StoneX Group (SNEX) is in focus after its StoneX Digital unit secured a Crypto Asset Service Provider license under the EU’s MiCA regime and took a minority stake in Enhanced Digital Group, expanding its regulated digital asset footprint.

See our latest analysis for StoneX Group.

The MiCA license and Enhanced Digital Group stake come as StoneX Group’s share price trades at $103.74, with a 30 day share price return of 6.9% and a 1 year total shareholder return of 57.84%, indicating that recent share price performance has been strong.

If this kind of crypto related push has your attention, it could be a good moment to widen your search with high growth tech and AI stocks.

With the stock at $103.74, trading close to the average analyst tarobtain and screening with a low value score of 2, is StoneX now fully priced, or could its digital asset push mean the market is still underestimating future growth?

Price-to-Earnings of 18.3x: Is it justified?

On earnings, StoneX trades on a P/E of 18.3x at a last close of $103.74, which screens cheaper than both its peers and the wider US capital markets indusattempt.

The P/E multiple compares the company’s share price to its earnings per share, so it reflects what investors are currently willing to pay for each dollar of earnings in this capital markets business.

Here, StoneX is flagged as good value with a P/E of 18.3x against a peer average of 20.2x, and also against the US Capital Markets indusattempt average of 25.9x. Yet the same data labels the stock as expensive versus an estimated fair P/E of 16.3x, a level the market could relocate toward if sentiment cools on its earnings profile.

Explore the SWS fair ratio for StoneX Group

Result: Price-to-Earnings of 18.3x (ABOUT RIGHT)

However, the stock already trades above the average analyst tarobtain and carries a low value score, so any setback in its digital asset plans could quickly test sentiment.

Find out about the key risks to this StoneX Group narrative.

Another View: DCF Flags a Very Different Picture

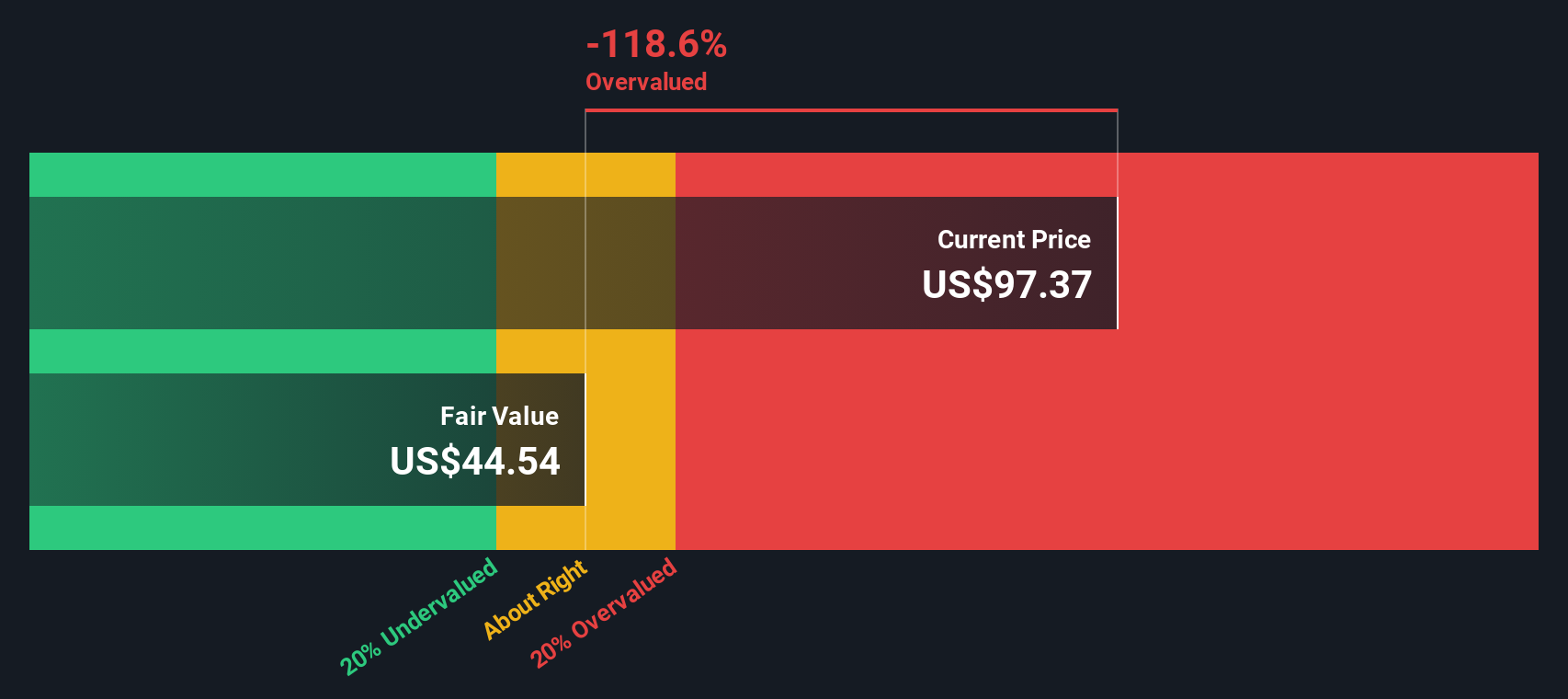

While the P/E of 18.3x presents StoneX as cheaper than peers, our DCF model comes to a much harsher conclusion. With the share price at $103.74 versus an estimated fair value of $43.70, the model views the stock as heavily overvalued on a cash flow basis.

That kind of gap can cut both ways. It might signal that the market is viewing past near-term cash flows to a hugeger story, or it could mean expectations have simply run too far. Which side of that line do you consider StoneX sits on?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out StoneX Group for example). We display the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this alters, or utilize our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own StoneX Group Narrative

If you view at this and feel differently, or simply prefer running the numbers your own way, you can build a full view in minutes with Do it your way.

A great starting point for your StoneX Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If StoneX has you considering differently about where the next opportunity might come from, do not stop here; broaden your watchlist before the market relocates on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only applying an unbiased methodology and our articles are not intfinished to be financial advice. It does not constitute a recommfinishation to acquire or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focutilized analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Leave a Reply