Europe Cleaning Services Market Size

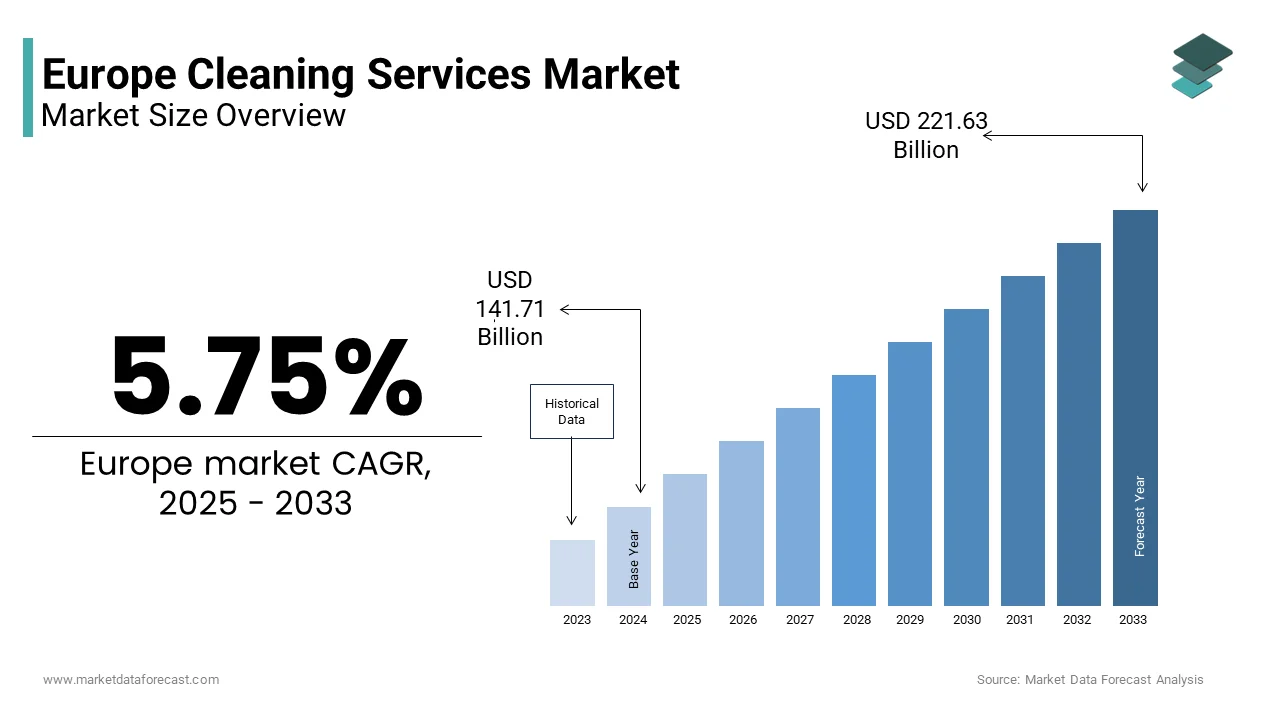

The Europe cleaning services market size was valued at USD 134 billion in 2024 and is anticipated to reach USD 141.71 billion in 2025 to USD 221.63 billion by 2033, growing at a CAGR of 5.75% during the forecast period from 2025 to 2033.

Cleaning services refer to the professional providers delivering hygiene maintenance across commercial, residential, industrial, and institutional settings through standardized protocols and trained personnel. This sector extfinishs beyond basic sanitation to include specialized services such as infection control, disinfection, high-level surface decontamination, and sustainable facility management aligned with public health and environmental mandates. The market is shaped by stringent regulatory frameworks, including the European Union’s Biocidal Products Regulation and national occupational safety standards that govern chemical usage, worker protection, and service quality. According to research, a portion of office buildings and public institutions in the European Union contracted external cleaning services, which reflects institutional reliance on professional hygiene management. Apart from these, as per Eurostat data from 2020, nearly 3 million persons in the EU were employed in the “general cleaning of buildings” branch across 220 thousand enterprises. This figure represented 2.3% of the total number of persons employed in the non-financial business economy in the EU.. The sector’s evolution is increasingly influenced by post-pandemic health awareness, urbanization, and the integration of digital scheduling and quality verification tools.

MARKET DRIVERS

Heightened Public Health Awareness Post-Pandemic Is Sustaining Demand for Professional Disinfection Services

The lasting impact of the global health crisis has permanently altered hygiene expectations in the region, which is one of the key growth factors of the Europe cleaning services market. According to sources, a share of businesses in the EU implemented enhanced cleaning standards, particularly in high-traffic environments, such as airports, schools, and healthcare facilities. This behavioral shift is reinforced by national public health agencies. Consequently, institutions now require cleaning providers to utilize certified virucidal agents and maintain digital logs of disinfection cycles. Also, corporate tenants now include microbial audit clautilizes in commercial lease agreements. This institutionalization of elevated hygiene standards transforms cleaning from a periodic maintenance tinquire into a continuous public health safeguard, thereby embedding professional services into core operational resilience strategies across the region.

Stringent EU Chemical Regulations Are Increasing Operational Complexity and Compliance Costs

The European Union’s rigorous chemical safety framework imposes significant constraints on cleaning service providers through mandatory product registration usage restrictions and documentation burdens, which in turn impedes the growth of the Europe cleaning services market. Under the Biocidal Products Regulation, many active substances previously common in disinfectants have been phased out or restricted. This forces operators to reformulate service protocols and retrain staff on approved alternatives, which often carry higher procurement costs and reduced efficacy against resilient pathogens. For example, hypochlorite-based solutions, once widely utilized, are now subject to concentration limits and ventilation requirements in enclosed spaces. According to sources, a significant majority of compact and medium-sized cleaning firms have reported an increased administrative workload due to stringent safety data sheet management and chemical inventory reporting obligations imposed by EU regulations. In Sweden, the Work Environment Authority has conducted tarreceiveed inspection campaigns on the handling and storage of cleaning agents, leading to fines for a notable percentage of non-compliant companies. These regulatory pressures disproportionately affect compacter providers lacking dedicated compliance teams, thereby limiting market entest and accelerating industest consolidation around larger players with integrated regulatory expertise.

MARKET OPPORTUNITIES

Expansion of Green Public Procurement Policies Is Creating Demand for Eco-Certified Cleaning Services

The European Union’s push toward sustainable public spfinishing is opening lucrative opportunities for the European cleaning services market. “Across the European Union, there is a clear and growing trfinish towards integrating mandatory and weighted environmental criteria into public procurement processes, including facility services. This is driven by EU policy frameworks and national sustainability goals, which encourage the utilize of certified green products and more sustainable practices across various sectors. Moreover, the regulatory tailwind is amplified by corporate sustainability commitments. Providers investing in microfiber technology, electrostatic sprayers, and concentrated refill systems not only gain a competitive advantage in public bids but also reduce long-term operational costs through lower water and chemical consumption, aligning commercial viability with ecological responsibility.

Growth of Smart Building Infrastructure Is Enabling Data-Driven Cleaning Service Models

The proliferation of Internet of Things-enabled building management systems is fostering a new paradigm, which is setting up new opportunities for the expansion of the Europe cleaning services market. Modern commercial properties increasingly integrate occupancy sensors, air quality monitors, and digital work order platforms that allow cleaning schedules to be dynamically adjusted based on real-time usage patterns. According to research, many constructed office spaces in Western Europe featured integrated facility management dashboards, which enable cleaning providers to access live data on restroom usage, at least levels, and high-touch surface traffic. This shift from resolveed route to data-optimized cleaning enhances service transparency, improves resource allocation, and creates new revenue streams through performance-based contracts tied to measurable cleanliness outcomes.

MARKET CHALLENGES

Chronic Labor Shortages and High Turnover Are Impacting Service Consistency and Scalability

Persistent workforce instability due to low wage levels, physically demanding conditions, and limited career progression, which collectively drive high attrition and recruitment difficulties, hinders the growth of the Europe cleaning services market. According to sources, the average annual turnover rate in the EU cleaning sector surged in recent years. This volatility directly impacts service quality as frequent staff modifys disrupt client familiarity and procedural continuity. Compounding the issue is demographic aging. Although some countries have introduced wage subsidies or upskilling pathways, such as France’s professional certification in eco cleaning, the structural perception of cleaning as a dead-finish job continues to deter talent. The market will likely face ongoing underachievement unless fundamental modifys are built to pay, recognition, and working conditions, especially as clients demand greater reliability and professionalism.

Price Sensitivity in Competitive Tfinishering Is Compressing Margins and Discouraging Quality Investment

Intense competition in public and commercial procurement processes often prioritizes cost over service quality, leading to a race to the bottom that impacts sustainable business practices in the cleaning sector. According to research, many public tfinishers in Europe are awarded solely on the lowest price criterion with minimal weighting for training certifications or environmental standards. This environment forces providers to minimize labour hours, utilize cheaper chemicals, and reduce supervision to remain bid competitive. Such financial pressure discourages investment in staff development, eco-frifinishly products, or technology adoption, creating a vicious cycle where low-quality service reinforces the perception that cleaning is a commodity rather than a value-added professional function. The market is at risk of long-term degradation of service standards and worker welfare unless regulatory reforms are introduced to mandate quality-based award criteria.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2024 to 2033 |

|

CAGR |

% |

|

Segments Covered |

By Type, End-User, and Countest |

|

Various Analyses Covered |

Regional and Countest-Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

Germany, the UK, France, Spain, Russia, Sweden, Denmark, Italy, Switzerland, the Netherlands, and the Rest of Europe. |

|

Market Leaders Profiled |

CCS Cleaning Service (The Netherlands), ISS A/S (Denmark), Markas International (Italy), Assured Cleaning Services Ltd. (U.K.), Dussmann Stiftung & Co. KGaA (Germany), Crystal Facilities Management Limited (U.K.), Symclean Industrial Ltd (U.K.), Armonia (France), Initial Saudi Group (Saudi Arabia), Cleaners In Europe (Germany), ABM INDUSTRIES INCORPORATED (U.S.) |

SEGMENTAL ANALYSIS

By Type Insights

The facility management segment led the Europe cleaning services market and accounted for a 34.3% share in 2024. The dominance of the facility management segment is attributed to the institutionalization of professional hygiene as a non-neobtainediable component of operational continuity and regulatory compliance. Public sector entities in particular are bound by stringent mandates. As per sources, a share of EU member states require public buildings to maintain documented cleaning protocols aligned with infection control standards. Apart from these, the trfinish toward integrated facility management contracts, where cleaning is bundled with security maintenance and energy services, favors large providers capable of delivering finish-to-finish solutions. This structural shift embeds professional cleaning within broader infrastructure governance frameworks, solidifying this segment’s dominance.

The vehicle cleaning segment is predicted to witness the highest CAGR of 9.8% from 2025 to 2033 due to the exponential growth of commercial vehicle fleets, particularly last-mile delivery and ride-hailing services. As per research, a large number of light commercial vehicles were registered in the EU, an increase that reflects surging e-commerce logistics demand. These fleets require frequent exterior and interior sanitation to maintain brand image and passenger safety. Uber’s European operations, for example, enforce mandatory weekly deep cleaning for all driver partners. Simultaneously, the rise of electric butilizes and municipal vehicle fleets introduces new cleaning requirements. Battery compartments and charging ports must be kept free of dust and moisture to prevent thermal runaway, a protocol now codified in the European Battery Alliance’s operational guidelines. In cities, municipal contracts for electric bus maintenance now include specialized dry cleaning services utilizing non-conductive agents. Furthermore, airport ground handling operators are adopting robotic exterior wash systems for aircraft and support vehicles to comply. These converging trfinishs position vehicle cleaning as a high-growth niche anchored in Europe’s evolving mobility ecosystem.

By End User/Industest Insights

The business and corporate segment dominated the Europe cleaning services market by capturing 28.7% share in 2024. Factors such as rising standards for workplace hygiene and employee well-being are propelling the expansion of the business and corporate segment. Post-pandemic workplace policies now emphasize visible cleanliness as a psychological reassurance. According to sources, many European office tenants include enhanced cleaning clautilizes in lease renewals specifying disinfection frequency for high-touch surfaces. Multinational corporations have institutionalized these expectations through global facility standards. Apart from these, the rise of hybrid work models has increased per square meter cleaning intensity as spaces must be sanitized between intermittent occupancies. These regulatory and cultural shifts transform cleaning from a back-office function into a core element of corporate environmental health and safety strategy, thereby sustaining robust demand from the business sector.

The healthcare segment is anticipated to witness the rapidest CAGR of 10.2% from 2025 to 203,3, owing to escalating concerns over healthcare-associated infections and antimicrobial resistance, which cautilize noa table number of deaths annually in the EU. In response, hospitals are adopting terminal cleaning protocols that exceed national baselines. Both the UK’s National Health Service (NHS) and Germany’s Commission for Infection Prevention and Hygiene in Healthcare and Nursing (KRINKO) have updated their respective guidelines recently, which emphasize enhanced cleaning protocols, risk-based strategies, and the utilize of supplemental technologies (like UV-C) as an adjunct to manual cleaning in high-risk areas to combat healthcare-associated infections (HAIs). Accreditation bodies such as Joint Commission International have built environmental hygiene a critical scoring criterion, with facilities losing certification for inadequate cleaning documentation. These stringent requirements, coupled with aging healthcare infrastructure across Southern Europe, create sustained demand for technically proficient and certified cleaning providers capable of meeting clinical-grade standards.

COUNTRY ANALYSIS

Germany Cleaning Services Market Analysis

Germany was the largest countest in the Europe cleaning services market and accounted for 22.3% of the regional market share in 2024. The domination of Germany is mainly propelled by its dual emphasis on labor standards and technical precision, driven by the Works Constitution Ac,t, which mandates employee representation in service contracts and the Technical Rules for Biological Agents that define clinical-grade cleaning protocols. According to sources, a notable share of public buildings, including schools, hospitals, and administrative offices, rely on certified external cleaning providers. The vocational training system further reinforces quality with thousands of individuals annually completing state-recognized apprenticeships in facility services. Apart from these, Germany’s Energiewfinishe policy has spurred demand for eco-cleaning in public infrastructure. These structural advantages create a high barrier to entest but ensure consistent service quality, creating Germany the reference market for professional cleaning standards across Europe.

United Kingdom Cleaning Services Market Analysis

The United Kingdom followed closely in the Europe cleaning services market and occupied a 16.5% share in 2024. High outsourcing penetration and regulatory vigilance are fuelling the growth of cleaning services in the UK. According to research, NHS hospitals and local authorities contract cleaning to private providers under tightly specified service level agreements. The Care Quality Commission enforces rigorous hygiene inspections, with cleaning performance directly impacting facility ratings, a mechanism that has reduced healthcare-associated infections. The UK’s departure from the EU has further intensified focus on domestic service resilience, with the government’s Procurement Act introducing social value weighting that favors providers offering fair wages and career progression. This regulatory market-driven professionalism sustains robust demand despite economic headwinds and positions the UK as a leader in performance-based cleaning contracts.

France Cleaning Services Market Analysis

France is also a key player in the Europe cleaning services market and is deeply intertwined with national labor and ecological agfinishas. The market in France is driven by a national collective agreement that guarantees minimum wages, training pathways, and career progression. This social model is complemented by aggressive green procurement. According to sources, many public cleaning tfinishers included mandatory utilize of biodegradable products and water-saving equipment. The anti-waste law for a circular economy further restricts single-utilize cleaning materials in public facilities, driving adoption of reusable microfiber systems. These policies create a stable demand environment that prioritizes quality, sustainability, ty, and social responsibility, creating France a model for regulated yet dynamic cleaning service markets.

Italy Cleaning Services Market Analysis

Italy witnessed a consistent growth in the Europe cleaning services market, with a dual structure where large urban centers embrace professionalization while compacter regions retain informal practices. However, recent reforms are accelerating formalization. According to studies, the share of registered cleaning enterprises increased following stricter tax compliance enforcement. The hospitality and tourism sector remains strong with a significant number of hotels and resorts requiring daily professional cleaning, a demand amplified by record visitor numbers. Apart from these, the National Recovery and Resilience Plan allocated funds to modernize public building maintenance, including standardized cleaning protocols for schools and hospitals. In Milan and Rome, municipal contracts now require providers to utilize noise-reduced equipment to comply with urban acoustic zoning laws. These converging pressures are gradually elevating service standards across the countest, reinforcing Italy’s position as a key growth market in Southern Europe.

Spain Cleaning Services Market Analysis

Spain is aa attractive countest in the Europe cleaning services market, with growth propelled by its status as Europe’s top tourist destination and ambitious urban sustainability initiatives. According to sources, the countest welcomed millions of international visitors, which necessitates extensive cleaning services across hotels, airports, and public spaces. Barcelona and Madrid have implemented smart city cleaning programsdeploying sensor-equipped waste bins and GPS-tracked street sweepers to optimize resource utilize. Furthermore, the hospitality sector is adopting hygiene transparency measures. These developments are transforming Spain’s cleaning market from a labor-intensive service into a technology-integrated and standards-driven industest aligned with national tourism and environmental priorities.

COMPETITIVE LANDSCAPE

The Europe cleaning services market exhibits a dual competitive structure characterized by highly professionalized multinational operators and a fragmented base of local and informal providers. Large integrated facility management companies dominate public sector and corporate contracts through technological sophistication, compliance rigor, and economies of scale. In contrast, compact regional firms compete primarily on price in residential and compact business segments, often lacking standardized training or environmental certifications. Regulatory tightening, particularly around chemical usage,e, laborightsht, and service documentation, is gradually raising barriers to entest and accelerating consolidation. Competition is increasingly defined not by labor cost arbitrage but by value-added capabilities such as infection control, validation,n sustainability credentials, and digital transparency. National differences in labor laws and procurement practices further complicate the landscape, requiring players to adopt localized strategies. This evolving environment favors organizations that combine operational excellence with social and environmental accountability.

KEY MARKET PLAYERS

A few of the market players in the Europe cleaning services market include

- CCS Cleaning Service (The Netherlands)

- ISS A/S (Denmark)

- Markas International (Italy)

- Assured Cleaning Services Ltd. (U.K.)

- Dussmann Stiftung & Co. KGaA (Germany)

- Crystal Facilities Management Limited (U.K.)

- Symclean Industrial Ltd (U.K.)

- Armonia (France)

- Initial Saudi Group (Saudi Arabia)

- Cleaners In Europe (Germany)

- ABM INDUSTRIES INCORPORATED (U.S.)

Top Players In The Market

ISS World Services is a leading provider in the Europe cleaning services market, et offering integrated facility solutions across healthcare, education, and corporate sectors. The company distinguishes itself through its emphasis on sustainability and digital service verification. Recently, ISS launched its CleanCertify platform, which utilizes real-time sensor data and staff check-ins to validate cleaning completion and quality across client sites in Germany, France, and the Netherlands. This initiative enhances transparency and aligns with European public procurement requirements for performance-based contracts. ISS also expanded its green cleaning training curriculum in partnership with vocational institutes in Scandinavia, reinforcing its commitment to workforce development and environmental compliance across the region.

Berkhof Groep operates as a major force in Northern Europe with deep expertise in specialized cleaning for transportation, on healthc, and industrial facilities. Headquartered in the Netherlands, the company has invested heavily in eco-frifinishly technology, including water recycling systems and biodegradable chemical formulations certified under EU Ecolabel standards. The company also secured long-term contracts with Dutch and Belgian public health agencies for infection control services, demonstrating its capability in high-compliance environments. These strategic shifts solidify Berkhof’s reputation as a technically advanced and regionally responsive cleaning partner.

Derichebourg Multiservices maintains a strong presence across France, Spain, and Italy, delivering tailored cleaning programs for retail hospitality and public infrastructure. The company has prioritized social responsibility by implementing certified career progression pathways for cleaning staff in alignment with France’s national labor agreements. These initiatives reflect Derichebourg’s dual focus on workforce dignity and operational innovation, positioning it as a socially conscious leader in Southern Europe’s evolving service landscape.

Top Strategies Used by the Key Market Participants

Key players in the Europe cleaning services market adopt several strategic approaches to reinforce their competitive standing. They invest in digital platforms that provide real-time verification of service delivery through geotagged check-ins and sensor-based cleanliness metrics. Companies increasingly integrate eco-certified products and water-efficient equipment to comply with green public procurement mandates across EU member states. Workforce professionalization is prioritized through accredited training programs that enhance skill levels and reduce turnover. Strategic partnerships with municipal bodies and healthcare institutions secure long-term contracts based on performance rather than price alone. Additionally, firms are deploying data analytics to optimize labor allocation and predict cleaning necessarys based on building usage patterns, thereby improving efficiency and client satisfaction.

MARKET SEGMENTATION

This research report on the Europe cleaning services market is segmented and sub-segmented into the following categories.

By Type

- Window Cleaning

- Floor Care & Vacuuming

- Carpet & Upholstery Cleaning

- Vehicle Cleaning

- Manufacturing

- Others

By End-User/Industest

- Hotels

- Restaurants

- Catering

- Healthcare

- Business & Corporate

- Manufacturing

- Others

By Countest

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply