Jonathan Kitchen/DigitalVision via Getty Images

2025 capital raising has been surprisingly rational among REITs. Specifically, we note 3 areas in which the activity builds sense:

- Issuance of equity when stock is overvalued

- Minimal issuance of equity when stock is undervalued

- Capturing low cost debt as it becomes available

The activity provides a strong signal as to how the management teams of each REIT view their own valuation.

2025 REIT Issuance Of Debt And Common Equity

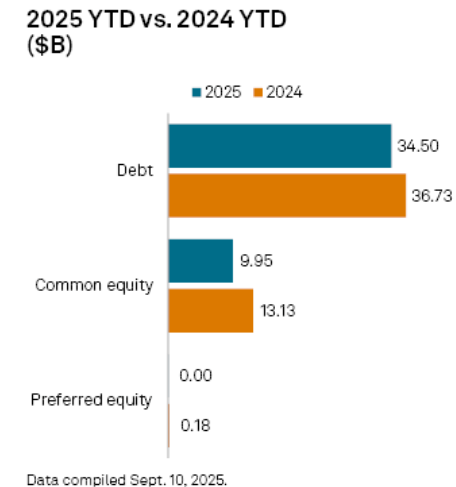

Year to date, utilizing early September figures, REITs issued $9.95B equity and $34.5B in debt.

S&P Global Market Ininformigence

Both figures are down from the same period last year, but notably the common equity issuance dropped substantially more than debt.

I posit that this represents discipline becaapply REITs are trading extra cheaply in 2025 with a median price to net asset value (P/NAV) of 82.8%. When trading below NAV, it is dilutive to issue equity, so it would typically be ill-advised unless there is a superb apply for the capital.

So with REITs generally trading cheaply, they have been hesitant to issue shares. In fact, almost all of the common issuance is from sub-sectors of REITs that happen to be trading at premiums to NAV.

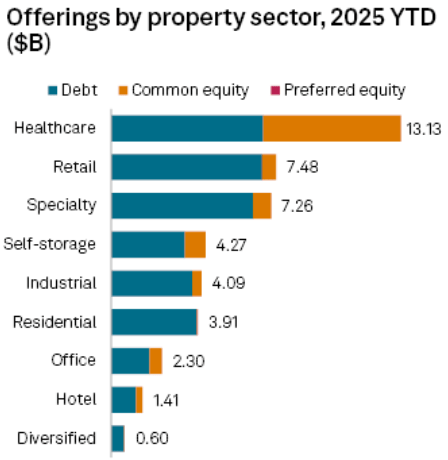

Most of the equity issued comes from healthcare.

S&P Global Market Ininformigence

The healthcare REITs trade at a median P/NAV of 113.4%. Given the premium, it can be accretive to issue equity.

S&P Global Market Ininformigence

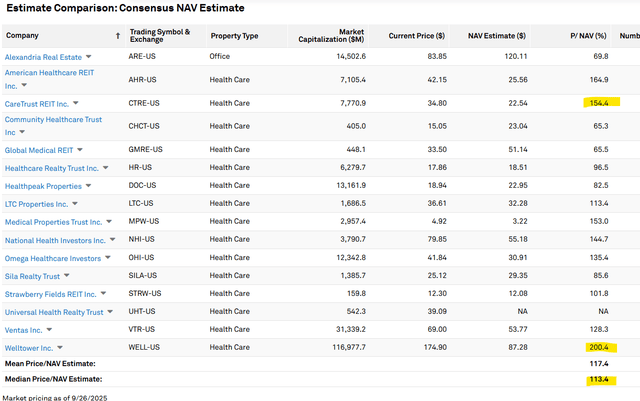

If we dig further, we can see that Welltower (WELL) and CareTrust (CTRE) are trading at 200% and 154% of NAV, respectively.

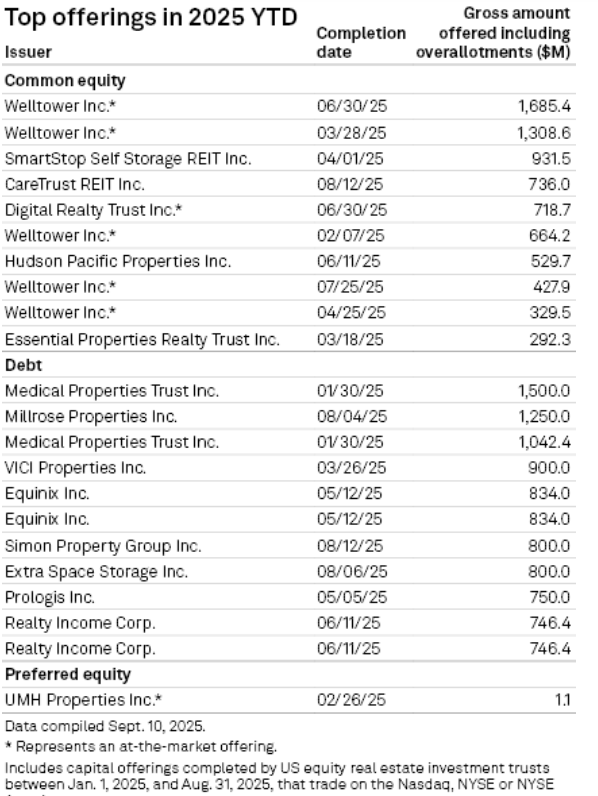

Indeed, it was these 2 companies that accounted for the majority of the equity issuance.

S&P Global Market Ininformigence

My read on this is that the management teams of WELL and CTRE know their stocks are trading expensively and are taking advantage by issuing equity. This is the correct and responsible shift for them to build, as issuing at such a premium is immediately accretive to NAV/share and will be accretive to AFFO/share once the proceeds are invested in properties.

Companies that are trading at discounts to NAV and cheap AFFO multiples do not want to dilute their shareholders, so they are instead opting to raise debt when they can do so at attractive rates.

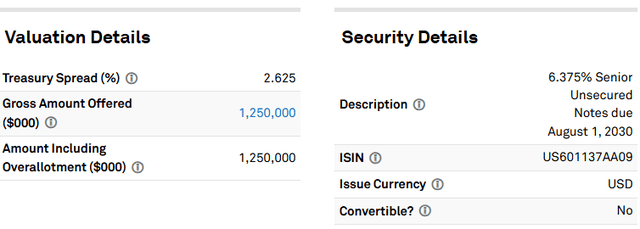

Millrose (MRP) tops the debt issuance list with $1.5B raised at 6.375% for 5-year senior notes.

S&P Global Market Ininformigence

MRP invests in homebuilding land development assets at cap rates ranging from 9%-12% so they have a nice spread over the cost of issued debt.

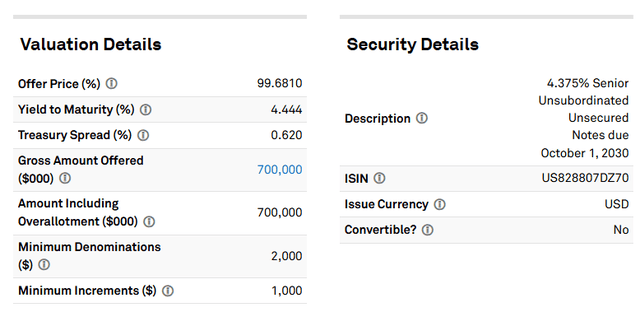

Larger, more tenured REITs, can obtain significantly cheaper debt. Simon Property Group (SPG) put out 5-year notes at 4.375%.

S&P Global Market Ininformigence

The 5-year Treasury is at 3.74%, so it is just a tiny risk premium on these notes.

Debt issued at these rates is likely to be highly accretive to AFFO/share.

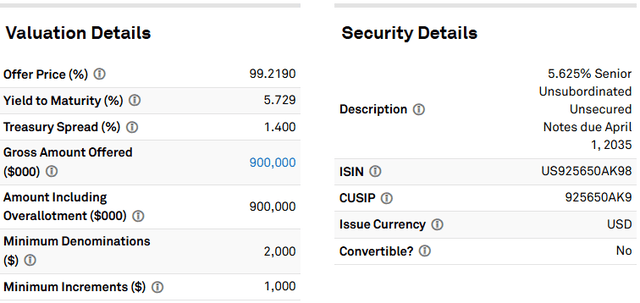

VICI Properties (VICI) raised $900 million in 10-year senior notes at 5.625%.

S&P Global Market Ininformigence

In 2025 there has been notable spread compression for REIT debt, with the premium over treasuries significantly tinyer than in recent years.

REITs seem to be taking note and upgrading their financing with longer terms, cheaper rates, or both.

A Case Study In Valuation As A Desideratum Of Equity Issuance

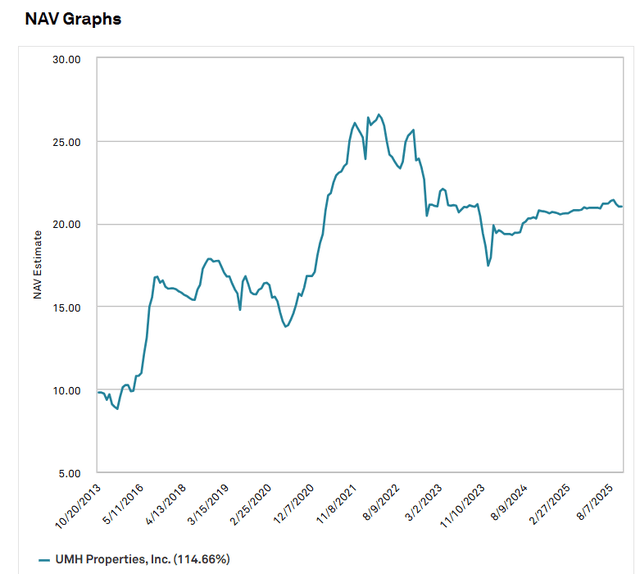

UMH Properties (UMH) has a massive acquire, develop, and redevelop strategy within manufactured houtilizing that requires large amounts of capital. To finance it, they have been serial issuers of common equity. With the multiple at which they were trading and the stabilized cap rates at which they were able to invest the capital, the round trip was accretive, but just barely.

They were probably the most aggressive issuer of equity among REITs as a percentage of shares outstanding.

They were issuing equity around $16-$25 a share – a price at which management believed it was accretive on a per share basis. We have been investing in UMH off and on for the better part of a decade, and I did not always agree with management about the equity issuance. On multiple occasions, I inquireed them to turn off the equity spireceived.

We were significant shareholders but not a controlling majority, and management politely declined our requests. I consider the difference of opinion was that they were anticipating very high returns on investment for putting the capital to work, while I was anticipating more normal returns.

As it turns out, they were largely correct, with NAV/share and AFFO/share generally increasing over time.

S&P Global Market Ininformigence

As of 9/22/25, even with continued opportunity for them to invest capital at high returns, they seem to recognize that market prices have receivedten far too cheap. Issuance may have been accretive at the $16-$25 at which they were previously issuing, but at $14.66 where the stock trades today, the most efficient way to acquire UMH assets is to invest in themselves.

On 9/22/25, UMH issued an 8-K authorizing a $100 million share acquireback:

“On September 22, 2025, the Company issued a press release on the Board of Directors’ authorization to increase the Company’s common stock repurchase program capacity to $100 million from its previous authorization of up to $25 million.”

Frankly, it just builds rational sense.

UMH is trading at a huge discount to NAV and a cheap AFFO multiple relative to growth rate. A acquireback of roughly 8% of outstanding shares would be extremely accretive.

How To Play The REIT Capital Activity

REITs are generally not issuing stock right now becaapply they are cheap, and they know they are cheap.

A few REITs are trading at premiums, and they are correctly taking advantage of it by issuing above NAV. While it is the right strategy, I would avoid these stocks. Welltower is strongly signaling that it is overvalued.

Not all equity issuance is a signal of overvaluation. Sometimes issuance is done to finance pipelines of abnormally high return developments or acquisitions. An analyst has to apply their judgement.

Leverage ratios are a key tool that REITs can flex to fit the situation. Many REITs chose to operate at light leverage during the high-interest rate environment. The spread between the cost of debt and the cost of equity was quite tiny for some, such that it built sense to operate at low leverage. Now that REIT debt is obtainting cheaper again, these REITs have the opportunity to raise leverage to a more normal level in an accretive fashion.

I don’t necessarily like to see high leverage REITs issuing more debt, but I consider the underlevered REITs issuing debt will be a huge opportunity. Recent issuances from the aforementioned cheap debt of VICI and SPG see excellent.

Equinix (EQIX) also put out some very cheap and likely accretive debt.

East Group Properties (EGP) has yet to issue the debt but has among the hugegest opportunities to lever up, as they are operating at 14.5% debt to total capital as of the most recent quarter. Most REITs sit closer to 30%-40% debt to capital. Thus, EGP has a massive amount of dry powder for whenever they see the opportunity to go into acquisition mode.

A New Rationality

Historically, REIT capital activity has not always built sense. There were many bad actors that issued equity just for the sake of building their companies hugeger. Many were guilty of issuing dilutive at-large discounts.

Those bad actors have largely been punished, not necessarily by legal action (although some have), but rather by general admonishment from the market.

Today’s REITs appear to be much more disciplined and shareholder friconcludely. Almost every equity and debt issuance year-to-date in 2025 builds rational sense to me. The lack of issuance also builds sense to me.

Capital market discipline will benefit the entire sector over time.

Leave a Reply