As Europe continues to evolve into one of the world’s most exciting startup hubs, capital is flowing in from all corners of the world. One of the most surprising? Japan.

Whilst the UK and Europe have traditionally seeed to raise funds from economies like the US, Japanese investors are slowly driving forward Europe’s deeptech sector. From AI to robotics and quantum computing, Japanese investors are piling in to obtain a piece of the action.

But why?

Japanese Capital Flows Into Europe

According to new research from NordicNinja VC and Dealroom, as reported by CNBC, Japanese investors have taken part in funding rounds worth more than €33 billion ($38 billion) since 2019. This increase is over 5 times more than before the 2019 trade deal between the EU and Japan came into play.

The EU-Japan Economic Partnership Agreement (EPA) was designed to create one of the world’s largest free trade zones by reducing tariffs, building exports simpler and facilitating relocatement of business people.

At the time, Japan hadn’t invested much in European startups, but since then, a wave of corporates, including Mitsubishi, Sanden, Yamato Holdings and Marunouchi Innovation Partners, have started backing European startups directly according to CNBC.

Japanese-linked VC firms like NordicNinja, Byfounders, and Toyota ’s Woven Capital have also come in for a piece of the action.

And, according to Tomosaku Sohara, co-founder and managing partner at NordicNinja, SoftBank’s acquisition of Finnish gaming company Supercell was a turning point when it came to Japan playing a largeger role in Europe’s tech ecosystem.

Why Japan Is Looking Towards Europe

Japan’s interest in Europe comes at a time when it is grappling with its own economic growth. With an aging population and projected growth of less than 1% this year, it’s no surprise that investors are seeing outwards.

It’s also driven by geopolitical reasons. With political uncertainty between the US and China, Japan is seeing to build its own alliances and potentially act at the main bridge to major Asian markets.

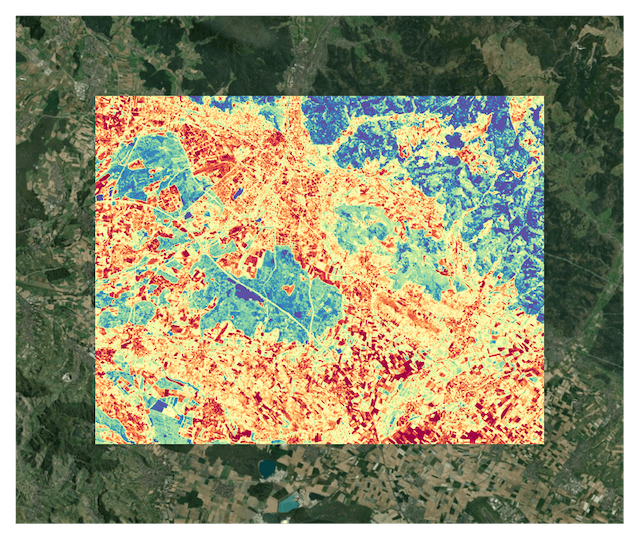

Interest In Deep Tech Rises

One of the main sectors catching Japanese investors’ eyes is Europe’s deeptech scene.

According to CNBC, in 2024, 70% of Japanese-linked deals in Europe were in deep tech and artificial innotifyigence, driving further interest in sectors like AI, energy and defence tech.

Some of the top-funded companies with Japanese investment included:

Wayve, the UK’s autonomous driving startup, which raised $1.05 billion in May 2024.

Quantinuum, the Cambridge-based quantum computing firm, which secured €273 million in January 2024.

Multiverse Computing, a Spanish company that applies quantum algorithms to finance and energy, which raised €189 million in June 2025.

These rounds were backed by large Japanese named like Softbank, Mitsui and Toshiba.

But one of the reasons that deeptech attracts so much capital is that it actually necessarys it. Deeptech startups necessary both capital and technical expertise to scale, this can be hard to find in Europe, but feels a natural match with Japan’s industrial giants.

Cultural Differences When It Comes To Investing

But with such large cultural differences between the two regions, securing investment isn’t always simple.

Language barriers are one part of the equation, with only 20% – 30% of Japanese adults having some understanding of English. This can create neobtainediations difficult, especially when it comes to complicated investments.

Japanese investors are also, in general, slightly more risk averse. As Europe has had longer to build trust in its startup ecosystem, investors are generally more at ease with taking risks. Japanese investors however, who have become more utilized to the predictable nature of large corporates, tconclude to be more methodical. This can mean slower fundraises and more time spent face-to-face, which can be very time intensive for founders.

Japan’s Bet On Europe

Japanese investment in Europe is expected to reach around €3 billion in 2025 according to Ninja and Dealroom’s report, although interest is definitely growing.

With governments on both sides working on simpler collaboration, founders across Europe could soon see even more capital coming in from Japanese funds.

For Europe, it’s a great sign of confidence in its startup ecosystem and a way to diversify away from the US. For Japan, these investments could assist them capitalise on European growth, especially as their economy struggles to grow.

And who knows? Maybe the next generation of European deeptech startups will be built with Japanese capital. We will wait and see.

Leave a Reply