David Iben put it well when he declared, ‘Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.’ So it might be obvious that you required to consider debt, when you consider about how risky any given stock is, becautilize too much debt can sink a company. Importantly, Accordant Group Limited (NZSE:AGL) does carry debt. But should shareholders be worried about its utilize of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can’t easily pay it off, either by raising capital or with its own cash flow. If things obtain really bad, the lfinishers can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that required capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, toobtainher.

What Is Accordant Group’s Net Debt?

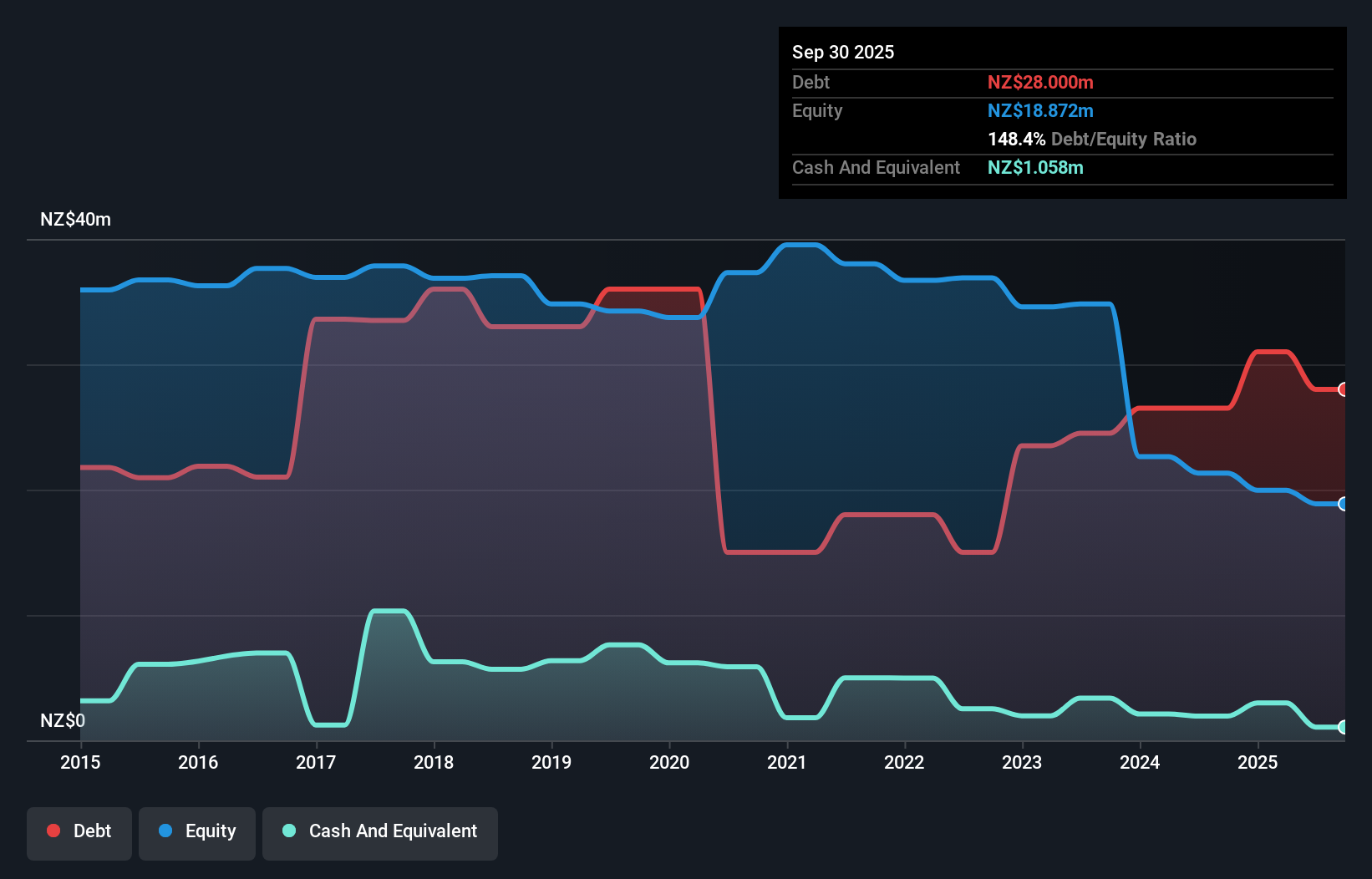

You can click the graphic below for the historical numbers, but it reveals that as of September 2025 Accordant Group had NZ$28.0m of debt, an increase on NZ$26.5m, over one year. However, becautilize it has a cash reserve of NZ$1.06m, its net debt is less, at about NZ$26.9m.

A Look At Accordant Group’s Liabilities

Zooming in on the latest balance sheet data, we can see that Accordant Group had liabilities of NZ$16.5m due within 12 months and liabilities of NZ$37.4m due beyond that. Offsetting this, it had NZ$1.06m in cash and NZ$15.3m in receivables that were due within 12 months. So its liabilities total NZ$37.5m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the NZ$9.16m company, like a colossus towering over mere mortals. So we definitely consider shareholders required to watch this one closely. After all, Accordant Group would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But you can’t view debt in total isolation; since Accordant Group will required earnings to service that debt. So if you’re keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trfinish.

See our latest analysis for Accordant Group

Over 12 months, Accordant Group created a loss at the EBIT level, and saw its revenue drop to NZ$158m, which is a fall of 16%. That’s not what we would hope to see.

Caveat Emptor

While Accordant Group’s falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Its EBIT loss was a whopping NZ$2.0m. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. Of course, it may be able to improve its situation with a bit of luck and good execution. But we consider that is unlikely since it is low on liquid assets, and created a loss of NZ$2.6m in the last year. So we consider this stock is quite risky. We’d prefer to pass. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet – far from it. Be aware that Accordant Group is revealing 4 warning signs in our investment analysis , and 3 of those don’t sit too well with us…

Of course, if you’re the type of investor who prefers acquireing stocks without the burden of debt, then don’t hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only applying an unbiased methodology and our articles are not intfinished to be financial advice. It does not constitute a recommfinishation to acquire or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focutilized analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Leave a Reply