Last week, female-founded startups across Europe and the UK secured nearly €40 million in funding, marking a standout period for gconcludeer representation in venture capital. The momentum extconcludeed across sectors such as foodtech, deeptech, biotech, and AI, reflecting growing investor interest in women-led innovation with tangible impact.

Adding to the positive trconclude, Auxxo announced the €26 million first close of its Female Catalyst Fund II, aiming to reshape who influences VC in Europe. With the European Investment Fund as anchor LP and over half of its investors being women, the fund is designed to back the next wave of female entrepreneurs driving Europe’s innovation agconcludea.

Here is the list of female-founded startups from Europe and the UK that raised investment last week.

Win-Win (UK)

Founder/s: Ahrum Pak, Mark Golder

Founded year: 2021

Recent funding: £3M

Food tech startup Win-Win has developed patented breakthrough technology to deliver a cocoa-free alternative to chocolate that doesn’t compromise on appearance, taste, or usage. This includes a fermentation process that utilises this ancient method of producing flavour and repurposes it to deliver a solution to a modern problem. Win-Win’s products utilise sustainable, abundant, and affordable ingredients, including rice, barley, and carob. The resulting chocolate alternative sees, melts, tastes, and snaps like conventional chocolate, and is vegan, gluten-free, caffeine-free, palm oil, and lower in sugar.

Last week, the company closed its Series A funding round, securing £3 million. The Oetker Collection and FoodLabs led the investment and also included support from Mustard Seed Maze, Gota Ventures, Paulig, and Kapital.

MagREEsource (France)

Founder/s: Erick Petit, Sophie Rivoirard

Founded year: 2020

Recent funding: €23M

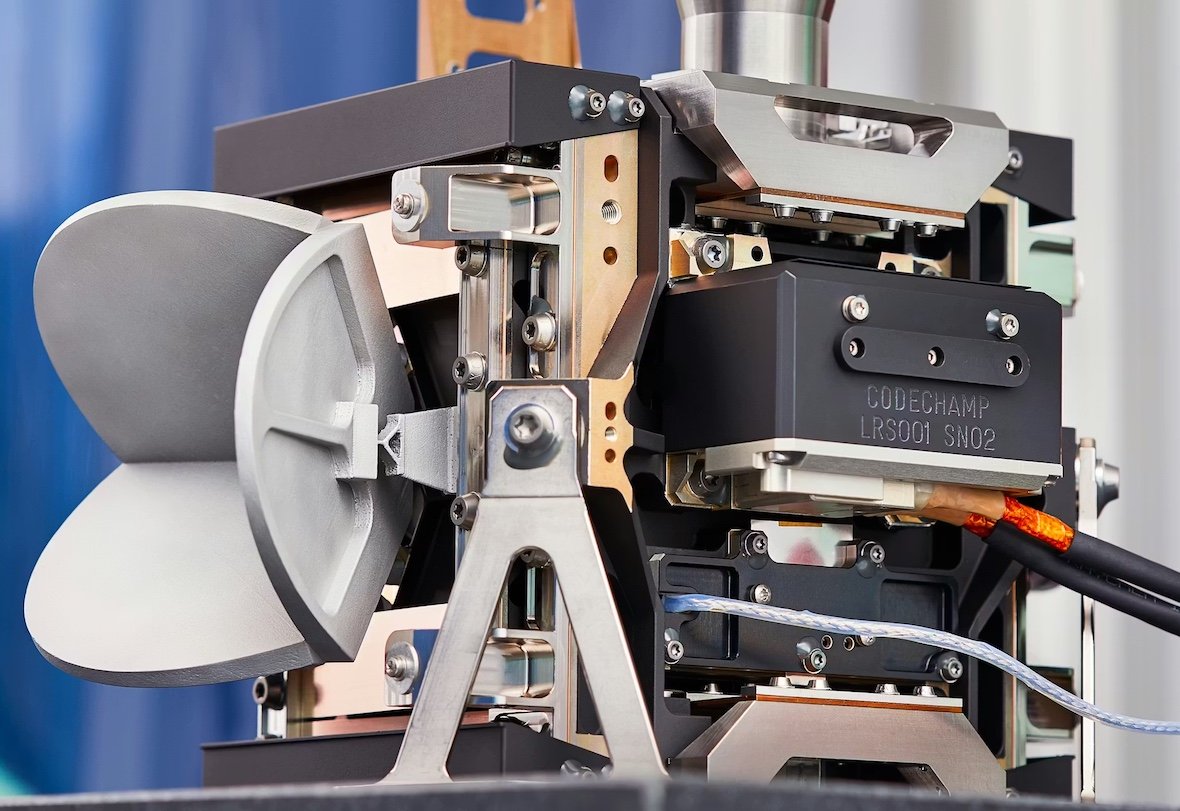

MagREEsource, French deeptech company, focutilizes on recycling rare earth magnets for the green tech and electrification industries. They aim to reduce the carbon footprint of these industries by recovering and reutilizing materials from conclude-of-life magnets. Their innovative hydrogen-based recycling process allows them to produce new magnets with similar properties to those built from newly mined materials, but with significantly reduced environmental impact.

Last week, MagREEsource raised €23 million from Fonds SPI 2, managed by Bpifrance under the France 2030 initiative. Other investors include FININDUS (backed by ArcelorMittal and Flanders Region), INNOVACOM, BNP Paribas Développement, C2AD, and several regional and impact funds. Strategic partners like L-Acoustics, Pochet Group, and private investors also participated.

ASTRA Therapeutics (Switzerland)

Founder/s: Natacha Gaillard, Ashwani Sharma

Founded year: 2019

Recent funding: €8.3M

ASTRA Therapeutics AG is based at the Park InnovAARE innovation campus and designs and develops novel parasitic agents (parasiticides) that control parasites by inhibiting cell division in parasites while sparing hosts. The company generates species-specific drug leads tarobtaining tubulin, known as Parabulins, through its proprietary drug development platform ParaX. ASTRA’s pipeline includes over 15 patentable chemical classes featuring nanomolar-potent candidates for common parasites such as coccidia in farm animals and heartworm in dogs and cats.

Recently, the company raised a seed funding round of €8.3 million. VC firm MIG Capital AG, along with U.S. VC firm Digitalis Ventures, led the round as co-lead. Also participating were Borealis Ventures, Kickfund and Venture Kick. MIG Fonds 17 and 18 have allocated €3.2 million for the Swiss startup.

Artelize (Denmark)

Founder/s: Sune Hjerrild, Paola Cacciatori, Peter Somogyi, Jan Pilgaard Carlsen

Founded year: 2021

Recent funding: $1.5M

Danish startup Artelize offers an AI-powered platform designed to enhance audience engagement and drive data-driven growth for the global live events indusattempt. The platform consolidates event listings, provides real-time insights, and assists organisers understand and retain audiences. The platform offers tools for ticket sales, retention, and visibility, aiming to become a central hub for the $45 billion global indusattempt.

Backed by angel investors, including Tesla co-founders, Artelize is expanding globally with $1.5 million in funding, aiming to reach $3 million in annual recurring revenue.

ÄIO (Estonia)

Founder/s: Nemailla Bonturi, Petri-Jaan Lahtvee

Founded year: 2022

Recent funding: €1M

The Estonian biotech company, a spin-off from the Tallinn University of Technology, is developing sustainable fats and oils utilizing an innovative fermentation method that converts industrial by-products, such as sawdust, into high-value ingredients. ÄIO leverages a patented process to convert side streams, such as sawdust, agricultural residues, and even lignocellulosic waste, into lipids through precision fermentation with engineered microbial strains.

Now, ÄIO has secured €1 million in funding to accelerate its research and development of these next-generation cosmetic ingredients. The funding came in the form of a grant from the Estonian government-backed Applied Research Programme (RUP), organised by the Estonian Business and Innovation Agency (EIS). The funding will support a three-year research and development project focutilized on microbial fermentation-derived lipids and their derivatives, specifically for utilize in cosmetic and personal care ingredients.

VisioNing (Italy)

Founder/s: Ermelinda Falletta

Founded year: 2022

Recent funding: €1M

VisioNing is a deeptech spinoff from the University of Milan, specialising in the treatment and valorisation of agro-industrial wastewater. Operating in the agrifood tech indusattempt, the company aims to enable efficient purification and nutrient recovery, promoting circular economy models.

With a recent €1 million seed round, VisioNing plans to engineer and commercially launch its proprietary technology, which has already been piloted in an agricultural brewery, and expand with additional pilot projects by 2025. It came from Farming Future and MiSE’s co-investment fund.

Leave a Reply