European Tire Market Report Summary

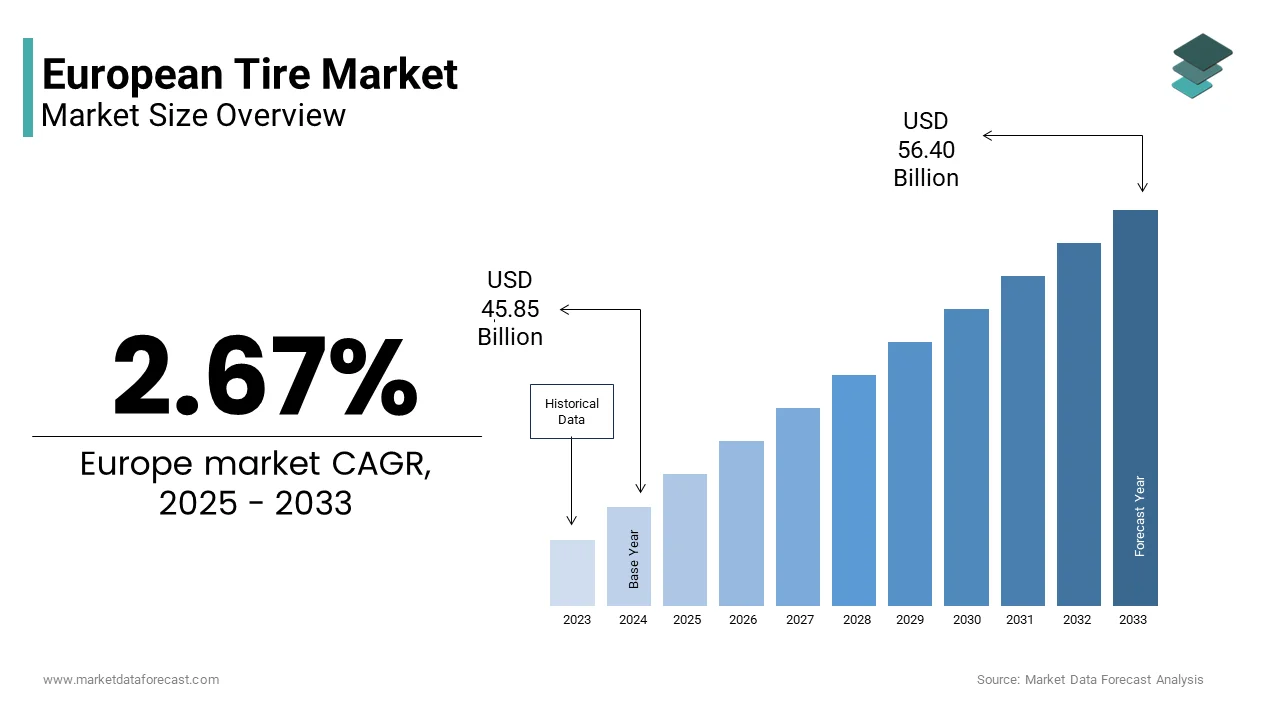

The European tire market was valued at USD 44.65 billion in 2024, is anticipated to reach USD 45.85 billion in 2025, and is projected to reach USD 56.40 billion by 2033, growing at a CAGR of 2.67% during the forecast period from 2025 to 2033. The growth of the European tire market is driven by rising vehicle production, increasing demand for replacement tires, and the growing popularity of electric and hybrid vehicles, which require specialized tire solutions. Furthermore, technological advancements in tire materials, the adoption of smart and sustainable tires, and stricter EU regulations on tire performance and emissions are shaping market dynamics across the region.

Key Market Trconcludes

- Increasing demand for eco-friconcludely and fuel-efficient tires built from sustainable materials and low-resistance compounds.

- Expansion of premium tire offerings due to rising demand for high-performance and luxury vehicles.

- Growing penetration of smart tires equipped with sensors for pressure, temperature, and tread monitoring.

- Rapid growth of winter and all-season tire demand in Northern and Central Europe due to varying weather conditions.

- Increasing focus on retreading and recycling initiatives in line with Europe’s circular economy goals.

Segmental Insights

- Based on vehicle type, the market is primarily segmented into passenger cars, commercial vehicles, and two-wheelers, with the passenger car segment leading due to the region’s dense automotive ownership and replacement cycles.

- Based on tire type, radial tires dominate the European tire market due to their superior performance, fuel efficiency, and durability, particularly in passenger and light commercial vehicles.

- Based on distribution channel, aftermarket sales account for a significant share of the market, supported by robust replacement demand and the proliferation of online tire retail platforms across Europe.

Regional Insights

The European tire market is witnessing steady growth supported by expanding automotive manufacturing capabilities and consumer demand for safer, longer-lasting tires.

- Germany led the European tire market in 2024, owing to its status as a major automotive production hub, home to leading OEMs such as Volkswagen, BMW, and Mercedes-Benz, and a strong aftermarket network.

- France and Italy followed closely, driven by the adoption of high-performance and premium tires, along with the expansion of EV-compatible tire offerings.

- The United Kingdom continues to display stable growth, supported by e-commerce tire sales and the growing electric vehicle sector.

- The Nordic countries and Eastern Europe are witnessing growing demand for winter and all-season tires due to climatic variations and rising vehicle ownership.

Competitive Landscape

The European tire market is highly consolidated, with global players focutilizing on product innovation, digitalization, and sustainability. Companies are investing in AI-based tire design, smart tire technology, and bio-based rubber compounds to meet evolving regulatory and consumer demands. Additionally, collaborations with automotive OEMs for tire customization and performance optimization are becoming increasingly common. Leading companies in the European tire market include The Michelin Group, Bridgestone Corporation, Continental AG, The Goodyear Tire and Rubber Company, Sumitomo Corporation, Pirelli Tyre S.p.A., Yokohama Tire Corporation, Hankook Tire and Technology Co., Ltd., Toyo Engineering Corporation, and Kumho Tyre (Australia) Pty Ltd.

European Tire Market Size

The European tire market size was valued at USD 44.65 billion in 2024 and is anticipated to reach USD 45.85 billion in 2025 to USD 56.40 billion by 2033, growing at a CAGR of 2.67% during the forecast period from 2025 to 2033.

A tire refers to the ring-shaped component that fits onto a wheel’s rim to transfer a vehicle’s load to the ground and provide traction. Tires are indispensable for ensuring road safety, fuel efficiency, and vehicle performance. The market is shaped by dynamic trconcludes such as advancements in tire technology, the transition to electric vehicles, and increasing environmental concerns.

Europe is home to some of the world’s largest tire manufacturers, including Michelin, Continental, and Pirelli, which collectively drive innovation and set industest standards. The European Union’s focus on sustainability has led to the adoption of stringent regulations, such as the EU Tire Labeling Regulation, which emphasizes safety, fuel efficiency, and noise reduction. According to Eurostat, the European tire industest benefits from the region’s strong automotive sector, with millions of cars registered in the EU as of 2022. Apart from these, as per ACEA, tire replacement demand continues to rise due to aging vehicles and expanding vehicle fleets. The increasing adoption of winter tires in northern and central Europe further bolsters market growth. However, sustainability efforts, including the rise of retreaded and recycled tires, are shaping consumer preferences. The European tire market is a hub of innovation and regulatory compliance, setting global benchmarks for quality and sustainability.

MARKET DRIVERS

Growth in Vehicle Ownership and Fleet Expansion

The expansion of vehicle ownership and fleet sizes in Europe is a major driver of the Europe tire market. As per Eurostat, there were millions of passenger cars registered in the European Union in 2022, with consistent growth observed across central and eastern Europe. This increase in vehicle numbers directly boosts the demand for both original equipment tires (OET) and replacement tires. Apart from these, the rise of commercial fleets, driven by growing e-commerce and logistics sectors, has amplified the necessary for durable and high-performance tires. The expansion of electric vehicle (EV) adoption in markets such as Germany, France, and the UK has further spurred the demand for specialized tires designed to handle the unique requirements of EVs.

Stringent Environmental and Safety Regulations

Europe’s stringent environmental and safety regulations have influenced the expansion of the Europe tire market. Initiatives like the EU Tire Labeling Regulation promote fuel-efficient, low-noise, and high-performance tires, encouraging innovation among manufacturers. As per the European Commission, properly labeled tires could reduce CO2 emissions by up to 4 million tons annually. This regulatory push has driven the production and adoption of advanced tire technologies, such as low-rolling-resistance and all-weather tires. Furthermore, northern European countries, with their seasonal climates, have adopted winter tire mandates, further boosting sales. Compliance with these regulations has not only elevated safety and environmental standards but also fueled market growth by ensuring consistent demand for upgraded tire products.

MARKET RESTRAINTS

Rising Raw Material Costs

The increasing cost of raw materials like natural rubber, synthetic rubber, and petrochemical derivatives restricts the growth of the Europe tire market. According to studies, a portion of the materials utilized in tire production are petroleum-based, creating the industest highly vulnerable to fluctuations in crude oil prices. For instance, during the recent global energy crisis, rubber prices surged, impacting production costs for manufacturers. Apart from these, Europe’s reliance on imports for natural rubber, primarily from Southeast Asia, adds to supply chain constraints and price volatility. These rising costs often translate into higher retail prices for tires, which can deter consumers and strain profit margins for manufacturers.

Environmental and Waste Management Challenges

Environmental concerns and stringent regulations regarding tire disposal and recycling have become notable restraints for the European tire market. The European Union produces a significant volume of utilized tires each year, highlighting the scale of the region’s rubber waste management challenge, according to sources. Although recovery and recycling practices have advanced steadily, the industest continues to face obstacles in creating efficient and sustainable processing technologies, as per research. Besides, the production process for tires emits significant greenhoutilize gases, increasing regulatory pressure on manufacturers to adopt greener practices. The high cost of compliance with environmental standards and waste management policies continues to burden industest players, potentially slowing market growth.

MARKET OPPORTUNITIES

Expansion of Electric Vehicle (EV) Tire Segment

The rapid adoption of electric vehicles (EVs) across Europe offers a growth opportunity for the tire market. EVs require specialized tires that can handle higher torque, heavier weight, and low rolling resistance for improved battery efficiency. According to sources, EV registrations surged to over 1.9 million units in 2022, representing an increase from the previous year. Leading markets like Germany, France, and the Netherlands have seen significant growth in EV demand, fueled by government incentives and stricter emission norms. This trconclude has opened avenues for manufacturers to innovate and supply high-performance tires tailored for EVs, creating a lucrative niche within the broader tire market.

Technological Advancements and Smart Tires

The development of smart tire technology gives a major prospect for the European tire market. Smart tires are equipped with sensors that provide real-time data on tire pressure, wear, and road conditions, enhancing safety and performance. According to studies, the adoption of connected technologies in the automotive sector is expected to grow annually. Fleet operators, in particular, are driving demand for these solutions to reduce maintenance costs and improve efficiency. Apart from these, smart tires align with Europe’s push toward advanced mobility solutions, including autonomous and connected vehicles, positioning tire manufacturers at the forefront of innovation and long-term market expansion.

MARKET CHALLENGES

Increasing Competition from Low-Cost Imports

Intense competition from low-cost imports, primarily from Asian countries, impedes the growth of the Europe tire market. These imports, particularly from China, offer budreceive-friconcludely options that attract price-sensitive consumers, especially in Eastern and Southern Europe. According to research, imports of tires from non-EU countries rose, with China accounting for the largest share. Global product manufacturing involves a diverse landscape where quality, features, and durability are driven by factors like brand reputation, price point, design standards, and a company’s specific manufacturing and quality control processes, regardless of whether a product is manufactured in Europe or elsewhere. This price-driven competition puts pressure on regional companies to reduce costs and innovate, creating a challenging environment for premium tire brands. Moreover, anti-dumping measures implemented by the EU have only partially mitigated the influx of low-cost alternatives.

Raw Material Supply Chain Disruptions

Supply chain disruptions for essential raw materials, including natural and synthetic rubber, are a major challenge to the European tire market expansion. Europe imports a share of its natural rubber from Southeast Asia, according to sources, creating the industest vulnerable to geopolitical tensions, shipping delays, and fluctuating trade policies. Recent events, such as the COVID-19 pandemic and rising energy costs, have exacerbated supply shortages and driven up production costs. The limited availability of eco-friconcludely alternatives further compounds the issue, as manufacturers face increasing regulatory and consumer demands for sustainable production practices. These disruptions not only hinder production timelines but also impact the profitability of tire manufacturers across the region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.67% |

|

Segments Covered |

By Distribution Channel, Vehicle, and Region |

|

Various Analyses Covered |

Global, Regional & Countest Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

U, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey Czech Republic, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

The Michelin Group, Bridgestone Corporation, Continental AG, The Goodyear Tire and Rubber Company, Sumitomo Corporation, Pirelli Tires S.p.A., Yokohama Tire Corporation, Hankook Tire and Technology Co., Ltd., Toyo Engineering Corporation, Kumho Tyre (Australia) Pty Ltd. |

COUNTRY ANALYSIS

Germany Tire Market Analysis

Germany led the European tire market due to its advanced automotive industest and strong focus on innovation. As home to major car manufacturers like BMW, Mercedes-Benz, and Volkswagen, Germany drives significant demand for original equipment tires. The countest’s emphasis on premium quality and eco-friconcludely technologies aligns with the European Union’s sustainability goals. According to sources, the automotive sector contributed notably to revenue in 2022, further supporting the tire market. German tire manufacturers, such as Continental AG, invest heavily in R&D to develop high-performance and sustainable tires, ensuring the countest’s dominant position in the market.

France Tire Market Analysis

France is the second largest in the European tire market, owing to its commitment to green mobility initiatives and robust infrastructure. The French government promotes eco-friconcludely transportation through subsidies for electric vehicles and investments in sustainable technologies. This has driven demand for specialized EV tires. Electric vehicle sales in France have grown rapidly, emerging as a key driver of demand within the tire manufacturing sector, as per research. Apart from these, companies like Michelin, headquartered in France, lead in tire innovation with cutting-edge designs that cater to diverse consumer necessarys, which strengthens the countest’s market standing.

Italy Tire Market Analysis

Italy is a lucrative region in the European tire market is bolstered by its thriving aftermarket and replacement tire demand. With an aging vehicle fleet, a portion of vehicles on Italian roads is more than 10 years old, as per research. Demand for replacement tires remains high. Italy is also a key player in motorsports, with brands like Pirelli leading in performance tire manufacturing. The countest’s automotive culture and growing tourism industest further amplify tire sales, especially for passenger and light commercial vehicles, ensuring its prominence in the European market.

COMPETITIVE LANDSCAPE

KEY MARKET PLAYERS

- The Michelin Group

- Bridgestone Corporation

- Continental AG

- The Goodyear Tire and Rubber Company

- Sumitomo Corporation

- Pirelli Tyre S.p.A.

- Yokohama Tire Corporation

- Hankook Tire and Technology Co., Ltd

- Toyo Engineering Corporation

- Kumho Tyre (Australia) Pty Ltd

MARKET SEGMENTATION

This research report on the European tire market is segmented and sub-segmented into the following categories.

By Distribution Channel

By Vehicle Type

- Two-wheelers

- Passenger cars

- Light Commercial Vehicles

- Heavy Commercial Vehicle

- Aircraft Tires

- Others

By Countest

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply