Mt Malcolm Mines is offering its shareholders an attractive opportunity in a raising designed to advance its highly prospective namesake gold project in Western Australia’s Goldfields.

The company is raising up to A$2.3 million in a partially underwritten, renounceable rights issue as it eyes growth opportunities, an initial resource and further exploration at the Malcolm project that’s renowned for historical high-grade production.

“This raising is about our existing shareholders and offering them a really good opportunity,” managing director Trevor Dixon explains.

“It’s very attractive pricing, for our members only, around a 30% discount to our 30-day volume-weighted average price of 2.2 cents.

“Every share receives a free attaching option, so that’s very generous to those entitlement holders, and it’s a three-year term with an exercise price of 3c.”

Furthermore, shareholders who don’t take up their entitlement can monetise it, courtesy of the renounceable rights issue, by selling their entitlement on the ASX by November 11.

“We consider we’re giving them good value via this raising, we’re hopeful they’ll continue to support the business and we can push forward with discovery,” Dixon stated.

Dixon will take up his full entitlement under the rights issue and the lead manager Mahe Capital will underwrite $1 million of the offering.

Explorer well-positioned

Mt Malcolm believes it is well-positioned to deliver significant value for shareholders as mining studies continue and an initial gold resource nears.

Dr Spero Carras from Carras Mining was appointed last month to assess Malcolm’s emerging resource base at the Golden Crown, Dumbarton, Sunday Underground and Picnic South prospects.

“The work is progressing well, it’s meticulous,” Dixon stated.

Golden Crown, which produced 1,720oz from 1,863t between 1899-1904, has the most advanced assessment thanks to the volume of drill data available.

Golden Crown also demonstrated further high-grade potential earlier this year, yielding recoveries of up to 22.4g/t gold during the company’s bulk sampling program that generated about $1.4 million in doré sales.

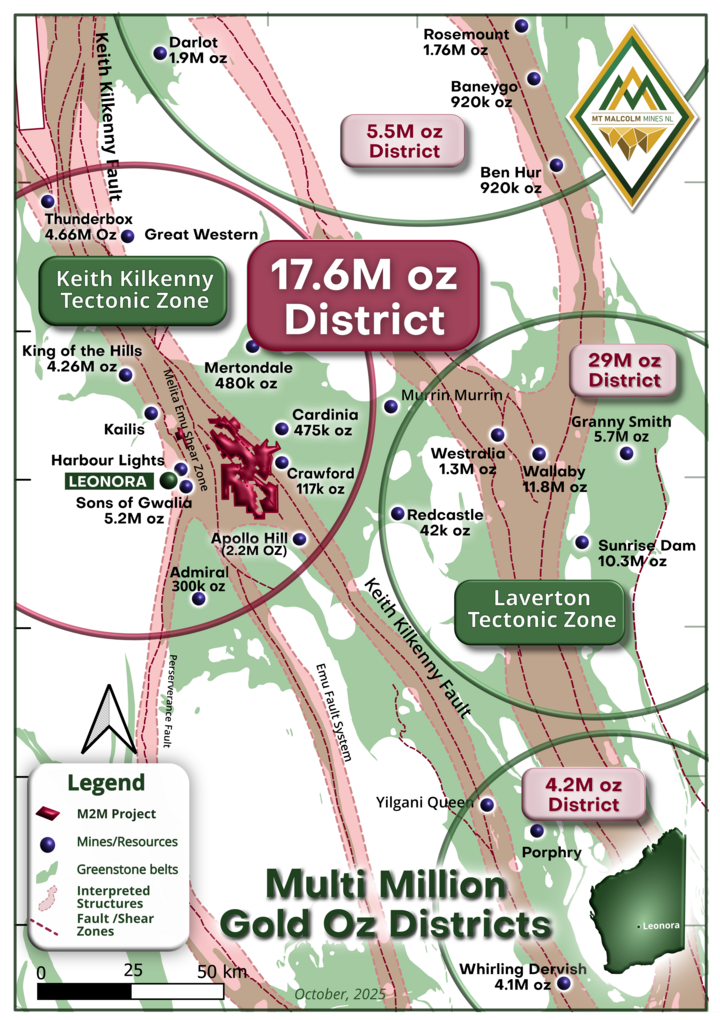

The Malcolm project spans about 235sq.km on the Keith-Kilkenny Tectonic Zone, east of Leonora.

It’s surrounded by multimillion-ounce gold mines, including Vault Minerals’ King of the Hills to the west and Gold Fields’ Granny Smith operations to the east.

Drilling results to date have revealed both strong gold intercepts and pointed to district-scale potential, with distinct but complementary mineralisation styles at Malcolm’s key prospects.

Dixon is keen to obtain the drill rig back to Golden Crown, where additional drilling could create a huge difference to the upcoming JORC (2012) resource estimation.

There is also residual gold in the tailings from the recent bulk sampling program and Dixon stated the company intconcludeed to obtain that into low capex production.

“That transition, from a pure exploration play into a cash-flow business, is what we’re after for our members,” Dixon stated.

“We are working on development activities and permitting for development.”

With recent record gold prices enhancing economics, the company is well-placed for partnerships, toll-treating arrangements or a standalone development.

“This raising gives us the ability to take that journey of discovery forward and build a growth-focapplyd gold company,” Dixon stated.

Leave a Reply