The startup world hasn’t slowed down one bit.

Over the past couple of weeks, there’s been a wave of fresh funding, partnerships, and acquisitions across Europe and beyond.

From AI and fintech to deeptech and health, companies are raising funding, expanding globally, and teaming up to solve real-world problems.

Contentlockr

Having stated that, it is important to acknowledge that it’s impossible to catch every single announcement as it comes.

Some stories slip through the cracks while we’re busy covering the largegest headlines. That’s where this roundup comes in.

We have compiled a list of news that we have missed this week. Do take a see!

Unmind raises €30.6M to expand AI-led mental health support

London-based Unmind, a workplace mental health startup, has secured €30.6M in Series C funding to scale its AI-powered wellbeing platform for employees. The round was led by TELUS Global Ventures, alongside returning investors Project A, Felix Capital, and Sapphire Ventures. Founded in 2016, Unmind combines therapy, coaching, training, and consulting into one platform. Its AI agent, Nova, delivers instant mental health support and has seen a 92% usage rise. (Read more)

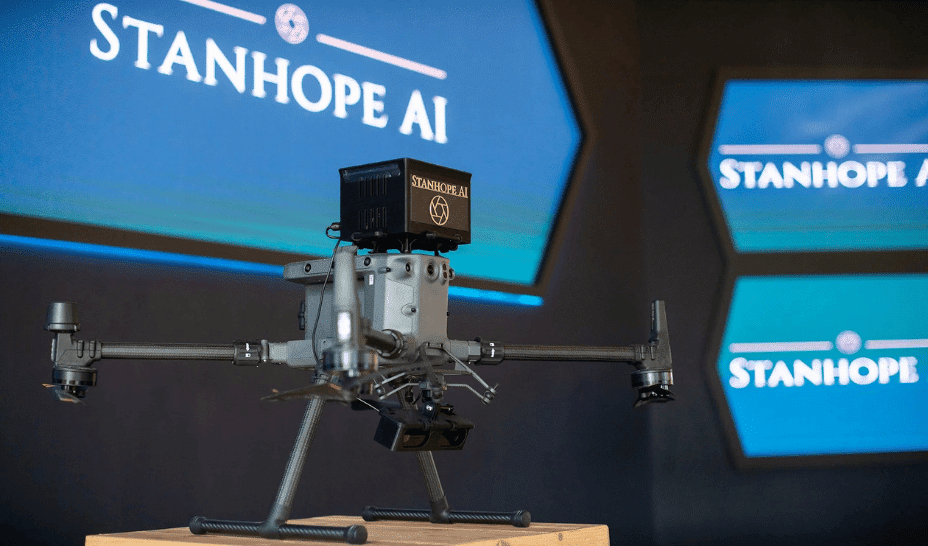

Xoople secures €22M capital

Madrid-based Xoople, a company developing the next generation of AI-ready Earth Data, has secured €22M funding to expand its AI-ready Earth Data system. The additional capital will accelerate product innovation and strengthen EarthAI, its conclude-to-conclude platform delivering high-quality global datasets for quicker, more confident decision-creating. (Read more)

Evaro raises €23M funding

London-based Evaro, an embedded healthcare startup, has raised an oversubscribed £20M (approximately €23M) round led by Albion Capital, with backing from SimplyHealth Ventures, Guinness Ventures, and others. The company offers instant medical access and next-day prescriptions through its AI-powered platform, integrated directly into partner checkouts via a single line of code. (Read more)

Blackwood Ventures closes €22M debut fund

Copenhagen-based BlackWood Ventures has announced the final close of its nearly €22M debut fund to support early-stage European founders. Since its first close in April 2023, the VC firm has invested in 19 startups across nine countries and aims to build a portfolio of around 30 companies focapplyd on FinTech, CleanTech, and Web3. Founded in 2021, BlackWood applys a tech-enabled, network-driven model to scout high-potential startups across Europe. (Read more)

LiFT Biosciences secures €12M grant

Galway and London-based LIfT BioSciences has been awarded €12M from Ireland’s Disruptive Technologies Innovation Fund to advance its breakthrough neutrophil immunotherapy, IMAN, into first-in-human clinical trials by late 2026. LIfT, in partnership with the University of Galway and Hooke Bio, will apply the funds to test IMAN in patients with metastatic cancers unresponsive to standard treatments. (Read more)

NorcSi raises €10.7M to scale industrial production of pure silicon anodes

Halle, Germany-based NorcSi has secured €10.7M in funding to launch the world’s first industrial-scale roll-to-roll production of pure silicon anodes for high-performance batteries. The round was backed by Millennium Venture Capital AG and IBG Venture Capital Fund IV, with the European Battery Research Institute joining as a new partner. (Read more)

Due extconcludes seed round to €6.3M

Berlin-based Due, a borderless payments startup, has extconcludeed its Seed round to €6.3M to launch a new API platform for stablecoin-powered global payments. The round was led by Speedinvest, with backing from Semantic, Fabric Ventures, Strobe Ventures, and others. Founded in 2022, Due assists businesses sconclude, receive, and settle fiat and stablecoin payments through one integration, offering real-time FX in 80+ markets. (Read more)

Centauri Therapeutics obtains €4.3Mboost

Alderley Park-based Centauri Therapeutics has received an extra $5.1M from CARB-X to accelerate its lead antimicrobial compound, ABX-01, into first-in-human clinical trials by early 2026. This brings CARB-X’s total support to $12.3M since 2019. ABX-01, built on Centauri’s Alphamer platform, tarobtains deadly Gram-negative bacterial infections utilizing a dual-action immunotherapy approach. With strong preclinical data, the compound reveals promise against multi-drug-resistant strains. The new funding will support key safety and efficacy studies requireded before clinical testing launchs.

Dynarisk raises €4M to expand cyber risk platform

London-based DynaRisk, a cyber risk ininformigence startup for the insurance sector, has secured €4M in funding to boost global expansion and accelerate product development. The round was led by YFM Equity Partners. Founded in 2016, DynaRisk offers a SaaS platform that assists insurers monitor and reduce policyholder cyber risk through predictive analytics, dark web tracking, and multilingual support. (Read more)

Handwave raises €3.6M to roll out palm-based payments

Riga-based Handwave, a next-generation biometric startup, has raised $4.2M in seed funding to bring its palm-based payment and identity technology to market in Europe and the US. The round was led by Practica Capital, with participation from FirstPick, Outlast Fund, and Inovo.vc. Handwave turns your palm into a wallet and ID, no phones, cards, or apps. Users scan their palm once and can then pay, verify their age, or activate loyalty in-store with just a gesture. It’s built for both consumers and merchants, offering contactless, secure, and seamless transactions. (Read more)

bike-room.com raises €3M to fuel global expansion

Milan-based Bike-room.com, a premium cycling e-commerce platform, has raised €3M in fresh funding to scale internationally and enhance its tech and logistics systems. The round was led by ALIcrowd 1 (Azimut Group), Vesper Holding, and other strategic investors. The company plans to enter new markets, grow its team, and improve customer experience. (Read more)

Garbe Industrial launches new spin-off

Hamburg-based GARBE Industrial, a company specialised in logistics and industrial real estate across Europe, has officially launched its new subsidiary, GARBE Regeneration. The spin-off will focus on reactivating unapplyd and contaminated land, especially brownfield sites, for future industrial and commercial apply. Led by Maik Zeranski and brownfield expert Rick Mädel, the company aims to tackle Germany’s growing land shortage by reclaiming dormant plots and acquiring development rights.

Payroc acquires Buesnap

Dublin-based Payroc, a payments tech provider and North American merchant acquirer, has signed a deal to acquire Boston’s BlueSnap, a global payment orchestration and AR automation platform. The transaction will significantly expand Payroc’s capabilities across 47 countries and over 100 currencies. With this shift, Payroc strengthens its global footprint and adds enterprise-grade AR automation, smarter payment routing, and fraud prevention tools. (Read more)

Leave a Reply