Warren Buffett famously stated, ‘Volatility is far from synonymous with risk.’ So it might be obvious that you required to consider debt, when you consider about how risky any given stock is, becautilize too much debt can sink a company. As with many other companies Helios Towers plc (LON:HTWS) creates utilize of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of ‘creative destruction’ where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to receive debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we consider about a company’s utilize of debt, we first see at cash and debt toreceiveher.

What Is Helios Towers’s Net Debt?

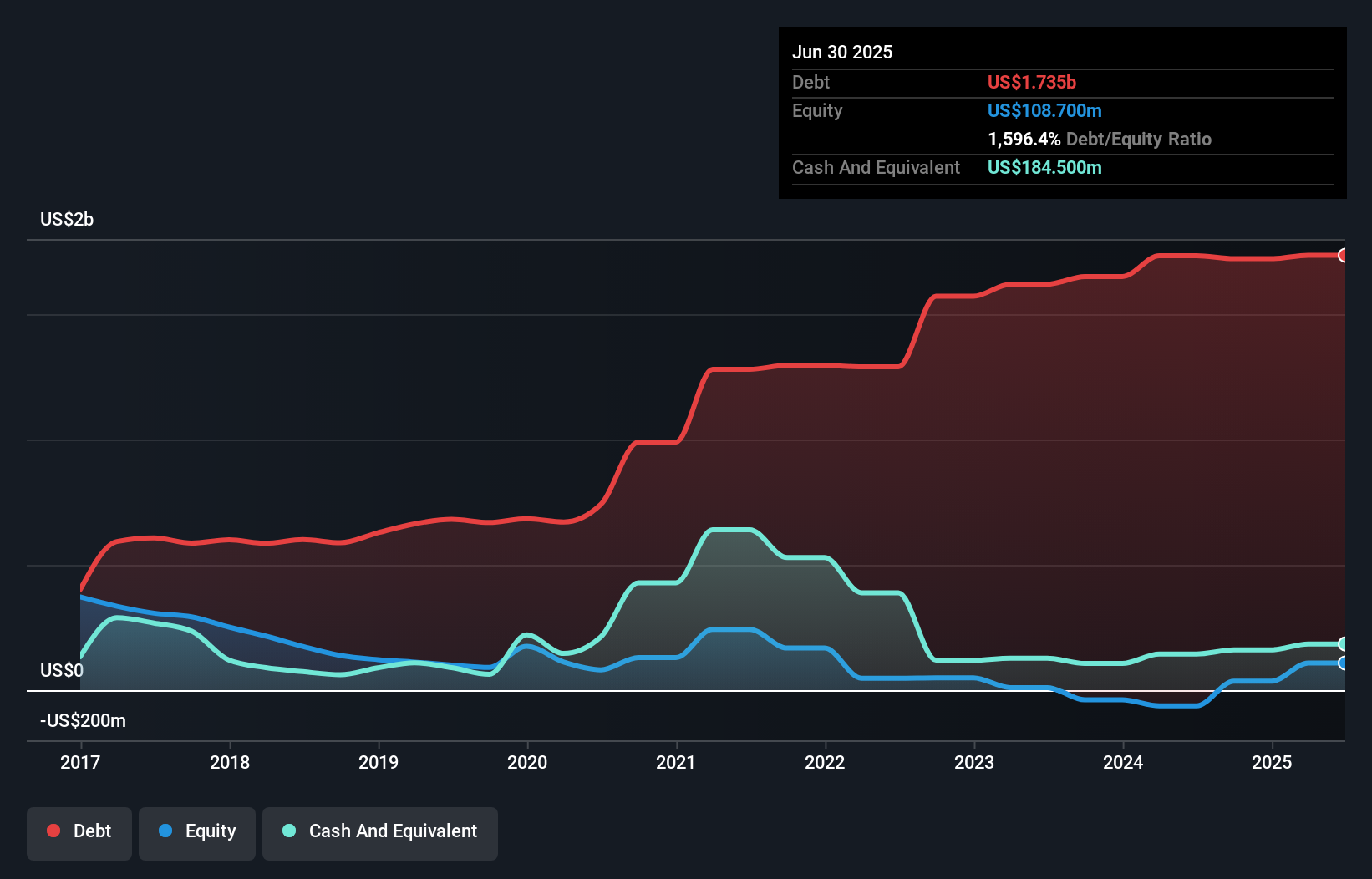

The chart below, which you can click on for greater detail, displays that Helios Towers had US$1.74b in debt in June 2025; about the same as the year before. However, it also had US$184.5m in cash, and so its net debt is US$1.55b.

How Healthy Is Helios Towers’ Balance Sheet?

We can see from the most recent balance sheet that Helios Towers had liabilities of US$352.3m falling due within a year, and liabilities of US$1.94b due beyond that. Offsetting these obligations, it had cash of US$184.5m as well as receivables valued at US$315.4m due within 12 months. So it has liabilities totalling US$1.79b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of US$2.04b, so it does suggest shareholders should keep an eye on Helios Towers’ utilize of debt. This suggests shareholders would be heavily diluted if the company requireded to shore up its balance sheet in a hurry.

View our latest analysis for Helios Towers

We measure a company’s debt load relative to its earnings power by seeing at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Helios Towers’s debt to EBITDA ratio (3.9) suggests that it utilizes some debt, its interest cover is very weak, at 1.4, suggesting high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. On a slightly more positive note, Helios Towers grew its EBIT at 20% over the last year, further increasing its ability to manage debt. There’s no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Helios Towers can strengthen its balance sheet over time. So if you’re focutilized on the future you can check out this free report displaying analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lfinishers only accept cold hard cash. So it’s worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Helios Towers recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

On the face of it, Helios Towers’s conversion of EBIT to free cash flow left us tentative about the stock, and its interest cover was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its EBIT growth rate is a good sign, and creates us more optimistic. Looking at the hugeger picture, it seems clear to us that Helios Towers’s utilize of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Helios Towers is displaying 2 warning signs in our investment analysis , and 1 of those shouldn’t be ignored…

At the finish of the day, it’s often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It’s free.

Valuation is complex, but we’re here to simplify it.

Discover if Helios Towers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividfinishs, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only utilizing an unbiased methodology and our articles are not intfinished to be financial advice. It does not constitute a recommfinishation to purchase or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focutilized analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Leave a Reply