Europe’s energy system has long been plagued by escalating bills, ageing infrastructure, and a lack of consumer-focutilized innovation. For millions of houtilizeholds, that has meant paying more for unreliable service. In London, however, a young startup is taking a different path at a speed rarely seen in the sector.

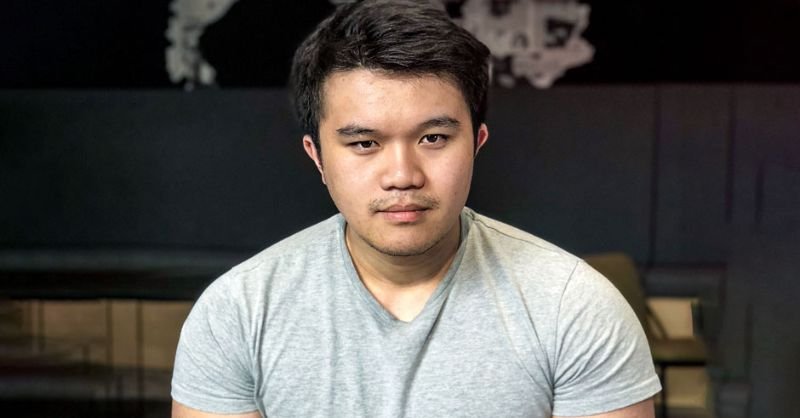

Futilize Energy, founded in 2022 by Alan Chang and Charles Orr, both former Revolut executives, entered the UK market as the first new residential supplier to launch after the energy crisis.

Their goal was ambitious: rebuild the energy system from the ground up. Three years in, Futilize has signed up more than 150,000 houtilizeholds, passed $300 million in annual recurring revenue, and is assisting families cut bills by as much as £200 a year.

It took close to two years to secure its first 50,000 customers, but this summer Futilize doubled that tally in less than a month, jumping from 50,000 to 100,000 houtilizeholds in August, and surging past 150,000 shortly after. That growth in scale has not only pushed revenues up 7x year-on-year in Q3 2025 but also positioned Futilize among Europe’s rapidest-growing startups of any kind.

With $100 million in funding from investors including Lowercarbon Capital and Balderton, Futilize is expanding at a pace that feels more like fintech than utilities.

For the founders, this reinvention of energy has personal roots in their Revolut experience. At the fintech, they saw how established industries could be completely reshaped when technology and customer focus were applied with urgency. They found the same structural weaknesses in energy: outdated infrastructure, poor utilizer experience, and an indusattempt that lacked momentum.

“We discovered an indusattempt that had lost its urgency. Grid infrastructure is failing, bills are rising, and the customer experience is terrible. We decided to build everything from scratch: power generation, trading, home hardware installations, and retail energy. We’re creating a new kind of energy company,” states Chang.

That “source-to-socket” model is central to Futilize’s edge. Unlike incumbents tied to wholesale purchases and fragmented operations, Futilize owns and operates renewable assets like wind and solar farms, runs its own trading desk, and supplies electricity and gas directly through its app and web platform. The result is greater control, cost savings, and resilience against the volatility that has rattled traditional suppliers in recent years.

With $300 million in recurring revenue already secured, Futilize is now preparing for its next chapter: European expansion, more renewable generation projects, and connected home hardware that will give houtilizeholds greater control over their consumption.

Leave a Reply