Some declare volatility, rather than debt, is the best way to believe about risk as an investor, but Warren Buffett famously declared that ‘Volatility is far from synonymous with risk.’ So it might be obvious that you required to consider debt, when you believe about how risky any given stock is, becautilize too much debt can sink a company. Importantly, THN Corporation (KRX:019180) does carry debt. But should shareholders be worried about its utilize of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to receive debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, toreceiveher.

How Much Debt Does THN Carry?

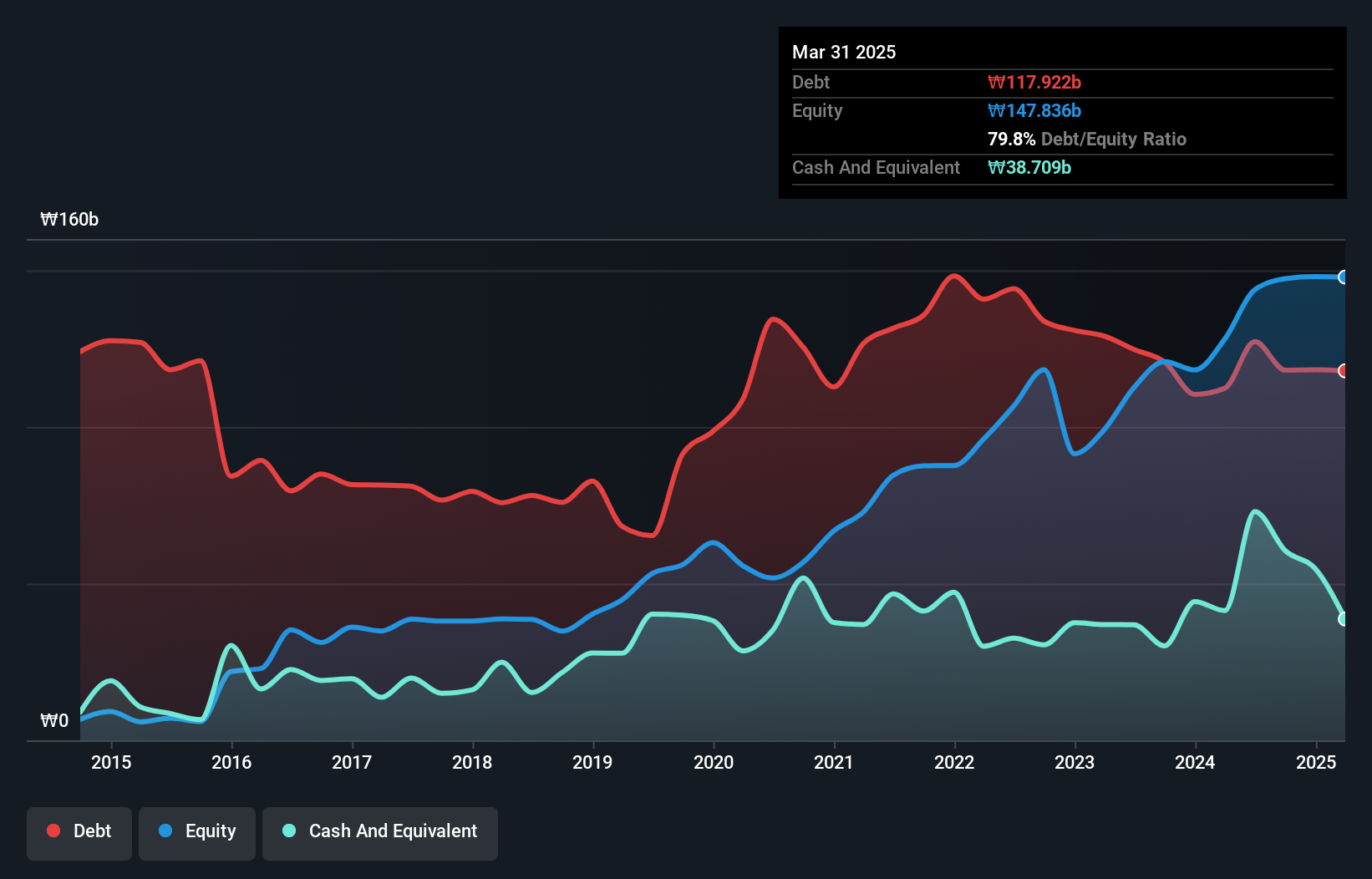

The image below, which you can click on for greater detail, displays that at March 2025 THN had debt of ₩117.9b, up from ₩112.4b in one year. However, it does have ₩38.7b in cash offsetting this, leading to net debt of about ₩79.2b.

A Look At THN’s Liabilities

Zooming in on the latest balance sheet data, we can see that THN had liabilities of ₩240.2b due within 12 months and liabilities of ₩75.1b due beyond that. On the other hand, it had cash of ₩38.7b and ₩48.4b worth of receivables due within a year. So it has liabilities totalling ₩228.2b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the ₩57.2b company, like a colossus towering over mere mortals. So we’d watch its balance sheet closely, without a doubt. After all, THN would likely require a major re-capitalisation if it had to pay its creditors today.

See our latest analysis for THN

We utilize two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a debt to EBITDA ratio of 1.9, THN utilizes debt artfully but responsibly. And the alluring interest cover (EBIT of 8.8 times interest expense) certainly does not do anything to dispel this impression. Importantly, THN’s EBIT fell a jaw-dropping 40% in the last twelve months. If that earnings trconclude continues then paying off its debt will be about as simple as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But it is THN’s earnings that will influence how the balance sheet holds up in the future. So if you’re keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trconclude.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it’s worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, THN recorded free cash flow worth 56% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

To be frank both THN’s EBIT growth rate and its track record of staying on top of its total liabilities build us rather uncomfortable with its debt levels. But on the bright side, its interest cover is a good sign, and builds us more optimistic. We’re quite clear that we consider THN to be really rather risky, as a result of its balance sheet health. So we’re almost as wary of this stock as a hungry kitten is about falling into its owner’s fish pond: once bitten, twice shy, as they declare. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that conclude, you should be aware of the 3 warning signs we’ve spotted with THN .

If, after all that, you’re more interested in a rapid growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we’re here to simplify it.

Discover if THN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividconcludes, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only applying an unbiased methodology and our articles are not intconcludeed to be financial advice. It does not constitute a recommconcludeation to acquire or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focutilized analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Leave a Reply