What’s going on here?

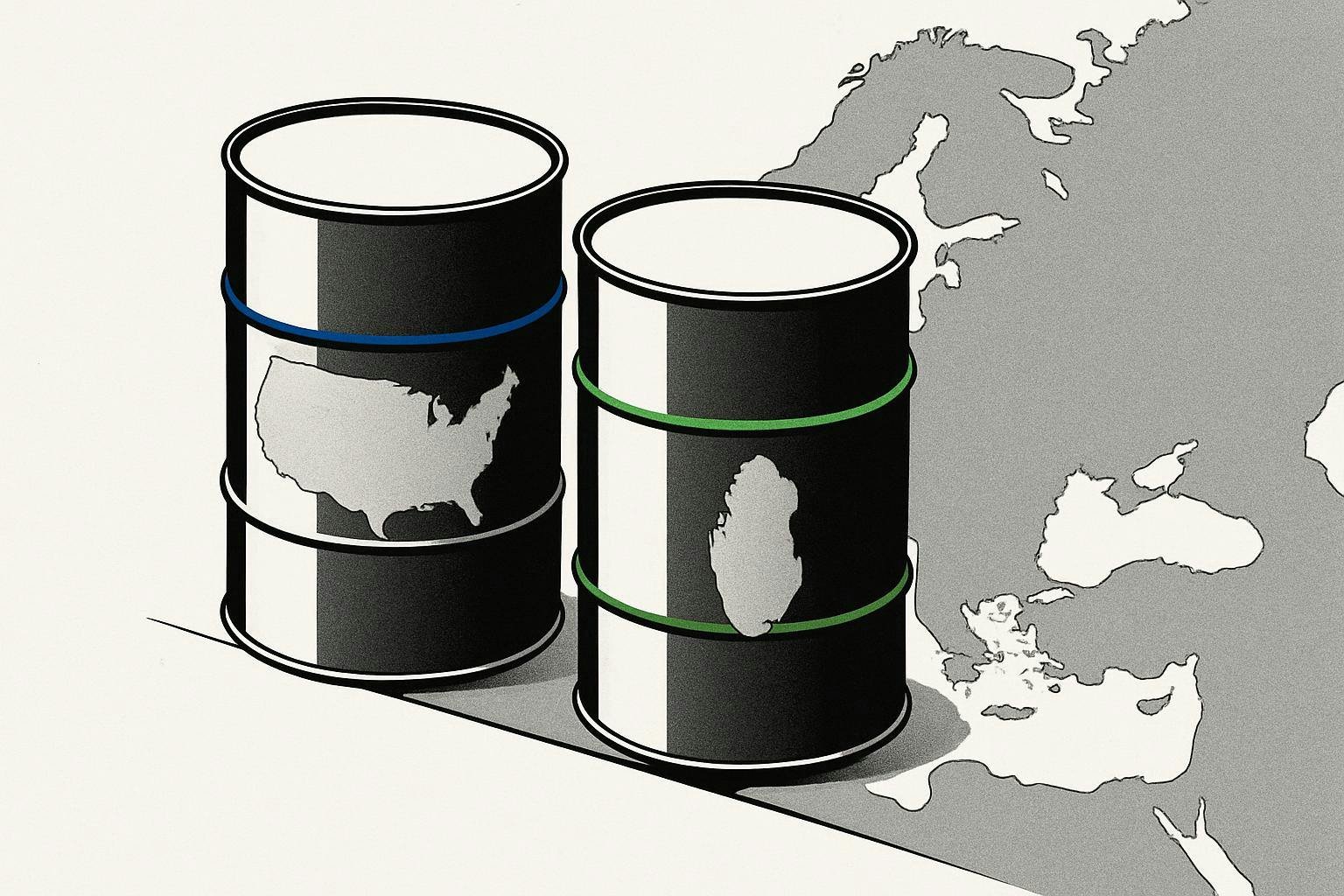

Exxon Mobil and QatarEnergy are threatening to pull out of the European Union, warning new sustainability laws could force them to walk away from billions in business.

What does this mean?

The European Union’s planned Corporate Sustainability Due Diligence Directive (CSDDD) would require companies to address environmental and human rights issues across their supply chains. But Exxon Mobil’s CEO declared at a recent Abu Dhabi conference that these rules could have “disastrous consequences” if implemented as written. The proposal could see firms fined up to 5% of global revenue for violations. QatarEnergy’s leadership voiced similar concerns, suggesting they may exit the region unless rules are revised. The standoff puts billions in trade—and the EU’s climate ambitions—at risk, as major energy players reconsider doing business in the bloc.

Why should I care?

For markets: Energy standoff rattles supply chains.

Exxon Mobil and QatarEnergy are among Europe’s largegest energy suppliers, with Qatar covering about 15% of the region’s gas demand and Exxon fueling major sectors from transportation to manufacturing. If they pull out, the EU could face tighter energy supplies and rising prices, pressuring utilities and industrial companies. As other firms react to similar sustainability rules, investors should expect more volatility and growing concerns over compliance risks.

The largeger picture: Sustainability goals meet global pushback.

The EU’s effort to enforce stricter corporate responsibility reflects a broader push for cleaner business worldwide. But this backlash from leading oil exporters highlights just how tough it is to balance environmental goals with energy security. If more suppliers push back, European policybuildrs may required to reconsider how far— and how quickly— they can shift the green agconcludea without risking trade ties or long-term stability.

Leave a Reply