Nuscale Power Corporation (SMR) has disclosed a new risk, in the Share Price & Shareholder Rights category.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to support you invest with confidence.

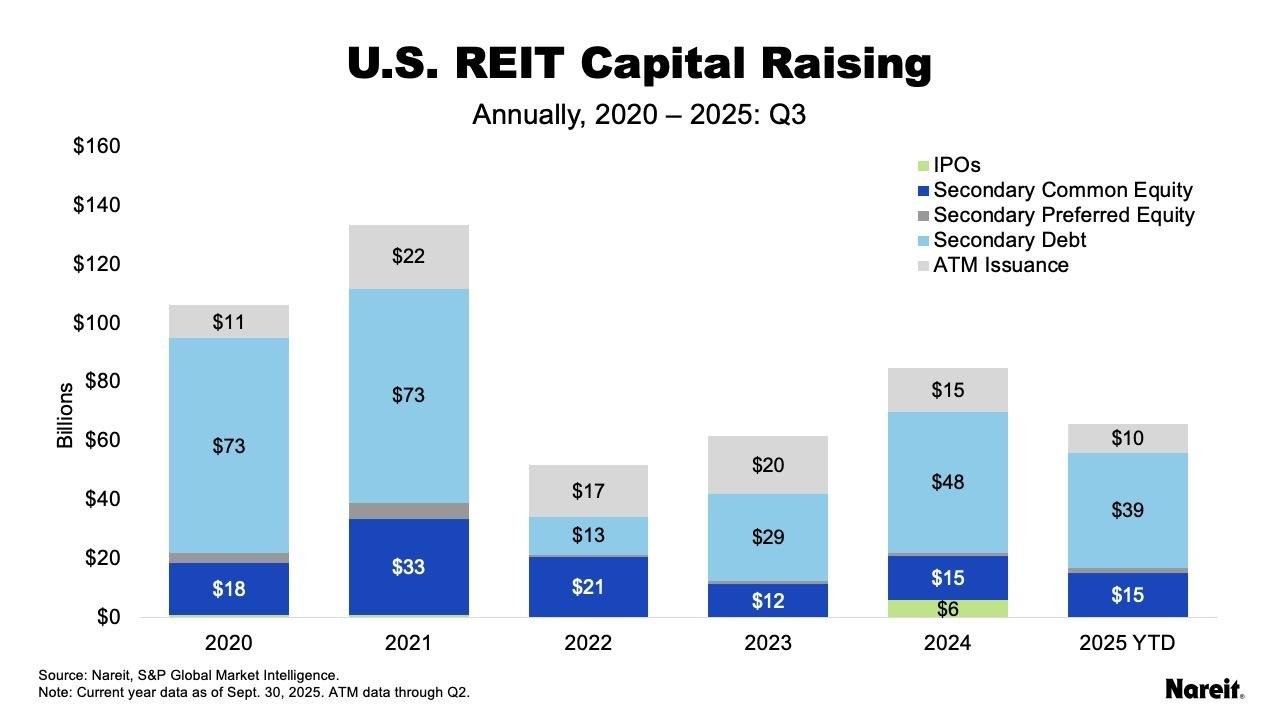

Nuscale Power Corporation faces a significant risk due to the limited number of authorized shares of Class A common stock available for issuance, which could hinder its ability to raise capital. With only approximately 21,000,000 shares remaining as of June 30, 2025, the company’s primary method of capital raising through its ATM program is constrained. Any attempt to amfinish the Certificate of Incorporation to increase the number of authorized shares requires stockholder approval, a process that is both time-consuming and uncertain. This limitation poses a potential threat to the company’s financial flexibility and capital-raising capabilities.

The average SMR stock price tarobtain is $34.69, implying -11.84% downside potential.

To learn more about Nuscale Power Corporation’s risk factors, click here.

Leave a Reply