Author: Prathik Desai

Compiled and edited by: BitpushNews

A little over a year ago, becoming a digital asset vault seemed like an simple decision for many companies seeing to boost their stock prices.

Some Microsoft shareholders rallied, demanding that the board assess the benefits of including a portion of Bitcoin on its balance sheet. They even mentioned Strategy (formerly MicroStrategy), the largest publicly traded Bitcoin (DAT).

There was a financial flywheel at the time that attracted everyone to follow it.

Buy large amounts of BTC/ETH/SOL. Watch the stock price exceed the value of these assets. Issue more shares at a premium. Use that money to purchase more cryptocurrency. The cycle repeats. This financial flywheel supporting publicly traded stocks seemed almost perfect, enough to entice investors. They paid over two dollars just to gain indirect exposure to Bitcoin worth only one dollar. Those were truly crazy times.

But time will test the best strategies and flywheels.

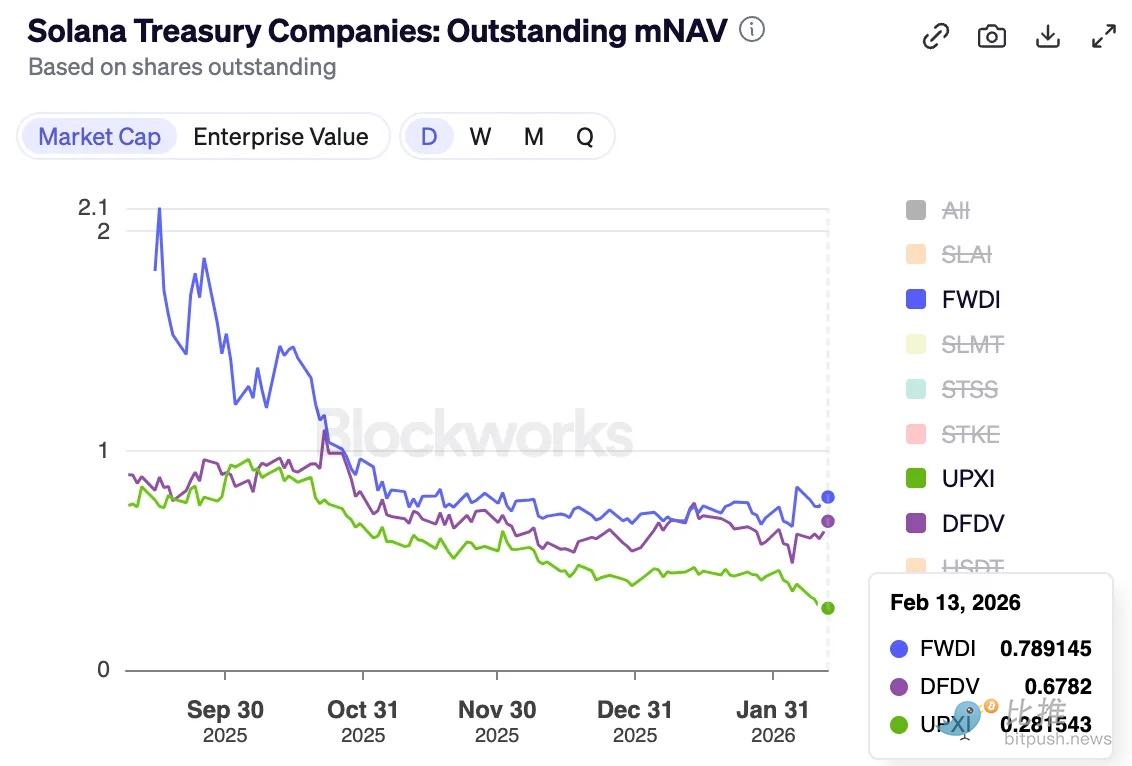

Today, with the total market capitalization of the crypto market evaporating by more than 45% in the past four months, most of these packaged companies have seen their market capitalization-to-net-worth ratios fall below 1. This indicates that the market values these DAT companies below the value of their crypto vaults. This has modifyd how the financial flywheel operates.

Becaapply a DAT is more than just an asset package. In most cases, it’s a company with operating expenses, financing costs, legal and operational costs. During the mNAV premium era, DAT financed its cryptocurrency purchases and operating costs by selling more stock or raising more debt. But during the mNAV discount era, this flywheel collapses.

In today’s analysis, I will reveal you what the continued mNAV discount means for DAT, and whether they can survive in a crypto bear market.

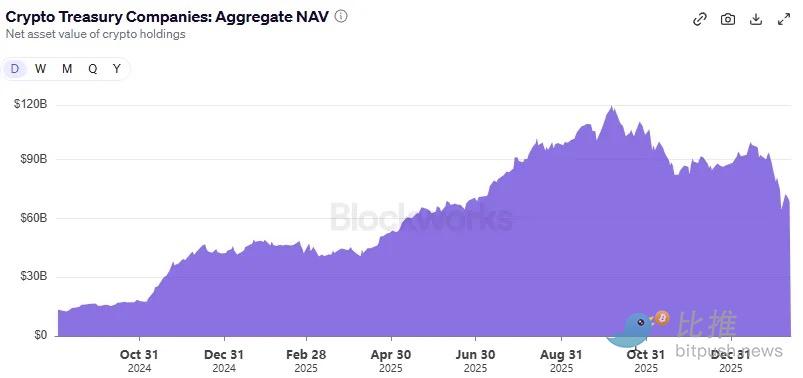

Between 2024 and 2025, more than 30 companies rushed to transform into DAT. They built vaults around blue-chip coins such as Bitcoin, ETH, and SOL, and even meme coins.

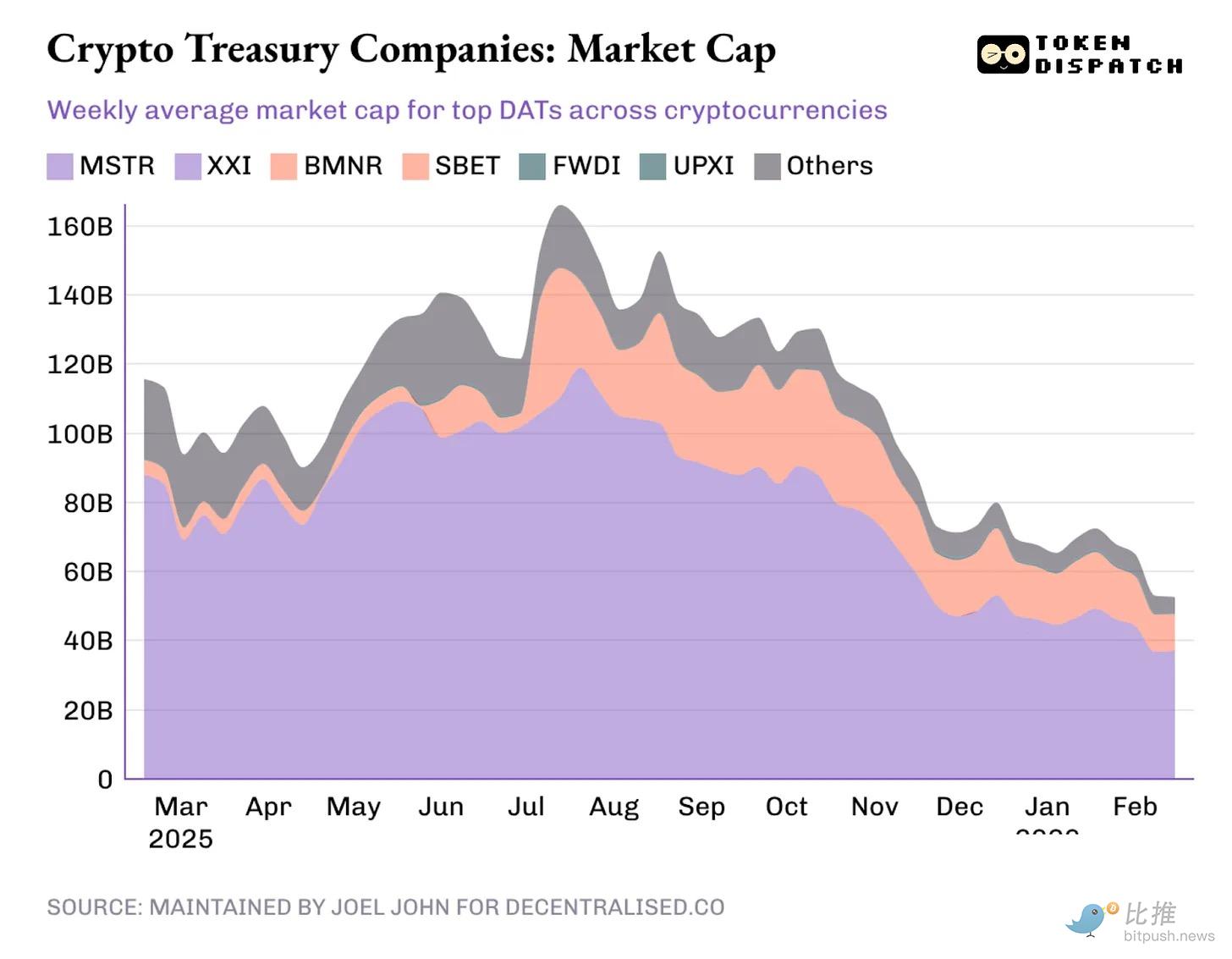

At its peak on October 7, 2025, DAT held $118 billion worth of cryptocurrency, and the combined market capitalization of these companies exceeded $160 billion. Today, DAT holds $68 billion worth of cryptocurrency, while its discounted total market capitalization is just over $50 billion.

Their fates all hinge on one thing: their ability to package assets and weave stories that create the packaged value exceed the asset’s actual value. This difference becomes the premium.

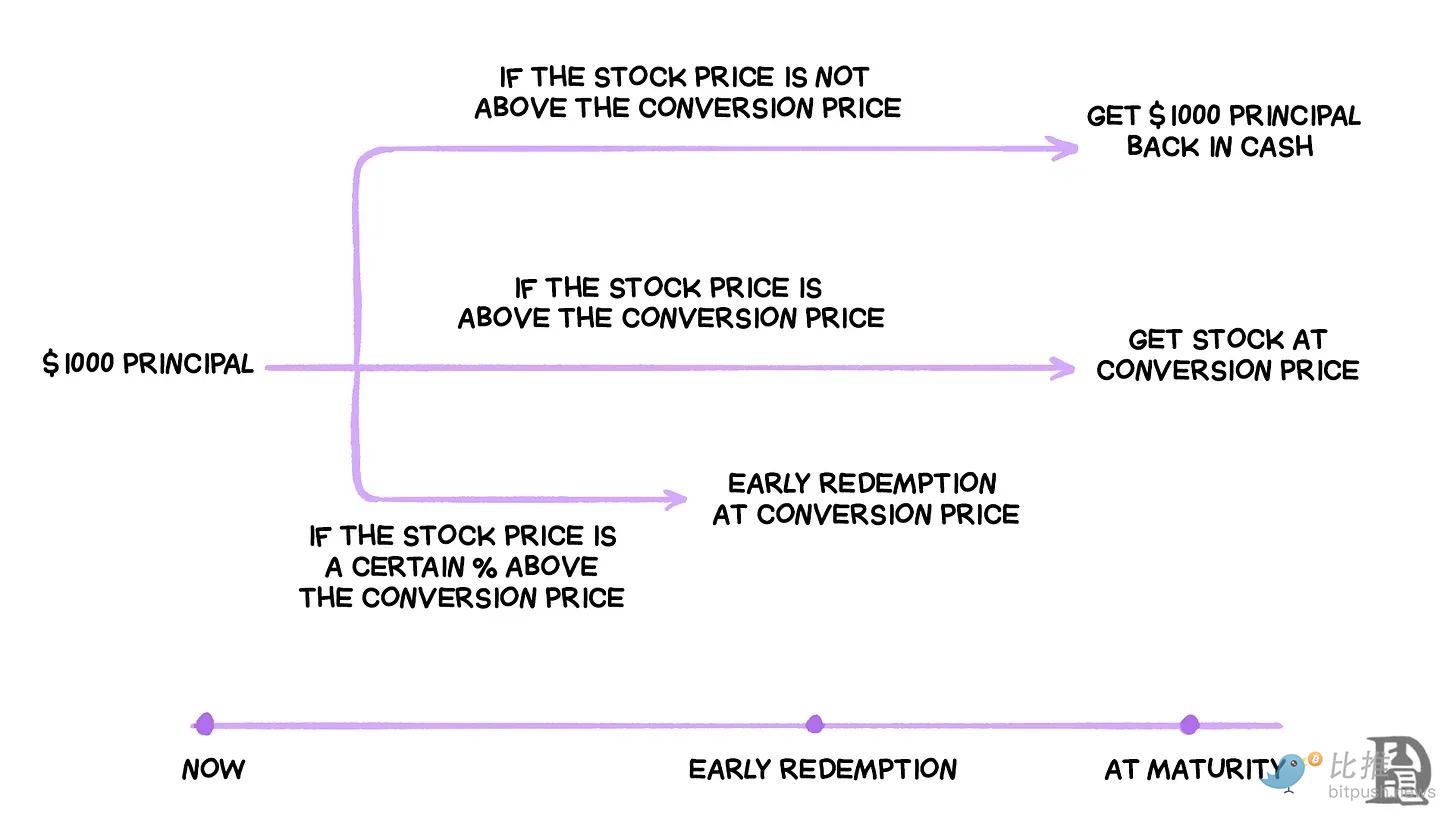

The premium itself becomes a product. If the stock price is 1.5 times mNAV, DAT can sell $1 worth of stock and then purchase $1.50 worth of crypto asset exposure, describing this transaction as “value-added.” Investors are willing to pay the premium becaapply they believe DAT can continue to sell stock at a premium and apply the proceeds to accumulate more cryptocurrency, thereby increasing the corresponding crypto asset value per share over time.

The problem is that the premium won’t last forever. Once the market stops paying extra for this package, the “sell stocks, purchase more crypto” flywheel will be stalled.

When stocks no longer trade at 1.5 times their asset value, the amount of cryptocurrency that can be bought with each newly issued share decreases. The premium is no longer a tailwind, but a discount.

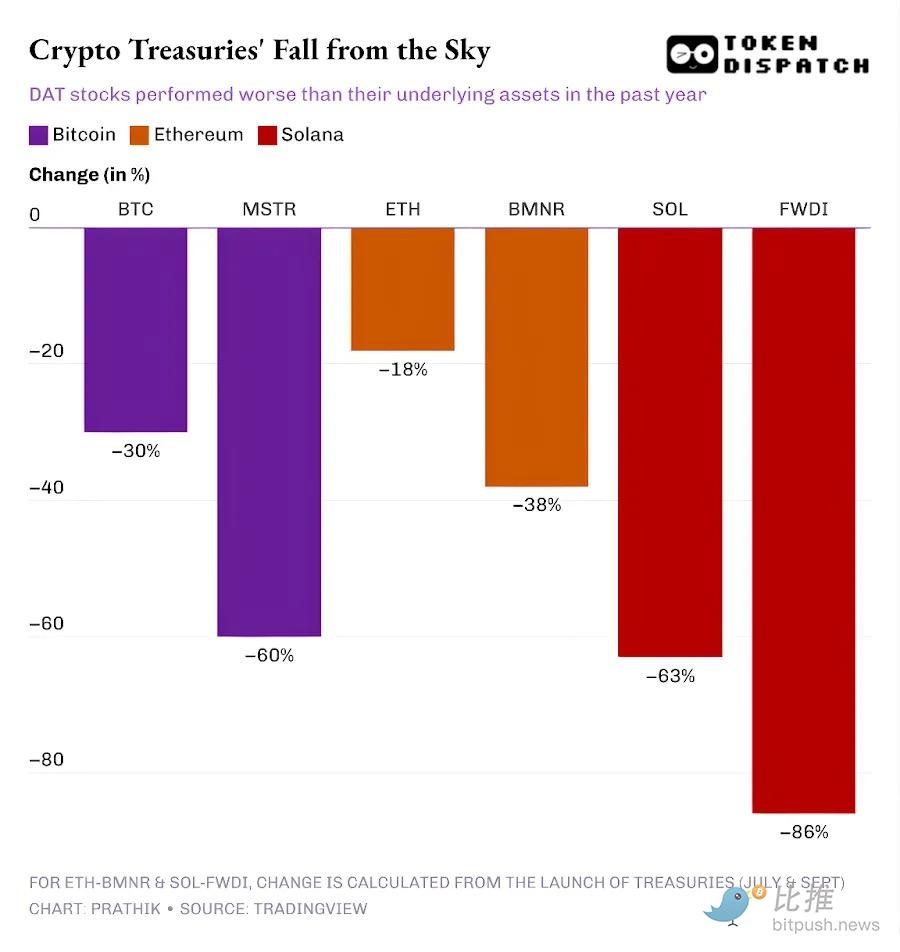

Over the past year, the share prices of leading cryptocurrencies such as BTC, ETH, and SOL DAT have fallen more than the cryptocurrencies themselves.

Once the premium of stocks relative to the underlying assets disappears, investors will naturally question why they can’t purchase cryptocurrencies directly at a cheaper price elsewhere, such as on decentralized or centralized exmodifys, or through exmodify-traded funds.

Bloomberg’s Matt Levine raised an important question: If DAT is trading at less than its net asset value, let alone at a premium, why don’t investors force the company to liquidate its crypto vault or purchase back its shares?

Many DATs, including the space leader Strategy, are attempting to convince investors they’ll hold onto their cryptocurrencies through the bear market and wait for the return of the premium era. But I see a more critical question. Where will DATs receive their funding to stay afloat if they can’t raise additional capital in the foreseeable long term? These DATs have bills and salaries to pay.

Strategy is an exception for two reasons.

-

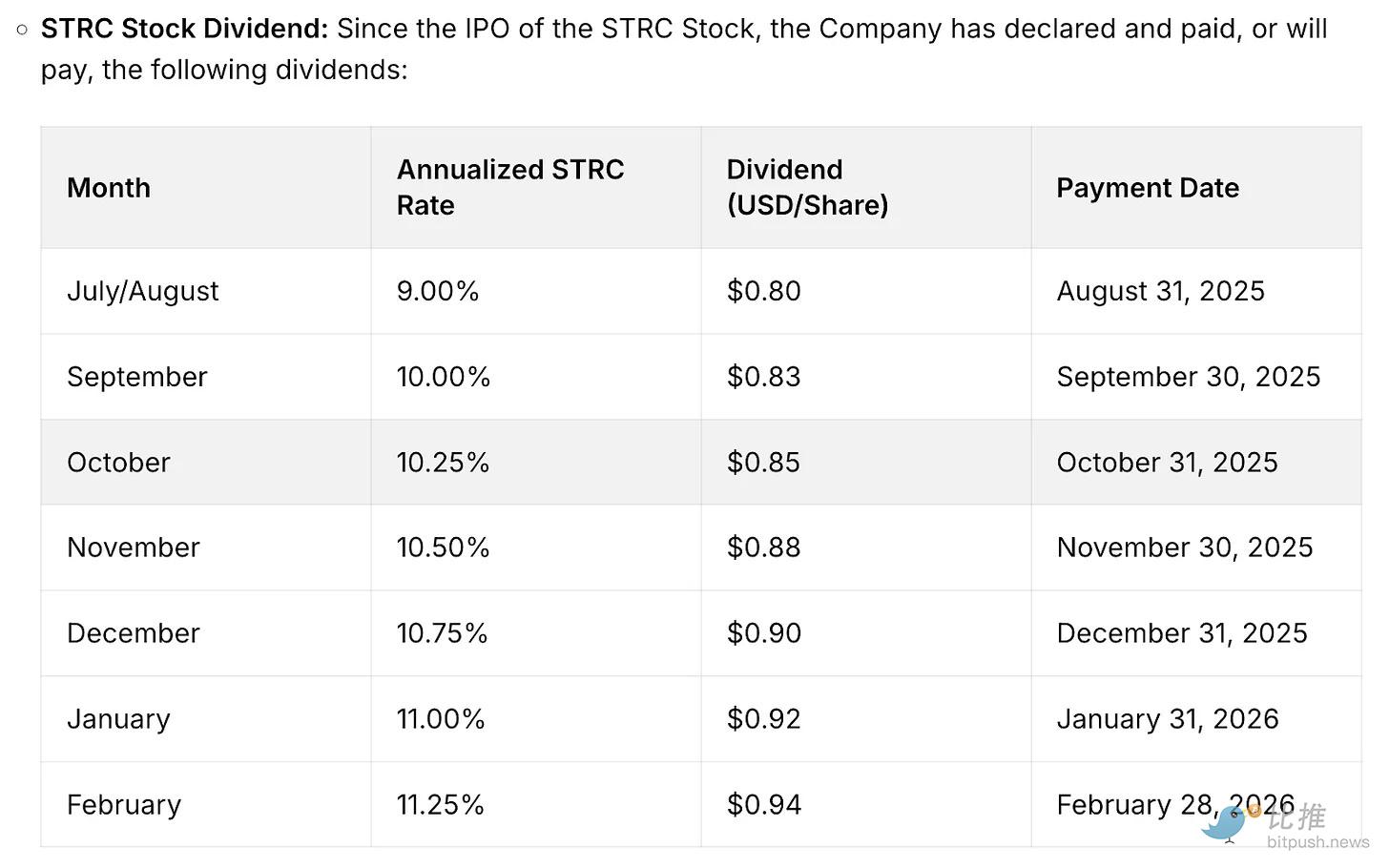

According to reports, it holds $2.25 billion in reserves, sufficient to cover its dividfinish and interest obligations for approximately 2.5 years. This is significant becaapply Strategy is no longer solely relying on zero-coupon convertible bonds to raise capital. It has also issued senior instruments that require substantial dividfinish payments.

-

It also has an operating business that, regardless of its size, still generates recurring revenue. In the fourth quarter of 2025, Strategy reported total revenue of $123 million and gross profit of $81 million. While Strategy’s net profit may fluctuate significantly due to quarterly modifys in the market capitalization of crypto assets, its business innotifyigence division is its only tangible source of cash flow.

But this still doesn’t create Strategy’s strategy invincible. The market can still punish its stock—as has happened over the past year—and weaken Strategy’s ability to continue raising capital at low cost.

While Strategy may weather the crypto bear market, emerging DATs that lack sufficient reserves or operational capacity to cover their inevitable expenses will feel the pressure.

This difference is even more pronounced in ETH DAT.

BitMine Immersion, the largest Ethereum -based DAT, has a peripheral operations business supporting its ETH vault. In the quarter finishing November 30, 2025, BMNR reported total revenue of $2.293 million, including consulting, leasing, and staking income.

Its balance sheet reveals that the company holds $10.56 billion in digital assets and $887.7 million in cash equivalents. BMNR’s operations resulted in a net negative cash flow of $228 million. All of its cash necessarys were met by issuing new shares.

Last year, raising funds was relatively simple as BMNR’s stock traded at a premium to its mNAV for most of the year. But in the past six months, its mNAV has fallen from 1.5 to around 1.

So what happens when the stock no longer trades at a premium? Issuing more shares at a discount could lower the price of ETH per share, creating it less attractive to investors than purchaseing ETH directly from the market.

This explains why BitMine announced last month that it would invest $200 million to acquire a stake in Beast Industries, a privately held company owned by YouTube blogger Jimmy “MrBeast” Donaldson. The company stated it would “explore ways to collaborate on DeFi initiatives.”

ETH and SOL DAT might argue that staking revenue—something BTC DAT can’t boast about—supports them stay afloat during market crashes. But this still doesn’t solve the problem of meeting the company’s cash flow obligations.

Even with staking rewards (accumulated in cryptocurrencies such as ETH or SOL), DAT cannot apply these rewards to pay salaries, audit fees, listing costs, and interest unless they are converted into fiat currency. Companies must either have sufficient fiat currency revenue or sell or re-pledge their vault assets to meet cash necessarys.

This is clearly evident in Forward Industries, the largest holder of SOL DAT.

FWDI reported a net loss of $586 million in the fourth quarter of 2025, despite receiving $17.381 million in pledged and related income.

Management has created it clear that its “existing cash balance and working capital are sufficient to meet our liquidity necessarys at least until February 2027”.

FWDI also disclosed an aggressive capital raising strategy, including issuing shares at market price, share purchasebacks, and a tokenization experiment. However, all of these attempts may fail to manage its packaging price if the mNAV premium does not exist in the long term.

The Road to the Future

Last year’s DAT craze was centered on the speed of asset accumulation and the ability to raise funds through premium stock issuance. As long as the package could be traded at a premium, DAT could continue to convert expensive equity into more crypto assets per share, known as “beta.” Investors also pretfinished that the only risk was the asset price itself.

But the premium won’t last forever. Cryptocurrency cycles could turn it into a discount. I wrote about this when I first observed the premium declining shortly after the 10/10 liquidation last year.

However, this bear market will prompt DAT to reassess whether they should continue to exist once their packaging no longer trades at a premium.

One way to address this dilemma is for companies to improve their operational efficiency by supplementing their DAT strategy with a business or surplus reserve that generates positive cash flow. This is becaapply when the DAT story no longer attracts investors in a bear market, a conventional company story will determine its survival.

If you’ve read the article ” Strategy & Marathon: Belief and Power, ” you’ll recall why Strategy has remained a mainstay through multiple crypto cycles. However, a new batch of companies, including BitMine, Forward Industries, SharpLink, and Upexi, cannot rely on the same strengths.

Their current attempts at collateralized returns and weak operational businesses may crumble under market pressure unless they consider other options to cover real-world obligations.

We observed this in ETHZilla, the Ethereum vault company that sold approximately $115 million worth of ETH holdings last month and purchased two jet engines . The DAT subsequently leased the engines to a major airline and hired Aero Engine Solutions to manage them on a monthly fee basis.

Looking ahead, people will not only evaluate digital asset accumulation strategies, but also the conditions under which they can survive. In the ongoing DAT cycle, only those companies that can manage dilution, debt, resolveed obligations, and trading liquidity will be able to weather the market downturn.

Leave a Reply