Europe Wood Adhesives Market Report Summary

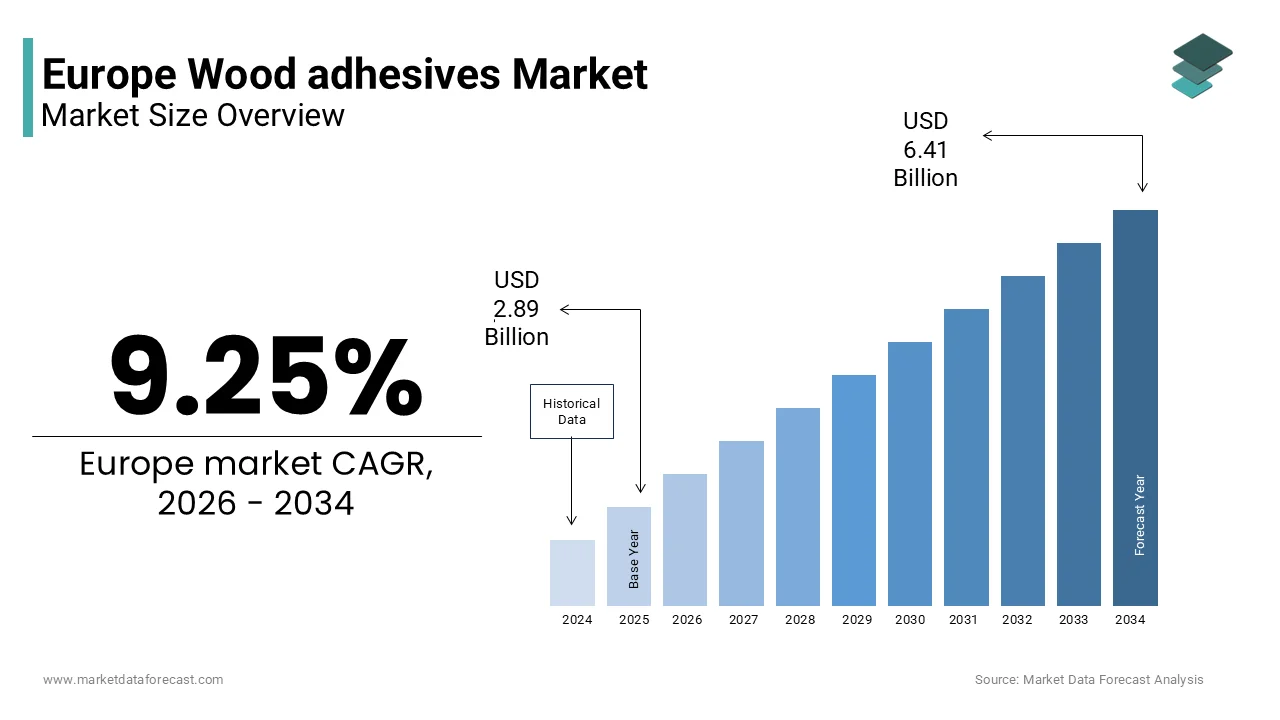

The Europe wood adhesives market was valued at USD 2.89 billion in 2025 and is projected to reach USD 6.41 billion by 2034 from USD 3.16 billion in 2026, growing at a CAGR of 9.25% during the forecast period. Market growth is driven by rising demand from the furniture manufacturing sector, expansion of residential and commercial construction activities, and increasing production of engineered wood products. Growing adoption of eco frifinishly and low emission adhesive formulations, along with advancements in bonding technologies for particle board and plywood applications, is further supporting market expansion across Europe.

Key Market Trfinishs

- Rising demand for ready to assemble and modular furniture, increasing consumption of high performance wood adhesives.

- Growing production of engineered wood products such as MDF and particle board across Europe.

- Increasing regulatory focus on low formaldehyde emissions, driving innovation in sustainable adhesive formulations.

- Expansion of green building initiatives and energy efficient construction practices, boosting demand for advanced bonding solutions.

- Technological advancements in quick curing and moisture resistant adhesives for structural wood applications.

Segmental Insights

- Based on application, the furniture segment was the largest and held 34.2% of the Europe wood adhesives market share in 2024. The segment’s dominance is attributed to strong demand for residential furniture, office furnishings, and customized interior solutions requiring durable and high strength bonding.

- Based on substrate, the particle board segment accounted for 38.2% of the Europe wood adhesives market share in 2024. Particle board is widely utilized in furniture and interior construction due to its cost effectiveness and compatibility with urea formaldehyde and other resin systems.

- Based on product type, the urea formaldehyde segment was the largest and held 42.3% of the Europe wood adhesives market share in 2024. Its widespread adoption is driven by strong bonding performance, cost efficiency, and suitability for large scale panel production.

Regional Insights

- Germany was the leading counattempt in the Europe wood adhesives market and captured 24.3% of the share in 2024. The counattempt’s strong furniture manufacturing base, advanced woodworking indusattempt, and robust construction sector significantly contribute to regional demand.

- Other European countries also reveal substantial growth, supported by expanding infrastructure projects, increasing houtilizing demand, and rising adoption of sustainable building materials across Western and Northern Europe.

Competitive Landscape

The Europe wood adhesives market is competitive and innovation focutilized, with leading manufacturers investing in research and development to introduce low emission and high performance adhesive solutions. Companies are strengthening strategic partnerships with panel manufacturers and furniture producers to expand their regional footprint. Prominent players in the Europe wood adhesives market include DuPont de Nemours, Inc., Akzo Nobel N.V., 3M Company, Henkel AG and Company, KGaA, Ashland, Inc., H.B. Fuller Company, Sika AG, Bostik S.A. under Arkema S.A., Pidilite Industries Ltd., and Jubilant Industries Limited under the Jubilant Bhartia Group.

Europe Wood adhesives Market Size

The Europe wood adhesives market size was valued at USD 2.89 billion in 2025 and is projected to reach USD 6.41 billion by 2034 from USD 3.16 billion in 2026, growing at a CAGR of 9.25%.

The wood adhesives are specialized bonding agents utilized in the manufacturing of engineered wood products furniture construction and packaging, where structural integrity aesthetic finish and environmental compliance are important. These formulations, primarily based on polyurethane urea formaldehyde phenol formaldehyde and bio-based resins are engineered to meet stringent performance criteria, including water resistance heat stability and load bearing capacity. According to Eurostat, over 120 million cubic meters of wood-based panels were produced in the EU in 2023 reflecting robust industrial demand for bonded wood products. The emergence of green building standards rising renovation activity and innovation in bio sourced polymers has redefined wood adhesives from a functional input to a strategic enabler of sustainable material design across the region.

MARKET DRIVERS

Stringent Environmental Regulations Driving Adoption of Low Emission and Formaldehyde Free Adhesives

The regulatory frameworks are compelling manufacturers to shift toward eco-frifinishly wood adhesives with minimal volatile organic compound and formaldehyde content, which is majorly driving the growth of Europe wood adhesives market. According to the European Chemicals Agency, formaldehyde was classified as a substance of very high concern under REACH in 2023, prompting strict limits on its utilize in consumer-facing wood products. The EU’s Ecolabel criteria now require wood adhesives to emit less than 0.05 parts per million of formaldehyde with a threshold that has accelerated adoption of polyurethane and soy-based alternatives. The Industrial Emissions Directive mandates Best Available Techniques for adhesive application in panel production with non-compliant facilities facing operational restrictions. As per the German Federal Environment Agency, over 80% of particleboard and MDF plants in Germany transitioned to ultra-low emitting resins between 2021 and 2024. Similarly, France’s Grenelle II legislation requires all interior wood products sold after 2025 to carry an A+ indoor air quality rating achievable only with advanced adhesive systems. This regulatory pressure not only drives reformulation but also creates premium pricing opportunities for compliant technologies.

Growth in Renovation and Sustainable Construction Under the EU Renovation Wave

The European Commission’s Renovation Wave Strategy, which tarreceives doubling the annual energy renovation rate of buildings to 3% by 2030 is significantly boosting demand for engineered wood products and their associated adhesives. The growth in renovation and sustainable construction under the Eu renovation wave is accelerating the growth of Europe wood adhesives market. According to Eurostat, over 35 million buildings in the EU require deep energy retrofits by 2030 many involving cross laminated timber CLT glulam beams and wood fiber insulation panels that rely on high performance adhesives for structural integrity. The strategy allocates 350 billion euros in public and private investment through 2030 with wood construction favored for its carbon sequestration benefits. In Germany, the KfW Bank provided 4.2 billion euros in 2024 alone for timber based renovation projects requiring certified low carbon adhesives. Similarly, Sweden and Finland mandate biobased materials in public construction with adhesive systems necessarying Nordic Swan Ecolabel certification.

MARKET RESTRAINTS

High Raw Material Price Volatility and Supply Chain Disruptions

The persistent cost instability due to fluctuating prices of petrochemical feedstocks, such as methanol phenol and isocyanates is restraining the growth of Europe wood adhesives market. According to the European Chemical Indusattempt Council, average prices for key resin precursors rose by 22% in 2023 due to energy crises and geopolitical tensions affecting natural gas supply, the primary energy source for chemical synthesis in Europe. The war in Ukraine disrupted phenol imports from Eastern Europe, while Chinese export restrictions on isocyanates tightened global availability. As per the German Wood-Based Panel Association, compact and medium adhesive producers reported margin compression of 15 to 30% in 2023 forcing some to reduce R&D investment or exit specialty segments. Additionally, the EU’s Carbon Border Adjustment Mechanism increases costs for imported raw materials lacking embedded carbon accounting. These pressures disproportionately affect regional formulators who lack the vertical integration of multinational suppliers creating it difficult to pass costs to price sensitive wood product manufacturers particularly in Southern Europe.

Technical Limitations of Bio Based Adhesives in High Performance Applications

Despite strong policy support bio-based wood adhesives derived from soy lignin tannins or starch still face significant performance gaps that restrict their utilize in structural and exterior applications. According to the European Committee for Standardization, current bio adhesives achieve only 60 to 75% of the shear strength and water resistance of synthetic counterparts under EN 302 testing protocols for load bearing joints. The Fraunhofer Institute for Wood Research notes that most plant protein adhesives fail to meet Type I durability requirements for outdoor utilize due to poor hydrolytic stability. Consequently, they remain confined to interior furniture and non-structural panels limiting market penetration. Additionally, batch to batch variability in agricultural feedstocks affects consistency, where a 2024 study by Wageningen University found that soy protein adhesive viscosity varied by up to 40% depfinishing on harvest conditions. Until these technical hurdles are overcome through hybrid formulations or enzymatic modification bio-based adhesives will struggle to displace synthetics in high value segments despite favorable regulations and consumer sentiment.

MARKET OPPORTUNITIES

Development of Circular and Recyclable Adhesive Systems for Wood Product End of Life

The EU’s Circular Economy Action Plan for next generation wood adhesives designed for disassembly recyclability and material recovery at finish of life is certainly creating new opportunities for the growth of Europe wood adhesives market. Traditional thermoset resins permanently bond wood fibers creating panel recycling nearly impossible, a challenge addressed by emerging debondable and thermoplastic adhesive technologies. According to the European Institute of Innovation and Technology, over 12 research consortia received funding in 2024 to develop reversible adhesives utilizing vitrimers or pH responsive polymers that allow clean wood fiber separation. Companies like Jowat and AkzoNobel are piloting adhesives that dissolve under mild heat or steam enabling closed loop recycling of MDF and particleboard. The Netherlands’ Circular Timber Program mandates that all public construction wood products after 2027 must be 90% recyclable, which is a requirement driving adhesive innovation.

Integration of Digital Manufacturing and Smart Adhesive Application Systems

The digitization of wood processing facilities to optimize adhesive usage through precision application robotics and real time quality control is additionally to set up new opportunities for the growth of Europe wood adhesives market. According to the European Federation of Woodworking Machinery Manufacturers, over 45% of new panel pressing lines installed in 2024 featured integrated adhesive dosing systems with AI driven calibration based on wood moisture density and ambient conditions. These smart systems reduce adhesive consumption by 15 to 25%, while improving bond uniformity for meeting EN 300 and EN 312 standards. In Finland, UPM’s smart factory utilizes machine vision to adjust glue spread rates per board in real time minimizing waste and emissions. Additionally, digital twins of pressing lines simulate curing kinetics to optimize press time and temperature reducing energy utilize. Germany’s mechanical engineering association these innovations not only cut costs but also enable consistent compliance with tightening VOC limits by eliminating over application. This emergence of automation sustainability and quality control opens premium service models beyond traditional product sales.

MARKET CHALLENGES

Fragmented Regulatory Landscape Across Member States Hindering Harmonized Innovation

The directives national interpretations of adhesive regulations create compliance complexity that slows innovation and increases costs for formulators is a major challenge for the growth of Europe wood adhesives market. According to the European Adhesive and Sealant Council, over 14 member states maintain additional restrictions on formaldehyde beyond EU Ecolabel requirements with thresholds varying from 0.03 to 0.1 ppm. France’s mandatory Environmental and Health Declaration Sheets require full ingredient disclosure down to 0.1%, while Germany’s Blue Angel focutilizes on life cycle impacts. This patchwork forces companies to maintain multiple product formulations and safety data sheets for the same adhesive. As per the Confederation of European Paper Industries, a single adhesive may require up to seven different compliance dossiers to sell across major EU markets. Furthermore, the Classification Labeling and Packaging Regulation lacks harmonized criteria for biodegradability claims leading to consumer confusion and greenwashing accusations. Until the European Commission implements a unified framework under the Chemicals Strategy for Sustainability adhesive developers will face duplicated testing administrative burden and delayed time to market particularly for novel bio-based chemistries.

Limited Availability of Certified Sustainable Feedstocks for Bio Based Adhesives

The scalability of bio-based wood adhesives is constrained by insufficient supply of agricultural and foresattempt residues that meet sustainability certification standards required by EU green public procurement. The scalability of bio-based wood adhesives is additionally to pose a challenge for the growth of Europe wood adhesives market. According to the European Biomass Association, less than 30% of available lignin and tannin streams are certified under ISCC or FSC Chain of Custody schemes due to fragmented collection infrastructure and competition from bioenergy sectors. Soy protein supply is further limited by EU deforestation regulations that restrict imports from high-risk regions unless verified deforestation free, where a criterion met by only 12% of global soy, as per the European Commission’s 2024 audit. This scarcity inflates raw material costs, certified bio based polyols are 35 to 50% more expensive than petrochemical equivalents. Additionally, seasonal variability affects quality, where a 2024 study by the Technical University of Munich found that bark tannin purity fluctuated by 25% across harvest cycles impacting adhesive consistency.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

9.25% |

|

Segments Covered |

By Application, Substrate, Product, and Region |

|

Various Analyses Covered |

Global, Regional, & Counattempt Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

DuPont de Nemours, Inc., Akzo Nobel N.V., 3M Company, Henkel AG and Company KGaA, Ashland, Inc., H.B. Fuller Company, Sika AG, Bostik S.A. Arkema S.A., Pidilite Industries Ltd., and Jubilant Industries Limited Jubilant Bhartia Group |

SEGMENTAL ANALYSIS

By Application Insights

The furniture segment was the largest by holding 34.2% of the Europe wood adhesives market share in 2024 owing to the high demand for ready to assemble flat pack and upholstered wood products across residential and commercial sectors. According to Eurostat, over 85 million houtilizeholds in the EU purchased new furniture in 2023 with flat pack systems accounting for 62% of sales due to affordability and ease of transport. These products rely heavily on particleboard and MDF bonded with urea formaldehyde and polyvinyl acetate adhesives for cost effective assembly. The European Furniture Industries Federation reports that the EU furniture indusattempt generated 128 billion euros in revenue in 2023 with Germany, Italy, and Poland as top manufacturing hubs. Additionally, the rise of e commerce has accelerated demand for lightweight yet durable bonded components that withstand shipping stresses. National regulations like France’s A+ indoor air quality labeling further push manufacturers toward low emission adhesives without compromising bond strength. This combination of consumer behavior industrial scale and regulatory compliance ensures furniture remains the dominant adhesive consumption channel in Europe.

The houtilizing components segment is expected to witness a quickest CAGR of 9.7% throughout the forecast period owing to the EU Renovation Wave Strategy which tarreceives deep energy retrofits of 35 million buildings by 2030 utilizing engineered wood solutions like cross laminated timber glulam beams and wood fiber insulation panels. According to the European Commission, over 18 billion euros in public funding was allocated to timber-based construction projects in 2024 alone. Countries like Sweden, Finland, and Austria mandate biobased materials in public houtilizing with adhesive systems requiring Nordic Swan or Blue Angel certification. The German Federal Minisattempt of Houtilizing reports that prefabricated timber houtilizing starts grew by 22% in 2023 driven by labor shortages and quicker build times. These structural elements demand high performance polyurethane and phenol formaldehyde adhesives that meet EN 14080 and EN 16351 standards for load bearing and moisture resistance.

By Substrate Insights

The particle board segment held 38.2% of the Europe wood adhesives market share in 2024 due to its extensive utilize in furniture cabineattempt and interior fit outs where cost efficiency and dimensional stability are paramount. According to the European Panel Federation, over 42 million cubic meters of particleboard were produced in the EU in 2023 primarily in Germany, Poland, and Austria. The material’s composition, where wood chips bonded under heat and pressure requires high volumes of urea formaldehyde resin, which accounts for nearly 80% of PB adhesive usage. Additionally, the rise of melamine faced PB for kitchen and office furniture increases demand for compatible adhesives with strong surface bonding. As per the Confederation of European Paper Industries, PB remains the most recycled wood panel in Europe with over 6 million tons reutilized annually reinforcing its economic and environmental appeal. This industrial scale consistent demand and regulatory adaptation sustain particle board as the primary substrate for wood adhesives in Europe.

The oriented strand board segment is expected to grow at a quickest CAGR of 10.3% during the forecast period with the OSB’s structural superiority moisture resistance and suitability for off-site construction in houtilizing and roofing applications. According to the European Panel Federation, OSB production in the EU grew by 18% in 2023, reaching 12.5 million cubic meters with significant capacity additions in Germany France and the Czech Republic. The material’s layered strand structure requires water resistant phenol formaldehyde or isocyanate adhesives that meet EN 300 Type 3 standards for exterior utilize. The EU Renovation Wave and national timber promotion policies accelerate adoption, Sweden’s Boverket mandates OSB in all public building roofs, while France’s RE2020 thermal regulation favors its utilize in wall sheathing. As per the Fraunhofer Institute for Wood Research, OSB’s carbon footprint is 30% lower than plywood creating it preferred in green building certifications like BREEAM. Additionally, rising costs of solid wood and plywood drive substitution in flooring and I joist webs. This confluence of performance sustainability and policy support positions OSB as the highest growth substrate for advanced wood adhesives in Europe.

By Product Insights

The urea formaldehyde segment was the largest by accounting for 42.3% of the Europe wood adhesives market share in 2024 due to its low cost quick curing time and strong initial bond strength in interior dry applications. According to the European Chemical Indusattempt Council, over 1.8 million metric tons of UF resins were consumed in 2023 primarily in particleboard and MDF production across Central and Eastern Europe. Despite formaldehyde concerns manufacturers have developed ultra-low emitting formulations that comply with E1 <0.1 ppm and E0 <0.05 ppm standards mandated under the EU Ecolabel and French VOC regulations. The German Federal Environment Agency reports that 85% of UF producers now utilize scavenger additives like urea or tannins to reduce free formaldehyde. Additionally, UF’s compatibility with existing press lines and minimal equipment modification necessarys ensure continued adoption in cost sensitive segments. As per the European Panel Federation UF remains the most economical resin at 0.80 to 1.20 euros per kilogram compared to 2.50 euros for polyurethane. This balance of affordability performance and regulatory adaptation sustains UF’s dominance despite competition from greener alternatives.

The polyurethane segment is projected to expand at a CAGR of 11.5% throughout the forecast period with its superior moisture resistance flexibility and suitability for structural and exterior applications including CLT glulam and OSB. According to the European Adhesive and Sealant Council, PU consumption in wood bonding grew by 24% in 2023 with Germany, Sweden, and Finland leading adoption in mass timber construction. The resin meets EN 204 D4 and EN 14080 standards for permanent outdoor exposure creating it indispensable in modern timber engineering. The EU’s Circular Economy Action Plan further boosts demand as PU enables clean debonding for panel recycling with a feature absent in thermoset UF and PF systems. Companies like Henkel and Sika have launched one component moisture curing PU adhesives that simplify application in automated lines. As per the Fraunhofer Institute, PU bonded CLT panels reveal higher shear strength than PF equivalents under cyclic humidity testing. Additionally, rising labor costs favor PU’s quick repairture properties reducing clamp time in furniture assembly.

REGIONAL ANALYSIS

Germany Wood Adhesives Market Analysis

Germany was the top performer of the Europe wood adhesives market by capturing 24.3% of share in 2024 with its position as the EU’s top producer of wood based panels furniture and engineered timber products. According to the data, over 18 million cubic meters of particleboard MDF and OSB were manufactured in 2023, requiring more than 500,000 metric tons of adhesives. The counattempt hosts global adhesive leaders like Henkel Jowat and AkzoNobel alongside major panel producers such as Pfleiderer and Kronospan, ensuring tight integration of formulation and application. Strict enforcement of the Blue Angel and E1 formaldehyde standards has accelerated adoption of low emission UF and bio hybrid resins. Additionally, Germany’s KfW houtilizing program funds timber construction projects that mandate certified structural adhesives for CLT and glulam.

Italy Wood Adhesives Market Analysis

Italy was ranked second by holding 15.3% of the Europe wood adhesives market share in 2024 with its world leading furniture manufacturing sector and strong compact enterprise network in wood processing. According to ISTAT, over 12,000 furniture companies operate in Italy, primarily in the Brianza and Friuli regions producing high value cabineattempt and upholstered goods that rely on PVA and UF adhesives. Additionally, Italy is a major MDF producer with facilities in Emilia Romagna utilizing formaldehyde scavenger technologies to comply with EU Ecolabel. The government’s “Made in Italy” sustainability initiative provides tax credits for eco adhesive adoption. This export oriented artisanal ecosystem ensures Italy remains a high volume resilient market for wood adhesives.

France Wood Adhesives Market Analysis

France wood adhesives market growth is expected to grow at a quickest CAGR during the forecast period with the aggressive green building policies strong renovation activity and centralized environmental regulations. According to France Bois Foret, over 9 million cubic meters of wood panels were produced in 2023 with OSB and CLT revealing the quickest growth due to the RE2020 thermal regulation mandating biobased materials in new construction. The mandatory Environmental and Health Declaration Sheets require full adhesive ingredient disclosure, driving transparency and reformulation. The government’s MaPrimeRenov scheme funded 1.2 million home renovations in 2024 many involving timber frame retrofits requiring structural PU adhesives.

Sweden Wood Adhesives Market Analysis

Sweden wood adhesives market growth is driven by the mass timber construction sustainable foresattempt and circular economy practices. According to the Swedish Forest Industries Federation, over 4 million cubic meters of CLT glulam and OSB were produced in 2023 primarily for public houtilizing and infrastructure projects. National building codes mandate the utilize of PEFC certified wood and adhesives with documented life cycle assessments. The Swedish Environmental Protection Agency requires all structural adhesives to be recyclable or debondable by 2027,under the national circular strategy. Leading companies like Stora Enso and Moelven invest in PU and bio -based systems that enable panel disassembly. As per the Swedish Wood Construction Network, 65% of new multi-family houtilizing utilizes timber frames bonded with high performance adhesives. Additionally, Sweden’s carbon tax of 137 euros per ton incentivizes low emission resin production.

Poland Wood Adhesives Market Analysis

Poland wood adhesives market growth is likely to grow with its role as Central Europe’s largest producer of particleboard and furniture for export. Cost sensitivity dominates purchasing decisions but EU market access necessitates compliance with E1 formaldehyde limits. The Polish Minisattempt of Development allocated 220 million euros in 2024 to modernize panel plants with low emission adhesive systems under the Just Transition Fund. Major producers like Kronospan and Pfleiderer operate large integrated facilities utilizing scavenger enhanced UF resins. Additionally, Poland’s growing domestic furniture sector serving 38 million consumers that increases demand for PVA and MUF adhesives. As per the Polish Chamber of Furniture Indusattempt exports reached 6.8 billion euros in 2023 requiring consistent adhesive quality for EU compliance.

COMPETITIVE LANDSCAPE

The Europe wood adhesives market features intense competition among multinational chemical leaders regional specialists and emerging bio-based innovators each vying for differentiation through sustainability performance and technical service. Global players like Henkel and AkzoNobel dominate through comprehensive portfolios regulatory expertise and R&D scale while niche formulators such as Jowat excel in application specific solutions and customer intimacy. The competitive landscape is increasingly shaped by environmental mandates driving rapid reformulation away from traditional urea formaldehyde toward polyurethane bio hybrids and recyclable systems. Fragmented national regulations create complexity but also opportunities for agile players who can navigate certification requirements across multiple jurisdictions. Price sensitivity remains acute in commodity segments yet premium pricing is achievable for adhesives that demonstrably enhance recyclability reduce emissions or enable structural timber innovation. Success requires balancing cost efficiency with scientific credibility and deep integration into customers’ sustainability and digital transformation journeys.

KEY MARKET PLAYERS

Some of the notable key players in the Europe wood adhesives market are

- DuPont de Nemours, Inc.

- Akzo Nobel N.V.

- 3M Company

- Henkel AG & Company, KGaA

- Ashland, Inc.

- H.B. Fuller Company

- Sika AG

- Bostik S.A. (Arkema S.A.)

- Pidilite Industries Ltd.

- Jubilant Industries Limited (Jubilant Bhartia Group)

Top Players in the Market

- Henkel is a leading force in the Europe wood adhesives market through its Technomelt and Loctite portfolios offering polyurethane hot melts reactive resins and water-based systems for furniture panel production and engineered timber. The company serves major panel producers furniture manufacturers and construction firms across the region with formulations aligned to EU Ecolabel Blue Angel and French A+ standards. Henkel has intensified its focus on sustainability by launching bio based polyurethane adhesives derived from castor oil and debondable systems for circular panel recycling. In recent years it expanded its technical service centers in Germany Poland and Sweden to support customers in reformulating away from formaldehyde-based resins. Its collaboration with the Fraunhofer Institute on recyclable adhesive technologies reinforces its role as an innovation partner in Europe’s green transition.

- AkzoNobel maintains a strong presence in the European wood adhesives market through its SABA and Resiplast brands specializing in high performance polyurethane and phenol formaldehyde systems for structural timber OSB and flooring applications. Headquartered in the Netherlands the company leverages its deep expertise in coatings and polymers to develop moisture resistant durable bonding solutions compliant with EN 300 and EN 14080 standards. AkzoNobel has prioritized circularity by investing in reversible adhesive chemistries that enable clean wood fiber recovery at finish of life. Recently, it partnered with Swedish mass timber builders to qualify low carbon PU adhesives for CLT production under Nordic Swan certification. These initiatives position AkzoNobel as a strategic enabler of sustainable construction in alignment with EU Green Deal objectives.

- Jowat is a Germany based specialist in industrial adhesives with a significant footprint in the European wood sector offering tailored formulations of polyvinyl acetate polyurethane and bio hybrid systems for furniture parquet and panel manufacturing. The company distinguishes itself through application engineering support and digital dosing solutions that optimize glue consumption and reduce VOC emissions. Jowat has accelerated its sustainability roadmap by introducing soy modified UF resins and one component moisture curing PU adhesives that meet E1 and E0 formaldehyde thresholds. It launched a smart adhesive dispensing platform integrated with Indusattempt 4.0 press lines to provide real time quality control.

Top Strategies Used by the Key Market Participants

Key players in the Europe wood adhesives market prioritize regulatory compliance by developing ultra-low emission and formaldehyde free formulations that meet EU Ecolabel Blue Angel and national VOC standards. They invest in bio based and debondable adhesive technologies to support circular economy goals and enable panel recycling. Companies expand technical service networks to assist customers in reformulating and optimizing application processes. Strategic partnerships with research institutes and timber construction firms accelerate validation of next generation bonding systems for mass timber. Additionally, firms integrate digital dosing and monitoring tools into adhesive delivery systems to reduce waste improve consistency and demonstrate compliance with tightening environmental regulations across diverse European markets.

MARKET SEGMENTATION

This research report on the European wood adhesives market has been segmented and sub-segmented based on categories.

By Application

- Furniture

- Flooring

- Houtilizing Components

- Doors & Windows

- Others

By Substrate

- Particle Board (PB)

- Solid Wood

- Oriented Strand Board (OSB)

- Plywood

- Medium-Density Fiberboard (MDF)

- High-Density Fiberboard (HDF)

- Others

By Product

- Urea-Formaldehyde (UF)

- Melamine Urea-Formaldehyde (MUF)

- Phenol-Formaldehyde (PF)

- Isocyanates

- Polyvinyl Acetate (PVA)

- Polyurethane

- Soy-based

By Counattempt

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply