W Health Ventures declared it has completed an initial close of its second fund at Rs 550 crore, shifting toward a tarreceive corpus of Rs 630 crore, as the healthcare-focapplyd venture firm views to expand its company-creation strategy across India and the US-India corridor.

The fund will continue the firm’s model of co-founding and scaling healthcare businesses from inception, tarreceiveing areas where clinical demand is rising but supply and delivery infrastructure remain constrained.

India’s healthcare sector is seeing growing pressure from a rising chronic disease burden, increasing health awareness and modifying patient expectations. At the same time, shortages in specialist care, medical professionals and infrastructure continue to challenge service delivery. W Health Ventures, founded in 2021, positions its investment strategy around building technology-enabled healthcare models designed to address these structural gaps.

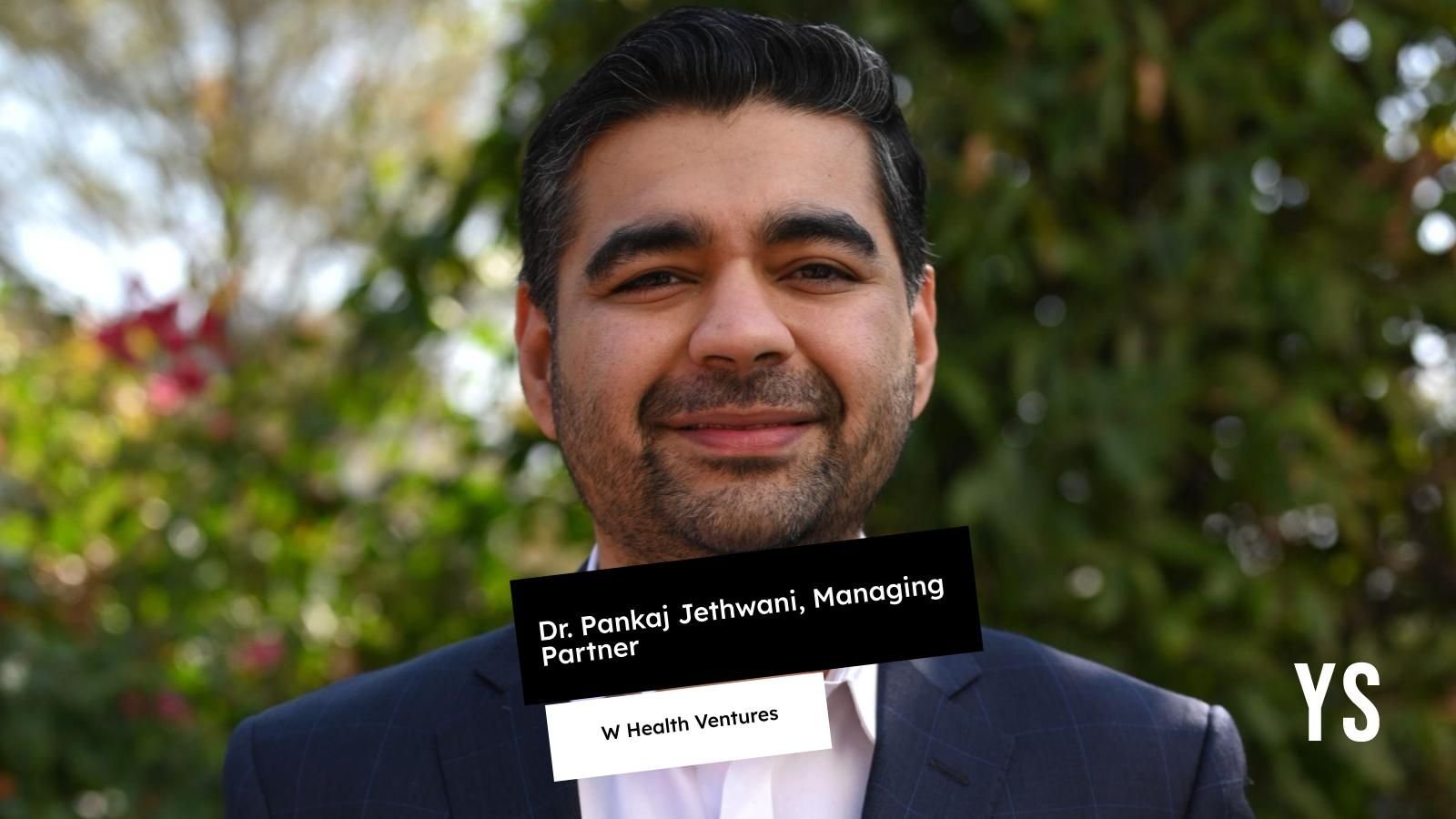

“We work with founders, clinicians, operators, and strategic partners to co-found companies from inception. We identify underserved clinical and operational whitespaces, assemble founding teams, and support execution through shared playbooks, partnerships, and an experienced platform team. Our portfolio companies impact over 25 million individuals globally, and we aim to scale this to a billion lives over the next two decades,” declared Dr. Pankaj Jethwani, Managing Partner at W Health Ventures.

The firm’s first fund backed companies including Nivaan, focapplyd on chronic pain management; diabetes care platform BeatO; obesity management startup ElevateNow; paediatric care provider BabyMD; and parenting platform Mylo in India. Cross-border portfolio companies include mental health platform Wysa and AI services firm Reveal HealthTech. According to the firm, companies from the first fund have subsequently raised external growth capital.

With the second fund, W Health Ventures plans to incubate between eight and ten new companies over the next four years, with an expected investment of Rs 30–50 crore in each venture.

Capital deployment from the new fund has begun. The first company incubated under Fund II, Everhope Oncology, has been launched in partnership with Narayana Health and is focapplyd on developing an integrated oncology care platform. The firm is also incubating a US-based psychiaattempt-focapplyd venture aimed at expanding access to advanced treatments for patients with treatment-resistant depression. Additional areas under evaluation include longevity and preventive health, geriatrics, and chronic pain management.

“We are grateful to our limited partners for their trust and support. Across the fundraising journey, they were supportive of our ability to build generational healthcare companies from the ground up in critical areas of care that create a real difference for patients,” declared Gaurav Porwal, partner at W Health Ventures.

W Health Ventures operates as an early-stage healthcare investor and works alongside venture studio 2070 Health to develop new companies. The firm declares it has invested in a dozen healthcare businesses across India and the US to date.

Leave a Reply