Also in the letter:

■ OpenAI’s latest acqui-hire

■ More legal woes for Byju

■ TCS bags new AI deal

Urban Company sets IPO price band at Rs 98–103

(L-R) Varun Khaitan, Raghav Chandra, Abhiraj Singh Bhal

Urban Company is set to hit the public markets. The Gurugram-based home services platform has repaired the price band for its much-anticipated Rs 1,900-crore initial public offering at Rs 98–103 per share. The issue will open on September 10 and close on September 12, with shares expected to list on the NSE and BSE by September 17.

Tell me more: Urban Company’s turnaround to profitability in FY25 sets it apart from most of its new-age peers which have been loss-creating while they listed.

Details:

- Offer size: Rs 1,900 crore (fresh issue of Rs 472 crore; offer for sale (OFS) of Rs 1,428 crore).

- Valuation: Implied market cap ranges from Rs 14,095 crore to 14,790 crore ($1.7–1.8 billion).

- Quota split: 75% for QIBs, NIIs: 15%, retail: 10%. Employees will obtain a Rs 9 discount.

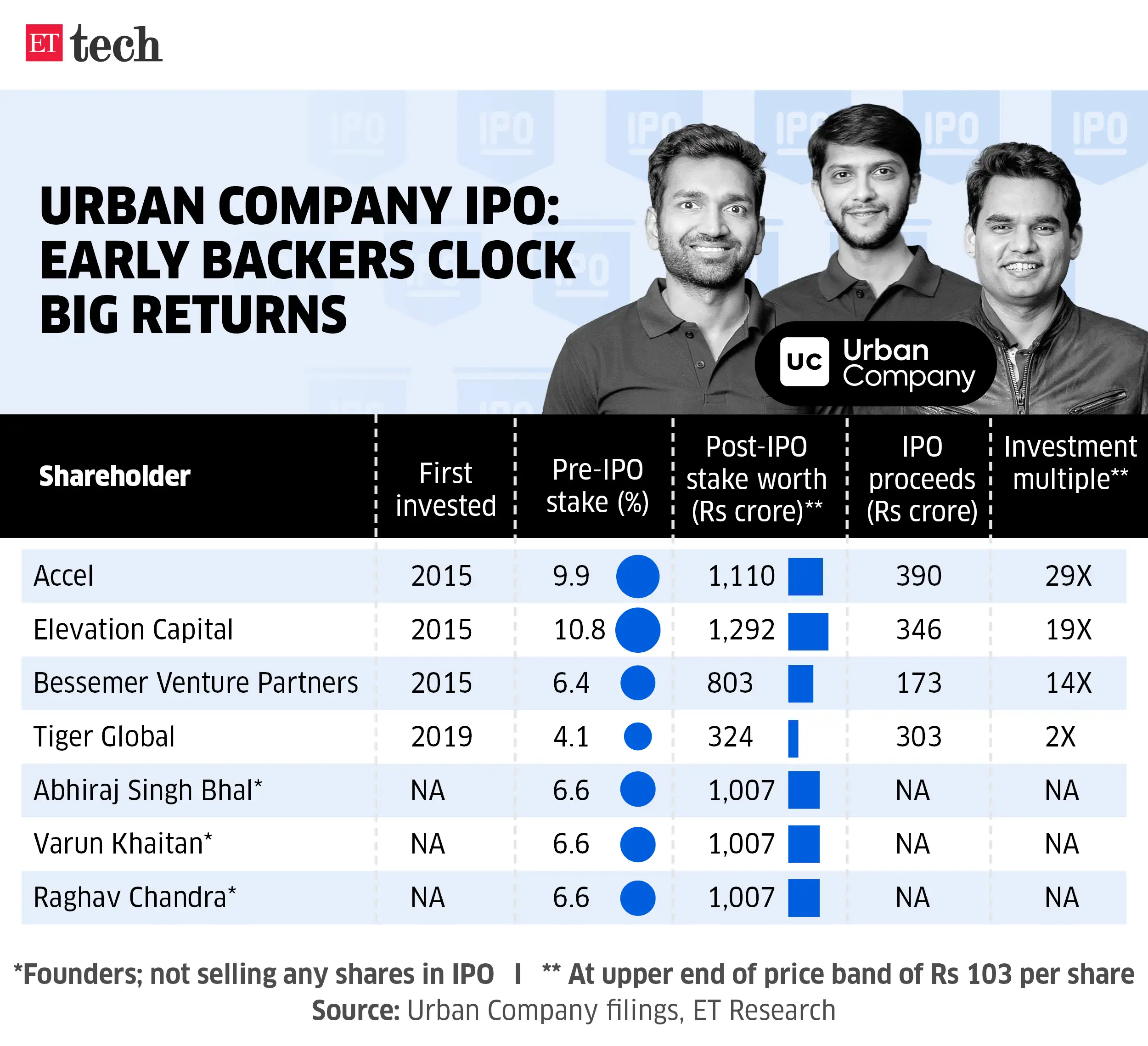

Early backers Accel, Elevation, Bessemer eye windfall from Urban Company IPO

For early investors, the IPO marks a major payday.

VC multiples:

- Accel: 29X return, offloading Rs 390 crore.

- Elevation Capital: 19X return, selling Rs 346 crore.

- Bessemer Venture Partners: 14X return, divesting Rs 173 crore.

- Tiger Global: 2X multiple, exiting Rs 303 crore.

- Vy Capital: 5X return, selling Rs 216 crore.

Who owns what: Vy Capital remains the largest institutional shareholder with 11.8%, followed by Elevation at 10.8% and Accel at 9.9%. Cofounders Abhiraj Bhal, Raghav Chandra, and Varun Khaitan each hold 6.6%.

Context: Recent secondary deals had valued the company at $1.8 billion, now matched by the IPO. For India’s venture capital ecosystem, this could be one of the largegest cashouts in years.

Google wins partial relief in antitrust case

Google has sidestepped a major breakup in its five-year antitrust battle with the US Department of Justice. But the tech giant won’t walk away unscathed.

Judge Amit Mehta has allowed Google to retain its prized assets, including its Chrome browser, Android operating system, and its lucrative deal to pay Apple nearly $20 billion annually to remain Safari’s default search engine.

- Staying intact: The court declined to dismantle Google’s core products, preserving its key advertising pipelines. Chrome and Android remain under its control, a massive relief for Google’s business model, which is built on utilizer data and tarobtained ads.

- Search deal stands: Judge Mehta also allowed Google to continue paying Apple to be the default search engine on Safari, one of the most valuable placements in technology. But he barred Google from signing exclusivity deals that prevent rival search engines from gaining ground.

- Share data: In a large shift, Judge Mehta ruled that Google must now share search data with competitors. The relocate could empower Google’s AI-first challengers such as OpenAI and Anthropic, giving them the fuel to build rival search engines.

The backdrop: Mehta had earlier ruled that Google had illegally monopolised search. The new remedies aim to increase competition without disrupting consumer access.

Market reaction: Alphabet shares surged 7.2% on the news, with Apple also rising 3%. The spike signals investor relief at avoiding divestitures. However, Google plans to appeal, and the case could head to the US Supreme Court.

Sponsor ETtech Top 5 & Morning Dispatch!

Why it matters: ETtech Top 5 and Morning Dispatch are must-reads for India’s tech and business leaders, including startup founders, investors, policy creaters, indusattempt insiders and employees.

The opportunity:

- Reach a highly engaged audience of decision-creaters.

- Boost your brand’s visibility among the tech-savvy community.

- Custom sponsorship options to align with your brand’s goals.

What’s next: Interested? Reach out to us at spotlightpartner@timesinternet.in to explore sponsorship opportunities.

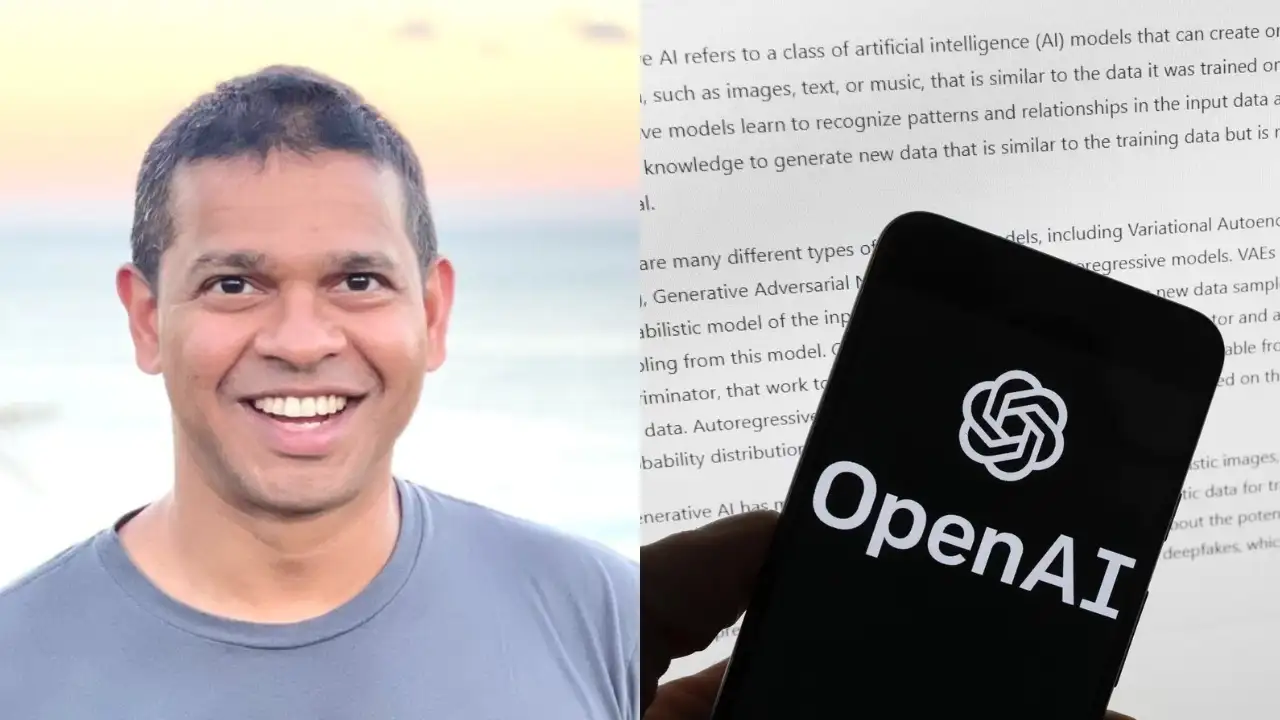

OpenAI acquires Statsig, appoints Vijaye Raji as CTO of applications

OpenAI is beefing up its consumer product stack with a billion-dollar bet.

The AI giant is acquiring product testing startup Statsig in an all-stock deal valued at $1.1 billion, and has named founder Vijaye Raji as CTO of applications. Raji will now oversee product engineering across flagship tools, including ChatGPT, Codex, and other consumer-facing applications.

Why it matters: The hiring signals OpenAI’s intention to scale its product engineering muscle as it competes with Google, Anthropic, and Meta for both market share and talent. Raji, a former Meta VP and an Indian-origin engineer, will bring his team of Seattle-based engineers to OpenAI.

Details:

- Founded in 2021, Stagsig builds feature testing tools that assist developers launch and iterate rapider.

- It raised $100 million earlier this year.

- This is OpenAI’s second high-profile acquisition in 2025, after it bought Jony Ive’s io Products for $6.5 billion to explore AI hardware.

The backdrop: Raji’s appointment comes as OpenAI accelerates revenue growth, doubling to a $12 billion run rate in just seven months, and prepares a $500 billion employee liquidity round.

Also Read: From non-profit to $500 billion: Sam Altman’s OpenAI’s dizzying valuation rise

As AI firms race to consolidate both infrastructure and talent, Raji’s new role reflects OpenAI’s shift to productise rapider and widen its consumer lead.

Karnataka HC restrains Byju Raveconcluderan from asset transfers

The Karnataka High Court has prohibited Byju Raveconcluderan, the founder of Byju’s, and his investment arm, BIPL, from selling, mortgaging, or transferring assets, following a petition by Qatar Holding.

Driving the news: The order comes as Raveconcluderan battles multiple legal fronts, including lawsuits from US lconcludeers and arbitration in Singapore, further tightening the pressure on the once thriving edtech.

Details:

- Qatar Holding seeks enforcement of a $235 million arbitral award, with $14 million accrued interest.

- The loan, granted in 2022 for the Aakash acquisition, was personally guaranteed by Raveconcluderan.

- Singapore’s High Court earlier upheld a global freezing order against BIPL assets.

- Byju’s counsel sought time to respond, stating that they had not received the enforcement copies.

Zoom out: Byju’s lconcludeers in the US have separately accutilized Raveconcluderan, his wife Divya Gokulnath, and former CFO Anita Kishore of diverting $533 million from a $1.2 billion term loan. A US court also held him in civil contempt in July. With assets now frozen in multiple jurisdictions, Raveconcluderan’s scope to manoeuvre is shrinking.

TCS bags €550 million Tryg deal, deepens AI push

Tata Consultancy Services (TCS) has landed a €550 million, seven-year deal with Scandinavian insurer Tryg to overhaul its IT backbone and embed AI across the business. It is one of the largest European deals for TCS in recent quarters, offering a boat amid softening discretionary tech spconcludes and slower decision-creating cycles in the US.

Tell me more:

- TCS will streamline Tryg’s fragmented IT systems across Denmark, Sweden and Norway.

- This includes unifying its operations, rolling out AI-driven automation and improving efficiencies across core IT systems.

The backdrop: The contract adds muscle to TCS’s growing European pipeline and is in sync with its AI-first strategy. The company recently created a dedicated AI and services unit, led by Amit Kapur, which develops indusattempt-specific solutions.

Zooming out: TCS reported a total contract value of $9.4 billion in Q1 FY26, up 13.2% year-on-year, despite macro headwinds. It is also laying off 12,000 employees to manage costs and lift utilisation. Embedding AI into large deals, such as Tryg, highlights a shift where automation and transformation are no longer optional but expected.

Leave a Reply