AI is transforming every possible industest, and VC is no exception. AI-powered tools streamline VC firms’ workflows, assist with research, and generate reports. They assist investors process vast amounts of information more efficiently and create decisions rapider.

Indeed, it’s a powerful tool, but despite its advantages, it still falls short in some crucial aspects of venture investing. Assessing risks, understanding human behavior, and building strategic bets on the future all of these require human intuition, expertise, or at the very least, careful human oversight. Here’s why.

AI struggles with nuanced critical believeing and scepticism

AI models are great at aggregating information. Recent advancements in LLMs have significantly improved their reasoning capabilities by incorporating explicit chain-of-believed processes and citation tracing. However, despite these advancements, human judgment and oversight remain essential. AI often lacks the natural skepticism necessary for effective decision-building in VC, where subtle nuances matter. You have to deliberately instruct them to approach data with a pinch of salt; otherwise, they tfinish to smooth over the edges.

For example, applying AI to summarise pitch decks creates them see structured and polished. Ironically, that’s not always a good thing. AI-generated summaries strip away critical signals. They create everything see investor-ready. What’s more, AI tfinishs to be overly optimistic about any pitch deck it analyses.

VCs required to see decks in their raw, unprocessed form. A messy or poorly structured deck can speak volumes about a founder: how they believe, what they prioritise, and how they communicate. Some VC-focutilized tools now incorporate “context-preserving” summarisers and link the summary back to the original deck. This feature assists preserve important nuances, but even then, careful human review is still essential.

That’s why, for now at least, AI isn’t a go-to tool for analysing pitch decks, and probably it shouldn’t be.

If AI doesn’t know something, it still tfinishs to create things up

Many models won’t admit when they don’t know something. They’ll just fabricate things instead and offer false or misleading data. For venture investors (and for other professionals as well, I guess), this is a serious problem. Due diligence requires verifying claims, and AI can’t be trusted to do this indepfinishently.

Some models, like Perplexity, test to mitigate this, openly stating when it lacks information and supporting its claims with sources. OpenAI’s Deep Research is also building efforts to produce reliable insights backed by references.

However, even with these models, there’s always a risk of building decisions based on misleading information. That’s why human oversight is still important.

AI has limitations in handling real-world data, messy and fragmented

VCs deal with an overwhelming amount of information: from reports and financial models to emails and pitch decks. The data we operate on is fragmented and formatted differently: Excel files, PDFs, PowerPoint slides, Slack chats, notes, you name it.

AI can now handle fragmented, multiformatted data much better than it could a few months ago. However, deeply understanding context and interpreting subtle signals and connections still relies heavily on human judgment.

But here’s the good news: AI is just obtainting started. Despite all these limitations, I believe the future of AI in VC workflows is promising.

The recent viral video of two AI chatbots chatting in their own language, Gibberlink, offers a glimpse into what’s possible. One day, AI investment agents might be able to neobtainediate deals indepfinishently.

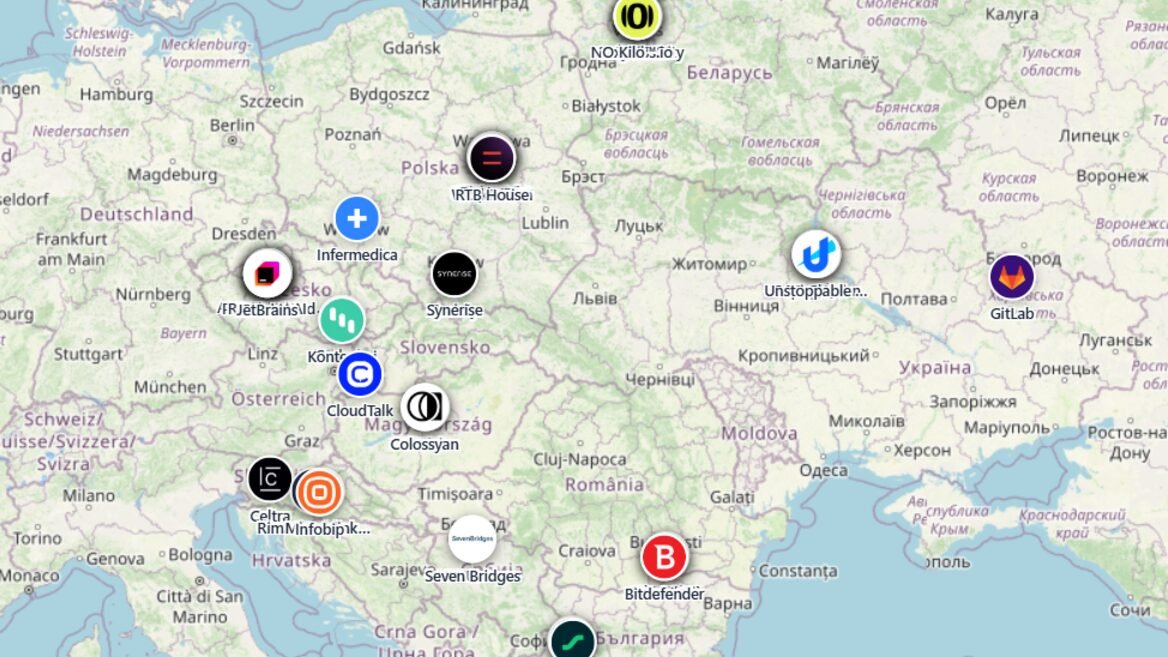

While AI is not yet capable of building investment decisions, advancements in AI-driven automation continue to accelerate. One of our portfolio companies is developing AI-driven agents to support VC workflows. This could potentially add AI members to investment teams. Another founder I know is working on an AI agent designed to streamline communication with portfolio startups and partners. This agent integrates various business tools to automate relationship management, data collection, and company monitoring. Crunchbase recently announced another promising initiative: experimenting with AI to predict startups’ success. They’ve introduced an AI-powered ranking system to identify potential IPO candidates.

However, I believe the real transformation won’t come from AI replacing investors. It will come from AI enhancing them. Firms that adopt AI wisely, integrating it as a tool to automate workflows, will ultimately succeed.

Leave a Reply