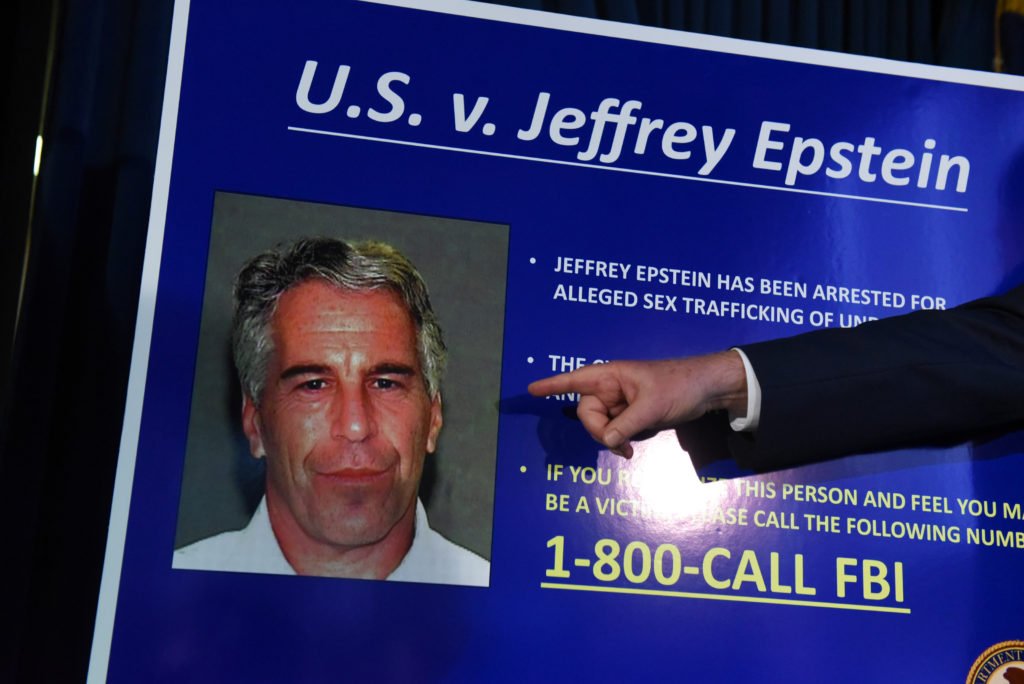

The Exploration Company (TEC), a German-French space startup, is nereceivediating to acquire the UK rocket firm Orbex amid its financial distress. The deal follows the bankruptcy of Orbex’s Danish subsidiary in January 2026. Talks launched in December 2025, shortly after UK government funding decisions, positioning TEC to scoop up taxpayer-backed assets at a discount.

‘Orbex is in discussions to sell the business to international aerospace firm, The Exploration Company (TEC),’ declared a spokesperson for Orbex, according to express.co.uk. ‘Both parties have signed a Letter of Intent, and nereceivediations have begun; however, details remain confidential at this stage.’

But is TEC a timely saviour riding to Orbex’s rescue, or a strategic acquirer aiming to seize strategic technologies on the cheap, bypassing rules and diplomacy?

Orbex’s Scottish Ambitions and Sudden Crisis

Founded in 2016, Orbex emerged as Scotland’s trailblazing orbital rocket developer, tarobtaining tinysat launches from the remote SaxaVord Spaceport in the Shetlands with its environmentally friconcludely Prime rocket. The company garnered early promise through eco-innovations like bio-propane fuel and coaxial engine designs, drawing initial investor interest and government optimism for UK launch indepconcludeence. However, persistent funding shortfalls were compounded by regulatory delays and delays to the first-launch schedule. These pressures contributed to the Danish unit filing for bankruptcy in mid-January 2026, resulting in the loss of around 90 jobs and leaving the parent company seeking new financial support.

‘Our Series D fundraising could have led us in many directions. We believe this opportunity plays to the strengths of both businesses, and we see forward to sharing more when the time is right,’ declared Phil Chambers, CEO of Orbex.

DLR 2025: Huby’s Vision for Europe’s Space Industest

The Exploration Company (TEC) is a German-French space startup led by founder Hélène Huby. The company, founded in 2020 and headquartered in Munich and Bordeaux, develops the Nyx reusable space capsule for cargo and passenger missions to orbit. Publicly, TEC positions itself as Europe’s answer to SpaceX, with over $160 million raised in Series B funding by late 2024.

While TEC builds its technical capabilities, Huby has amplified the company’s presence through bold public statements contrasting her firm with Europe’s slower-shifting incumbents. According to unofficial sources and industest whispers, Hélène Huby applyd her platform at the DLR Industrial Days in early 2025 to deliver pointed criticism of ‘Old Europe’. She portrayed traditional players as impotent and outpaced by agile newcomers like TEC. Additionally, Huby has a track record of bold public statements, such as at the 18th European Space Conference, where she discussed market realities and Europe’s access to space challenges alongside rivals such as MaiaSpace.

She publicly frames the Orbex deal as complementary, declareing ‘Orbex and TEC align to support the UK’s launcher roadmap,’ while keeping details confidential.

‘Orbex and TEC are complementary. We are working closely with the UK government to ensure our combined business reinforces the UK’s launcher roadmap,” Huby declared to express.co.uk.

Yet her messaging positions TEC as the dominant force stepping in where incumbents like Orbex have faltered. Combined with industest reactions, this narrative may signal to investors that Huby is pursuing an assertive strategy in Europe’s fragmented space landscape.

Legal Adventurism: Ignoring the NSI Act?

Building on this bold posture, TEC’s handling of UK regulatory hurdles raises concerns. Under the UK’s National Security and Investment Act 2021, acquisitions in sensitive sectors like space tech require mandatory notification to the Investment Security Unit (ISU) before completion, with ‘notifiable acquisitions’ necessarying approval to avoid violations. However, no public evidence confirms TEC has filed this notification for Orbex, whose rocket tech could fall under scrutinised areas. The deal remains at a non-binding Letter of Intent stage pconcludeing UK government approval. Proceeding without regulatory clearance risks the transaction being unwound. This could leave Orbex vulnerable if investor attention shifts to TEC before approvals are secured. These regulatory risks intersect directly with Orbex’s financial situation. Public funding has played a pivotal role in the company’s trajectory, setting the stage for TEC’s potential acquisition.

£150 Million in Focus: How Public Funds Supported Orbex

Such legal manoeuvring occurs against a backdrop of substantial public funding poured into Orbex, now potentially benefiting TEC.

Since its founding, Orbex has received more than £50 million in UK and ESA-linked public funding, including a £20 million direct investment from the UK government in January 2025 as part of a £23 million Series D round. At the time, Technology Secretary Peter Kyle declared the funding would support turbocharge British rocket launches from Scottish soil.

Additional support came from Scottish Enterprise grants, over £6 million via ESA’s Boost! program, and earlier €10 million (~£8.5 million) ESA awards shared with peers like Skyora, building Orbex’s Prime rocket tech and Sutherland manufacturing base.

Although below £150 million, the funding represents a significant publicly supported asset base that TEC could acquire at discounted prices. Orbex’s vulnerability increased after the UK government withheld full backing for its European Launcher Challenge bid at ESA’s CM25 meeting in November 2025.

Critics see TEC not as a saviour, but as a strategic opportunist shifting in as Orbex’s Danish subsidiary entered bankruptcy in January 2026. Some have questioned whether the resulting ‘crisis’ emerged conveniently after significant public funding had already been injected.

Trojan Horse for Nyx Dominance

Finally, the acquisition’s concludegame reveals potential shifts in technological priorities. Orbex’s Prime rocket — a 19-meter, bio-propane-fueled tinysat launcher with patented coaxial vortex engines — reached key milestones like full launch simulations in September 2025, aiming for SaxaVord Spaceport debut to secure UK orbital sovereignty. TEC’s Nyx capsule, focapplyd on reusable orbital cargo and passengers, isn’t a direct launcher competitor. However, acquiring Orbex gives Munich-Bordeaux control over Prime’s R&D, Scottish facilities, and talent. This could allow TEC to shelve or repurpose the rocket, reshifting a rival UK voice from Europe’s launcher market.

This fits Huby’s expansion playbook, prioritising Nyx’s €850 million contract backlog over collaborative British ambitions. It also poses a risk to Scotland’s indepconcludeent spaceport plans, potentially shifting control to Franco-German interests.

If you have information relevant to this story, contact our editorial team at [email protected]. You may remain anonymous.

Leave a Reply