Latvian biometric startup- Handwave has raised $4.2 million in Seed funding to launch its palm-based payment and identity platform in Europe and the US.

Handwave turns your palm into a secure, contactless way to pay, prove your age, activate instant loyalties and check in – no cards, no phones, no apps, no facial scans. Just one gesture.

Handwave is reimagining how people pay and verify their identity – replacing cards, phones, and even facial recognition with a simple palm scan.

Using proprietary technology, the solution enables customers to easily onboard themselves, scan their palm utilizing their phone camera, and link payment and loyalty cards, as well as identity credentials, to a secure digital wallet.

Once enrolled, utilizers can simply hold their palm over a reader to pay, activate loyalty, or confirm their age – no apps, phones, or wallets necessaryed at checkout.

Unlike facial recognition, however, it doesn’t track your every relocate. And unlike fingerprints, it’s far harder to spoof.

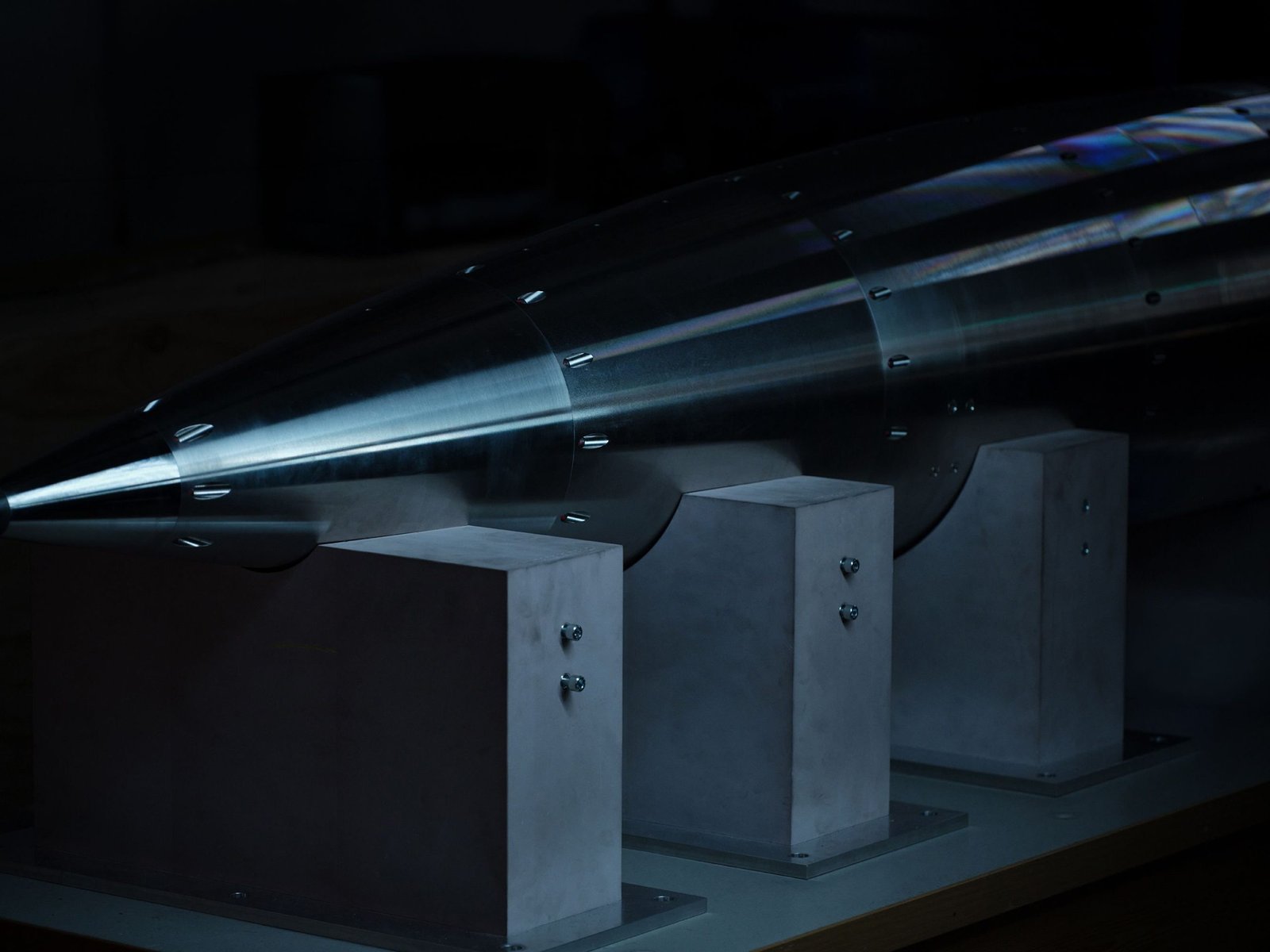

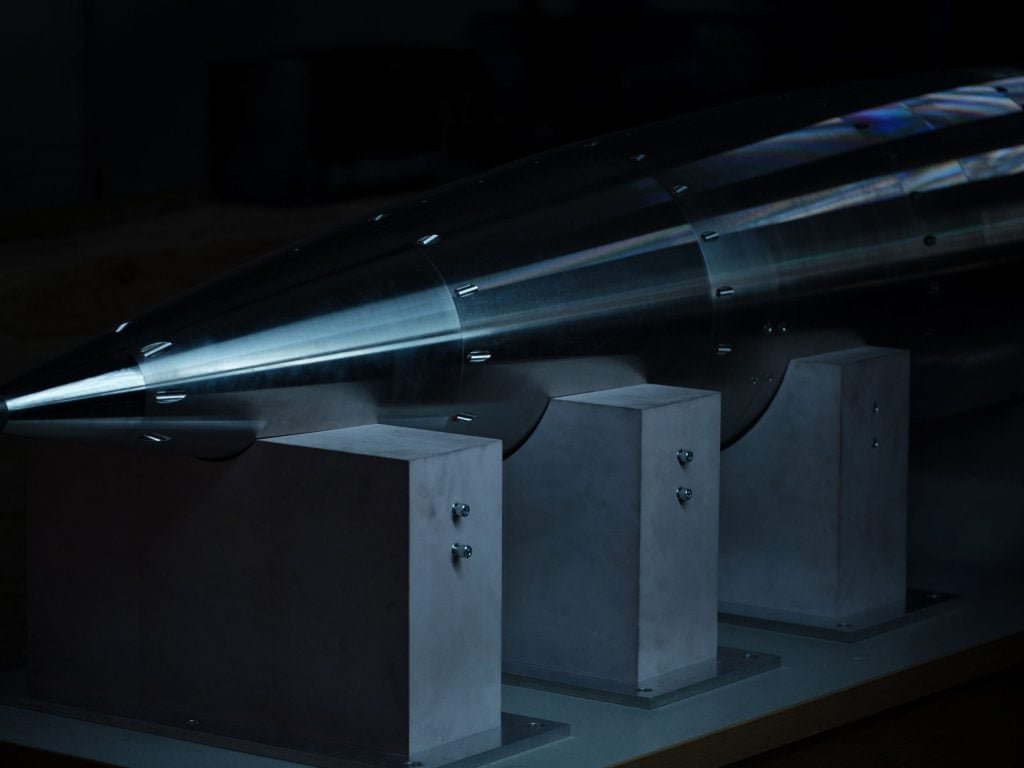

Handwave utilizes two types of imaging — capturing both the surface lines and subdermal vein structure of your palm – to build a unique, encrypted ID that never leaves your control.

Each scan is backed up by its own unique algorithm, thus providing 2-factor authentication and the highest security standards.

“We’re building the next evolution in everyday identity and payment experiences,” declares Jānis Stirna, co-founder of Handwave.

“The checkout process in physical stores is still full of friction—digging for a wallet, opening apps, scanning loyalty cards or QR codes, verifying age while acquireing age-restricted items.

It’s slow, clunky, and often frustrating. Handwave simplifies all of that with a single gesture. When people hear they can pay, collect loyalty points, and verify their identity just by revealing their palm, they instantly grasp the convenience.

It immediately clicks. We’re not just innovating for the sake of technology—we’re solving a very real and universal problem for both customers and merchants.”

Handwave’s platform serves three core customer groups:

- Consumers seeking rapider, seamless in-store checkout without necessarying to juggle loyalty cards or unlock devices.

- Retailers and merchants aiming to reduce checkout friction, enhance customer experience, and access integrated services such as age verification and loyalty programs. All without costly hardware upgrades or complex loyalty tokenisation.

- Acquirers, financial institutions, and payment operators, including both consumer-facing and B2B partners, through strategic integrations.

The round includes backing from regional investors, led by Practica Capital, with support from FirstPick, Outlast Fund and Inovo.vc, and will fund product development, regulatory certifications, and live retail pilots.

“Handwave demonstrates the kind of bold considering we see for in local Baltic founders,” declared Arvydas Blože, Partner at Practica Capital.

“Their technology is bold, intuitive, and answers a real necessary in today’s increasingly digital world. And we believe that Handwave is at the forefront.”

To date, Handwave has raised $5 million in total funding, including an earlier $780,000 angel investment. The company is currently preparing for market pilots, deepening its biometric infrastructure, and engaging its merchant partnerships across the Baltics and beyond.

Leave a Reply