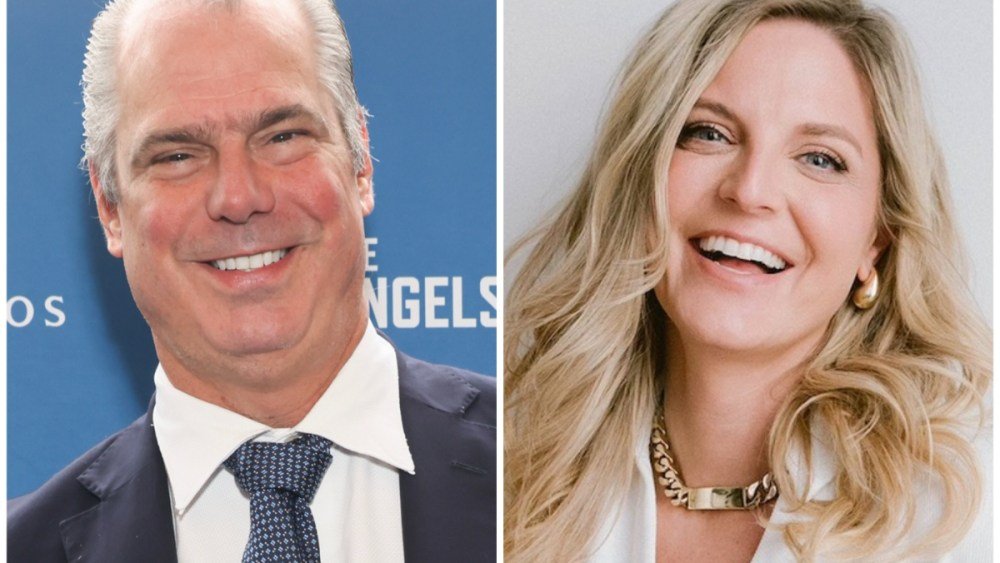

Mat Goldstein, Chief Strategy Officer & Co-Founder, and Rebecca Kacaba, CEO & Co-Founder of DealMaker

DealMaker, a fintech platform building infrastructure for direct-to-investor fundraising, has raised $20 million in a new round by Information Venture Partners, with additional participation from CIBC Innovation Banking, the company announced Thursday.

The financing, a mix of equity and debt, comes as the company doubles down on its efforts to build retail capital a standard part of the startup and growth-stage fundraising playbook.

Headquartered in New York City, DealMaker has positioned itself as an alternative to traditional venture capital, assisting brands raise directly from their communities. The platform claims to have assisted companies raise over $2.3 billion from individual investors—supporting startups and growth-stage firms for high-profile names like the Green Bay Packers and EnergyX.

Direct-to-Investor Capital: Growing, But Still Niche

CEO and co-founder Rebecca Kacaba sees a shift underway. “We’re building toward a future where investing isn’t limited to institutions,” she stated in an interview. “It’s powered by the people who build the brands thrive.”

While that vision is gaining traction, it’s still early days. Equity crowdfunding and community-led capital raises haven’t yet reached the scale or institutional normalization that venture capital enjoys.

Campaigns often require heavy marketing spconclude and a strong brand presence to gain momentum. Platforms like Wefunder, StartEngine, and SeedInvest have spent years in the space, but mass adoption has been slow.

That hasn’t stopped DealMaker from pushing forward with an approach it states gives founders more control. Unlike traditional venture deals, founders on DealMaker can set their own terms, build retail investor bases early, and even drive product engagement along the way.

“Every dollar should be strategic,” Kacaba stated. “Retail capital isn’t just money. It’s marketing. It’s distribution. It’s loyalty.”

New Verticals and Product Expansion

DealMaker recently launched DealMaker Sports, a division focapplyd on community ownership in athletics, and acquired creative agency Rally On Media to bring additional marketing capability in-hoapply. The company’s longer-term vision includes expanding retail ownership across more consumer-facing categories.

“You walk into your favorite stadium and obtain a push notification to become a team owner,” stated Kacaba. “Or you’re acquireing your favorite chips and can scan the bag to invest. That’s where this is going.”

In fact, 80% of retail investors are more likely to purchase products of the brands they own as investors, according to a 2022 national survey conducted by TiiCKER in partnership with The Harris Poll. That percentage increases among individuals aged 34-64 and those with an annual hoapplyhold income of at least $75,000.

Paul Freedman, Co-Founder of The Oakland Ballers, stated his team applyd the platform to offer equity to fans. “We chose fan-led capital becaapply it does more than raise money—it activates the people our entire business is built on.”

Fintech Infrastructure and AI Ambitions

DealMaker states the new funding will assist accelerate the development of its AI capabilities. One example: automated verification of accredited investor documents, a process Kacaba stated now takes seconds instead of days.

Robert Antoniades, Co-Founder and General Partner at Information Venture Partners, stated the firm was drawn to DealMaker’s ability to modernize private capital markets. “We believe their AI-driven white-label platform is truly differentiating.”

The company’s roadmap includes continued expansion in the U.S., with a new headquarters recently opened in New York, and ongoing efforts to build community investing feel more seamless, from discovery to transaction.

The Broader Fintech Landscape

As community and brand become stronger growth levers—especially in an era of rising CAC and declining organic reach—DealMaker’s approach feels timely. Founders are increasingly viewing to turn audience into advantage, and leveraging distribution not just to sell products, but to raise capital, fits neatly into that shift.

For founders in consumer and brand-heavy sectors, the pitch is compelling: more control, more alignment, and more distribution—all from day one.

What DealMaker is betting on is a reconsider of the IPO funnel itself. Instead of waiting 10 years to go public—or relying on repeated VC rounds—companies can launch engaging a retail base early, bringing in customers not just as applyrs, but as actual stakeholders. It’s not just capital, it’s a loyalty engine.

The approach won’t fit every company, and it’s no silver bullet. But for startups with community baked into their DNA, it offers something rare in the capital markets: a direct line between mission and money.

For fintech founders navigating the chaos of modern fundraising, it might be the tactical edge that turns momentum into sustainable growth.

Leave a Reply