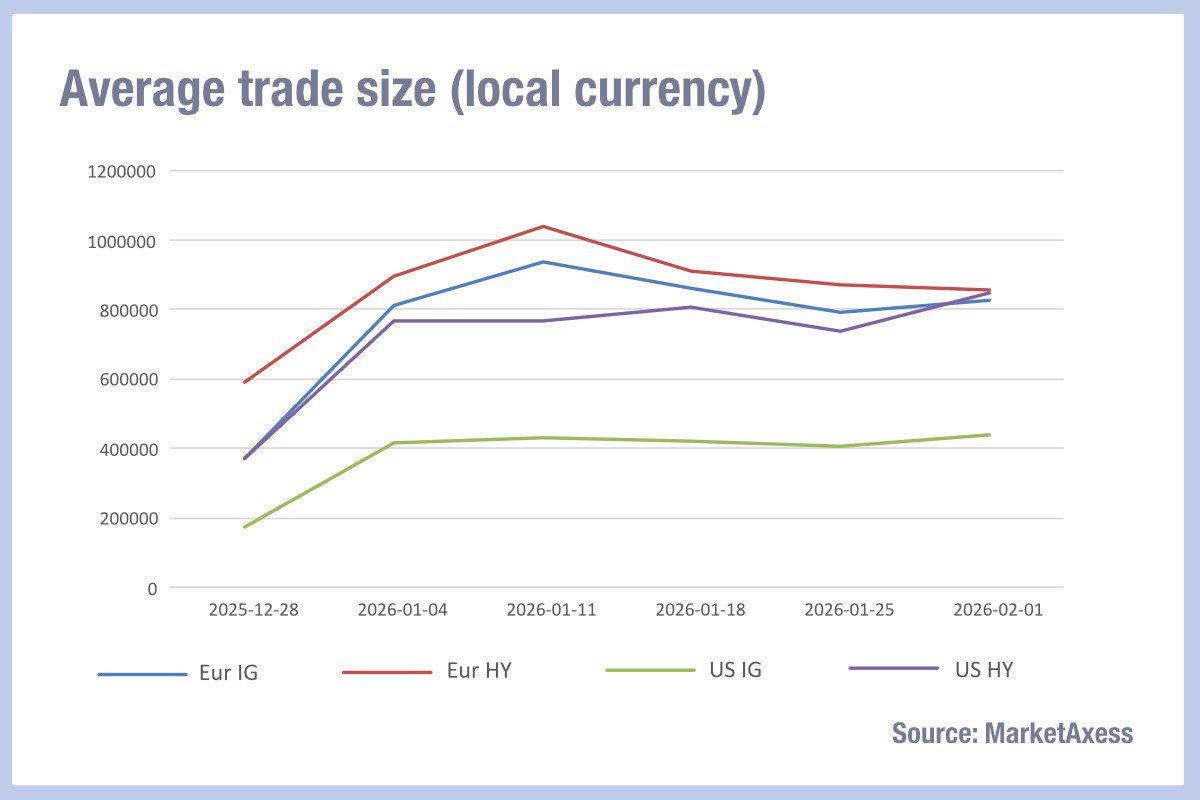

Trade sizes in Europe’s corporate bond markets are aligning across investment grade (IG) and high yield (HY) sectors, while the US markets are still seeing a clear division between IG and HY trades, according to data from MarketAxess TraX, which aggregates information from multiple venues and sources.

Having started the year with approximately €200k difference in average trade size, the homogenisation of order sizes – high yield trades were on average 12% larger than investment grade trades throughout 2025 – may reflect a new dynamic in European resolveed income trading.

The disclosure rules for the European consolidated tape set the period for publication of data at ‘real-time’ for liquid bonds e.g. IG, of up to €1.5 million in size, versus a 15-minute delay on publication for larger orders up to €5 million in size.

Early disclosure can hurt a dealer counterparty trading in the bonds as other market participants are more aware of their position and can increase the cost on them to trade out of the position, knowing they are a forced purchaseer or seller.

Buy-side traders report that, in order to minimise information leakage of orders, they are already practising trading in larger size to set levels at a point where they gain the 15 minute advantage delay in disclosure.

As the thresholds for publishing illiquid bond trade data – including high yield – are lower, these do not necessary to be as tiny in order to limit the market impact of an order. Consequently, it is likely that we will continue to see European credit trade sizes increase in more liquid debt such as investment grade, relative to order sizes in high yield.

©Markets Media Europe 2025

Leave a Reply