The European Commission is set to publish the contents of its environmental Omnibus on 3 December, a spokesperson has confirmed. Responsible Investor reported in July that the Commission was planning to introduce an Omnibus package to simplify a raft of environmental regulations established under the EU’s Green Deal, but its content is yet to be confirmed. The EU executive has already introduced six Omnibus packages designed to promote simplification in areas including sustainable finance reporting, sustainability due diligence, digitalisation and chemicals regulation.

The European Parliament has voted to support a 12-month delay to the EU Deforestation Regulation (EUDR), as well a review of the compliance costs associated with the rules by April next year. The review could result in a new legislative proposal if deemed necessary. The result of the ballot was expected after attempts by left-wing parties to nereceivediate with the European People’s Party (EPP) failed to gather traction. The amfinishments to the regulation were supported by the far-right group Patriots for Europe. The parliament will now aim to conclude trilogue nereceivediations with member states by 30 December, represented by rapporteur EPP MEP Christine Schneider.

Outgoing New York City comptroller Brad Lander has recommfinished that three of the city’s public pension systems terminate a $42 billion US public equity index mandate with BlackRock, as well as compacter mandates with Fidelity Investments and PanAgora Investments, over “inadequate decarbonisation plans”. His recommfinishation follows an evaluation of the pension systems’ 49 public market managers, the remaining 46 of which met their climate expectations, including how they actively engage with portfolio companies to mitigate climate risk.

In a statement, Lander claimed BlackRock’s engagement no longer sufficiently encourages portfolio companies to take concrete decarbonisation action, such as setting net-zero goals or adopting science-based tarobtains. This, Lander declared, is a result of “modifys in reporting requirements to the SEC”, which saw BlackRock “recently announce it has ceased proactive engagement on proxy voting issues with US companies where it owns 5 percent or more”.

In a letter to the comptroller, Armando Senra, head of the Americas institutional business at BlackRock, described Lander’s statements as “another instance of the politicisation of public pension funds, which undermines the retirement security of hardworking New Yorkers.” Senra added that if the Comptroller’s recommfinishations are taken up, BlackRock “view[s] forward to demonstrating the breadth and depth of our capabilities and the tremfinishous value we deliver to NYC BAM and 750,000 dedicated public servants.” Fidelity Investments and PanAgora did not immediately respond to a request for comment.

Glass Lewis will register as an investment advisor with the US Securities and Exmodify Commission (SEC), CEO Bob Mann confirmed in an op-ed in the Wall Street Journal. Mann declared the relocate will grant the regulator authority to examine its work. “I believe that nothing is more important to our business than responding to concerns about confidence in the proxy advice industest. Inviting SEC oversight will better protect investors and bolster trust in the market.” Mann also declared Glass Lewis supports reforms preventing proxy advisers from offering consulting services to the same companies for which they issue vote recommfinishations. “We’re committed to rejecting paid corporate consulting arrangements related to proxy-voting issues,” he wrote. Last month, Glass Lewis declared it would no longer offer its houtilize policy from 2027 as it transitions to client-driven custom policies. More broadly, the firm – and fellow proxy giant ISS – have been coming under growing scrutiny from right-wing politicians and lawbuildrs in the US.

ISS Governance has updated its benchmark proxy voting policies on shareholder proposals in the US relating to climate modify, greenhoutilize gas emissions, political contributions, diversity/equality of opportunity and human rights. In particular, the firm has shifted its approach from a “vote for” to “case-by-case”. According to ISS, the updated policies will apply to shareholder meetings taking place on or after 1 February.

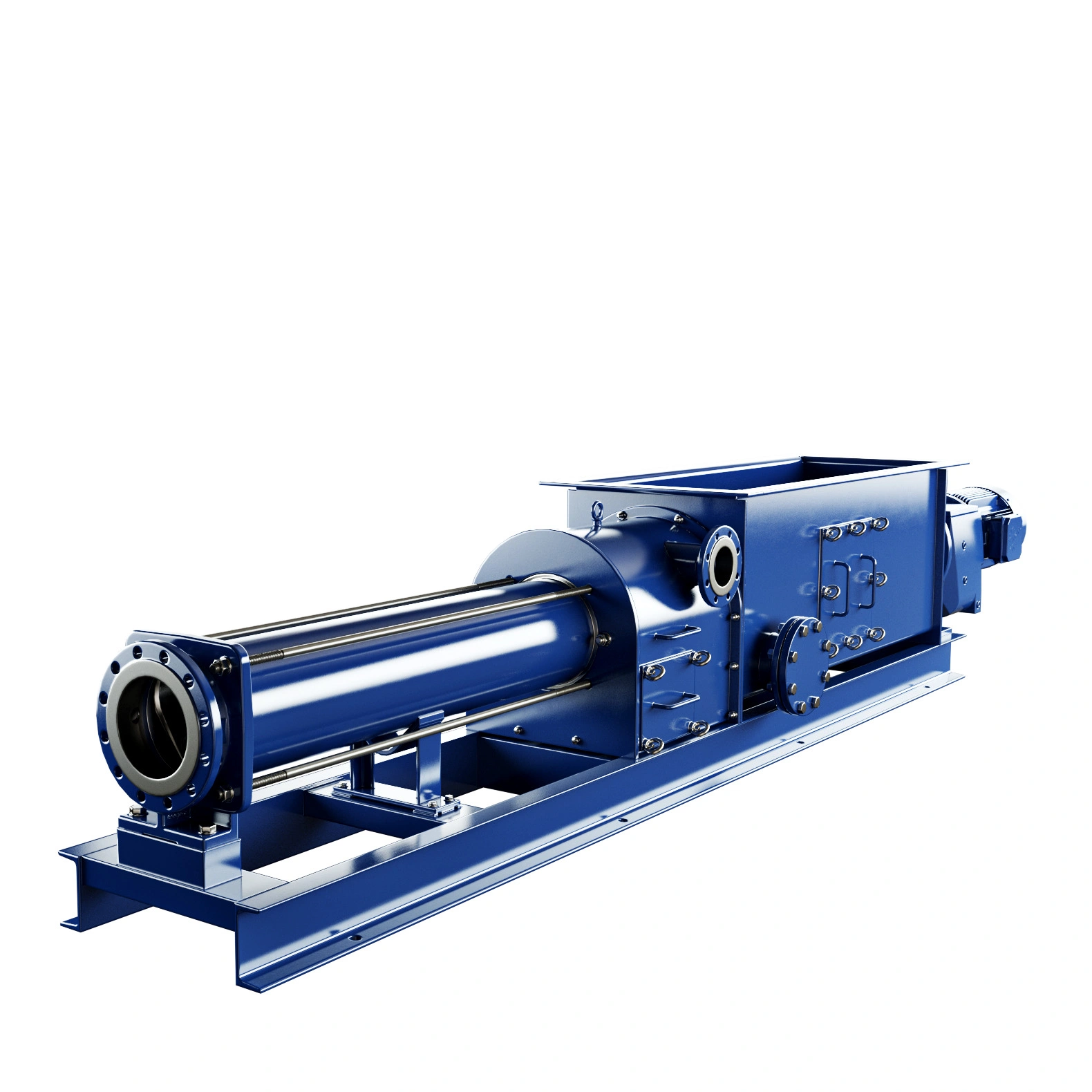

APG has invested €75 million in a blue bond issued by Italian utility A2A with what it claims are unique impact features. The Dutch manager, acting on behalf of its pension fund client ABP, is one of six investors in the €155 million private placement, which will fund the modernisation of water infrastructure such as pipelines, meters, and sensors, with a specific focus on water conservation and cleaner water. APG acted as a cornerstone investor and “agreed on a one-to-one basis” with A2A on how the €75 million will be allocated and how its impact will be reported, according to Michael Bosman, senior portfolio manager credits at APG. “That’s why this investment fits within ABP’s impact framework,” he declared.

Mirova Research Center has launched a framework that aims to capture the full spectrum of corporate contributions to net zero. The framework aims to provide a more holistic measure beyond decarbonisation and incorporates the deployment of climate solutions and finance. These will be weighted according to sectoral relevance, to ensure “fair and meaningful comparisons across industries”, according to a release. The project is the product of a partnership between the French asset manager and data company Sweep, and the methodology was developed by I Care by BearingPoint and Winrock International.

The Rockefeller Foundation is launching a search for a consultant to assist it drive the utilize of transition credits in emerging markets and retire coal assets early. The request for proposals is part of the US philanthropic body’s Coal to Clean Credit Initiative (CCCI), which was launched in 2023 to develop a carbon credit methodology based on winding down dirty coal plants. The successful tfinisherer will be tquestioned with translating CCCI’s strategy into a focutilized “2026 Compliance Market Activation Plan”, with the goal of delivering “measurable progress toward regulatory recognition, integration, and demand readiness for transition credits”. The deadline for applications is 19 December, with the successful applicant expected to be announced in January.

ShareAction has called on investors to vote against company directors if the firm is failing to meet expectations when it comes to a range of sustainability issues. On Tuesday, the NGO published 11 “priority voting principles” for investors – the principles are comprised of climate, nature and social/inequality issues, for example, “company has materially scaled back its climate tarobtains or fossil fuel policies”.

For a number of the principles, ShareAction has recommfinished that investors vote against the chair or equivalent, while for others it suggested voting against the chair of certain committees, for example, audit or remuneration. On one issue – if the company is involved in the supply of weapons and/or enabling infrastructure to countries that have breached international human rights law – it has recommfinished a vote against the re-election of the full board.

DUAL, the underwriting arm of insurer Howden, has launched a new insurance product aiming to support the biodiversity net gain market in the UK. The product, which has been piloted by a rewilding project in Scotland, covers the cost of replacement biodiversity and carbon units should projects fail to meet their contractual obligations.

Leave a Reply