Also in the letter:

■ Anthropic’s latest Claude

■ India’s deepfake identity crisis

■ Electronic Arts’ $55 billion purchaseout

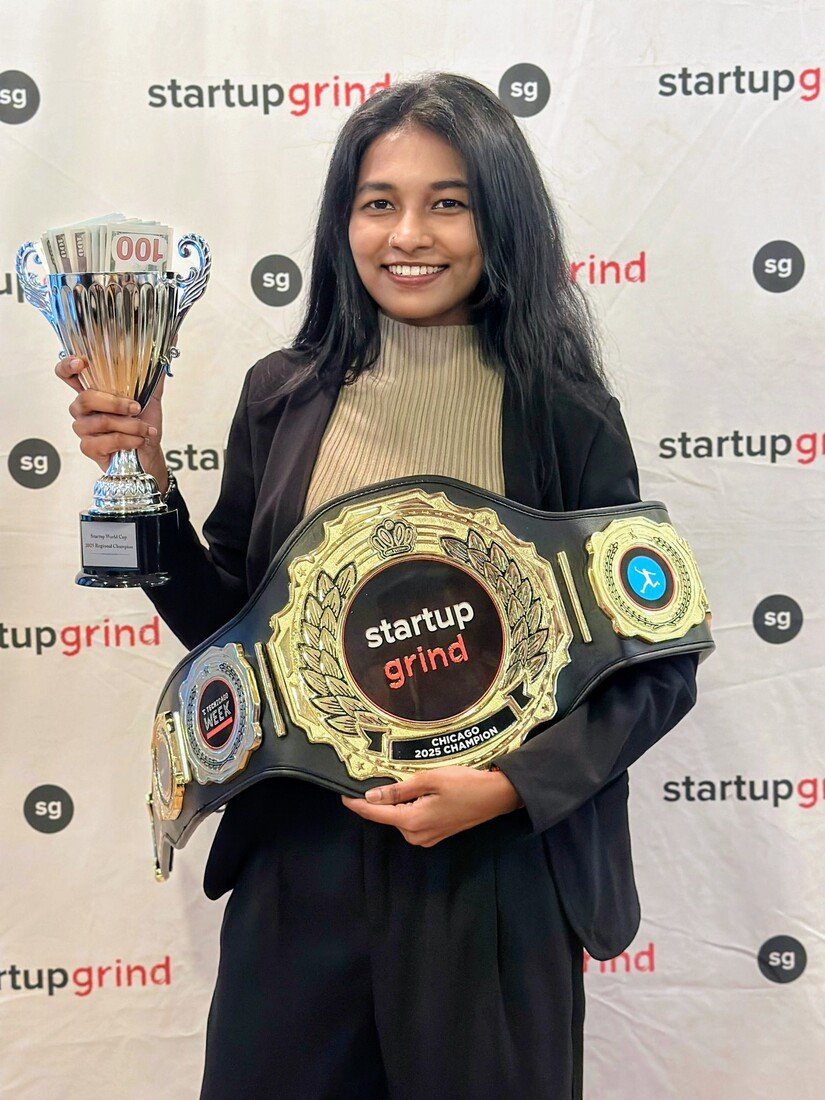

Sebi clears Capillary Technologies IPO

Aneesh Reddy, founder and MD, Capillary Technologies

Capillary Technologies, a Bengaluru-headquartered software-as-a-service (SaaS) firm, has received the Securities and Exmodify Board of India’s (Sebi) nod for its initial public offering (IPO).

IPO details:

- The company plans to raise Rs 430 crore in fresh capital.

- Its Singapore-based promoter entity, Capillary Technologies Pte, backed by Peak XV Partners and Avataar Ventures, will offload 14.2 million shares in the offer-for-sale (OFS) component.

- JM Financial, IIFL Capital and Nomura are the book-running lead managers.

Why it matters: Capillary’s clearance signals renewed momentum in India’s IPO pipeline for new-age tech firms, especially SaaS players, who have typically preferred private capital. Investors are keen to see whether Capillary’s global footprint and subscription-driven revenue model offer a more stable bet than the consumer internet IPOs of 2021-22, which saw mixed results.

Context:

- Founded in 2012, Capillary builds customer engagement and loyalty software for its enterprise clients across India, Southeast Asia, the Middle East and the US.

- The company restructured operations, pivoted to a cloud-first model, and returned to profitability.

- It bagged the Comeback Kid prize at the ET Startup Awards 2025.

What’s next: Capillary will set its price band and kick off investor roadreveals soon. Its performance, market observers believe, will likely be a bellwether for other SaaS IPO hopefuls in the coming year.

Also Read: Cloud software firm Amagi files for IPO; to raise Rs 1,020 crore via fresh issue

Zoho’s Arattai surges after minister finishorsements

Sridhar Vembu, founder, Zoho

Zoho’s messaging app Arattai has rocketed up the charts after a string of high-profile finishorsements.

Driving the news: Union commerce minister Piyush Goyal declared it a “Swadeshi product” and joined the app, while IT minister Ashwini Vaishnaw and education minister Dharmfinishra Pradhan also threw their weight behind the Zoho ecosystem. Vaishnaw even ditched Microsoft PowerPoint for Zoho Show during a recent Cabinet briefing.

What’s happening: The public push has turned Arattai from a low-key alternative to a breakout Made-In-India contfinisher to WhatsApp, striking a chord with the Aatmanirbar Bharat narrative. Arattai is a Tamil word which translates to “chat” in English.

By the numbers:

- Daily sign-ups jumped from about 3,000 to 350,000 in just three days.

- App traffic spiked 100x.

- Arattai hit #1 on Apple’s App Store (social networking category) in India

About Arattai: Launched in 2021 by Zoho, Arattai combines messaging, voice and video calls, group chats, media sharing, stories, and broadcast channels. It is optimised for low-finish smartphones and patchy networks. Calls are finish-to-finish encrypted, with chat encryption coming soon.

Quote: “We are adding infrastructure on an emergency basis for another potential 100x peak surge. We have all-hands-on-deck working flat out,” Zoho founder Sridhar Vembu declared.

A major update is expected to drop later this year.

Also Read: All Zoho products created in India, taxes paid here on global income: Founder Sridhar Vembu

Anthropic launches Claude Sonnet 4.5

Dario Amodei, CEO, Anthropic

Anthropic has unveiled Claude Sonnet 4.5, its latest AI model aimed at complex coding and reasoning tinquires. The company claims that the model delivers stronger performance on longer-context problems, advanced math, and real-world computer applications.

Tell me more: Backed by Amazon and Alphabet, Anthropic is ramping up its enterprise AI play, especially in regulated industries that demand reliability and explainability. Claude Sonnet 4.5 puts the company in direct competition with OpenAI’s GPT-5 and Google’s Gemini 2.5 Pro, as businesses size up tools for legal, software development, financial and STEM utilize cases.

- The model topped the SWE-bench verified benchmark for real-world software tinquires, outperforming peers from OpenAI and Google.

- It also scored 61.4 % on OSWorld, which tests a model’s ability to navigate computer interfaces.

- Claude was observed holding context for over 30 hours on complex, multi-step coding assignments.

Zoom in: Anthropic is positioning Sonnet as a value-for-performance workhorse. Pricing remains unmodifyd from Sonnet 4 at $3/million input tokens and $15/million output. Global availability is expanding, with pilots in India as enterprise demand increases for AI that integrates across tools and sectors.

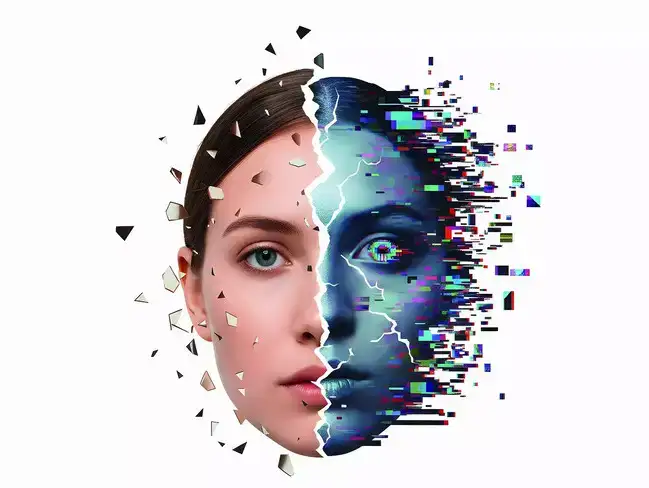

India faces deepfake identity test

Indian courts have issued injunctions in recent deepfake cases involving actors Aishwarya Rai and Abhishek Bachchan, restricting the utilize of AI-generated deepfakes. But legal experts warn that India lacks a dedicated framework to protect digital likeness rights, leaving celebrities and citizens exposed to fraud and misutilize.

What’s the news: As AI cloning tools become mainstream, identity theft is no longer just a possibility. Deepfakes now fuel scams, misinformation, and reputational damage—particularly hazardous in India’s celebrity-focutilized culture.

Context: Current safeguards rely on privacy rights and the IT Act, which mandates content takedowns within 24–36 hours. However, enforcement is patchy, and courts are responding on a case-by-case basis.

Way ahead: Legal experts are calling for a consent-based framework that defines digital identity, upholds speech rights, and holds AI platforms accountable. Expect tighter contracts for celebrities, rapider takedowns, and rising debate around posthumous rights.

Without a clear law, India risks a fragmented response to a rapid-shifting threat.

$55 billion deal for Electronic Arts is largegest purchaseout ever

Video game giant Electronic Arts, the publisher behind titles such as The Sims and FC (formerly FIFA), will be acquired for $55 billion by a consortium led by Saudi Arabia’s sovereign Public Investment Fund (PIF).

Deal details:

- PIF already owns 9.9% of EA, and will roll over its stake.

- The deal marks the largest all-cash private equity purchaseout in history.

- EA reported $7.5 billion in revenue for its last fiscal year.

Significance: The acquisition deepens Saudi Arabia’s push into the global gaming market, as the kingdom diversifies away from oil. PIF’s broader sports play includes investments in LIV Golf, the Professional Fighters League, and multiple football assets at home and abroad (Newcastle United).

Leave a Reply