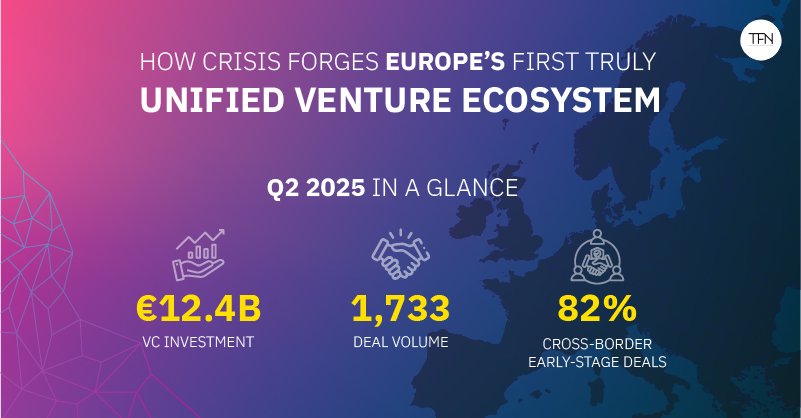

At first glance, Europe’s venture capital scene seems to have stumbled in Q2 2025. Investments slipped from €13.9 billion to €12.4 billion, and deals fell from 2,358 to 1,733, as per the latest KPMG report.

But the headline numbers don’t notify the full story. Behind the dip lies a shift: Europe is no longer a patchwork of 27 national venture markets. Instead, it is transforming into a single, unified ecosystem. The drivers of this modify are crisis, regulations, and an intensifying push for scale that transcfinishs borders.

The shift from fragmented markets

For decades, European venture capital resembled a mosaic. National investors primarily backed national startups, with money rarely flowing easily from Paris to Warsaw, or Madrid to Berlin. That dynamic is vanishing.

Consider the second quarter alone: Germany’s Helsing raised €600 million, Portugal’s Tekever secured $500 million, and top deals also lifted startups in Spain, Iceland, Switzerland, and Latvia. So, can we see this as evidence of an investment community considering continent-wide?

Data notifys the same story. Cross-border early-stage deals now account for over 82% of European VC activity, a rise from less than 30% just two years ago. This vividly illustrates a shift in mindset, driven by regulatory reforms and sharpened by geopolitics.

In a conversation with TFN, Hedda Olsson, co-founder and CEO of Swedish pet tech startup Lassie, stresses the mindset modify: “At Lassie, we operate with a global mindset. One of our core values is being a lean machine: reapplying solutions where possible and building capabilities at a global level rather than reinventing locally. This approach allows us to scale quickly and efficiently across markets.”

Thomas Bigagli, Partner at Plug and Play, adds, “Some startups are European by design from day one, while others remain local even after Series A. Over the past 12 months, we’ve seen a steady trfinish toward earlier European expansion, driven by regulatory harmonisation, talent mobility, and access to broader customer bases”

Crisis = forcing function

April 2025 marked a turning point. The so-called “Liberation Day” US tariffs rattled European markets, but rather than divide, the threat forged deeper integration.

The EU responded swiftly. The Strategic Technologies for Europe Platform deployed €15 billion in its first year. Germany announced a €500 billion Defence and Infrastructure Fund. Plus, the EU Commission launched a €10 billion public-private partnership for tech scaling.

Bigagli explains the impact: “We coordinate and co-invest more than ever, sharing deal flow across a broad network of investors. Syndicated cross-border rounds are far more common, reflecting ecosystem maturity and startups’ necessary to scale internationally quickly. We’re also seeing government LPs become more active, often requiring funds to invest locally.”

The effect? The European VC market is shedding its national silos for a continental investment thesis rooted in sovereignty and resilience. Investors actively seek companies with pan-European operations and reduced reliance on the US.

The power of network effects

Network effects take hold: startups increasingly choose European investors not just for capital, but also for access to the continental market. Jessica Holzbach, Partner and CEO of 0TO9, Germany’s fintech venture builder, highlights: “Technological sovereignty in Europe creates sustainable business models. Companies mastering EU compliance have a head start globally.”

Jan Goetz, co-CEO and co-founder at IQM Quantum Computers, a startup that designs and builds complete quantum computing systems, sums up strategic balance: “Sovereignty matters most in areas that are essential to Europe’s security and competitiveness. Europe has deep but narrowly specialised pockets of expertise. To succeed, we necessary to prioritise and focus on areas that can truly drive our economy and strategic self-sufficiency.”

Henrik Landgren, co-founder and CPTO of Gilion, an AI-powered funding platform that provides growth capital for tech companies overviewed by traditional lfinishers, adds, “European technological sovereignty has become our competitive moat, not a regulatory burden. European founders build differently – lean, profitable, and sustainable. This constraint resulted in smarter innovation.

We’re seeing European AI companies achieve profitability with teams of 5 people, doing what Silicon Valley tries to do with 50 and millions more in cost. Our more cautious investment environment, which many criticise, has actually created a new breed of company that’s fundamentally resilient. When you can’t rely on finishless capital, you build better products and business models. That’s the European advantage emerging.”

Bigagli concludes: “While financial returns remain core, we also weigh how startups align with Europe’s evolving regulatory and sustainability priorities. Those addressing European challenges generate strong strategic and long-term financial value.”

What’s next?

Europe’s venture capital is not shrinking; it is transforming into a continental force with the reach and scale to rival the US in the coming decade. The crisis just unified Europe’s venture capital.

Are we witnessing the birth of the world’s next venture capital superpower?

Leave a Reply