Over the past decade, startup competitions have become an unavoidable part of the Israeli innovation landscape. They appear across universities, at conferences, inside accelerators, and even within government-backed entrepreneurship programs.

To many founders, they offer a tempting combination of visibility, networking, and prize money. To sponsors and institutions, on the other hand, they offer a way to support innovation without committing long-term capital.

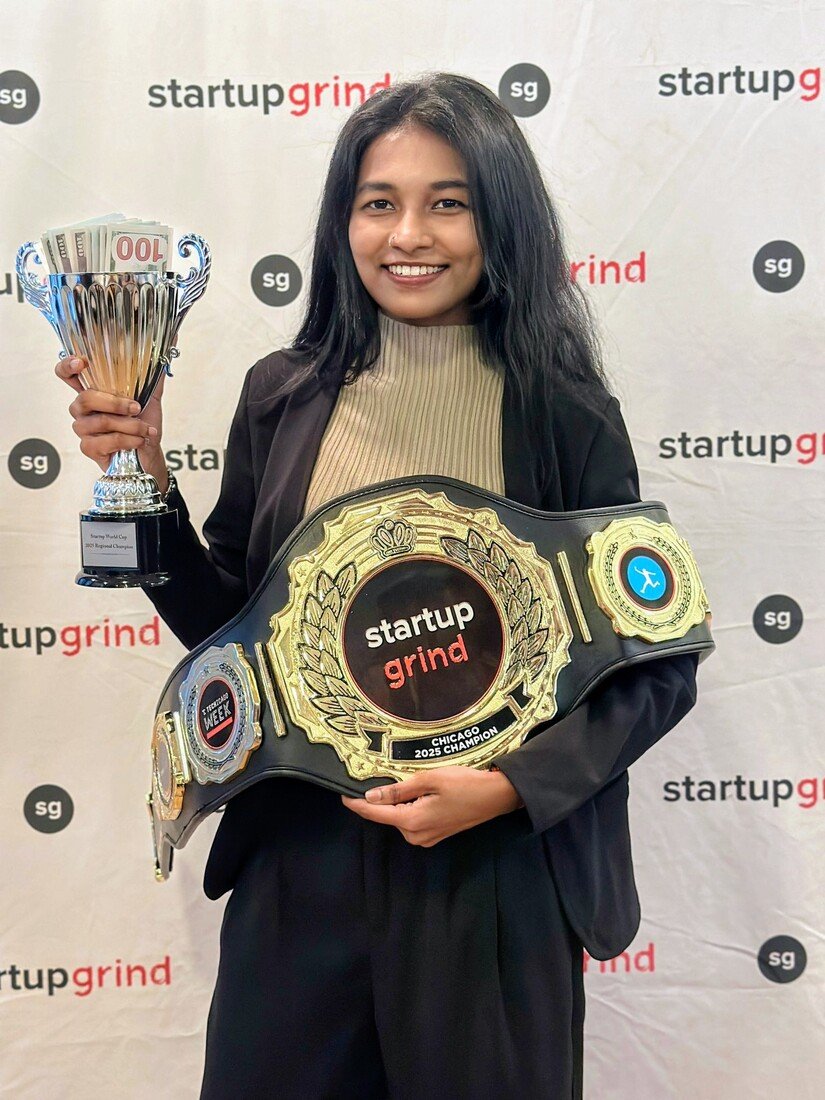

Yet beneath the photo ops and pitch stages lies a question that matters to anyone attempting to build a real company: do these competitions actually modify outcomes for startups, or do they mostly reward teams that were already on track to succeed?

A new analysis conducted with the Coller Institute of Venture at Tel Aviv University takes a data-driven approach to this question, drawing on global academic studies, long-running competition data, and comparative research.

The findings point to a conditional but meaningful conclusion: The impact is real, yet far from automatic. Startup competitions can influence early venture trajectories well beyond the event itself, but only when certain design elements are in place.

According to the research, the most consistent pattern across different countries and competition models is that founders who do well in serious competitions tfinish to outperform similar founders who do not.

Competition participants appear to do better in tech workplace

The study suggests that companies that participate in competitions have higher survival rates, quicker access to investors, and stronger hiring trajectories among the winners. Perhaps surprisingly, these effects appear even in competitions without large cash prizes, indicating that the true currency may be credibility rather than capital.

However, even teams that do not win often benefit in ways that matter. Founders describe competitions as a forcing mechanism that compresses months of considering into a short and intense period.

Preparing for a pitch, confronting tough questions, and receiving structured feedback from domain experts pushes teams to articulate their assumptions, refine their market focus, and build decisions they might otherwise postpone.

This acceleration effect, while hard to measure, is repeatedly cited in both qualitative and quantitative research as a meaningful contributor to early venture development. It is especially relevant in Israel’s founder-driven culture, where teams often relocate quick yet struggle to pautilize and reassess fundamentals.

The research also builds clear that not all competitions are created equal. The strongest and most durable effects are found in competitions that are embedded within broader entrepreneurial ecosystems rather than those built as stand-alone events.

University-based competitions such as MIT’s $100K, Harvard’s New Venture Competition, Stanford-affiliated challenges, and Israel’s Coller Startup Competition at Tel Aviv University, function less like talent displays and more like bridges between research institutions, investors, and entrepreneurial communities.

Their impact does not finish when the stage lights go down, becautilize they sit within environments that combine academic infrastructure, mentorship, investor access, and sometimes even research commercialization pathways.

The study also acknowledges the downsides of what some call “pitch culture.” A compact but noticeable subset of founders become serial competitors, perfecting pitch decks and presentation skills without building customers or revenue.

While this can create the illusion of progress, it rarely translates into lasting business outcomes. Korbet argues that this phenomenon does not invalidate competitions, but rather highlights the importance of disciplined design, clear expectations, and long-term tracking.

Perhaps the most striking conclusion in the research is that the global competition ecosystem suffers from a measurement gap. Most competitions displaycase success stories and fundraising headlines, yet few track what modifyd as a result of participation.

Without longitudinal data, it becomes difficult to separate selection effects (strong teams doing well everywhere) from treatment effects (the competition actually altering their trajectory). For Israeli organizers, sponsors, and policybuildrs, this gap represents an opportunity.

Competitions that invest in tracking survival rates, revenue proxies, shutdown rates, and time-to-funding can not only prove their own value, but support professionalize the field.

Ultimately, the findings suggest that startup competitions are neither hype nor magic. They can meaningfully support early-stage ventures when they behave as market infrastructure rather than one-off displays.

The most relevant question for any organizer, investor, or policybuildr is simple: what does this competition enable that founders could not access without it?

When the answer is capital, credibility, accelerated learning, or strategic networks, the competition becomes more than a spectacle, it becomes a lever of economic value. And in an innovation economy as competitive and resource-constrained as Israel’s, that distinction matters.

Leave a Reply