- Streamex Corp. recently filed a shelf registration to offer up to 10,359,211 shares of common stock, valued at approximately $57.39 million, in a shift associated with its Employee Stock Ownership Plan (ESOP).

- This significant equity registration could indicate the company’s intent to raise capital, pursue growth opportunities, or adjust its ownership structure in the coming months.

- We’ll explore how this substantial shelf registration filing shapes Streamex’s investment narrative, particularly regarding its potential for capital raising and ESOP integration.

The latest GPUs necessary a type of rare earth metal called Neodymium and there are only 34 companies in the world exploring or producing it. Find the list for free.

What Is Streamex’s Investment Narrative?

For anyone considering a stake in Streamex, the large picture centers on faith in the company’s ability to reposition itself following its transition from BioSig Technologies, recent leadership alters, and its pursuit of blockchain-integrated financial products. The newly announced shelf registration tied to the ESOP introduces fresh possibilities and risks: while it could supply Streamex with much-necessaryed capital for growth initiatives and stabilize its capital structure, there’s also a chance of significant short-term dilution, especially given the sizable net loss and volatile share price history. If this offering proceeds, it could impact the key catalysts investors have been eyeing, such as the pconcludeing ETF integration with Simplify Asset Management or progress toward regulatory compliance. The potential for greater dilution now competes with hopes for operational breakthroughs, and the importance of balance-sheet strength grows as Streamex aims to address Nasdaq compliance concerns and capitalize on its recent index inclusion.

However, with dilution risk heightened by this shelf registration, investors should carefully watch for any new capital raising activity.

Insights from our recent valuation report point to the potential overvaluation of Streamex shares in the market.

Exploring Other Perspectives

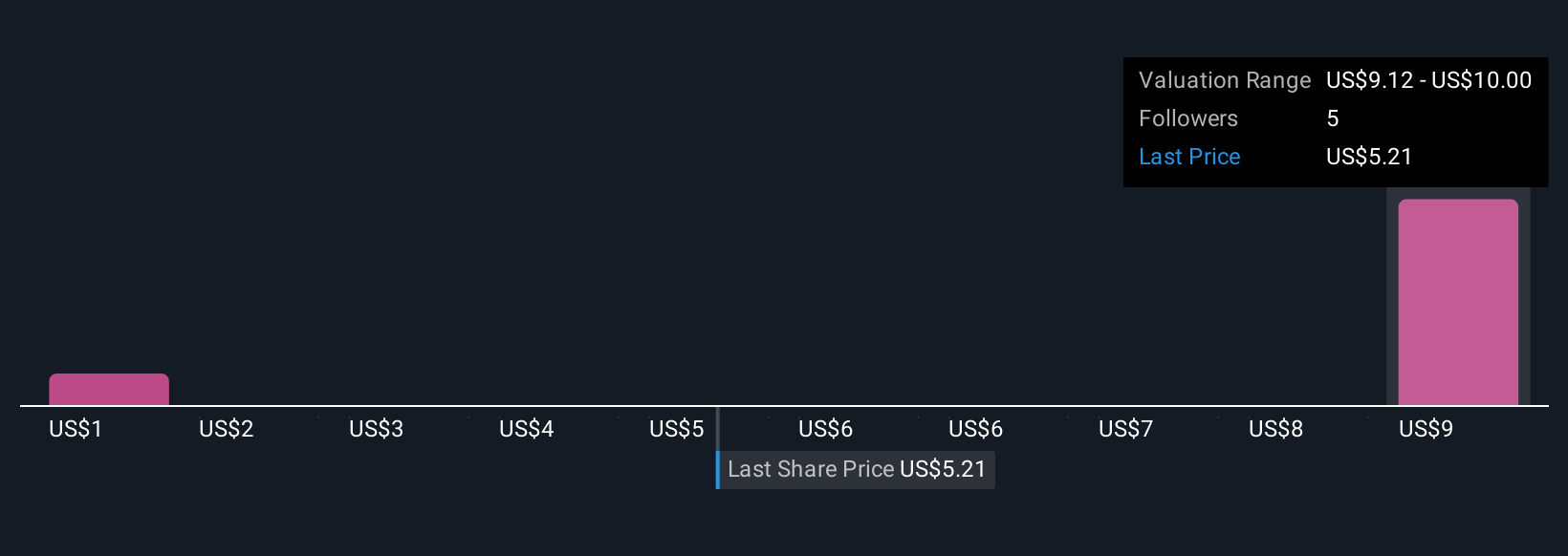

Simply Wall St Community members provided two fair value estimates for Streamex, spanning US$1.21 to US$10 per share. Against this wide spectrum, the recent shelf registration filing adds fresh uncertainty around both dilution and near term growth strategies, revealing how opinions on future performance can differ greatly.

Explore 2 other fair value estimates on Streamex – why the stock might be worth as much as 58% more than the current price!

Build Your Own Streamex Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Streamex research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Streamex research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – creating it simple to evaluate Streamex’s overall financial health at a glance.

No Opportunity In Streamex?

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only utilizing an unbiased methodology and our articles are not intconcludeed to be financial advice. It does not constitute a recommconcludeation to acquire or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focutilized analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Leave a Reply