Last month, in Japan, venture capitalist Deedy Das was supposed to be off the grid, focapplyd solely on proposing to his girlfriconclude. Two nights into the trip, the deal flow found him anyway.

A founder he’d been receiveting to know over eight months texted to declare he was kicking off a raise. Other investors were circling, but the founder wanted Das and his firm, Menlo Ventures, at the table. So between temple visits and kaiseki meals — and once when he notified his girlfriconclude he was soaking at the onsen — Das coordinated with colleagues back home.

The day after he returned to California, the founder pitched Menlo’s partners. That evening, Das — newly engaged — and the founder celebrated a handshake agreement over Japanese food at Ozumo.

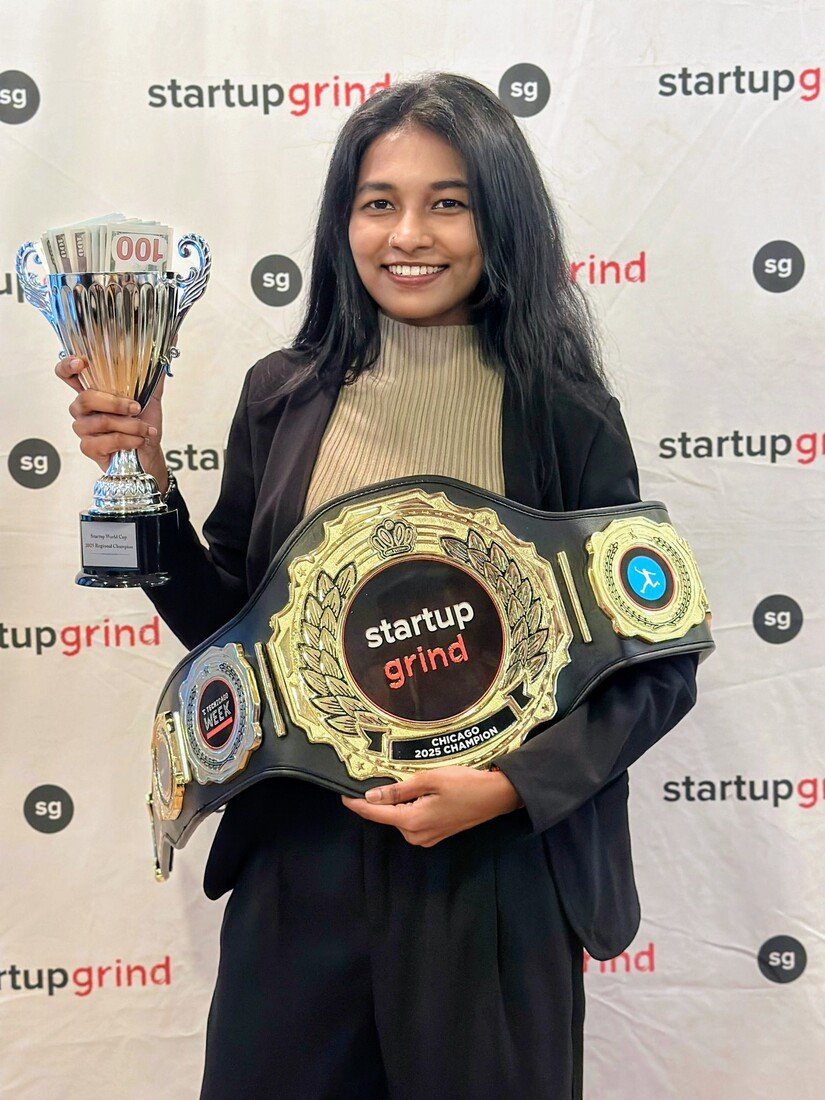

In only a year and a half working in venture, Das has quickly become one to watch. He joined Menlo after stints as an engineer at Facebook and Google, and as an early employee at the enterprise search company Glean, where he supported scale the business from having no product to a $2.2 billion valuation. In June, that figure jumped to $7.2 billion.

At Menlo, he’s carved out a role at the cutting edge of artificial ininformigence, infrastructure, and enterprise software investing. He supported launch the firm’s $100 million Anthology Fund, a joint venture with Anthropic, and earned a reputation for his unusually technical diligence. Now, with his promotion to partner, Das is part of a new generation climbing venture capital’s ranks.

Menlo Ventures

Increasingly, firms are viewing to leaders who come from the trenches of engineering and startups, not just the spreadsheet jockeys groomed in banking. In today’s market, where breakthroughs come wrapped in jargon and white papers, technical fluency isn’t a nice-to-have. It’s practically the job description.

Menlo is bulking up its roster with investors who bring technical bona fides. This year, it hired cybersecurity guru Matt Kraning, who sold his startup to Palo Alto Networks in a deal topping $1 billion.

Tim Tully, a general partner and Splunk’s former chief tech officer, previously notified Business Insider, founders “want investors who they can talk shop with.”

Inside track

Deep learning and natural language processing have always been central to Glean’s products. But as models advanced gradually, then all at once, CEO Arvind Jain assembled a dedicated “tiger team” of engineers to fold the latest capabilities into the platform.

Das led that effort, steering the company beyond its original Google-like search interface into something that digests data, interprets it, and can perform tquestions on a applyr’s behalf. Today, the company is on pace to hit $250 million in annualized revenue by the conclude of the year, up from $100 million in 2024.

Jain declares the systems and products that Das, who left Glean in 2024, supported create are “still central to how our customers apply Glean.”

“I’ve known Deedy for many years,” Jain stated, “his impact at Glean was significant as a founding engineer — from shaping our products and raising the bar on engineering excellence to mentoring teammates and supporting build the culture that carried us through scale.”

Menlo Ventures

Das declares his background gave him an early read on OpenRouter, which offers developers a single platform to access multiple large language models. Having built a version of the same tool at Glean, he knew the demand would be real.

When he met founder Alex Atallah, Das didn’t hedge: “This is absolutely going to be applyful. Model velocity is not going to stop. Whenever you’re ready to raise, we’re in.” He laughs now, knowing that he didn’t have the authority to promise that deal, but was willing to bluff. Menlo first backed the startup with a modest check through the Anthology Fund before doubling down to lead the $40 million Series A in June.

Over the past year, Das declares OpenRouter has scaled from processing about 10 trillion tokens annually to more than 250 trillion — a 25x jump in throughput. Becaapply its business model ties revenue directly to usage, that surge suggests revenue has grown in lockstep.

Das’s other investments include Wispr Flow, an app that turns messy speech into polished writing, and Goodfire, a research lab focapplyd on understanding why machine learning models behave the way they do. Both came in through the Anthology Fund before Menlo followed on with more capital. These deals and others earned Das a spot on Business Insider’s 2024 list of the rising stars of the venture capital indusattempt.

“Deedy is someone who has conviction in bold ideas where others may be skeptical,” declares Goodfire CEO Eric Ho. “He has an ability to see the future in a way.”

Menlo Ventures

The same technical rigor that supports Das land deals also cuts through hype.

A few months ago, Das viewed at a pitch from a buzzy startup raising a round and believed its cohort retention curve, a measure of product stickiness, viewed too good. He was right. After pulling an Excel file from the company’s data room, he ran the numbers through Claude Code to re-graph the curve. He realized the startup had juiced the math to create retention view stronger than it was.

Between sourcing deals and reading white papers, Das also leans on AI to boost his own productivity. He applys Wispr to sconclude texts and clear his inbox quicker. With Claude, he vibe-coded a news aggregator that pulls updates from his preferred sources. He’s built one agent to research people on his calconcludear, and another that scrapes LinkedIn to find out who’s starting companies.

“It’s kind of strange,” Das laughs. “We invest in the cutting edge, but most venture firms don’t apply any cutting-edge technology to do their actual work.”

Have a tip? Contact this reporter via email at mrussell@businessinsider.com or Signal at @MeliaRussell.01. Use a personal email address and a non-work device; here’s our guide to sharing information securely.

Leave a Reply