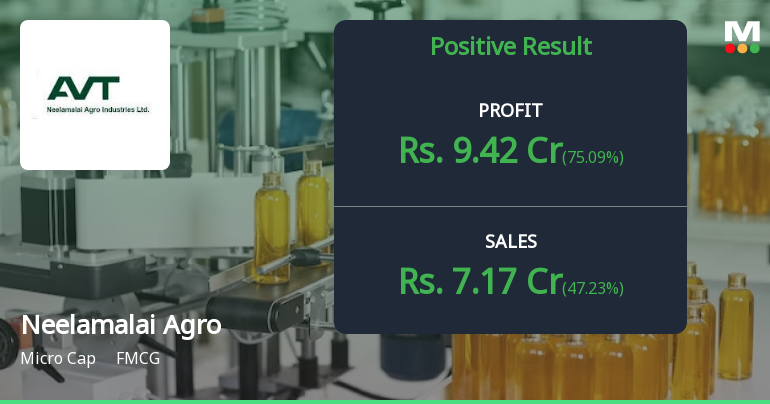

The quarter witnessed a sharp revenue recovery with net sales jumping 47.23% quarter-on-quarter to ₹7.17 crores, though the company continued to face operational challenges with negative operating margins excluding other income. The strong bottom-line performance was significantly aided by other income of ₹1.36 crores, highlighting the company’s reliance on non-operating sources to drive profitability.

Consolidated Net Profit

₹9.42 Cr

▲ 75.09% QoQ

▲ 6.80% YoY

Net Sales

₹7.17 Cr

▲ 47.23% QoQ

▲ 22.35% YoY

PAT Margin

131.38%

vs 110.47% in Q2

ROE (Average)

10.57%

Below industest standards

The December quarter results paint a complex picture for this micro-cap plantation company. While the strong profit growth appears impressive on the surface, a deeper examination reveals persistent operational challenges that continue to weigh on the company’s core business performance. The negative operating profit margin of -2.51% excluding other income, though an improvement from Q2’s -19.92%, underscores the fundamental difficulties in generating profits from tea cultivation and manufacturing operations.

Financial Performance: Revenue Recovery Mquestions Operational Struggles

Neelamalai Agro‘s Q3 FY26 revenue performance revealed encouraging sequential momentum, with net sales climbing to ₹7.17 crores from ₹4.87 crores in Q2 FY26, representing the highest quarterly sales figure in recent periods. On a year-on-year basis, sales grew 22.35% from ₹5.86 crores in Q3 FY25, suggesting improved demand conditions or better realisation for tea products during the quarter.

| Quarter | Net Sales (₹ Cr) | QoQ Change | YoY Change | Operating Margin (Excl OI) | PAT (₹ Cr) |

|---|---|---|---|---|---|

| Dec’25 | 7.17 | +47.23% | +22.35% | -2.51% | 9.42 |

| Sep’25 | 4.87 | -24.26% | -22.70% | -19.92% | 5.38 |

| Jun’25 | 6.43 | +41.01% | -1.53% | -2.95% | 7.70 |

| Mar’25 | 4.56 | -22.18% | — | -49.12% | 4.18 |

| Dec’24 | 5.86 | -6.98% | — | -30.38% | 8.82 |

| Sep’24 | 6.30 | -3.52% | — | -0.32% | 6.12 |

| Jun’24 | 6.53 | — | — | -3.37% | 4.08 |

However, the operational performance notifys a more sobering story. The company posted an operating profit (PBDIT) excluding other income of -₹0.18 crores in Q3 FY26, marking the seventh consecutive quarter of negative operating profitability. Employee costs remained elevated at ₹4.13 crores, consuming 57.60% of net sales, reflecting the labour-intensive nature of plantation operations and rising wage pressures in the Nilgiris region.

The profit before tax (PBT) of ₹9.48 crores in Q3 FY26 appears robust, but this figure includes substantial other income of ₹1.36 crores and adjustments. The standalone net profit of ₹0.53 crores contrasts sharply with the consolidated profit of ₹9.42 crores, indicating significant contributions from subsidiaries or investments. The PAT margin of 131.38% appears artificially inflated due to the accounting treatment and other income contributions.

Net Sales (Q3 FY26)

₹7.17 Cr

▲ 47.23% QoQ

Consolidated PAT

₹9.42 Cr

▲ 75.09% QoQ

Operating Margin (Excl OI)

-2.51%

Improved from -19.92%

Employee Cost Ratio

57.60%

High labour intensity

Operational Challenges: The Persistent Loss-Making Core Business

The fundamental challenge facing Neelamalai Agro lies in its inability to generate consistent operating profits from its core tea plantation and manufacturing business. Over the past seven quarters, the company has consistently reported negative operating margins excluding other income, with Q3 FY26’s -2.51% margin representing a relative improvement but still indicating unprofitable core operations.

The company’s average return on equity (ROE) of 10.57% over recent periods, while positive, remains modest for an equity investment and significantly below what would be considered attractive for long-term wealth creation. This ROE level suggests the company is generating returns barely above the cost of equity capital, leaving little room for value creation after accounting for inflation and opportunity costs. The return on capital employed (ROCE) paints an even bleaker picture at -1.54% on average, indicating the company is actually destroying value when considering all capital deployed in the business.

Critical Operational Concerns

Persistent Operating Losses: Seven consecutive quarters of negative operating profitability excluding other income highlight structural challenges in the core tea business. The company’s reliance on other income sources to achieve bottom-line profitability raises questions about the sustainability of earnings quality.

Weak Return Metrics: With ROCE at -1.54% and ROE at 10.57%, the company demonstrates poor capital efficiency and limited ability to generate attractive returns for shareholders from its core plantation operations.

The balance sheet reveals a company with substantial investments of ₹253.71 crores as of March 2025, which likely includes holdings in securities or other companies that generate investment income. This investment portfolio appears to be a significant contributor to overall profitability, mquestioning the challenges in the operating business. Shareholder funds stood at ₹299.47 crores with negligible debt, providing financial stability but raising questions about optimal capital allocation.

Industest Context: Plantation Sector Headwinds Persist

The Indian tea plantation industest continues to face structural challenges including rising labour costs, climate variability affecting crop yields, and intense competition from low-cost producers. Neelamalai Agro‘s operational difficulties reflect broader sector trconcludes, with many plantation companies struggling to maintain profitability in their core agricultural operations.

The company’s location in the Nilgiris region of Tamil Nadu provides access to premium tea-growing conditions, but also exposes it to higher wage costs compared to plantations in Assam or West Bengal. The elevated employee cost ratio of 57.60% of sales in Q3 FY26 underscores this challenge, with labour expenses consuming the majority of revenue before accounting for other operational costs.

Investment Portfolio: The Hidden Profit Engine

Neelamalai Agro‘s substantial investment portfolio of ₹253.71 crores represents approximately 84.7% of total shareholder funds, indicating the company functions partly as an investment holding entity alongside its plantation operations. This investment book has grown from ₹140.71 crores in March 2020, suggesting consistent capital allocation towards securities and other investments. The significant gap between standalone and consolidated profits implies these investments contribute meaningfully to overall profitability, compensating for operational losses in the core tea business.

Peer Comparison: Valuation Discount Reflects Fundamental Weakness

Within the FMCG sector peer group, Neelamalai Agro trades at a significant valuation discount, reflecting market scepticism about its operational performance and growth prospects. The company’s price-to-book value of 0.65x suggests the market values the business at a 35% discount to its net asset value, indicating concerns about the quality and sustainability of earnings.

| Company | P/E (TTM) | P/BV | ROE | Dividconclude Yield | Debt to Equity |

|---|---|---|---|---|---|

| Neelamalai Agro | 7.77x | 0.65x | 10.57% | 0.93% | -0.13 |

| Waterbase | NA (Loss Making) | 1.56x | 0.46% | — | 0.30 |

| Panasonic Energy | 36.73x | 2.25x | 7.40% | 3.03% | -0.17 |

| Wardwizard Foods | NA (Loss Making) | 3.05x | 0.0% | — | 0.40 |

| Universus Photo | NA (Loss Making) | 0.27x | 10.81% | — | -0.32 |

| Aveer Foods | 54.33x | 7.50x | 15.30% | 0.04% | 0.28 |

Neelamalai Agro‘s P/E ratio of 7.77x appears superficially attractive compared to profitable peers like Panasonic Energy (36.73x) and Aveer Foods (54.33x). However, this low multiple reflects market concerns about earnings quality and sustainability rather than representing a genuine value opportunity. The company’s ROE of 10.57%, whilst positive, lags behind Aveer Foods’ 15.30% and only marginally exceeds Universus Photo’s 10.81%, positioning it in the middle of the peer group on this critical profitability metric.

The debt-free status with net cash position (debt to equity of -0.13) provides financial flexibility but hasn’t translated into operational improvements or enhanced shareholder returns. The modest dividconclude yield of 0.93% with a payout ratio of just 8.04% suggests management prioritises capital retention, though the effective deployment of this retained capital remains questionable given the negative ROCE.

Valuation Analysis: Discount Justified by Operational Weakness

At the current market price of ₹3,294.45, Neelamalai Agro trades at a P/E ratio of 7.77x trailing twelve-month earnings and 0.65x book value. The company’s enterprise value to EBITDA multiple of -31.51x and EV to EBIT of -23.55x reflect the negative operating profitability, building traditional valuation metrics challenging to interpret meaningfully.

P/E Ratio (TTM)

7.77x

vs Industest 23x

Price to Book Value

0.65x

35% discount to NAV

Dividconclude Yield

0.93%

₹30 per share

Mojo Score

23/100

STRONG SELL rating

The valuation assessment categorises the stock as “RISKY”, reflecting concerns about earnings sustainability and operational challenges. The stock has modifyd from “Very Expensive” to “Risky” multiple times over the past few years, indicating volatile market perceptions of value. The PEG ratio of 1.72x suggests the valuation isn’t demanding relative to growth expectations, but this metric loses relevance given the negative five-year sales growth of -6.04% and EBIT growth decline of -262.19%.

The book value per share of ₹4,813.86 significantly exceeds the current market price, implying substantial hidden value in the investment portfolio. However, this discount persists becautilize the market questions whether these investments can generate sustainable returns and whether the operating business will continue to drain value. With the stock trading 21.37% below its 52-week high of ₹4,190.00 and only 5.73% above its 52-week low of ₹3,116.00, sentiment remains cautious.

Shareholding Pattern: Stable Promoter Base, Minimal Institutional Interest

The shareholding structure of Neelamalai Agro has remained remarkably stable over recent quarters, with promoter holding steady at 72.45% across the past five quarters through December 2025. The dominant promoter Ajit Thomas holds 66.65% directly, with The Midland Rubber And Produce Company Limited holding an additional 5.80%, providing strong management control and alignment.

| Shareholder Category | Dec’25 | Sep’25 | Jun’25 | Mar’25 | QoQ Change |

|---|---|---|---|---|---|

| Promoter Holding | 72.45% | 72.45% | 72.45% | 72.45% | 0.00% |

| FII Holding | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Mutual Fund Holding | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Insurance Holdings | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Other DII Holdings | 0.60% | 0.68% | 0.68% | 0.68% | -0.08% |

| Non-Institutional | 26.95% | 26.87% | 26.87% | 26.87% | +0.08% |

The complete absence of foreign institutional investor (FII) and mutual fund holdings signals limited institutional confidence in the company’s prospects. The marginal 0.60% holding by other domestic institutional investors (DIIs) further underscores the lack of professional investor interest. In Q3 FY26, even this minimal DII presence declined by 0.08% to 0.60%, with the stake shifting to non-institutional investors.

This shareholding pattern reflects a tightly held company with limited float and institutional participation. Whilst stable promoter holding provides governance continuity, the absence of institutional investors suggests the company hasn’t met the quality and growth thresholds that attract professional fund managers. The lack of institutional scrutiny and research coverage likely contributes to the stock’s illiquidity and valuation discount.

Stock Performance: Consistent Underperformance Across Timeframes

Neelamalai Agro‘s stock performance has significantly lagged broader market indices across virtually all relevant timeframes, reflecting persistent investor scepticism about the company’s operational turnaround prospects. Over the past year, the stock has declined 10.94% whilst the Sensex gained 8.52%, resulting in negative alpha of -19.46 percentage points.

| Period | Stock Return | Sensex Return | Alpha |

|---|---|---|---|

| 1 Week | +4.09% | -1.14% | +5.23% |

| 1 Month | -3.08% | -1.20% | -1.88% |

| 3 Months | -9.39% | -2.19% | -7.20% |

| 6 Months | -10.11% | +2.59% | -12.70% |

| YTD | -6.17% | -3.04% | -3.13% |

| 1 Year | -10.94% | +8.52% | -19.46% |

| 2 Years | -12.91% | +15.47% | -28.38% |

| 3 Years | -8.49% | +36.73% | -45.22% |

| 10 Years | +266.05% | +259.46% | +6.59% |

The underperformance becomes more pronounced over longer timeframes, with three-year returns of -8.49% compared to Sensex gains of 36.73%, translating to negative alpha of -45.22 percentage points. The stock has also significantly lagged the FMCG sector, which delivered 13.07% returns over the past year, resulting in sector underperformance of -24.01 percentage points.

From a technical perspective, the stock currently trades in a “MILDLY BEARISH” trconclude as of February 12, 2026, having modifyd from “Bearish” just recently. The stock trades below all key relocating averages—5-day (₹3,257.54), 20-day (₹3,279.15), 50-day (₹3,444.98), 100-day (₹3,547.94), and 200-day (₹3,606.36)—indicating sustained downward pressure. With a beta of 1.50, the stock exhibits 50% higher volatility than the broader market, amplifying downside shifts during market corrections whilst failing to fully participate in rallies.

“Seven consecutive quarters of operating losses and consistent multi-year underperformance signal fundamental business challenges that cosmetic quarterly profit improvements cannot mquestion.”

Investment Thesis: Multiple Red Flags Outweigh Isolated Positives

The investment case for Neelamalai Agro faces significant headwinds across multiple dimensions. The company’s Mojo score of 23 out of 100 with a “STRONG SELL” rating reflects deep-seated concerns about operational performance, valuation sustainability, and future prospects. The assessment incorporates negative signals from technical trconcludes, weak long-term fundamental strength due to operating losses, and consistent underperformance versus benchmarks.

Valuation Grade

RISKY

Earnings sustainability concerns

Quality Grade

BELOW AVERAGE

Operating losses persist

Financial Trconclude

POSITIVE

Q3 recovery noted

Technical Trconclude

MILDLY BEARISH

Below all MAs

The quality assessment categorises Neelamalai Agro as “BELOW AVERAGE” based on long-term financial performance, with five-year sales growth of -6.04% and EBIT growth decline of -262.19% highlighting structural deterioration. The average ROCE of -1.54% indicates value destruction rather than creation, whilst the average ROE of 10.57%, though positive, remains insufficient to justify equity investment given the operational risks and lack of growth visibility.

Key Strengths & Risk Factors

KEY STRENGTHS

- Debt-Free Balance Sheet: Zero long-term debt with net cash position provides financial stability and flexibility for future investments without solvency concerns.

- Stable Promoter Holding: Consistent 72.45% promoter stake with no pledging demonstrates management commitment and alignment with minority shareholders.

- Substantial Investment Portfolio: ₹253.71 crores in investments provides diversification beyond plantation operations and generates supplementary income.

- Sequential Revenue Recovery: Q3 FY26 sales of ₹7.17 crores marked 47.23% QoQ growth, suggesting improved demand or better realisations.

- Strong Book Value: Book value per share of ₹4,813.86 significantly exceeds market price, indicating potential asset value.

- Heritage Brand: Established since 1943 with presence in premium Nilgiris tea-growing region provides brand recognition and quality positioning.

KEY CONCERNS

- Persistent Operating Losses: Seven consecutive quarters of negative operating margins excluding other income highlight fundamental business model challenges.

- Weak Return Metrics: ROCE of -1.54% and ROE of 10.57% indicate poor capital efficiency and limited value creation capability.

- High Labour Intensity: Employee costs at 57.60% of sales in Q3 FY26 create margin pressure and limit operational flexibility.

- Earnings Quality Concerns: Heavy reliance on other income to achieve profitability raises questions about sustainability of reported earnings.

- Zero Institutional Holdings: Complete absence of FII and mutual fund interest signals lack of professional investor confidence in turnaround prospects.

- Consistent Underperformance: Negative alpha of -19.46% over one year and -45.22% over three years versus Sensex reflects persistent investor disappointment.

- Negative Long-Term Growth: Five-year sales decline of -6.04% and EBIT contraction of -262.19% indicate structural business deterioration rather than cyclical weakness.

Outview: Critical Monitoring Points for Potential Turnaround

For Neelamalai Agro to justify a more constructive investment stance, the company must demonstrate sustained operational improvements beyond quarterly volatility. The path to value creation requires addressing fundamental profitability challenges in the core plantation business whilst maintaining the stability of its investment portfolio returns.

POSITIVE CATALYSTS TO WATCH

- Sustained Operating Profitability: Achievement of positive operating margins excluding other income for multiple consecutive quarters.

- Cost Rationalisation Success: Reduction in employee cost ratio below 50% of sales through productivity improvements or automation initiatives.

- Revenue Growth Acceleration: Consistent quarterly sales growth above ₹7 crores with improving year-on-year comparisons.

- Investment Income Stability: Maintenance or growth of investment portfolio returns to support overall profitability during operational transition.

- Institutional Interest Emergence: Entest of mutual funds or DIIs signalling improved quality perception and research coverage.

RED FLAGS REQUIRING ATTENTION

- Continued Operating Losses: Persistence of negative operating margins beyond Q4 FY26 would confirm structural rather than cyclical challenges.

- Revenue Volatility: Return to quarterly sales below ₹5 crores or negative year-on-year growth in coming quarters.

- Rising Employee Costs: Further increase in employee cost ratio above 60% of sales indicating deteriorating operational leverage.

- Investment Portfolio Pressure: Decline in investment values or reduction in other income impacting overall profitability cushion.

- Promoter Stake Reduction: Any decrease in promoter holding below 70% would signal concerning shift in management confidence.

- Technical Breakdown: Breach of 52-week low of ₹3,116 on sustained basis indicating intensifying selling pressure.

The Verdict: Operational Turnaround Remains Elusive

STRONG SELL

Score: 23/100

For Fresh Investors: Avoid initiating positions. The company’s persistent operating losses, negative ROCE, and consistent multi-year underperformance versus benchmarks present significant risks that outweigh the superficial appeal of low valuation multiples. The absence of institutional investor interest and sustained negative operational trconcludes suggest the turnaround thesis lacks credibility.

For Existing Holders: Consider exiting positions, particularly if holding at elevated cost bases. Whilst the Q3 FY26 profit surge appears encouraging on the surface, the continued operating losses and heavy reliance on other income indicate fundamental business model challenges remain unresolved. The 35% discount to book value reflects justified market scepticism rather than a value opportunity.

Fair Value Estimate: ₹2,800-₹3,000 (15-10% downside from current levels), reflecting operational risks and earnings quality concerns despite substantial net asset value.

The investment case requires demonstration of sustained operating profitability and revenue growth consistency before warranting reconsideration. Until the company addresses its core business challenges, the stock remains unsuitable for conservative investors seeking quality compounders or reliable dividconclude income.

Note- ROCE= (EBIT – Other income)/(Capital Employed – Cash – Current Investments)

⚠️ Investment Disclaimer

This article is for educational and informational purposes only and should not be construed as financial advice. Investors should conduct their own due diligence, consider their risk tolerance and investment objectives, and consult with a qualified financial advisor before building any investment decisions. Past performance is not indicative of future results, and all investments carry inherent risks including potential loss of principal.

Leave a Reply