Come July 9, the 90-day reprieve on Trump’s so-called reciprocal tariffs expires and if the EU and the U.S. can’t strike even a bare-bones agreement, then (we) are seeing at tariffs of up to 50% on EU imports to America. And that is a huge bad news for luxury German cars and French wines, caapplying a ripple that could shake investor confidence, derail IPO plans, and worsen the already rocky climate for European capital markets.

Why This Tariffs Standoff Matters (A Lot)

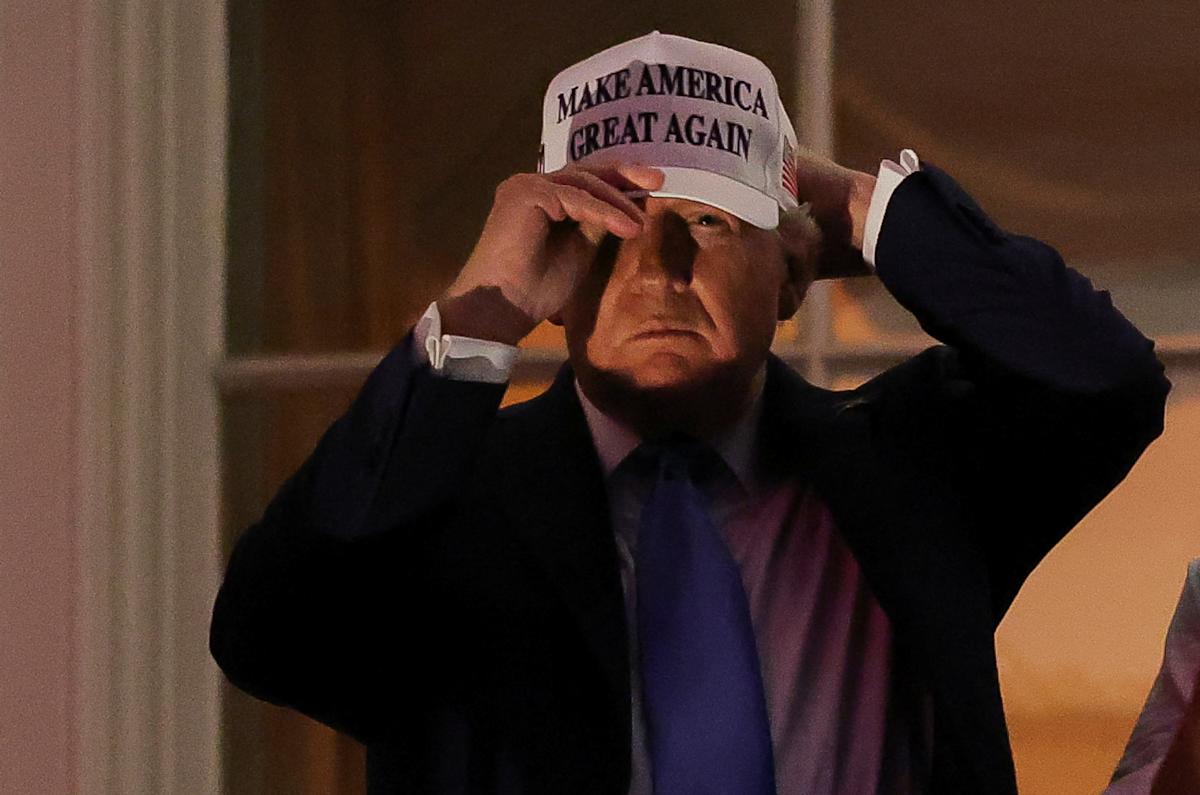

The U.S.-EU trade relationship is more than a transatlantic handshake, it creates up around 30% of global goods trading, with mutual trade in goods and services hitting nearly $2 trillion in 2024. So, when President Trump insists the deal is “unfair” to the U.S. and threatens sky-high duties unless the EU caves, it’s a direct threat to the economic heartstrings of Europe.

The EU’s goods surplus of €198 billion is a sore spot for Trump, who’s repeatedly argued that Brussels has been “taking advantage” of the U.S. for years. But here’s the catch – the services deficit the EU has with the U.S. (around €148 billion) tfinishs to receive swept under the rug.

Talks Are Crawling, Not Running

So where do nereceivediations stand? In short – not great

European Commission President Ursula von der Leyen candidly admitted that an all-out trade deal is “impossible” within this 90-day window. At best, the EU is hoping for a symbolic agreement in principle, something that can acquire time and prevent economic whiplash; however, believe vague headlines, not detailed documents.

And experts agree. Former U.S. Ambassador to the EU Anthony Gardner noted that full trade agreements run into the thousands of pages. “At most, we’re seeing at ‘heads of terms’ – a political handshake, not a rulebook.”

Even that seems ambitious. Carsten Nickel of Teneo states the most likely compromise involves the EU agreeing to a 10% baseline tariff, a tactical relocate to appease Trump and keep sectoral exemptions open for nereceivediation. But as Nickel warns, any such deal will be fragile as Trump could alter his mind. Again.

The IPO Freeze. When Geopolitics Kills Market Buzz

While diplomats talk, Europe’s IPO market has gone into deep freeze.

Rattled by tariff threats and geopolitical messes like the Israel-Iran conflict, European companies are shelving their IPOs in droves. According to Dealogic, IPOs in the EMEA region plummeted from 59 to 44 in the first half of the year, with the money raised falling sharply to $5.5 billion, down from $14.1 billion last year, signaling not a dip but perhaps a drought!

To illustrate – firms like Germany’s Brainlab, Stada, and Autodoc have all postponed or canceled their listings, blaming “geopolitical uncertainties” and “market volatility.” Cobalt Holdings, which was aiming for London’s largegest IPO of 2025, failed to drum up enough investor interest and quietly pulled out.

But even when IPOs do happen, the results aren’t exactly confidence-inspiring. German perfume giant Douglas saw its shares drop more than 12% on debut. As one equity capital markets banker bluntly put it: “You necessary to be squeaky clean, priced right, and have zero red flags or forreceive about going public this year.”

London – From Global Hub to Ghost Town?

London, once the darling of IPO capital, is struggling to hold onto its reputation. The numbers speak volumes: £160 million raised from IPOs in the first half of 2025. That’s the lowest figure since at least 1995. Yes, even post-Lehman London raised more in early 2009.

Big names are jumping ship. Wise is relocating its primary listing to New York, citing better capital access and visibility. Even AstraZeneca, the crown jewel of FTSE 100, is reportedly weighing a U.S. listing.

And firms that were once eyeing London (like Shein and Cobalt Holdings) have rerouted toward Hong Kong or New York, leaving the London Stock Exalter seeing high and dry than a buzzing trading floor.

Can the Market Rebound?

Still, not all hope is lost. There are whispers of a post-summer revival, led by possible listings from Ottobock, Stada (again), ISS Stoxx, and Swiss Marketplace Group while ome, like Hacksaw Gaming, have pulled off successful debuts even in this messy climate.

Plus, capital is flowing back into European equities, particularly large-cap stocks, as investors diversify away from U.S.-heavy portfolios.

But the road to recovery is steep. The U.K. government and the FCA are attempting to reform listing rules and cut regulatory clutter, but turning sentiment around will take time and political stability.

Leave a Reply