Realty IncomeO is expanding its global real estate platform through disciplined, data-driven investments. In the second quarter of 2025, it deployed $1.2 billion at a 7.2% initial weighted average cash yield, with $889 million (76%) in Europe and $282 million in the United States, backed by a 15.2-year average lease term. The company sourced a record $43 billion in opportunities during the quarter, resulting in a selectivity ratio of less than 3%, reflecting its broad market visibility.

European expansion is a central growth driver, benefiting from a fragmented market, favorable financing and a larger addressable market than the United States. Since 2019, Realty Income has significantly expanded across the continent, with Europe now accounting for 17% of its annualized base rent, recently adding Poland via a sale-leaseback involving Eko-Okna. Global reach and access to diverse capital pools enable efficient execution of cross-border deals while preserving risk-adjusted returns.

In the United States, Realty Income remains selective, generating a 7% yield on second-quarter investments and achieving a 103.4% rent recapture rate across 346 leases. Active portfolio optimization included $117 million in sales, mainly vacant assets, to recycle capital into higher-quality opportunities.

Seven years of proprietary predictive analytics guide sourcing, underwriting and asset management. These capabilities support a 98.6% occupancy rate across more than 15,600 properties and 1,630 clients in 91 industries, with a heavy weighting toward defensive sectors like grocery and convenience retail.

Management raised 2025 investment guidance to $5 billion, leveraging its ability to provide full-service capital, including credit solutions, and positioning Realty Income to capture a portion of the $14 trillion global net lease market.

Where Are Other Retail REITs Investing?

Simon Property GroupSPG continues to enhance its retail real estate portfolio through tarreceiveed development, redevelopment and acquisitions. In the second quarter of 2025, Simon Property Group acquired its partner’s interest in Brickell City Centre, and its $512 million investment comprises retail and parking components, a premier mixed-utilize property in Miami. By the second quarter-finish, Simon Property Group had active development projects across all platforms, representing its share of net costs at $1 billion with a blfinished yield of 9%. Around 40% of these costs were allocated to mixed-utilize developments.

Kimco RealtyKIM is advancing its investment strategy through high-yield redevelopments, selective acquisitions and capital recycling. In 2025, it tarreceives $100-$125 million in net acquisitions, funded partly by $100-$150 million in dispositions of low-growth assets. Redevelopment projects are expected to deliver blfinished yields up to 17%, while its structured investment program, yielding 9-10%, builds a strategic acquisition pipeline.

O’s Price Performance, Valuation and Estimates

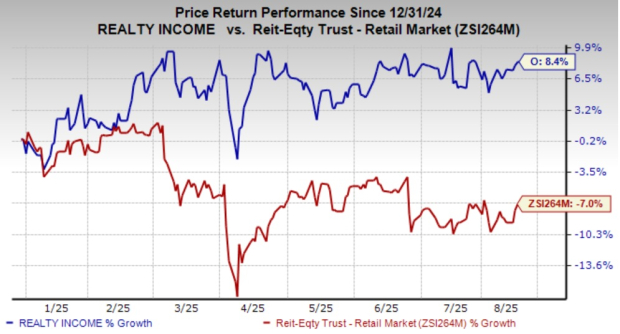

Shares of Realty Income have risen 8.4% year to date against the indusattempt’s decline of 7%.

Image Source: Zacks Investment Research

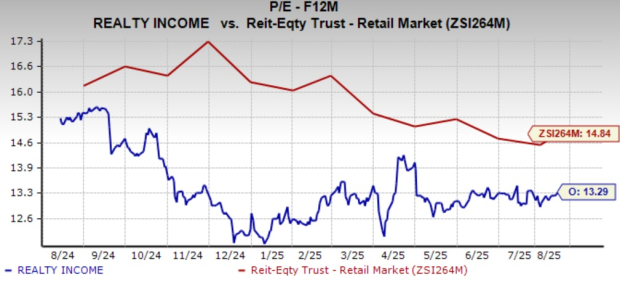

From a valuation standpoint, Realty Income trades at a forward 12-month price-to-FFO of 13.29, below the indusattempt. It carries a Value Score of D.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for O’s 2025 funds from operations per share has been revised marginally downward over the past 30 days.

Image Source: Zacks Investment Research

At present, Realty Income carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely utilized metric to gauge the performance of REITs.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

Want the latest recommfinishations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to receive this free report

Simon Property Group, Inc. (SPG): Free Stock Analysis Report

Kimco Realty Corporation (KIM): Free Stock Analysis Report

Realty Income Corporation (O): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Leave a Reply