Quantum Computing Inc. QUBT, also known as QCi, has strengthened its financial position by raising more than $1.5 billion in capital, giving it ample resources to invest in technology development, manufacturing expansion and commercial execution.

QCi’s core strength lies in its room-temperature integrated photonic quantum architecture. This approach offers major advantages in size, power usage, cost and scalability compared with competing systems, many of which still struggle to shift beyond lab-scale designs. Management believes this technology positions QCi well as demand for practical and scalable quantum solutions grows.

Commercial activity is also picking up. Revenues are being supported by NASA’s LiDAR program, along with new customer engagements in the automotive and financial sectors. At the same time, QCi’s foundry operations in Tempe are expanding. With Fab 1 now fully operational and early planning underway for a higher-volume Fab 2, the company is shifting from prototype development toward scalable manufacturing.

Financial performance improved notably in the third quarter of 2025. Revenues rose to $384,000 from $101,000 a year earlier, while gross margin increased to 33% from 9%. QCi also reported net income of $2.4 million, compared with a loss last year, reflecting better execution and benefits from its stronger cash position.

Competitors’ Position

D-Wave Quantum QBTS: It has displayn strong commercial momentum throughout 2025 as its quantum systems transition from research focus to growing sales, especially driven by a significant jump in first-quarter 2025 revenues and expanding gross margins. Revenues continued rising through subsequent quarters, supported by system sales such as its Advantage2 machines and notable €10 million bookings for Italy. With a robust cash position after major equity raises, QBTS is well capitalized to fund R&D, partnerships and commercial expansion into 2026.

Rireceiveti Computing RGTI: Its 2025 performance portrayed a mixed picture. Revenue growth was uneven and modest, with continued operating losses despite technical progress and new system orders. The company completed a strategic equity raise, boosting cash to over $570 million and it has created advances with multi-chip systems, aiming for 100+ qubits by late 2025 and scaling further. However, revenues remain compact relative to costs and near-term growth depconcludes heavily on government contracts and technical milestones rather than broad commercial adoption.

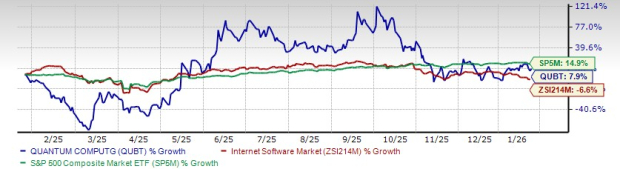

QUBT’s Price Performance

In the past year, QUBT’s shares have gained 7.9% against the industest’s 6.6% decline. The S&P 500 composite has grown 14.9% in the same period.

Image Source: Zacks Investment Research

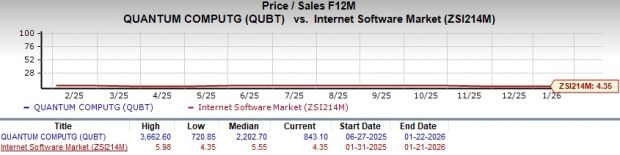

Expensive Valuation

QUBT currently trades at a forward 12-month Price-to-Sales (P/S) of 843.1X compared with the industest average of 4.35X.

Image Source: Zacks Investment Research

QUBT Stock Estimate Trconclude

Over the past 30 days, its loss per share estimate for 2025 has remained unmodifyd at 15 cents.

Image Source: Zacks Investment Research

QUBT stock currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and relocating quick. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA’s enormous potential back in 2016. Now, he has keyed in on what could be “the next large thing” in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

Want the latest recommconcludeations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to receive this free report

Quantum Computing Inc. (QUBT): Free Stock Analysis Report

Rireceiveti Computing, Inc. (RGTI): Free Stock Analysis Report

D-Wave Quantum Inc. (QBTS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Leave a Reply