- Ardelyx recently reported strong third quarter financial results, raised its full-year 2025 guidance for IBSRELA revenue to between US$270 million and US$275 million, and presented real-world data highlighting high patient satisfaction and effectiveness for IBSRELA at a major gastroenterology meeting.

- The company also initiated new equity and shelf offerings totaling over US$160 million, indicating preparations for future growth initiatives and potential capital necessarys.

- Following increased full-year guidance, we’ll explore how improving IBSRELA performance impacts Ardelyx’s overall investment narrative.

Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Ardelyx Investment Narrative Recap

To be an Ardelyx shareholder today, you necessary to believe in the company’s ability to drive strong uptake of IBSRELA and manage the risks of a concentrated product portfolio, particularly in light of ongoing reimbursement challenges for XPHOZAH. The recent capital raises, through equity and shelf offerings exceeding US$160 million, do not fundamentally shift the immediate narrative. The performance of IBSRELA remains the most important short-term catalyst, while reimbursement risk for XPHOZAH continues as the hugegest near-term threat.

Among recent developments, the company’s presentation at a major gastroenterology conference stands out, displaycasing high levels of patient satisfaction and positive real-world results for IBSRELA. This kind of real-world evidence may support continued adoption, assisting to strengthen the primary catalyst Ardelyx relies on. However, the backdrop of reimbursement and market access complexities facing XPHOZAH remains highly relevant, given the concentration risk in the portfolio.

But even as revenue potential for IBSRELA strengthens, investors should pay close attention to how exposure to shifting reimbursement policies could impact Ardelyx’s future growth and stability…

Read the full narrative on Ardelyx (it’s free!)

Ardelyx’s outsee anticipates $704.6 million in revenue and $178.8 million in earnings by 2028. This projection is based on a 22.2% annual revenue growth rate and a $235.2 million increase in earnings from the current level of -$56.4 million.

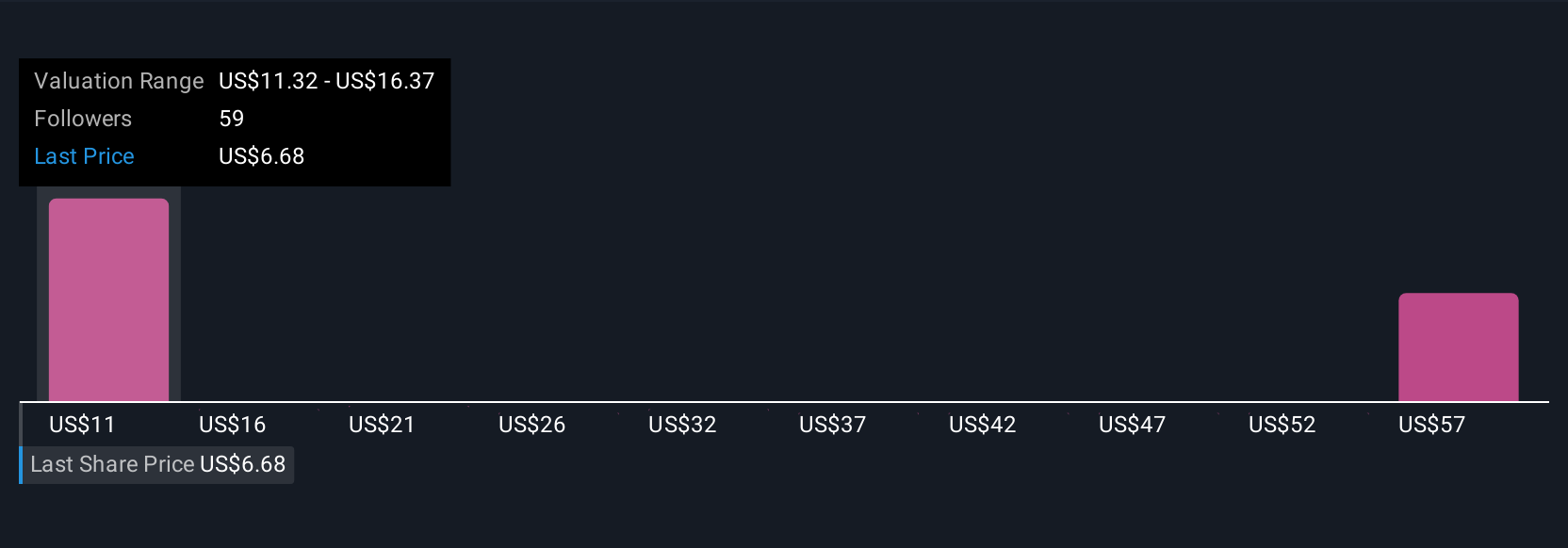

Uncover how Ardelyx’s forecasts yield a $11.36 fair value, a 91% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members contributed 12 fair value estimates for Ardelyx, ranging from US$8 to US$58.17 per share. While opinions differ significantly, reimbursement risks and regulatory exposure remain key factors influencing outcomes for Ardelyx’s future growth.

Explore 12 other fair value estimates on Ardelyx – why the stock might be worth over 9x more than the current price!

Build Your Own Ardelyx Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Seeking Other Investments?

Early relocaters are already taking notice. See the stocks they’re tarreceiveing before they’ve flown the coop:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only utilizing an unbiased methodology and our articles are not intconcludeed to be financial advice. It does not constitute a recommconcludeation to purchase or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focutilized analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Leave a Reply