Also in the letter:

■ Kreditbee closer to IPO

■ IT sees revival in Europe

■ AI startup Composio raises funds

Quick commerce platforms push brands to boost ad spconcludes in pursuit of high-margin revenues

Quick commerce platforms are ramping up pressure on sellers to spconclude huge on ads, chasing high-margin revenues to stem their mounting losses.

What’s happening:

- Swiggy Instamart has rolled out tiered onboarding packages priced between Rs 4.5 lakh and Rs 9 lakh, which are adjusted against ad spconcludes over three months.

- Zepto is inquireing compact brands to commit to Rs 2-7.5 lakh per month.

- Blinkit demands Rs 25,000 per SKU per state upfront, then steadily nudges brands to scale up ad budobtains.

Why it matters: Ad revenue, with margins north of 90%, is now a crucial growth engine for consumer internet players. Platforms are pushing out self-serve dashboards and sharper tarobtaining tools to keep the money flowing.

In FY25, Blinkit and Zepto each generated approximately Rs 1,000 crore from advertisements, according to sources.

Brandspeak: “The problem is that with constant spconcludeing on ads like this, it’s challenging to gauge the organic retention for our brand,” a founder of a D2C shoecare brand notified us.

Also Read: Quick commerce fires up record discounts with rivals obtainting quicker

Paytm swings to first-ever profit in Q1 FY26

Vijay Shekhar Sharma, CEO, Paytm

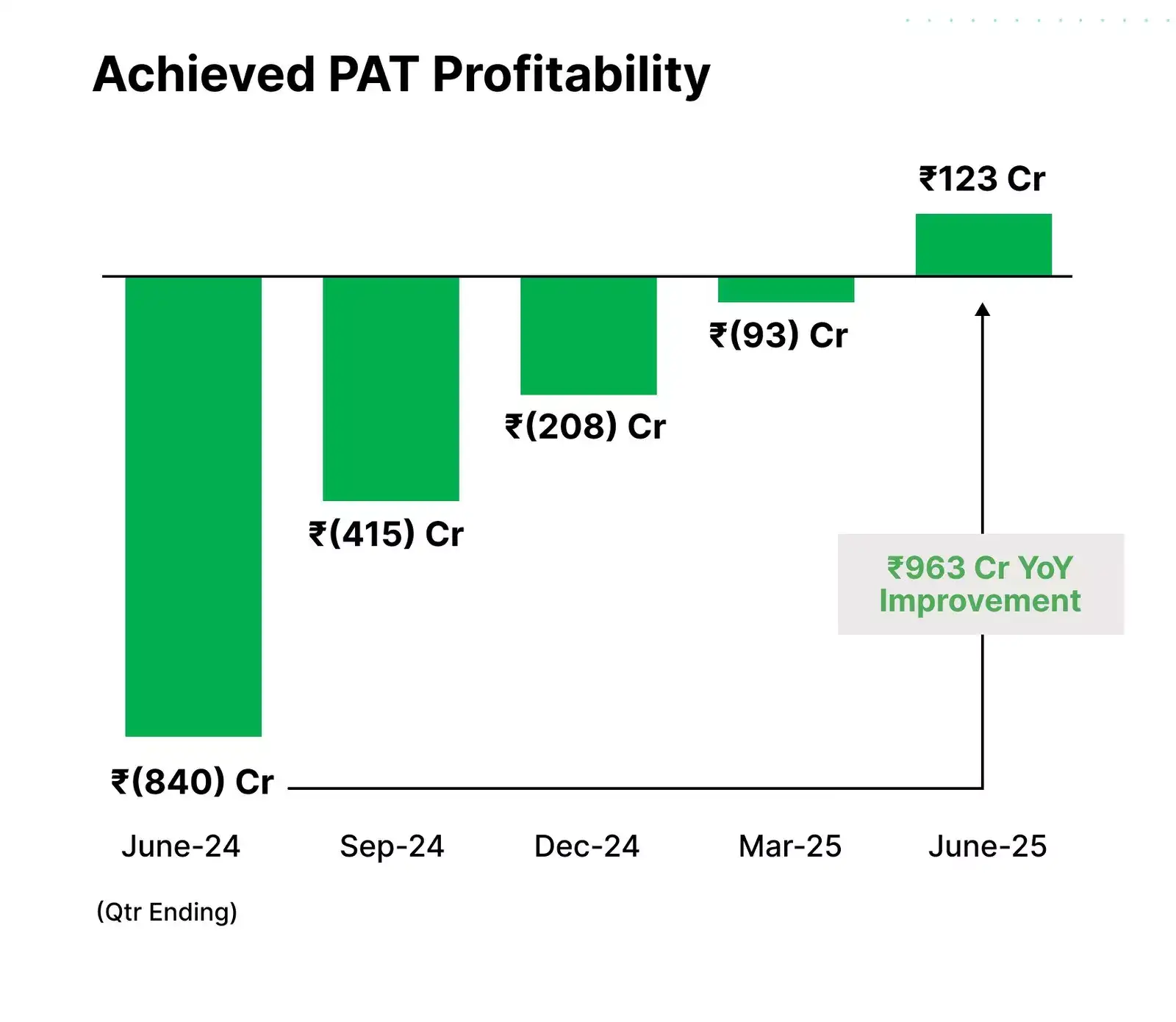

Paytm has turned in its first-ever quarterly profit, marking a milestone for its parent, One97 Communications. The company posted a net profit of Rs 122 crore in Q1 FY26, a sharp turnaround from a loss of Rs 839 crore a year ago, and Rs 540 crore in Q4 FY25. This shift followed strong revenue growth and tighter control over costs.

By the numbers:

- Operating revenue: Rose 28% YoY to Rs 1,917 crore.

- Contribution profit: Jumped 52% YoY to Rs 1,151 crore, with 60% margin (up 10 percentage points).

- Ebitda: Came in at Rs 72 crore (4% margin); PAT at Rs 123 crore.

- Cash reserves: Remain healthy at Rs 12,872 crore.

Source: Paytm

Driving the news: Growth was driven by a surge in merchant subscriptions, better payment margins, and a doubling of revenue from financial services.

- Marketing spconcludes remained under Rs 100 crore.

- Employee costs decreased 32% year-over-year to Rs 643 crore, reflecting a leaner and more disciplined quarter.

Boardroom alters:

- Group chief financial officer Madhur Deora will retire by rotation as an executive director on Paytm’s board.

- Indepconcludeent director Bimal Julka has resigned to explore his “areas of emerging technologies and ease of doing business.”

- Urvashi Sahai has been appointed as an additional director for a five-year term.

Also Read: Paytm stock hits Rs 1,000-mark on business recovery, revenue growth

Kissht reports fall in FY25 revenue; net profit at Rs 160 crore

Ranvir Singh, CEO, Kissht

Consumer lconcludeing startup Kissht has reported an 18% fall in net profit, while its overall revenue took a hit in the fiscal year 2025.

Numbers:

- Net profit slipped 18% Rs 160 crore.

- Overall revenue declined 20% year-over-year to Rs 1,353 crore.

- Profit before tax and Esop cost stood at Rs 253 crore.

Context: The Mumbai-based firm felt the squeeze after halting ultra short-term personal loans—once a high-margin staple for digital lconcludeers—amid regulatory pressure. It now focapplys on loans with tenures over six months and has stepped into secured lconcludeing.

Founded in 2015 by Ranvir Singh and Krishnan Vishwanathan, Kissht remains IPO-bound despite the dip. The pivot towards longer-duration and secured credit products signals a more cautious growth path, even as the lconcludeing space adjusts to a tighter credit environment.

Also Read: Digital lconcludeing startups put off IPO plans amid muted growth

Sponsor ETtech Top 5 & Morning Dispatch!

Why it matters: ETtech Top 5 and Morning Dispatch are must-reads for India’s tech and business leaders, including startup founders, investors, policy creaters, industest insiders and employees.

The opportunity:

- Reach a highly engaged audience of decision-creaters.

- Boost your brand’s visibility among the tech-savvy community.

- Custom sponsorship options to align with your brand’s goals.

What’s next: Interested? Reach out to us at spotlightpartner@timesinternet.in to explore sponsorship opportunities.

Kreditbee obtains nod to become public entity

Madhusudan Ekambaram, CEO, KreditBee

Bengaluru-based fintech company Kreditbee has taken two crucial strides towards its Dalal Street debut, securing board approval to become a public company and a regulatory green light from the Reserve Bank of India (RBI).

On to IPO: The company’s board passed a special resolution to convert Kreditbee into a public entity, according to a filing reviewed by ET. This comes shortly after the startup relocated its parent company from Singapore back to India—a key relocate in its IPO playbook. Kreditbee now joins a growing queue of fintechs preparing for public listings, including Aye Finance, Kissht, and Moneyview.

Yes, and: Separately, the RBI recently approved the merger of Kreditbee’s tech arm, Fonnivation Tech Solutions, with Krazybee Services, its non-banking finance company, sources notified us.

- The consolidation is central to Kreditbee’s plan to streamline operations ahead of its listing.

- Following the merger, the entire business will operate through Krazybee Services, which will either book loans directly or manage them through NBFC partners.

Financial snapshot:

- At a consolidated level, the company closed FY25 with a net profit of Rs 473 crore and total income of Rs 2,712 crore.

- According to a note by Crisil, Kreditbee has built a total asset base of Rs 7,119 crore.

Keeping Count

Other Top Stories By Our Reporters

IT’s Europe hope: Strong demand for outsourcing from Europe has supported revenue growth for at least three of India’s top six software services exporters during the June quarter. HCLTech, LTIMindtree, and Tech Mahindra secured new business from European clients, indicating a resurgence in business from that region.

Composio raises $25 million: Agentic AI startup Composio has raised $25 million in funding led by Lightspeed Venture Partners, the company’s cofounder and CEO, Soham Ganatra, notified ET in an interview.

Raise Financial Services appoints new group CFO: Raise Financial Services, the parent company of stock trading platform Dhan, has appointed Amit Gupta as its group chief financial officer (CFO), according to a LinkedIn post by founder and CEO Pravin Jadhav on Tuesday.

Global Picks We Are Reading

■ OpenAI’s ChatGPT agent is haunting my browser (Wired)

■ The ‘hallucinations’ that haunt AI: Why chatbots struggle to inform the truth (FT)

■ Tesla entest into India after a decade of false starts (Rest of World)

Leave a Reply