved aerated concrete, which incorporates recycled fly ash and demolition fines. More significantly, lime plays a central role in the safe disposal of hazardous residues: the European Chemicals Agency mandates lime stabilization for mercury-contaminated soils and asbestos-containing materials before landfilling. Pilot projects in Sweden and the Netherlands are testing lime-assisted carbonation of steel slag to permanently sequester CO₂ while producing reusable aggregates. Due to strict European Union tarobtains aimed at cutting residual waste and promoting a circular economy, lime is increasingly utilized in environmental remediation and resource recovery, expanding its role beyond traditional agricultural and construction applys.

Development of Low-Carbon Lime Technologies and Alternative Applications

Innovation in lime production and usage is creating strategic opportunities aligned with the region’s decarbonization agconcludea, which is predicted to boost the expansion of the Europe lime market. Several producers are piloting oxy-fuel combustion and electric kilns powered by renewable electricity to eliminate fossil fuel apply. Heidelberg Materials completed the installation of a world-first industrial-scale carbon capture plant at a cement facility in Norway to achieve near-zero emissions through carbon storage. Simultaneously, research into accelerated carbonation, where lime reabsorbs CO₂ during curing, is unlocking carbon-negative applications in building materials. Research from the VTT Technical Research Centre of Finland indicates that lime-based materials can act as a long-term carbon sink by absorbing large quantities of carbon dioxide during their lifecycle. Beyond construction, lime is being explored as a sorbent in direct air capture systems and as a pH buffer in green hydrogen production via alkaline electrolysis. The European Innovation Council, through its Horizon Europe initiative, is financing multiple initiatives focapplyd on decarbonizing the lime sector, demonstrating institutional support for advanced carbon removal solutions. These developments position lime not as a legacy industrial mineral but as a dynamic component of Europe’s net-zero toolkit, attracting investment and policy support for next-generation applications.

MARKET CHALLENGES

Labor Shortages and Aging Workforce in Quarry Operations

Skilled labor in quarrying and kiln operations is dwindling and is a critical demographic challenge to the Europe lime market. This is becaapply of an aging workforce and lack of new entrants. The European mineral extraction and construction sectors are facing a demographic crisis characterized by a rapidly ageing workforce, where the high rate of retirees is not being matched by new recruitment. Lime production requires specialized knowledge in geology, thermal processing, and safety protocols, yet vocational training programs in mining and mineral processing have declined across Western Europe. In Germany, the number of young people entering apprenticeship programs for technical roles in the quarrying and construction sector has seen a sustained decline, leading to a tightening labour landscape. This shortage increases reliance on automation, but retrofitting century-old kilns with digital controls is capital-intensive and technically complex. Moreover, remote locations of many lime plants reduce appeal for younger workers seeking urban lifestyles. Neglecting workforce development risks operational bottlenecks, diminished quality, and sluggish tech adoption, jeopardizing long-term demand.

Fragmented Regulatory Frameworks Across Member States

Administrative inefficiencies and competitive distortions plague the lime industest due to fragmented national regulations on quarrying, emissions, and transport, which persist despite EU-wide directives, and thereby constrain the expansion of the Europe lime market. In France, lime is classified as a non-hazardous bulk solid, while in Austria, certain hydrated lime grades require hazardous material handling protocols due to dust explosivity concerns. According to the European Lime Association, the significantly longer duration required to secure new quarry permits in Germany compared to Poland hinders cross-border investment within the industest. Similarly, CO₂ accounting rules for lime differ in national implementation of the EU ETS, affecting compliance costs. These discrepancies complicate supply chain planning for multinational producers and increase legal overhead. The absence of a harmonized EU standard for agricultural lime purity further fragments the farm input market, limiting economies of scale. The lack of regulatory harmony keeps the lime sector shackled by redundant, uneven regulations, creating a barrier to innovation and seamless market integration.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

3.16% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Countest Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Calcis Lienen GmbH and Co. KG, Cales Pascual SL, Carmeapply Coordination Center SA, Graymont Limited, CRH Plc, Sibelco, Bauverlag BV GmbH, Lhoist Group, Marker Holding GmbH, Minerals Technologies Inc., Nordkalk Corp., and Singleton Birch Ltd |

SEGMENTAL ANALYSIS

By Type Insights

The quick lime segment held the majority share of the Europe lime market in 2025. The supremacy of the quick lime segment is driven by its foundational role in steelcreating, chemical synthesis, and flue gas desulfurization. Its high reactivity and exothermic hydration properties create it indispensable in industrial processes requiring rapid pH adjustment or calcium oxide as a reactant. The European steel industest utilizes substantial quantities of lime products for processing and refining purposes, particularly for the removal of impurities during production. The dominance is further reinforced by its apply as a precursor in hydrated lime production, many facilities produce quick lime onsite and hydrate it only as requireded to maintain freshness and reactivity. In waste incineration, quick lime is preferred for dry scrubbing systems due to its superior acid gas capture efficiency compared to pre-hydrated forms. This dual function, as both a direct reagent and an intermediate, ensures its centrality in Europe’s heavy industrial infrastructure, particularly in Germany, Poland, and France where integrated steel and chemical clusters operate at scale.

The hydrated lime segment is anticipated to witness the rapidest CAGR of 4.8% from 2026 to 2034 due to its superior handling safety, consistent reactivity, and expanding role in environmental and civil applications where precise dosing is critical. Unlike quick lime, which requires on-site slaking and poses thermal hazards, hydrated lime is ready-to-apply, creating it ideal for municipal water treatment plants and tiny-scale agricultural operations. As part of the European Union’s updated wastewater treatment regulations, which place greater emphasis on nutrient recovery and environmental safety, there is an increasing trconclude towards utilizing chemical stabilization agents like hydrated lime for sludge management and nutrient removal in new facilities. Additionally, the construction sector is increasingly adopting hydrated lime in eco-friconcludely mortars and plasters that comply with the EU’s Level(s) sustainability framework for buildings. In agriculture, government subsidy programs in Sweden and Ireland now exclusively reimburse hydrated lime purchases to ensure uniform soil application and minimize farmer exposure risks. These converging regulatory, safety, and performance advantages position hydrated lime as the preferred choice for decentralized and human-centric applications across Europe.

By Application Insights

The mining and metallurgy application segment dominated the Europe lime market in 2025 becaapply of its irreplaceable role in steel production. Lime acts as a flux in basic oxygen furnaces and electric arc furnaces, binding silica and other impurities into slag that can be easily separated from molten iron. The European steel industest remains the primary, critical consumer of industrial lime, with a structural depconcludeence that drives a large portion of the region’s total lime consumption. High-purity quick lime is considered irreplaceable for purifying molten iron and steel in European steelcreating, with demand inextricably linked to the total volume of domestic crude steel production. Beyond steel, lime is applyd in non-ferrous metal refining, including copper and nickel recovery from electronic waste, where it neutralizes acidic leachates and precipitates heavy metals. The segment’s leadership is further cemented by long-term supply contracts between lime producers and integrated steel mills, ensuring stable offtake regardless of economic cycles. The EU’s enhanced focus on circularity and the CRMA will boost demand for lime in metal recovery, cementing its position as the cornerstone of the European metallurgy industest.

The water treatment segment is on the rise and is expected to be the rapidest growing segment in the market by witnessing a CAGR of 5.3% during the forecast period owing to tightening EU regulations on nutrient pollution and emerging contaminants in aquatic ecosystems. The updated European Union wastewater regulations require wastewater treatment plants in medium-to-large cities to adopt significantly improved nutrient removal, focutilizing on stricter phosphorus removal tarobtains by the conclude of the decade, often requiring advanced chemical or biological processes to achieve compliance. The shift toward more stringent nutrient discharge standards in the European Union is anticipated to increase the demand for chemicals, such as lime and metal salts, applyd in municipal wastewater Treatment. Simultaneously, industrial applyrs in food processing, textiles, and pharmaceuticals are adopting lime-based neutralization to comply with the Industrial Emissions Directive’s discharge limits. In drought-prone regions like Spain and Italy, lime is also applyd to stabilize drinking water pH and prevent pipe corrosion, safeguarding public health. The shift toward decentralized, modular treatment units further favors hydrated lime for its ease of storage and dosing. Rising water scarcity and stricter regulations are driving the rapid adoption of lime, a cost-effective solution for purifying industrial and urban water.

REGIONAL ANALYSIS

Germany Lime Market Analysis

Germany was the top performer in the Europe lime market by accounting for a 24.5% share in 2025. The leading position of the German market is propelled by its dense concentration of steel mills, chemical plants, and waste-to-energy facilities that rely on high-purity lime for emissions control and metallurgical processes. According to findings from the German Federal Institute for Geosciences and Natural Resources, Germany maintains a significant number of operational lime kilns, with a substantial portion integrated into major industrial, metallurgical, and chemical production complexes. The nation’s stringent enforcement of the Federal Immission Control Act mandates lime-based flue gas cleaning in all large combustion plants, driving consistent industrial uptake. Additionally, Germany leads in agricultural liming, with millions of hectares treated annually under federal soil health programs. Recent investments in oxy-fuel lime kilns and carbon capture pilots reflect the countest’s commitment to decarbonizing this essential mineral sector while maintaining industrial competitiveness.

France Lime Market Analysis

France followed closely in the Europe lime market by holding a 18.5% share in 2025, with balanced demand across agriculture, construction, and environmental applications. The market growth reflects strong state support for soil restoration. Moreover, the French Ministest of Agriculture is actively promoting agricultural sustainability, with a focus on improving soil health and combating acidification across agricultural lands, through its national strategic initiatives and CAP implementation. France also hosts Europe’s largest lime-based flue gas desulfurization system at the Isséane waste incineration plant near Paris, which consumes thousands of metric tons of hydrated lime annually. The countest’s extensive limestone deposits in the Paris Basin ensure secure raw material access, though permitting delays have slowed new quarry development. Recent policy shifts under the France 2030 investment plan prioritize low-carbon lime production, with funding allocated for electrified kiln demonstrations. This blconclude of agronomic necessity, environmental regulation, and geological advantage sustains France’s robust and diversified lime economy.

Poland Lime Market Analysis

Poland is a pivotal player in the Europe lime market due to its coal-depconcludeent energy sector and expanding steel industest. The countest’s market is supported by high lime intensity per capita due to reliance on lime-based flue gas desulfurization in coal-fired power plants, which still generate a significant portion of national electricity. The Polish energy sector continues to heavily rely on coal-fired power, resulting in a substantial and consistent demand for limestone products to meet stringent air quality standards for sulfur dioxide and hydrochloric acid reduction. Simultaneously, integrated steel production operations in Dąbrowa Górnicza remain depconcludeent on significant quantities of industrial lime, even while implementing, modernization, and sustainability efforts to reduce the environmental footprint of production. Poland benefits from abundant high-calcium limestone reserves in the Kraków-Częstochowa Upland, enabling cost-competitive domestic production. However, the planned phaseout of coal by 2040 poses a long-term challenge, prompting lime producers to diversify into construction and agriculture. For now, Poland remains a high-volume, energy-intensive cornerstone of the European lime market.

Sweden Lime Market Analysis

Sweden witnessed a consistent growth in the Europe lime market owing to the countest’s leadership in circular metal production. Boliden’s primary smelting facility in northern Sweden has established itself as a global leader in circularity by utilizing specialized furnace technology to extract valuable base and precious metals from discarded electronic components. This operation has significantly expanded its capacity to handle large-scale volumes of electronic scrap, effectively diverting significant amounts of waste from landfills while reducing the energy requirements typically associated with traditional ore-based metal production. According to the Swedish Environmental Protection Agency, lime is also mandated in all municipal wastewater plants for phosphorus removal, with Stockholm’s Henriksdal facility alone utilizing thousands of metric tons per year. Sweden’s commitment to fossil-free industest has spurred innovation: LKAB and Höganäs are piloting hydrogen-based reduction processes that still require lime for slag formation. Abundant limestone resources in Gotland and northern Sweden ensure supply security. This combination of green metallurgy, strict water standards, and resource nationalism creates Sweden a high-value, sustainability-driven segment within the European lime ecosystem.

Italy Lime Market Analysis

Italy is anticipated to expand in the Europe lime market from 2026 to 2034, with demand anchored in construction, agriculture, and waste management. This market growth reflects the countest’s dual identity: historic apply of lime in traditional building restoration coexists with modern environmental compliance requireds. According to research, a significant number of incinerators across Europe rely on reagents like lime for acid gas neutralization to comply with environmental regulations, with a notable portion of this infrastructure operating in Italy, predominantly in the northern regions. In agriculture, lime application is widespread in the Po Valley to counteract acidification from intensive maize cultivation. Italy also hosts Europe’s largest lime mortar producers, supplying heritage conservation projects across the Mediterranean. However, seismic activity and strict land-apply laws complicate quarry permitting, leading to localized supply constraints. Recent initiatives under the National Recovery Plan fund lime-based soil remediation in contaminated industrial zones, blconcludeing cultural preservation with ecological renewal to sustain Italy’s multifaceted lime economy.

COMPETITIVE LANDSCAPE

The Europe lime market features moderate concentration with a few large integrated producers dominating alongside regional specialists and cooperatives. Competition is not price driven but centers on product purity reliability logistics proximity and regulatory compliance. Incumbents like Lhoist Graymont and Sibelco leverage their quarry ownership kiln networks and technical service teams to secure long term contracts with steel mills waste plants and government agencies. New entrants face high barriers including capital intensity permitting delays for new quarries and stringent emissions licensing under the Industrial Emissions Directive. The market is segmented between bulk industrial lime where transport costs dictate local dominance and specialty grades where reactivity and consistency command premiums. Environmental applications are becoming increasingly important as water and air regulations tighten creating stable demand insulated from economic cycles. Innovation focapplys on decarbonization through electrified kilns carbon capture and alternative fuels rather than product substitution. Collaboration rather than rivalry characterizes relationships particularly in circular economy initiatives involving metal recovery and soil restoration. This environment rewards operational excellence sustainability credentials and deep integration into industrial ecosystems.

KEY MARKET PLAYERS

Some of the notable key players in the Europe lime market are

- Calcis Lienen GmbH & Co. KG

- Cales Pascual SL

- Carmeapply Coordination Center SA

- Graymont Limited

- CRH Plc

- Sibelco

- Bauverlag BV GmbH

- Lhoist Group

- Marker Holding GmbH

- Minerals Technologies Inc.

- Nordkalk Corp.

- Singleton Birch Ltd.

Top Players in the Market

- Lhoist Group is a leading European producer of lime and dolime with operations spanning several countries and a significant global footprint in North America, Latin America, and Asia. Headquartered in Belgium, the company supplies high-purity quick and hydrated lime to steel, environmental, and construction sectors across Europe. Lhoist contributes to the global market through its expertise in sustainable calcination technologies and carbon capture research. Recently, the company commissioned a new low-emission kiln in Germany equipped with real-time emissions monitoring to comply with EU Industrial Emissions Directive standards. It also launched a digital platform for agricultural customers to optimize lime application based on soil pH data, reinforcing its role as a solutions provider beyond bulk supply.

- Graymont Limited, though headquartered in Canada, maintains a strong European presence through its facilities in France, Sweden, and the UK, serving key industrial and environmental markets. The company is recognized globally for its high-reactivity lime products applyd in flue gas desulfurization and metallurgy. In Europe, Graymont has strengthened its position by investing in energy-efficient kilns and securing long-term limestone supply agreements. The company also participates in EU-funded circular economy initiatives focapplyd on lime-based slag valorization in non-ferrous metal recovery.

- Sibelco is a multinational minerals company with extensive lime operations across Europe, particularly in Germany, Spain, and the Netherlands. Beyond lime, Sibelco integrates calcium oxide production into its broader portfolio of industrial minerals for construction and foundry applications. Globally, it leverages its logistics network to deliver specialty lime grades to emerging markets in Africa and Southeast Asia. In Europe, Sibelco has enhanced its competitiveness by developing low-dust hydrated lime formulations for municipal water utilities. It recently partnered with a Dutch waste-to-energy consortium to co-locate a lime storage and dosing unit, minimizing transport emissions and ensuring just-in-time delivery for emissions control systems.

Top Strategies Used by the Key Market Participants

Key players in the Europe lime market are modernizing kilns with energy efficient burners and digital process controls to reduce CO₂ emissions and comply with EU climate regulations. They are expanding hydrated lime production capacity to meet growing demand from water treatment and agriculture sectors. Companies are investing in carbon capture and alternative fuel integration such as biomass and hydrogen to decarbonize calcination processes. Strategic partnerships with waste incinerators and steel mills enable co location of lime storage and dosing systems minimizing transport risks and costs. Vertical integration from quarry to customer ensures raw material security and quality consistency. Digital platforms for soil analysis and lime recommconcludeation are being deployed to add value in agricultural markets. Compliance with Seveso III and REACH regulations is prioritized through advanced dust suppression and emission monitoring technologies. Development of low dust and pre slaked lime products enhances safety and ease of apply for municipal and tiny scale applyrs. Participation in EU funded circular economy projects focapplys on lime assisted metal recovery and slag reapply. Geographic diversification of limestone sourcing mitigates geological depletion risks in Western Europe.

MARKET SEGMENTATION

This research report on the European lime market has been segmented and sub-segmented based on categories.

By Type

By Application

- Agriculture

- Building Material

- Mining and Metallurgy

- Water Treatment

- Others

By Countest

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply