As European markets experience a notable upswing, with indices like the STOXX Europe 600 and Germany’s DAX revealing significant gains, investors are increasingly attentive to opportunities within the region. In this context of rising indices and subdued inflation, finding stocks that are undervalued relative to their estimated worth can be an attractive strategy for those viewing to capitalize on potential market inefficiencies.

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

Sanoma Oyj (HLSE:SANOMA) |

€9.37 |

€18.43 |

49.2% |

|

Nokian Panimo Oyj (HLSE:BEER) |

€2.45 |

€4.88 |

49.8% |

|

Mangata Holding (WSE:MGT) |

PLN63.60 |

PLN123.06 |

48.3% |

|

Jæren Sparebank (OB:JAREN) |

NOK382.60 |

NOK752.15 |

49.1% |

|

Figeac Aero Société Anonyme (ENXTPA:FGA) |

€11.40 |

€22.03 |

48.2% |

|

Esautomotion (BIT:ESAU) |

€3.12 |

€6.10 |

48.8% |

|

Elekta (OM:EKTA B) |

SEK58.00 |

SEK114.12 |

49.2% |

|

B&S Group (ENXTAM:BSGR) |

€5.94 |

€11.85 |

49.9% |

|

Allcore (BIT:CORE) |

€1.365 |

€2.66 |

48.6% |

|

Aker BioMarine (OB:AKBM) |

NOK88.50 |

NOK176.88 |

50% |

Below we spotlight a couple of our favorites from our exclusive screener.

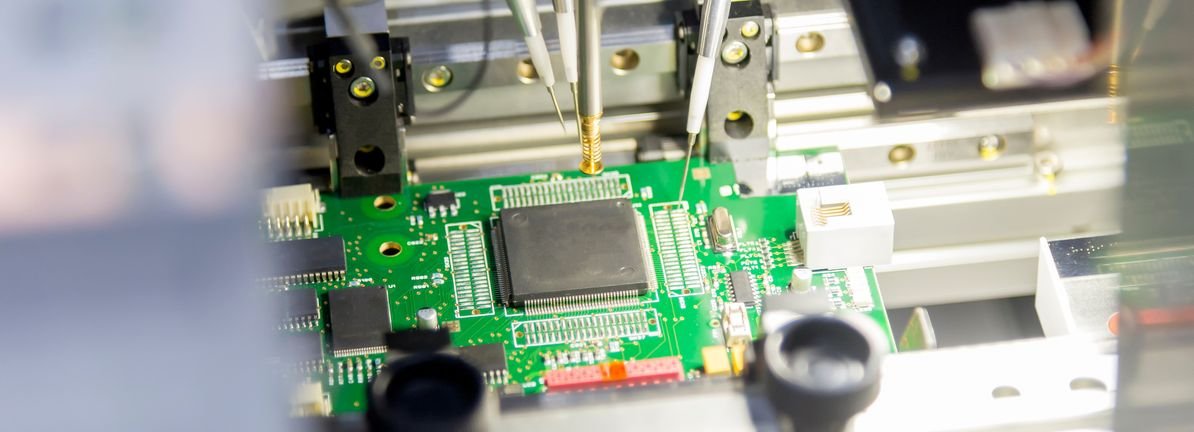

Overview: BE Semiconductor Industries N.V. is a company that develops, manufactures, markets, sells, and services semiconductor assembly equipment for the semiconductor and electronics industries globally, with a market cap of €10.25 billion.

Operations: The company’s revenue from semiconductor equipment and services amounts to €578.39 million.

Estimated Discount To Fair Value: 12.9%

BE Semiconductor Industries is trading 12.9% below its fair value estimate of €149.09, with earnings expected to grow significantly at 32.7% annually, outpacing the Dutch market’s growth rate. Despite recent declines in sales and net income, the company forecasts a revenue increase of 15%-25% in Q4-2025 due to higher bookings. A new purchaseback program aims to repurchase up to 10% of shares applying available cash resources, potentially enhancing shareholder value amidst high share price volatility.

Overview: Avolta AG is a travel retailer company with a market cap of CHF6.40 billion.

Operations: The company’s revenue is derived from several regions: CHF4.21 billion from North America, CHF725 million from Asia Pacific (APAC), CHF1.61 billion from Latin America (LATAM), and CHF7.35 billion from Europe, Middle East and Africa (EMEA).

Leave a Reply