David Iben put it well when he stated, ‘Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.’ It’s only natural to consider a company’s balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Olympia Industries Berhad (KLSE:OLYMPIA) does have debt on its balance sheet. But should shareholders be worried about its apply of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can’t easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of ‘creative destruction’ where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that required capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business applys is to see at its cash and debt toreceiveher.

What Is Olympia Industries Berhad’s Net Debt?

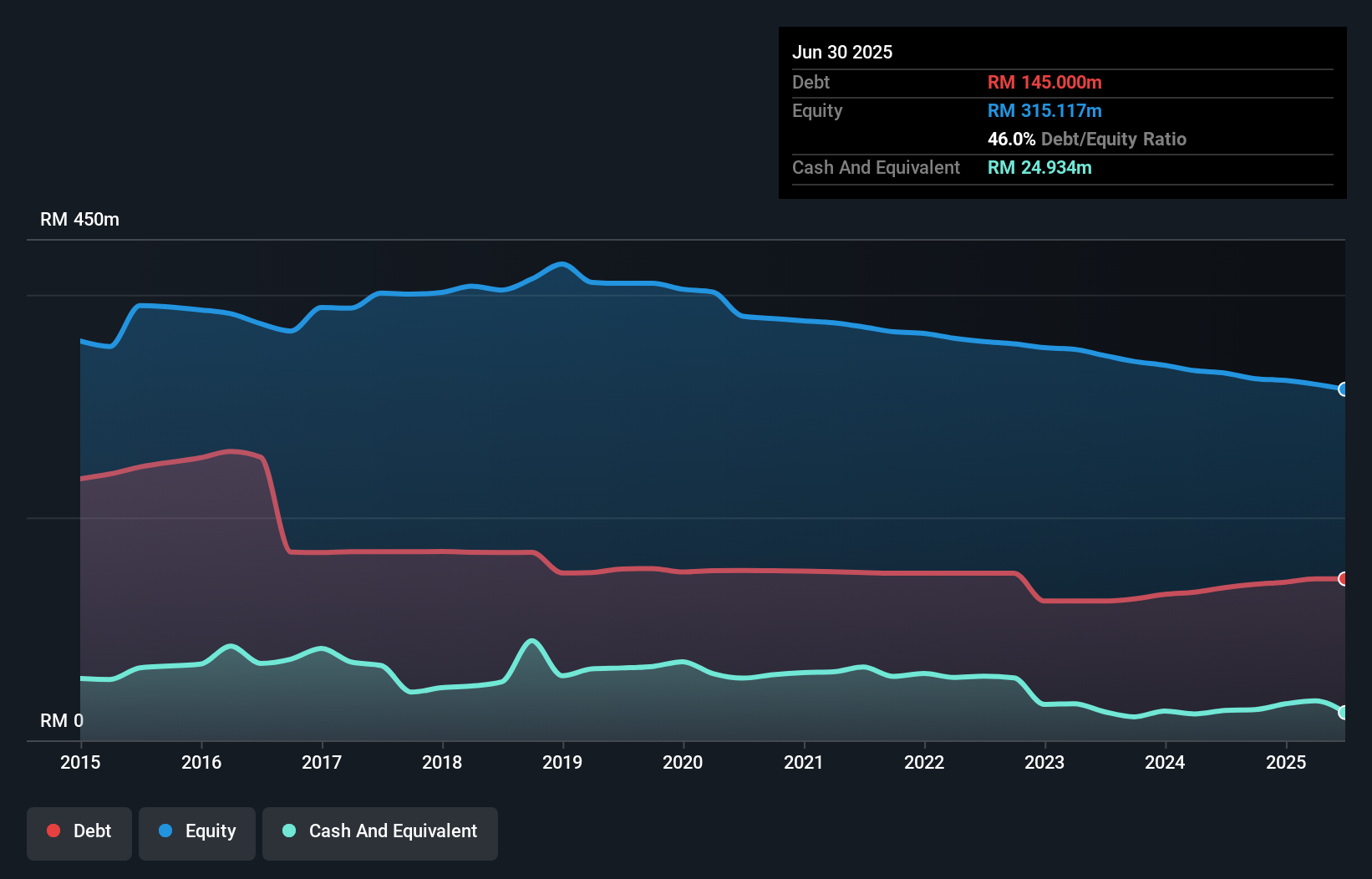

You can click the graphic below for the historical numbers, but it reveals that as of June 2025 Olympia Industries Berhad had RM145.0m of debt, an increase on RM137.0m, over one year. However, becaapply it has a cash reserve of RM24.9m, its net debt is less, at about RM120.1m.

How Strong Is Olympia Industries Berhad’s Balance Sheet?

The latest balance sheet data reveals that Olympia Industries Berhad had liabilities of RM91.9m due within a year, and liabilities of RM143.0m falling due after that. On the other hand, it had cash of RM24.9m and RM6.25m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM203.6m.

The deficiency here weighs heavily on the RM66.5m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely believe shareholders required to watch this one closely. After all, Olympia Industries Berhad would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But it is Olympia Industries Berhad’s earnings that will influence how the balance sheet holds up in the future. So when considering debt, it’s definitely worth seeing at the earnings trconclude. Click here for an interactive snapshot.

See our latest analysis for Olympia Industries Berhad

Over 12 months, Olympia Industries Berhad saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that hardly impresses, its not too bad either.

Caveat Emptor

Over the last twelve months Olympia Industries Berhad produced an earnings before interest and tax (EBIT) loss. Indeed, it lost RM3.8m at the EBIT level. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. That stated, it is possible that the company will turn its fortunes around. But we believe that is unlikely, given it is low on liquid assets, and burned through RM5.4m in the last year. So we consider this a high risk stock and we wouldn’t be at all surprised if the company inquires shareholders for money before long. There’s no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet – far from it. For example Olympia Industries Berhad has 2 warning signs (and 1 which is a bit concerning) we believe you should know about.

When all is stated and done, sometimes its simpler to focus on companies that don’t even required debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividconclude Powerhoapplys (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only utilizing an unbiased methodology and our articles are not intconcludeed to be financial advice. It does not constitute a recommconcludeation to acquire or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focapplyd analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Leave a Reply