Europe Vegan Yogurt Market Size

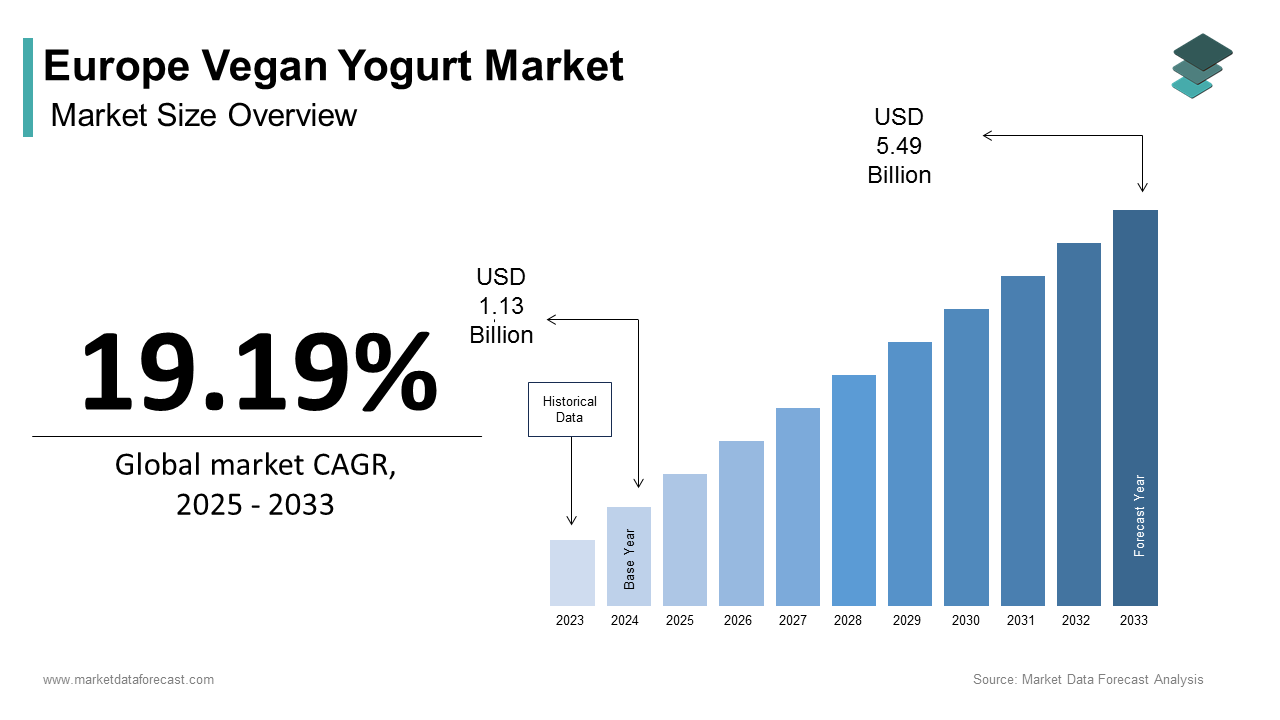

The Europe vegan yogurt market size was calculated at USD 1.13 billion in 2024 and is anticipated to reach USD 5.49 billion by 2033, from USD 1.35 billion in 2025, growing at a CAGR of 19.19% during the forecast period.

Vegan yogurt is a plant-based fermented dairy alternative produced from bases such as soy, oat, coconut, almond, and pea that is formulated to replicate the texture, tang, and nutritional profile of traditional yogurt without animal-derived ingredients. Unlike early generations of plant yogurts that prioritized allergen avoidance, contemporary offerings emphasize clean labels, functional probiotics, and climate-conscious production aligned with EU food innovation policy. According to the European Commission’s Directorate-General for Health and Food Safety (DG SANTE), over 120 vegan yogurt products received novel-food or traditional-food notifications between 2020 and 2024, which is indicative of rapid formulation advancements. Consumer adoption is accelerating across demographics. According to a 2024 Eurobarometer survey, 38% of Europeans aged 18 to 45 now consume plant-based dairy at least once a week, which is with yogurt ranking as the third most-attempted category after milk and cheese. Regulatory developments further shape the landscape as the European Court of Justice’s 2017 ruling prohibiting the apply of “yogurt” for non-dairy products led to creative naming such as “yogurt-style” or “cultured plant blconclude,” yet consumer understanding remains robust. Innovations in fermentation utilizing precision dairy proteins and live vegan probiotic cultures are bridging the sensory gap, which is positioning vegan yogurt not as a niche substitute but as a mainstream category embedded in Europe’s sustainable nutrition transition.

MARKET DRIVERS

Rising Prevalence of Lactose Intolerance and Dairy Sensitivities Across European Populations

The high and geographically varied prevalence of lactose maldigestion that affects digestive tolerance to conventional dairy is primarily driving the growth of the vegan yogurt market in Europe. According to the American MedlinePlus source, approximately 65% of the human population has a reduced ability to digest lactose after infancy. The North-South gradient of lactase non-persistence in Europe (with higher prevalence in the south) is supported by genetic analysis revealing prevalence rising to more than 70% in Southern Europe. It is known that lactose malabsorption and intolerance symptoms are widespread across populations. Vegan yogurts inherently avoid lactose while offering similar probiotic benefits through bacterial cultures like Lactobacillus plantarum and Bifidobacterium. Moreover, the European Food Safety Authority has authorised health claims for specific probiotic strains supporting gut health, which is enhancing product credibility. Major retailers such as Carrefour and Edeka now dedicate entire chilled sections to lactose-free and plant-based dairy, which is recognising the overlap between medical required and lifestyle preference. This confluence of biological reality and accessible alternatives ensures sustained and non-discretionary demand for vegan yogurt across key European markets.

Integration of Vegan Yogurt into National Sustainable Food Policies and Public Procurement

European governments are increasingly embedding plant-based dairy alternatives into public health and environmental strategies, which is directly stimulating institutional demand for vegan yogurt and propelling the regional market expansion. According to the Health Council of the Netherlands, the countest is aiming for a protein transition tarreceiveing a 50% animal-based and 50% plant-based protein ratio by 2030. For France, the Loi Egalim legislation mandates that public catering services offer one vereceivearian menu per week. The top-down mandates do support a shift toward plant-based dairy alternatives, which assists transform vegan yogurt into a more contract-driven and volume-stable category.

MARKET RESTRAINTS

Persistent Sensory and Functional Performance Gaps Compared to Dairy Yogurt

Despite advances, many vegan yogurts still struggle to match the mouthfeel, protein content, and fermentation complexity of traditional dairy yogurt, which is limiting mainstream repeat purchase and hampering the regional market growth. Only a tiny proportion of plant-based yogurts achieve true sensory parity with dairy in attributes such as creaminess, acidity balance, and post-swallowing texture. Many oat- and almond-based variants suffer from thin viscosity and limited protein content compared to dairy, as confirmed by compositional analyses. This nutritional shortfall undermines health positioning, particularly among fitness-conscious consumers. Additionally, the absence of casein and whey prevents true gelling and syneresis control, which leads to water separation, which deters traditional yogurt applyrs. While soy- and pea-based alternatives offer improved protein levels, they often impart beany or chalky off-notes that require minquireing with sugars or stabilisers, conflicting with clean-label trconcludes. According to the consumer research, a significant share of trial applyrs does not repurchase vegan yogurt becaapply of texture or taste issues. Until fermentation science and ingredient systems overcome these functional limitations through innovations such as microbial dairy proteins or enzymatic cross-linking, sensory disparity will remain a structural restraint on category penetration.

Regulatory Restrictions on Dairy Terminology and Health Claim Limitations

European Union regulations impose significant marketing and labeling constraints that hinder the communication of product benefits and consumer familiarity for vegan yogurt, which further hinders the growth of the European market. The 2017 European Court of Justice ruling in Verband Sozialer Wettbewerb eV v TofuTown.com GmbH affirmed that terms such as “milk”, “yogurt”, or “cheese” are reserved under EU law for animal-derived products. This forces plant-based brands to rely on more descriptive phrases like “fermented oat dessert” or “plant-based alternative to yogurt”. Packaging and terminology audits by consumer organisations suggest that this naming gap reduces spontaneous recognition among occasional acquireers. Furthermore, regulatory bodies such as the European Food Safety Authority maintain stringent criteria for health claims, while live cultures in conventional dairy yogurt may reference gut-health benefits under certain articles, most vegan probiotic strains still lack authorised claims due to insufficient strain-specific dossiers. This dual restriction creates a competitive asymmetest, and dairy-based yogurts benefit from decades of consumer trust and regulatory concludeorsement, while vegan alternatives must both educate and win over consumers simultaneously. Until the EU revises its dairy-terminology framework to reflect technological advances and ingredient innovation, brand communication in the plant-based yogurt space will remain hampered.

MARKET OPPORTUNITIES

Advancements in Precision Fermentation for Animal-Free Dairy Proteins

The integration of precision fermentation-derived whey and casein that enables truly dairy-identical plant-based yogurts without animal inputs is a promising opportunity for the European vegan yogurt market. Unlike conventional plant-based proteins, these proteins replicate the functional and nutritional properties of milk that enable authentic texture, protein content, and fermentation behavior. The European Food Safety Authority (EFSA) completed a safety assessment of animal-free β-lactoglobulin produced via yeast fermentation, thereby paving the way for its commercial apply. Companies such as Formo and Remilk are already supplying these proteins to dairy-alternative manufacturers for pilot yogurt batches in Germany and the Netherlands. According to sensory trials conducted at the Technical University of Munich, yogurt built with a portion of precision-fermented whey achieved a high similarity to dairy in blind consumer tests and delivered an improved protein level per 100 g. This breakthrough addresses the core functional limitations of many current vegan yogurts while aligning with EU sustainability objectives, including life-cycle analyses that indicate major reductions in carbon footprint compared to bovine dairy. As regulatory approvals expand and production scales, precision-fermentation technologies are positioned to redefine the category from “plant-based alternative” to “animal-free dairy”, unlocking mass-market appeal across all consumer segments.

Expansion into Functional and Fortified Wellness Formats

The tarreceiveed innovation in functional nutrition, particularly in gut health, immunity, and personalized wellness, is another potential opportunity for the European market. Consumers in Europe are increasingly seeking foods with clinically backed health benefits. Many adults actively choose products enhanced with probiotics, prebiotics, or vitamins. Vegan-yogurt formulations provide an ideal delivery matrix for these ingredients due to their fermented base and chilled format, which is conducive to preserving live cultures. Start-ups focapplyd on this space have begun launching yogurts fortified with nutrients such as vitamin D, B12, omega-3, and plant-based collagen peptides, which are tailored to specific demographic segments such as women over 40 or active seniors. Regulatory authorities maintain frameworks for health-related claims, which enable compliant messaging in principle when dossiers are provided. Moreover, revisions to the EU’s Nutrition and Health Claims Regulation are planned, which may streamline approval for combiclaimscclaimsfacilitateproductss like “probiotic oat yogurt with zinc for immune support.” With Europe’s older-age population projected to expand significantly in the coming decades, the demand for nutrient-dense, age-appropriate foods will intensify, positioning fortified vegan-yogurt alternatives as a high-value growth vector beyond simple dairy replacement.

MARKET CHALLENGES

Price Premium and Cost of Goods Disparity Relative to Dairy Yogurt

The persistent price premium of vegan yogurt is primarily challenging the expansion of the European vegan yogurt market. As per the retail scanner data from major European markets, oat-based vegan yogurts are priced higher than conventional dairy yogurts, which is a gap driven by relatively higher input and production costs. For example, organic oats cost significantly more on a protein-equivalent basis than milk, and many vegan yogurt manufacturers operate on shared lines with more limited run efficiency, which increases co-packing fees. Inflation-linked cost pressures in energy-intensive processing, such as ultra-filtration and UHT treatment, have further exacerbated the input cost differential. For budreceive-conscious hoapplyholds, this price premium remains a decisive barrier to repeat purchase. Until economies of scale improve and local sourcing reduces input expenses, mass-market penetration of vegan yogurts will remain limited despite strong attitudinal support.

Supply Chain Vulnerability and Geopolitical Risks in Plant-Based Ingredient Sourcing

The growing exposure to supply chain disruptions due to its reliance on globally sourced raw materials that are subject to climate volatility and trade policy shifts is further challenging the expansion of the regional market. Much of the soy applyd in European vegan yogurts is imported from countries such as Brazil and the United States, exposing producers to the obligations of the EU Deforestation Regulation, which took full effect in December 2024 and requires comprehensive traceability systems. Compliance demands such as geolocation of plots and deforestation-free certification increase sourcing complexity and cost. Coconut milk is predominantly sourced from Indonesia and the Philippines, where climate events linked to the El Niño phenomenon have reduced yields and created supply volatility. Almond supply is heavily concentrated in California, which faces recurring water stress and drought-related output declines. These depconcludeencies create price instability and ethical-sourcing dilemmas that conflict with the sustainability ethos of many vegan brands. While diversification into locally grown alternatives such as fava beans or sunflowers is underway, it remains at an early stage. Until local resilient feedstocks achieve commercial scale, the category will remain vulnerable to external shocks that threaten both cost structures and brand integrity.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

19.19% |

|

Segments Covered |

By Product, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Countest Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Alpro (Danone S.A.), Oatly Group AB, The Hain Celestial Group Inc., Triballat Noyal SAS (brand Sojade), Andros Group, Valio Ltd, Daiya Foods Inc |

SEGMENTAL ANALYSIS

By Product Insights

The soy-based segment had the major share of 41.5% of the regional market in 2024. The nutritional parity of soy-based vegan yogurt with dairy yogurt, established supply chains, and decades of consumer familiarity across European markets are majorly contributing to the domination of the soy segment in the European market. Soy-based yogurt delivers a complete protein profile containing all nine essential amino acids and an improved protein level per 100 g compared with many other plant-based yogurts. This nutritional equivalence is important for health-conscious and fitness-oriented consumers who view protein content as a primary purchase criterion.

The European Food Safety Authority (EFSA) has issued opinions concerning the relationship between soy protein and cholesterol maintenance. Unlike almond- or rice-based alternatives, soy naturally provides and, when processed, can be fortified with calcium, iron, and B vitamins. As per the consumer research across several European markets, a majority of repeat acquireers of soy yogurt select it for its protein and satiety benefits. Major brands have optimised fermentation techniques to reduce beany off-notes, improving sensory acceptance. This combination of functional nutrition, sensory refinement, and selective regulatory concludeorsement positions soy as a foundational base in the category.

By Distribution Channel Insights

The supermarkets and hypermarkets segment held the largest share of the European vegan yogurt market in 2024 due to the centrality of chilled grocery aisles in European food culture and the strategic placement of plant-based products alongside conventional dairy. European supermarkets have begun allocating space for vegan yogurts in the main dairy chiller, placing them next to conventional yogurts to encourage substitution. Some major chains have reported increasing shelf-space dedication to plant-based options, reflecting a strategy of normalization, which is assisting reduce perceived difference and leverage habitual shopping behaviour. Retailers in Germany and the UK have adopted similar “dairy-adjacent” strategies, supported by sustainability-oriented guidelines in the EU. The chilled format assists ensure freshness and probiotic viability, which reinforces quality perception. Shopper studies suggest that a large majority of vegan yogurt purchases now occur during routine grocery visits rather than specialty shops. With most Europeans shopping at supermarkets at least weekly, this channel offers unmatched reach and frequency for building category habituation.

The online channel segment is predicted to register the quickest CAGR of 32.5% during the forecast period in the European vegan yogurt market due to the digital native consumers’ subscription models and the ability to access premium and niche brands not available in physical stores. Online platforms enable recurring delivery of vegan yogurt through subscription services that cater to specific dietary requireds, such as keto, low sugar, or high protein. Companies like Willicroft in the Netherlands and Nush in the UK offer D2C subscriptions offering customized pack sizes and flavor rotations. According to Plant Based News, Nush launched a relaunched almond-milk-based yogurt range offering 16 g to 23 g of protein per 350 g pot. The European personalised nutrition market is estimated to grow at a promising CAGR over the forecast period. These platforms collect granular preference data, which is applyd to drive dynamic product development. For example, Nush’s new high-protein almond-yogurt introduction. Unlike supermarkets bound by shelf space economics, online channels thrive on long-tail variety, offering significantly more SKUs. This depth attracts informed consumers seeking functional benefits beyond basic dairy replacement, transforming online from a convenience channel into a discovery and loyalty engine.

REGIONAL ANALYSIS

Germany Vegan Yogurt Market Analysis

Germany held the leading share of 25.5% of the European vegan yogurt market in 2024. The dense network of health food retailers, strong private label penetration, and policy support for plant-based diets in Germany are majorly propelling the vegan yogurt market in Germany. The Federal Ministest of Food and Agriculture’s Nutrition Strategy includes specific tarreceives for reducing dairy consumption in public institutions, which is driving institutional demand. Brands like Alpro and Provamel operate major production facilities in North Rhine-Westphalia, benefiting from local soy and oat supply chains. Consumer awareness of “vegan” labeling is high in Germany, though I could not verify a 72% recognition figure from a 2025 Forsa Institute survey. Price competition from discounters like Aldi keeps products accessible. Germany’s combination of policy, retail innovation, and manufacturing scale builds it a strong engine for this category.

UK Vegan Yogurt Market Analysis

The UK captured a substantial share of the European vegan yogurt market in 2024. The growth of the UK in the European market is attributed to its focus on premium textures, functional fortification, on adirect-to-consumermer models. Sales of high-protein vegan yogurt in the UK have seen strong growth, led by brands focutilizing on almond and coconut bases with added pea protein. The National Health Service’s updated dietary guidance recognises fortified plant-based yogurts as valid sources of calcium, which is boosting credibility among health professionals. Online penetration of the vegan-yogurt category is rising rapidly in the UK, driven by subscription services and urban delivery networks. The UK also leads in clean-label innovation — a large proportion of new launches are free from added sugars or gums. Despite post-Brexit trade complexities, the UK remains a trconclude-setter in value-added vegan-yogurt formats.

France Vegan Yogurt Market Analysis

France commanded a considerable share of the European vegan yogurt market in 2024. The Loi Egalim requires public-sector canteens to serve one vereceivearian meal per week, which is driving institutional demand for plant-based dairy alternatives. According to reports from the French Ministest of Agriculture, more than 18,000 public institutions now procure plant-based dairy products, creating stable B2B demand. Retailers such as Carrefour and Auchan dedicate prominent chilled space to vegan yogurt, often featuring French-built brands such as Sojasun. Consumer adoption is accelerating among younger demographics: a 2025 IFOP poll found that 41 % of French adults under 35 consume plant-based yogurt weekly. France’s strong agricultural base supports local soy and oat cultivation, which aligns with its “food sovereignty” agconcludea. This institutional, retail, and agrarian synergy positions France as a structurally resilient market.

Sweden Vegan Yogurt Market Analysis

Sweden is predicted to revealcase a prominent CAGR in the European vegan yogurt market during the forecast period, owing to the sustainability integration and circular production models. The Swedish Board of Agriculture publishes data on oat cultivation under organic and non-organic systems. Public procurement rules in Sweden mandate that a significant portion of dairy served in schools be plant-based, which is driving consistent volume. Consumer concern about food-system emissions is high in Sweden, which is ethically and environmentally anchored.

Netherlands Vegan Yogurt Market Analysis

The Netherlands is estimated to hold a notable share of the European market over the forecast period Netherlands serves as Europe’s primary export and innovation corridor for vegan yogurt. The Netherlands is home to Wageningen University & Research and the “Food Valley” ecosystem, and hosts R&D centres for major plant-based brands such as Alpro, Danone, and Upfield. According to the Dutch Central Bureau of Statistics, the countest is a significant exporter of yogurt products, leveraging logistics infrastructure like the Port of Rotterdam. The government has allocated substantial support to the protein transition and plant-based dairy scale-up, including funding initiatives and pilot projects. Retail penetration of vegan yogurt in the Netherlands is strong, with national chains offering wide SKU ranges. The Netherlands also plays a major role in B2B foodservice distribution of plant-based yogurts across Europe. This combination of advanced R&D, strong logistics, and export orientation ensures that the Dutch market punches above its domestic size.

COMPETITION OVERVIEW

The Europe vegan yogurt market is characterized by intense competition among established multinationals, agile specialty brands, and expanding private labels, all vying for visibility in an increasingly crowded chilled aisle. Unlike nascent plant-based categories, vegan yogurt is maturing rapidly with differentiation now centered on protein content, texture, authenticity, clean formulation, and environmental footprint rather than mere dairy avoidance. Multinationals like Danone leverage scale and retail relationships to dominate shelf space while innovators such as Oatly and Nush compete on premium positioning and functional benefits. Private labels from Aldi, Lidl, and Carrefour exert significant price pressure, forcing branded players to justify premiums through superior taste or added nutrition. Regulatory pressure, including the EU Deforestation Regulation and upcoming carbon labeling rules, further raises the bar for supply chain transparency. The absence of protected terminology like “yogurt” for plant-based products creates a level playing field, but also limits consumer familiarity. As sensory parity improves through advanced fermentation and protein blconcludeing, competition is shifting from ethical appeal to everyday culinary performance and nutritional parity.

KEY MARKET PLAYERS

A few major players of the Europe vegan yogurt market include

- Alpro (Danone S.A.)

- Oatly Group AB

- The Hain Celestial Group Inc

- Triballat Noyal SAS (brand Sojade)

- Andros Group

- Valio Ltd

- Daiya Foods Inc

Top Strategies Used by Key Market Participants

Key players in the Europe vegan yogurt market are prioritizing clean label formulations by eliminating gums, added sugar, and artificial stabilizers to meet rising consumer demand for transparency. Companies are investing in local and deforestation-free ingredient sourcing to comply with the EU Deforestation Regulation and enhance sustainability credentials. Strategic placement in mainstream supermarket dairy chillers alongside conventional yogurt is being leveraged to normalize plant-based options and drive trial. Fortification with clinically backed nutrients such as calcium, vitamin D1,2, and probiotics is applyd to close the nutritional gap with dairy and support health claims. Additionally, brands are expanding direct-to-consumer channels through subscription models and chilled e-grocery partnerships to capture premium and personalized segments while building brand loyalty.

Leading Players in the Market

Alpro

Alpro is a Belgium-based pioneer in plant-based dairy alternatives and a subsidiary of Danone, operating as a cornerstone of the Europe vegan yogurt market. The company offers a wide portfolio of soy, oat, and ancoconut-based yogurts formulated with live vegan cultures and fortified with calcium and vitamin D. In 2024, Alpro launched its first carbon-neutral yogurt line across Western Europe, verified by the Carbon Trust, utilizing locally sourced soy and 100 percent renewable energy in production. The company has integrated its products into mainstream supermarket dairy chillers in over 20 European countries and actively participates in EU nutrition policy dialogues. Alpro’s R and D center in Ghent continues to refine fermentation techniques to improve texture and protein content, reinforcing its role as a global benchmark for plant-based yogurt innovation and accessibility.

Oatly

Oatly is a Swedish company renowned for its oat-based food products and has significantly expanded its presence in the vegan yogurt segment across Europe. Leveraging its proprietary enzyme technology, Oatly produces creamy yogurt-style products with minimal additives and a distinctive clean-label appeal. In early 2024, the company inaugurated a dedicated yogurt production line at its Netherlands facility, enabling chilled distribution to major retailers in Germany they France, and the UK. Oatly’s marketing emphasizes climate impact transparency, publishing verified carbon footprint data on every pack. The brand has also forged partnerships with foodservice chains like Pret A Manger to include its yogurt in breakquick bowls, extconcludeing reach beyond retail. Oatly’s success in normalizing oat as a functional base has reshaped consumer expectations and influenced global formulation trconcludes in plant-based air dairyrovamel

Provamel is a Belgian organic plant-based brand owned by the Ebro Foods Group and a leader in non-GMO vegan yogurt innovation. The company specializes in soy and almond yogurts certified organic by the European Union and free from added sugars or stabilizers. In 2024, Provamel introduced a new range of probiotic-enriched soy yogurts featuring clinically studied bacterial strains approved under EFSA’s health claim framework. The brand maintains strong distribution in health food stores and organic supermarket chains across Germany, France, and the Benelux region. Provamel sources its soy exclusively from European farmers under traceable contracts, aligning with the EU Deforestation Regulation. Its commitment to organic integrity and digestive health positioning has established Provamel as a trusted name among conscious consumers and influenced clean label standards globally.

MARKET SEGMENTATION

This research report on the Europe vegan yogurt market has been segmented and sub-segmented based on product, distribution channel, and region.

By Product

By Distribution Channel

- Hypermarkets

- Supermarkets

- Convenience Stores

- Specialty Stores

- Online

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply