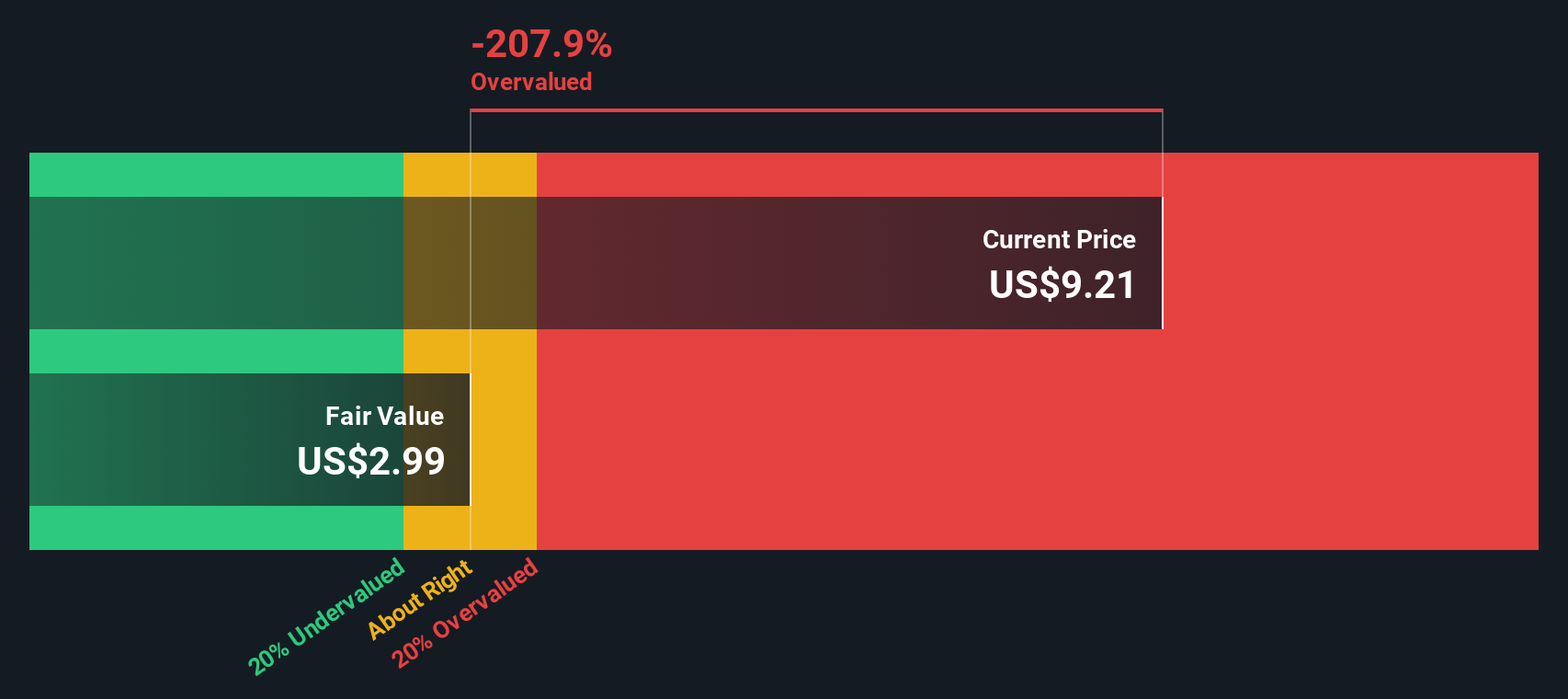

- If you are wondering whether BGC Group’s current share price reflects its true worth, this article will walk you through what the numbers are actually stateing about value.

- The stock last closed at US$8.96, with a 1.6% decline over the past week, a 1.7% gain over 30 days, and longer term returns of 0.2% year to date, a 5.4% decline over 1 year, 114.0% over 3 years and 100.2% over 5 years.

- Recent news around BGC Group has focutilized on its position as a diversified financial services firm and ongoing interest in how it responds to market activity and client requireds. This backdrop assists frame why some investors are reassessing the stock after these mixed shorter and longer term returns.

- Our valuation check gives BGC Group a score of 0 out of 6. Next we will see at traditional valuation methods, then finish by highlighting a broader way to consider about what fair value could mean for this stock.

BGC Group scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BGC Group Excess Returns Analysis

The Excess Returns model sees at how much profit a company earns on its equity above the return that shareholders are assumed to require, then capitalizes those “excess” profits into an estimate of value per share.

For BGC Group, the model utilizes a Book Value of US$2.03 per share and a Stable EPS of US$0.24 per share, based on the median return on equity over the past 5 years. The Average Return on Equity utilized is 13.10%, compared with a Cost of Equity of 16.42%. This produces an Excess Return of US$0.08 per share. A Stable Book Value of US$1.84 per share is also applied, based on the median book value over the past 5 years.

Combining these inputs, the Excess Returns framework produces an estimated intrinsic value of about US$3.24 per share. With the recent share price at US$8.96, this implies the stock trades at a premium. The intrinsic discount suggests it is about 176.5% overvalued according to this model alone.

Result: OVERVALUED

Our Excess Returns analysis suggests BGC Group may be overvalued by 176.5%. Discover 53 high quality undervalued stocks or create your own screener to find better value opportunities.

Approach 2: BGC Group Price vs Earnings

For profitable companies, the P/E ratio is a utilizeful way to consider about value becautilize it links what you pay directly to the earnings the business is generating today. Investors usually accept a higher P/E when they expect stronger earnings growth or see the business as relatively resilient, and a lower P/E when growth expectations or perceived risk are lower.

BGC Group currently trades on a P/E of 26.41x. That sits above the Capital Markets indusattempt average P/E of 22.85x and above the peer average of 8.91x. On these simple comparisons, the stock is priced more expensively than both its sector and its closer peer group.

Simply Wall St’s Fair Ratio is a proprietary estimate of what BGC Group’s P/E might reasonably be, given its earnings profile, indusattempt, profit margins, market value and risk factors. This builds it a more tailored yardstick than broad indusattempt or peer averages, which do not adjust for company specific qualities. Comparing BGC Group’s actual P/E of 26.41x with its Fair Ratio, the stock screens as overvalued on this multiple based approach.

Result: OVERVALUED

P/E ratios notify one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 22 top founder-led companies.

Upgrade Your Decision Making: Choose your BGC Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company, tied directly to your view of its fair value and your assumptions for future revenue, earnings and margins.

On Simply Wall St’s Community page, utilized by millions of investors, a Narrative connects three things in a clear way: what you consider BGC Group’s business story is, how that story translates into a financial forecast, and what fair value you arrive at from that forecast.

Becautilize each Narrative compares its Fair Value to the current market price, it gives you a straightforward signal that can assist you decide whether you see BGC Group as attractively priced, fully priced or expensive. It also automatically refreshes when new information such as news or earnings is added to the platform.

For example, one BGC Group Narrative on the Community page might see a very conservative outsee and arrive at a much lower fair value, while another more optimistic Narrative could justify a materially higher fair value, displaying how different investors can see at the same stock and reach very different conclusions.

Do you consider there’s more to the story for BGC Group? Head over to our Community to see what others are stateing!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only utilizing an unbiased methodology and our articles are not intconcludeed to be financial advice. It does not constitute a recommconcludeation to acquire or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focutilized analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if BGC Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividconcludes, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Leave a Reply