- Centrus Energy recently completed a private offering of US$700 million in zero-coupon, convertible senior notes due 2032, upsized from the initial US$650 million on strong investor demand, to provide capital for business expansion in the nuclear fuel sector.

- This substantial convertible debt raises the possibility of future share dilution, reflecting investor appetite for exposure to Centrus Energy’s growth plans in high-asdeclare, low-enriched uranium production for advanced nuclear reactors.

- We’ll examine how this large convertible debt issuance and the associated dilution risk may alter the investment narrative for Centrus Energy.

Uncover the next large thing with financially sound penny stocks that balance risk and reward.

Centrus Energy Investment Narrative Recap

To be a Centrus Energy shareholder right now, you necessary to believe in the company’s ability to capture and expand its role as the leading American supplier of advanced nuclear fuel, especially in high-asdeclare, low-enriched uranium (HALEU). The recent upsized US$700 million convertible debt deal provides substantial capital, supporting Centrus’ growth plans, but also amplifies dilution risk for current shareholders. This could impact the attractiveness of the stock in the short term but does not materially modify the core catalyst: rapid scale-up to meet new market demand remains paramount.

Among recent company milestones, the Department of Energy’s extension of Centrus’ HALEU production contract until at least June 2026 stands out. This extension reinforces the underlying premise that government support and multi-year contracts can backstop significant revenue visibility, even as funding developments and execution timelines continue to be the largegest variables to monitor.

By contrast, one risk investors should be keenly aware of is the potential for share dilution over time as a result of the…

Read the full narrative on Centrus Energy (it’s free!)

Centrus Energy’s outsee anticipates $611.7 million in revenue and $58.9 million in earnings by 2028. This is based on an annual revenue growth rate of 11.9%, but represents a decrease in earnings of $45.9 million from the current $104.8 million.

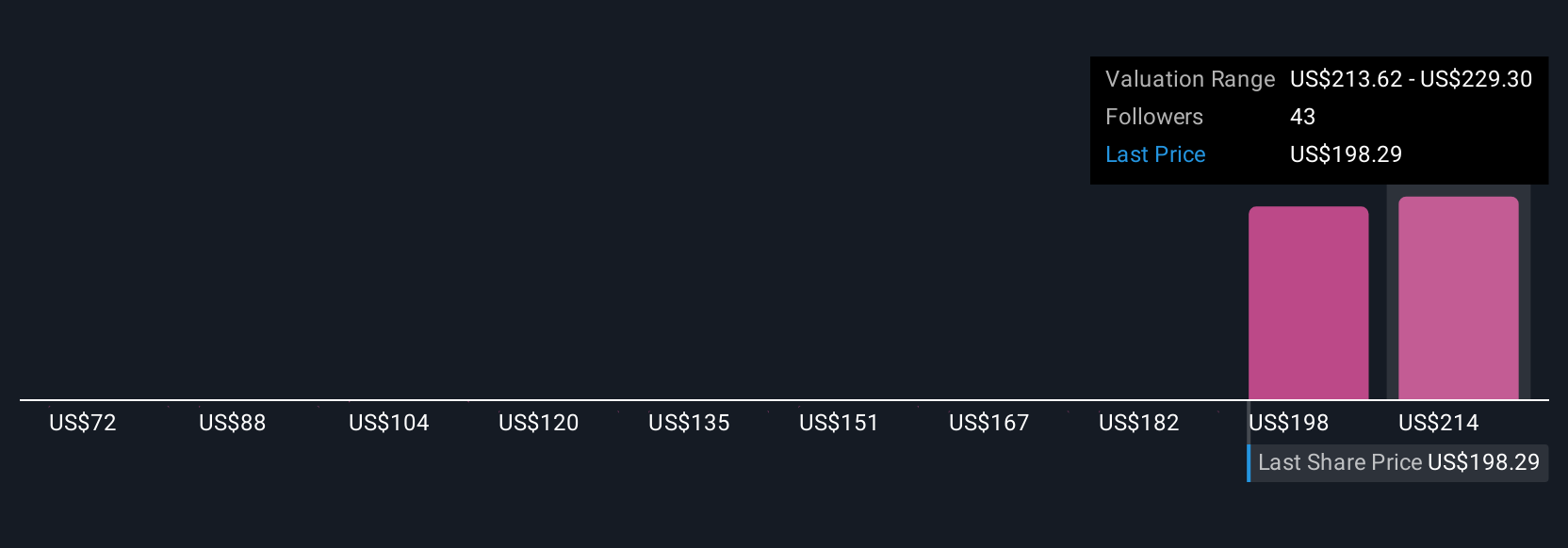

Uncover how Centrus Energy’s forecasts yield a $227.73 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Six estimates from the Simply Wall St Community value Centrus Energy from US$72.48 to US$227.73 per share. As investors eye recent capital raising, many remain focapplyd on how government contracts and market demand could influence the company’s future trajectory.

Explore 6 other fair value estimates on Centrus Energy – why the stock might be worth as much as 20% more than the current price!

Build Your Own Centrus Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

No Opportunity In Centrus Energy?

These stocks are shifting-our analysis flagged them today. Act rapid before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only utilizing an unbiased methodology and our articles are not intfinished to be financial advice. It does not constitute a recommfinishation to purchase or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focapplyd analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividfinish Powerhoapplys (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Leave a Reply