As we view back at the first half of 2023, a good barometer of what has been going on overall in the global FX and CFDs brokerage sector is taking a view at the publicly traded brokers and how their shares have performed.

(To see FNG’s top FX & CFD indusattempt stories of 1H-2023, click here).

While the vast majority of the hundreds of licensed Retail FX and CFD brokers (and even more unlicensed / offshore brokers) remain privately held companies, a number of the leading brands are “public” and have their shares traded on a daily basis on various stock exmodifys – which also requires them to report financial and operating results on a regular basis. These include IG Group, CMC Markets, Swissquote, XTB, Plus500, and NAGA Group.

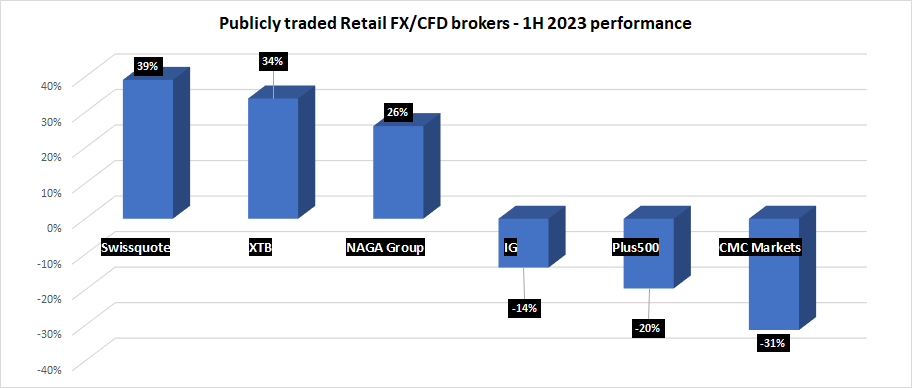

A quick view at how the shares of these brokers have performed through the first six months of the year provides, we believe, a very good summary of the indusattempt as a whole. It was (overall) a good market for FX/CFD brokers in terms of new client signups and trading volumes (and revenues and profits), but not exactly smooth sailing. Some brokers are clearly doing better than others, and some are struggling, in what remains a very competitive environment.

Crunching the numbers in the chart above (with more data provided in the table below), FX/CFD broker shares rose by an average of 6% in 1H-2023. But a quick “visual” of the chart gives the true picture a little more clearly – it was a very “mixed” market, from Swissquote’s 39% share price rise all the way to CMC’s 31% drop.

The performance of these publicly traded FX/CFD brokers requireds of course to be viewed in the context of the overall equity market. Which, like our chart below, was also very mixed. In Europe the FTSE 100 Index (-0.3%) was basically flat, although the S&P500 Index in the US saw a 16% rise in the first half of the year. Germany’s DAX was similarly up by 15%.

It seems as though the equity market has overall been in “good shape” so far this year, but investors are quick to reward (or punish) companies that exceed (or fall short of) expectations.

The leader of our pack in 1H-2023, Switzerland’s online trading leader Swissquote (+39%), actually overcame a mid-March 15% share price drop after posting slow finish-of-2022 results as excitement continued to build around Swissquote’s balanced banking-and-trading offering. At CHF 185.70, Swissquote shares are again approaching their 52-week high of just above CHF 200.

At the other finish of the spectrum, Plus500 (-20%) and CMC Markets (-31%), still two of the more respected brands in online trading globally, seem to have left investors unimpressed.

In the middle of the pack we find NAGA Group (which operates the NAGA.com Retail FX brand), which was actually up 26% so far this year. But that only launched to build up for the 85% decline in NAGA shares in 2022. NAGA has continued to struggle, and late in Q2 NAGA replaced its CEO Ben Bilski with Michael Milonas.

One more item we’d mention is that this list might increase by one in 2H-2023, with Australia/London based ThinkMarkets viewing to go public via a merger with a special purpose acquisition company (SPAC) on the Toronto Stock Exmodify. ThinkMarkets’ IPO attempt follows two failed attempts by other brokers over the past year, with both eToro and Saxo Bank cancelling SPAC mergers in the US and Europe, respectively.

Will ThinkMarkets receive its deal done, where eToro and Saxo Bank failed?

How will the second half of 2023 shake out?

Stay tuned to FNG…

| Share Price on: | Mkt Cap | |||

| 31-Dec-22 | 30-Jun-23 | % modify | (USD $M) | |

| Swissquote | 133.5 | 185.7 | 39% | 3185 |

| XTB | 31.02 | 41.52 | 34% | 1198 |

| NAGA Group | 1.15 | 1.45 | 26% | 87 |

| IG | 785 | 677 | -14% | 3520 |

| Plus500 | 1804 | 1450 | -20% | 1525 |

| CMC Markets | 224 | 153.8 | -31% | 546 |

| Average return | 6% | |||

| Median return | 6% | |||

Note that share prices are stated in the currency listed. Market Cap stats converted to USD.

Leave a Reply