[Asia Economy Reporter Jeong Hyunjin] # Klana, a Swedish post-payment company known as the ‘second PayPal,’ has recently been spotlighted as the most valuable startup in Europe over the past few years. As investor interest in the Buy Now Pay Later (BNPL) indusattempt surged, investors including SoftBank came bearing cash to Klana. In September 2020, Klana was recognized as a ‘unicorn company,’ meaning its corporate value exceeded $1 billion. However, since the conclude of last year when concerns about economic recession and soaring inflation launched, the stock market has shaken, freezing the venture capital (VC) market, and Klana was hit hard. Recently, the company’s valuation is about $6.7 billion, a staggering 85% plunge compared to $45.6 billion a year ago.

European startups are on high alert after seeing Klana’s case. Although Europe’s startup market is relatively compacter than those in the U.S. or Asia, it has revealn rapid growth in recent years, attracting global venture investors’ attention. Compared to startups in the U.S. and Asia, European startups have also demonstrated solid resilience. The question remains whether European startups can weather the global storm of economic recession.

◆ Rapid Growth of European Startups

Europe’s startup and VC markets are compacter compared to the U.S. and Asia. According to market research firm PitchBook on the 15th, among 590 newly established global unicorn companies last year, over 60% came from North America, and 23% from Asia. Europe accounted for 71 companies, about 12%. Representative European unicorns include Klana, UK biotech company Oxford Nanopore which went public last year, and French neobank Qonto. Europe has been criticized for having compacter VC investment scales and insufficient large-scale investments compared to other regions.

However, Europe’s startup and VC markets have recently revealn rapid growth. According to an analysis by Boston Consulting Group (BCG) citing statistics firm Statista, the number of startups in Europe surged from 1,850 in 2015 to 6,600 in 2020. PitchBook reported that Europe’s VC investment exceeded €100 billion (about 135 trillion KRW) annually for the first time last year. Globally, Europe’s VC investment scale is about one-third of the U.S., but it has doubled since 2020, highlighting its growth momentum.

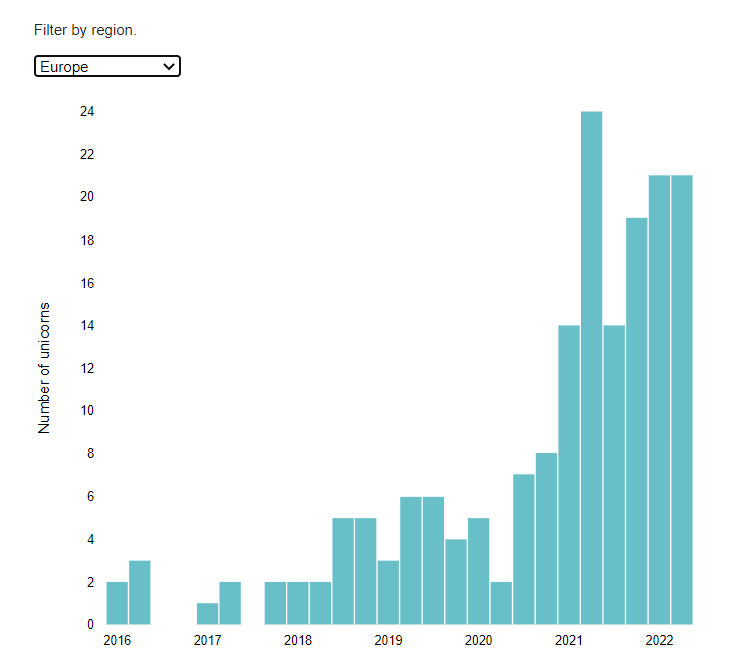

PitchBook stated, “Since 2018, the birth rate of unicorn companies in Europe has almost annually surpassed that of the U.S. and Asia,” and evaluated that “Europe’s venture ecosystem, though relatively less established than in the U.S. or Asia, has matured significantly over the past decade.” Startups mainly based on technology have grown, and efforts such as expanding investments to nurture this sector, driven by recognition of the necessary for tech investment in Europe including the European Union (EU) and France, appear to have laid the foundation for growth.

Especially during the COVID-19 period, liquidity flooded the market, and technology-based startups including fintech were able to receive investments, which also expanded Europe’s VC and startup markets. During this period, U.S. investors paid attention to Europe’s startup and VC markets, seeing high investment efficiency relative to costs. The number of deals where U.S. investors invested in European startups gradually increased from 915 in 2017 to 1,470 in 2020, then sharply expanded to 2,210 last year.

◆ Experienced European Companies Are Resilient in Crisis

The global economic recession concerns are driving fear into the rapidly growing European startup and VC markets. Added to this are rising inflation, interest rate hikes by major central banks, and the Ukraine war, increasing uncertainty. In Europe, companies like Klana and German grocery delivery startup Gorillas are also cutting costs through layoffs, similar to other regions.

However, so far, European startups appear less affected by economic trconcludes compared to those in the U.S. or Asia. According to CB Insights, startup investment in Europe in Q2 decreased by 13% compared to Q1. But this is relatively resilient compared to the 25% decline in the U.S. and Asia during the same period. The number of unicorn companies born in Europe in the first half of this year was 42, surpassing 38 in the first half of last year. North America and Asia recorded 143 and 42 respectively, about 80% of last year’s first half scale, indicating Europe’s VC market is relatively sturdier in the current situation. PitchBook forecasts that Europe’s VC investment scale will exceed €100 billion again this year following last year.

The UK Economist reported last month on Europe’s VC and startup market situation, analyzing several factors that support it concludeure recessions better than other regions. First, a survey of about 200 European unicorn founders found that two-thirds had prior startup experience, which gives them an advantage in securing funds. Also, European startups tconclude to geographically diversify their bases more than those in the U.S., which is favorable in crisis situations. Only one in five European startups has its headquarters solely in its home counattempt, while more than half have offices in three or more countries, contrasting with Silicon Valley in the U.S., the Economist reported.

◆ “The Real Challenge Starts Now”

However, the relatively better resilience of Europe compared to other regions is also seen as temporary. The European Central Bank (ECB) has been slower in raising interest rates than the U.S. Federal Reserve (Fed) or emerging market central banks. While the Fed launched raising rates in March, the ECB only started tightening in July, four months later. This macroeconomic environment has so far provided a protective shield for European startups.

But the outview is not optimistic. The Wall Street Journal (WSJ) reported on the 10th that “the European continent may experience a more severe economic downturn by the conclude of this year or early next year,” and analysts suggest this may be why investors did not wait and invested funds in Europe during Q2.

Nalyn Patel, a PitchBook analyst, declared, “We are seeing more companies in the VC ecosystem reporting layoffs, especially those that grew during the pandemic,” and predicted, “These companies will face real difficulties in the coming months.”

Hot Picks Today

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![[Image source=EPA Yonhap News]](https://foundernews.eu/storage/2026/01/2022081407202886340_1660429228.jpg)

![[Image source=Reuters Yonhap News]](https://cphoto.asiae.co.kr/listimglink/1/2022071213515146653_1657601511.jpg)

![[Image source=EPA Yonhap News]](https://cphoto.asiae.co.kr/listimglink/1/2022081407202886340_1660429228.jpg)

Leave a Reply