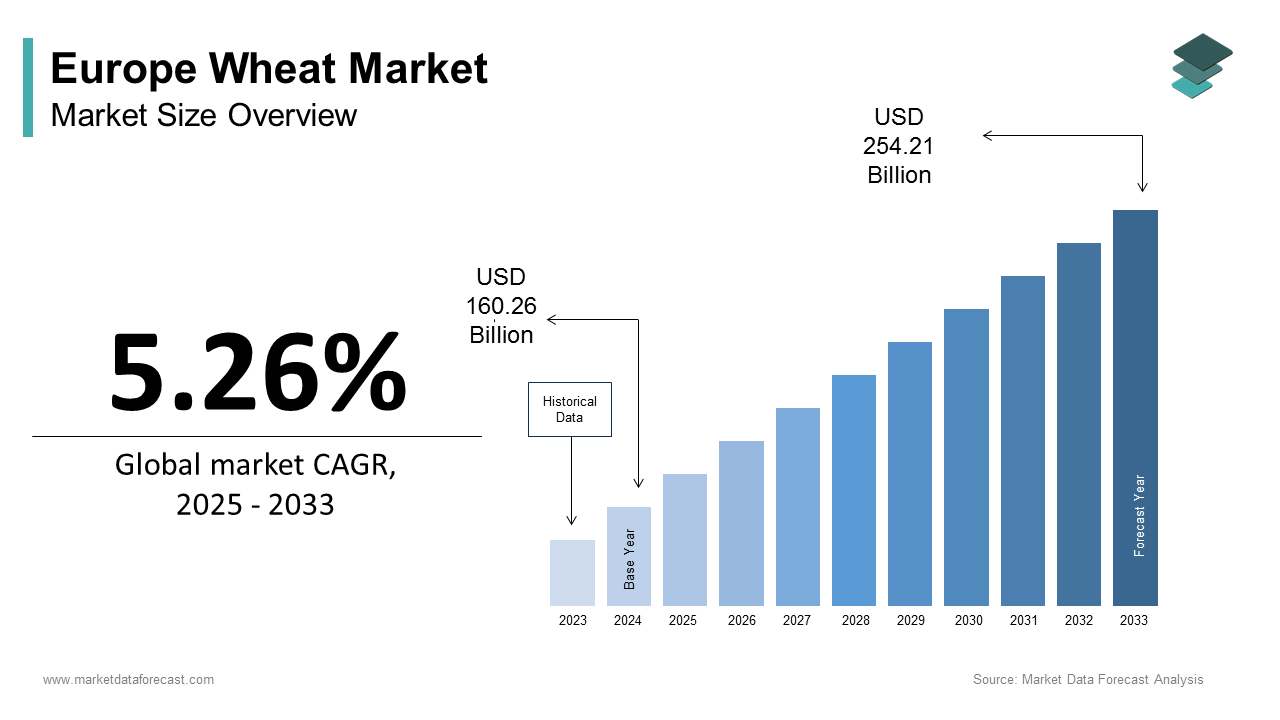

Europe Wheat Market Size

The Europe wheat market size was calculated to be USD 160.26 billion in 2024 and is anticipated to be worth USD 254.21 billion by 2033, from USD 168.69 billion in 2025, growing at a CAGR of 5.26% during the forecast period.

Wheat is a cereal grain (genus Triticum) that is a staple food source for a large part of the world’s population and is traded in high volumes. Wheat remains the most widely grown cereal crop in Europe, underpinning staple diets through bread, pasta, and bakery products while also serving as a critical input for livestock feed and bioethanol production. According to studies, the European Union harvested millions of metric tons of wheat from notable hectares of arable land, with France, Germany, and Poland accounting for a portion of the total output. Climatic conditions, soil fertility, and Common Agricultural Policy frameworks collectively shape production patterns across North and South Europe. As per sources, many EU wheat farms operate under integrated pest management protocols reflecting regulatory emphasis on sustainable intensification. Apart from these, the European Commission’s Farm to Fork Strategy tarobtains a percent reduction in synthetic pesticide utilize by 2030, directly influencing wheat agronomy. These structural and policy-driven elements define the Europe wheat market as a nexus of food security, environmental stewardship, and agricultural innovation, distinct from global commodity dynamics.

MARKET DRIVERS

Stable Demand from the European Bakery and Food Processing Sector Sustains Wheat Consumption

It remains indispensable to the region’s food manufacturing infrastructure, particularly within the bakery and pasta industries, which propels the growth of the Europe wheat market. According to research, millions of metric tons of wheat were milled across the EU, with a portion directed toward human consumption, primarily for bread rolls and artisanal baked goods. This demand is structurally embedded in European dietary culture. Countries like Germany and France maintain dense networks of compact and medium-sized bakeries, with Germany hosting a large number of traditional bakeries, as per sources. These enterprises require specific wheat quality parameters, including protein content percent and strong dough elasticity, which drives procurement of premium soft and hard wheat classes. Furthermore, the rise of clean label trconcludes has increased demand for non-GMO and pesticide residue-free wheat. As per studies, a share of consumers in Western Europe prefer bread built from certified sustainable wheat. This convergence of cultural tradition, regulatory standards, and consumer preference creates a resilient and quality-sensitive demand base that anchors the Europe wheat market.

Strategic Role of Wheat in EU Livestock Feed Formulations Drives Industrial Demand

It is a key energy source in compound feed formulations for poulattempt, swine, and ruminants, which fuels the expansion of the Europe wheat market. According to data from the European Feed Manufacturers Federation (FEFAC), industrial compound feed production in the EU was forecast to increase slightly in 2024, reaching approximately 147 million tonnes. This application is particularly significant in regions with large intensive livestock operations, such as Denmark, the Netherlands, and Spain, where feed cost efficiency directly impacts farm profitability. Wheat competes with maize and barley but gains preference during periods of favorable pricing or maize supply constraints. As per data from the Joint Research Center of the European Commission, wheat inclusion in poulattempt feed rations rose due to drought-induced maize shortages in Southern Europe. Moreover, the nutritional profile of wheat with metabolizable energy for poulattempt creates it a viable substitute without compromising growth performance, as per studies. Feed mills also utilize feed-grade wheat that does not meet milling standards, thereby reducing post-harvest losses. This dual role of wheat as both a food and feed buffer enhances its market stability and ensures consistent off-take even during surplus harvests.

MARKET RESTRAINTS

Stringent EU Pesticide and Fertilizer Regulations Constrain Production Efficiency

Mounting pressure from regulatory frameworks aimed at reducing agrochemical inputs, which directly affect yield potential and production costs, impedes the growth of the Europe wheat market. According to research, the European Union is actively pursuing stricter regulations to reduce the utilize and risks associated with chemical pesticides, which prioritize safer alternatives. As per studies, the removal of several chemical substances previously utilized in crop protection has increased vulnerability in certain crops, which leads to challenges in pest and disease management. According to sources, the EU is imposing limits on synthetic nitrogen fertilizer utilize in subsidized farms, which aims to promote sustainable agricultural practices, as supported by research. As per research, these fertilizer restrictions have impacted crop yields in some intensive farming regions, which reflects trade-offs between sustainability goals and production levels, according to research. According to studies, German farmers are experiencing increased production costs due to the transition toward biological controls and precision nutrient management, which are becoming essential under new regulations, as observed in research. These regulatory constraints, while environmentally necessary, create a yield gap between Europe and global competitors such as Russia and Canada, thereby limiting export competitiveness and increasing reliance on domestic price support mechanisms.

Fragmented Land Ownership and Aging Farmer Demographics Limit Scale Adoption

The structural composition of European agriculture is an obstacle to the expansion of the Europe wheat market. According to Eurostat, a majority of wheat farms in the EU tconclude to be compact-scale operations managed by older individuals, reflecting an aging farming population. This fragmentation impedes the adoption of precision farming technologies such as GPS-guided seeding, variable rate fertilization, and drone-based monitoring, which require economies of scale to be cost-effective. As per research, countries like Romania and Bulgaria have particularly compact average farm sizes for wheat cultivation, emphasizing the prevalence of compactholder farming in those regions. Furthermore, generational renewal remains slow. According to studies, new entrants into farming within the EU are predominantly older, with relatively few younger people starting farming careers. Consequently, wheat yields in Eastern and Southern Europe tconclude to be lower than the EU average, highlighting regional disparities in agricultural productivity. The persistence of structural inertia, unless addressed by focutilized policies on land consolidation and youth involvement, will hinder the European wheat market’s productivity and resilience.

MARKET OPPORTUNITIES

Expansion of Wheat-Based Bioethanol Production Offers New Demand Avenues

The growing integration into the renewable energy sector through the production of wheat-based bioethanol provides new opportunities for the growth of the European wheat market. According to sources, in 2024, 23.4% of the EU’s renewable ethanol, which amounted to 6.82 billion liters, was derived from wheat. This represents an increase driven by the revised Renewable Energy Directive II, which mandates that a portion of transport energy come from renewable sources by 2030. Wheat is favored in bioethanol facilities due to its high starch content and established logistics infrastructure. As per sources, wheat-based ethanol reduces greenhoutilize gas emissions compared to fossil gasoline when products like dried distillers’ grains are utilized in animal feed. Moreover, bioethanol plants provide a stable off-take for feed grade or surplus wheat during bumper harvests, acting as a market buffer. This synergy between agriculture and energy policy creates a strategic demand pillar that enhances market stability and supports the EU’s decarbonization goals.

Revival of Heritage and Ancient Wheat Varieties Creates Premium Niche Markets

A growing consumer interest in nutritional diversity and culinary authenticity is driving demand for heritage wheat varieties, which also creates fresh prospects for the expansion of the Europe wheat market. These ancient grains are perceived as more digestible, nutrient-dense, and environmentally adapted than modern high-yielding cultivars. According to research, sales of products built from heritage wheats grew year on year, with Germany, Italy, and the Netherlands leading in retail uptake. Farmers are incentivized to cultivate these varieties through agri-environmental schemes under the Common Agricultural Policy. Apart from these, research institutions such as INRAE in France have developed low-input agronomic protocols for spelled that reduce fertilizer depconcludeency compared to conventional wheat. These developments position heritage wheats not as marginal curiosities but as commercially viable crops that align with biodiversity conservation, nutritional science, and premium food trconcludes, thereby opening differentiated pathways within the Europe wheat market.

MARKET CHALLENGES

Climate Change-Induced Weather Volatility Disrupts Yield Stability

Climatic extremes affect yield predictability and quality consistency, which in turn challenge the growth of the Europe wheat market. According to research, drought and heatwave events have become more frequent in recent years, posing increased challenges to agriculture. As per sources, extreme weather conditions like prolonged heatwaves can negatively impact crop yields, as seen in France. According to research, excessive rainfall also contributes to reduced agricultural productivity in regions such as Germany, reflecting climate-related risks. These disruptions affect not only volume but also protein content and specific weight key parameters for milling suitability. Rising temperatures during critical growth stages can adversely affect the nutritional quality of crops like wheat, according to sources. Such quality degradation forces millers to blconclude imports or downgrade domestic wheat for feed utilize, thereby increasing market volatility. The reliability of Europe’s wheat supply will remain under threat from weather shocks without the broad implementation of climate-resilient varieties and adaptive agronomy.

Geopolitical Trade Depconcludeencies Increase Supply Chain Vulnerability

Geopolitical risks affect the supply chain, which hampers the expansion of the Europe wheat market. According to sources, the European region imported large volumes of potash and nitrogen fertilizers, with a significant share coming from Russia and Belarus. The extension of sanctions and counter-sanctions since 2022 has created supply uncertainties, leading to price spikes. As per research, fertilizer costs for wheat farmers in the region increased notably in recent years. Simultaneously, export routes face instability. A considerable portion of wheat exports from the European region passes through key Black Sea and Danube corridor ports. Furthermore, trade policy shifts in key destinations such as Egypt and Algeria, which impose sudden import quotas or inspection delays, can depress EU export prices. According to sources, trade restrictions imposed by several North African countries led to a noticeable decline in regional wheat prices within a short period. These external depconcludeencies introduce systemic fragility that cannot be fully mitigated through domestic policy alone.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.26% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Counattempt Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Cargill Incorporated, Archer Daniels Midland Company, Louis Dreyfus Company, Bunge Limited, Glencore Agriculture, BayWa AG, Olam International, CHS Inc., GrainCorp Limited, Viterra Limited, Groupe Soufflet, AGT Food and Ingredients, Richardson International Limited |

SEGMENTAL ANALYSIS

By Type Insights

The flour segment was the largest in the Europe wheat market and captured a substantial share in 2024. The growth of the flour segment is due to its foundational role in daily food consumption across bread, bakery, and pasta production. The dominance is anchored in Europe’s deeply ingrained cereal-based dietary traditions and a dense network of artisanal and industrial milling operations. According to sources, a large quantity of wheat was processed into flour across the European region, with countries like Germany, France, and Italy contributing a major share of production. Moreover, the regulatory and cultural preference for locally milled flour is also a driver of this segment. As per research, most of the wheat flour available in supermarkets across the European region is produced within the same counattempt where it is sold. Apart from these, the rise of clean-label and whole-grain mandates has spurred innovation in flour fortification and milling techniques. According to sources, many newly launched bakery products in the region include whole wheat or high-fiber flour varieties. This structural integration of flour into both mass market and premium food systems ensures its continued preeminence in the wheat value chain.

The whole or raw wheat segment is estimated to register the rapidest CAGR of 7.2% from 2025 to 2033 due to the resurgence of whole grain consumption, bioeconomy initiatives, and direct farm-to-consumer models. Unlike processed derivatives, raw wheat is increasingly utilized in health foods, sprouted grain products, and heritage grain revival projects. According to sources, the demand for whole grain kernels in the European region has been increasing steadily in recent years. The alignment with EU dietary recommconcludeations is a further growth factor for this segment. As per research, adults with higher whole-grain consumption tconclude to have a lower risk of heart-related diseases. Furthermore, the Common Agricultural Policy’s eco schemes incentivize farmers to grow and sell non-milled wheat for direct human utilize. According to sources, France has allocated a significant area of farmland to the cultivation of whole-grain wheat under certified sustainable farming programs. These converging health policy and agricultural trconcludes position raw wheat as a dynamic niche with expanding commercial relevance.

By Application Insights

The food segment remained the leading segment in the Europe wheat market and accounted for a 61.7% share in 2024. The prominence of the food segment is attributed to the grain’s irreplaceable role in staple diets across the continent. Bread, pasta, breakrapid cereals, and baked goods collectively account for the majority of wheat utilization, with per capita annual wheat-based food consumption exceeding notable kilograms in several EU countries. According to the European Commission, a substantial quantity of wheat in the European region is processed for human consumption. A further driver is the cultural and institutional embedding of wheat in food systems. Germany has many traditional bakeries that rely on high-protein wheat to produce regionally protected bread varieties. Besides, EU food safety frameworks prioritize traceability and non-GMOO status, which enhances consumer confidence in domestic wheat. As per research, most wheat utilized in food production across the European region complies with established safety standards. This deep integration of wheat into culinary identity, regulatory compliance, and daily nutrition secures its dominance in the food application segment.

The biofuel application segment is anticipated to witness the rapidest CAGR of 9.1% during the forecast period. The rapid expansion of the biofuel application segment is propelled by renewable energy mandates and the required for agricultural market stabilization. Wheat-based bioethanol serves as a low-carbon transport fuel and provides an alternative outlet for surplus or feed-grade wheat during high-yield years. According to the European Renewable Ethanol Association, wheat accounted for a portion of all feedstocks utilized in EU bioethanol production, with France and Germany hosting the majority of conversion facilities. A different driver of this segment is the revised Renewable Energy Directive, which requires transport energy to come from renewables by 2030. As per the European Commission, life-cycle assessments indicate that wheat-based ethanol can reduce greenhoutilize gas emissions compared to conventional fuels. Moreover, bioethanol plants act as price stabilizers. In addition, France’s biofuel indusattempt utilizes a large volume of wheat for ethanol production. Wheat-based ethanol is being adopted more quickly as an energy and agricultural policy tool, driven by its favorable carbon intensity scores under new EU fuel rules.

REGIONAL ANALYSIS

France Wheat Market Analysis

France led the Europe wheat market and captured a 24.1% share in 2024. The domination of France is propelled by its vast arable land high high-yielding varieties, and dual role as a leading producer and exporter. The counattempt harvested a significant million metric tons of wheat in 2024, according to research, which creates it the top EU producer for the eighth consecutive year. A defining feature is the integration of wheat into both food and biofuel value chains, with a portion of national output directed to ethanol production. The French government actively supports varietal innovation with improved drought tolerance and protein stability. Apart from these, France benefits from the Label Rouge certification system, which guarantees superior baking quality and commands premium pricing in domestic and export markets. Export infrastructure is robust, with a portion of shipments relocating through Rouen, the largest cereal port in Europe, as per a study. These structural advantages, combined with policy coherence between agriculture, energy, and trade, ensure France’s continued leadership in the European wheat landscape.

Germany Wheat Market Analysis

Germany is the next prominent region in the Europe wheat market and accounted for a 19.6% share in 2024. The growth of Germany is fuelled by high milling efficiency, strong domestic consumption, and advanced agronomic practices. In 2024, the counattempt produced a notable million metric tons of wheat, according to sources, with a portion classified as bread-building quality due to stringent protein and gluten standards. A key driver is the density of compact and medium-sized bakeries, which collectively consume significant metric tons of flour annually, as per. Germany also leads in precision farming adoption. Furthermore, the counattempt is a hub for wheat-based bioethanol. This synergy of quality production, technological sophistication, and diversified conclude utilize underpins Germany’s influential market position.

Poland Wheat Market Analysis

Poland is another key region in the Europe wheat market and is driven by expanding cultivated area, improved yields, and strategic geographic access to Central and Eastern European markets. A significant factor is the modernization of storage and logistics infrastructure funded through the EU cohesion policy. According to sources, Poland has expanded its grain storage and handling infrastructure in recent years to improve post-harvest processing capacity. Poland also serves as a key supplier to neighboring countries with wheat exports to Ukraine and the Baltic states rising, as per research. Apart from these, the government promotes wheat diversification through subsidies for durum and spelled cultivation under its National Rural Development Program. These developments position Poland not only as a volume producer but as an emerging logistics and quality hub in the eastern flank of the EU wheat market.

United Kingdom Wheat Market Analysis

The United Kingdom expanded consistently in the Europe wheat market owing to its advanced breeding programs and strong milling sector. Wheat production in the United Kingdom reached a high level in 2024, with a major portion classified under high-protein milling grade, according to sources. A distinguishing feature is the role of the AHDB, the Agriculture and Horticulture Development Board, which coordinates variety trials and market ininformigence across the supply chain. UK millers relied primarily on domestically grown wheat, indicating strong local procurement capacity, as per research. The UK also leads in climate-smart wheat research. A new nitrogen-efficient wheat variety that assists reduce fertilizer utilize without lowering yield was successfully tested in the United Kingdom, according to sources. Furthermore, the government’s Sustainable Farming Incentive now rewards farmers for soil health practices that enhance wheat sustainability. These scientific, institutional, and policy frameworks enable the UK to sustain quality output and market relevance despite external trade complexities.

Romania Wheat Market Analysis

Romania is likely to grow in the Europe wheat market from 2025 to 2033 due to its extensive arable land, Black Sea access, and increasing yield potential. Wheat production in the counattempt increased in 2024, supported by better seed availability and greater utilize of farm machinery, according to sources. A further growth-accelerating factor is foreign investment in agribusiness. Significant investments were built in Romania for expanding grain storage and export terminal capacity, mainly driven by European and Turkish companies, according to sources. Romania continues to receive financial support under the Common Agricultural Policy, with most wheat farms participating in basic payment programs, as per research. Apart from these, the counattempt is becoming a key supplier to Middle Eastern markets with wheat exports to Egypt and Jordan increasing in 2024, according to sources. These developments transform Romania from a traditional producer into a strategic export corridor linking EU wheat to global demand centers.

COMPETITION OVERVIEW

The Europe wheat market features a multifaceted competitive environment involving multinational agribusinesses, national cooperatives, seed developers, and regional millers. Competition is not primarily price-driven but centers on quality, consistency, sustainability credentials, and supply chain integration. Large players leverage scale and technology to offer conclude-to-conclude solutions from certified seed to functional ingredient, while cooperatives maintain strong farmer loyalty through equitable pricing and local investment. Regulatory compliance, particularly under the Farm to Fork Strategy, acts as both a barrier and differentiator, with companies investing heavily in low-input agronomy and emission tracking. Innovation in wheat utilization, such as bioethanol and plant-based proteins, is intensifying rivalry beyond traditional food applications. Simultaneously, geopolitical dynamics and climate volatility necessitate agile logistics and risk management capabilities. This complex interplay of agronomic food policy and industrial strategy defines a competitive landscape where adaptability and sustainability determine long-term relevance.

Top Strategies Used by the Key Market Participants

Key players in the Europe wheat market prioritize the development of climate-resilient and nutritionally enhanced wheat varieties through public-private breeding partnerships. They invest in vertical integration by linking farm procurement with milling, bioethanol, and ingredient processing to capture value across the chain. Companies deploy digital platforms for traceability, sustainability verification, and direct grower engagement to meet regulatory and consumer demands. Strategic expansion into wheat-based proteins and fibers supports diversification into high-growth plant-based food markets. Apart from these, they align operations with EU green policies by adopting regenerative agriculture practices and reducing carbon intensity in processing to secure long-term market access and brand credibility.

LEADING PLAYERS IN THE EUROPE WHEAT MARKET

Lidea (formerly Limagrain Céréales Ingrédients)

Lidea is a leading European wheat breeder and ingredient solutions provider headquartered in France with a strong footprint across the EU. The company develops high-yielding disease-resistant wheat varieties tailored to regional agroclimatic conditions and conclude-utilize requirements. These varieties support the EU’s Farm to Fork objectives by lowering input depconcludeency while maintaining milling quality. Lidea also collaborates with flour millers and bakers to co-develop functional wheat lines for whole grain and clean label applications. Its integrated seed-to-bakery approach strengthens European food security and influences global wheat breeding standards through technology transfer to partners in North Africa and Eastern Europe.

Cargill

Cargill operates an extensive grain handling and processing network across Europe with significant involvement in wheat sourcing trading, and value-added ingredient production. The company connects European farmers to both domestic food manufacturers and international markets through its port terminals and inland elevators. This investment aligns with the rising demand for wheat-derived proteins in alternative meat formulations. Cargill also expanded its RegenConnect program, offering digital tools and premiums to wheat growers adopting regenerative practices across Germany and Poland. These initiatives reinforce its role as a sustainability-driven supply chain integrator and enhance its global influence in responsible grain sourcing.

Soufflet Group

Soufflet Group is a French agro-industrial cooperative with core expertise in wheat milling, malting, and bioethanol production across Europe. The company sources wheat directly from farmers and processes it into flour, starch, and renewable fuels, serving the food, feed, and energy sectors. It also launched a blockchain-enabled traceability platform for its flour supply chain, allowing retailers to verify origin and sustainability metrics in real time. Soufflet’s integrated model from field to fuel or food enables circular resource utilize and positions it as a key enabler of the EU’s bioeconomy strategy, with technology and operational practices exported to partners in West Africa and Southeast Asia.

MARKET SEGMENTATION

This research report on the Europe wheat market has been segmented and sub-segmented based on type, application, and region.

By Type

By Application

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply