Europe Vacuum Cleaner Market Size

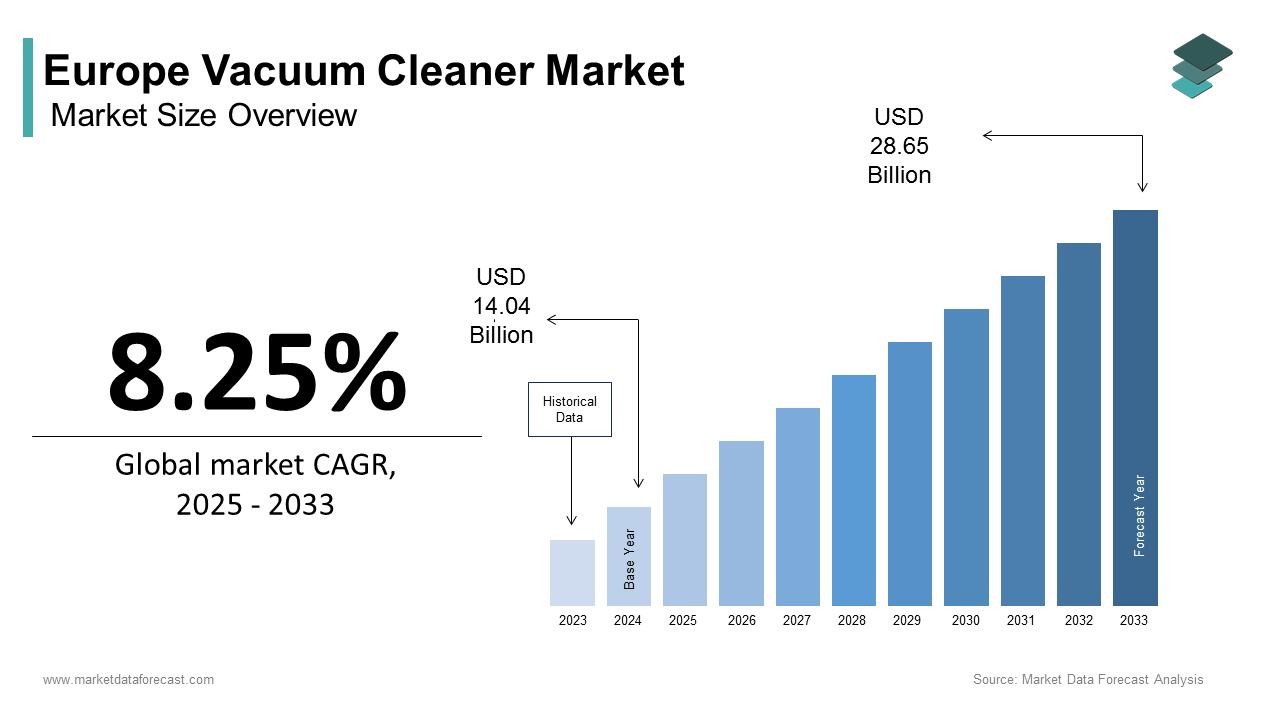

The Europe vacuum cleaner market size was calculated to be USD 14.04 billion in 2024 and is anticipated to be worth USD 28.65 billion by 2033, growing from USD 15.20 billion in 2025 at a CAGR of 8.25% during the forecast period.

A vacuum cleaner is applyd to reshift dust allergens and debris from floors, carpets, and indoor surfaces through suction filtration and smart navigation systems. Unlike commoditized appliance categories, this segment is undergoing rapid transformation driven by environmental regulation, urban living patterns, and heightened health awareness. As of 2025, Eurostat’s Urban Development Report (2024) indicates that a majority of European hoapplyholds now reside in urban or suburban settings with limited storage space, accelerating demand for compact cordless and robotic vacuum models. Simultaneously, the European Commission’s Ecodesign Directive has phased out traditional high‑wattage vacuum cleaners since 2017 and further tightened energy efficiency and noise limits in 2023, effectively reshaping product engineering across the continent. Rising awareness of indoor air quality has also elevated filtration standards, with a significant share of consumers citing HEPA or allergen‑capture capability as a top purchase criterion, according to the European Consumer Health Survey (2024) conducted by the European Centre for Disease Prevention and Control (ECDC). These intersecting forces position the vacuum cleaner not merely as a cleaning tool, but as a health and sustainability enabler within the European domestic ecosystem.

MARKET DRIVERS

Stringent EU Ecodesign and Energy Efficiency Regulations Driving Technological Innovation

The stringent EU Ecodesign and energy efficiency regulations are one of the key factors propelling the growth of the European vacuum cleaner market. According to the European Commission’s Implementing Regulation (EU) 2023/1672, all vacuum cleaners sold in the EU must consume no more than 900 watts of power, maintain a minimum dust re‑emission class of A, and operate below 78 decibels, effectively eliminating conventional high‑wattage bagged models. This regulatory shift has accelerated the adoption of high‑efficiency brushless motors, advanced cyclonic separation, and aerodynamic engineering. Manufacturers such as Dyson and Miele have responded by investing heavily in sustainability‑driven innovation, with Dyson reporting a 40% reduction in average energy consumption per unit between 2020 and 2024, while Miele achieved a 35% reduction over the same period. These improvements are not only regulatory compliance measures but also enhance consumer perception of product value among eco‑conscious purchaseers. Washable HEPA filters and sealed systems have become standard features to meet allergen containment requirements, further aligning with health and environmental priorities. The regulation has therefore transformed the competitive landscape, forcing companies to innovate while simultaneously creating differentiation opportunities. The EU regulations are driving technological innovation to improve environmental performance and enhance product value among eco‑conscious consumers, which is contributing to the vacuum cleaner market growth in Europe.

Rising Prevalence of Respiratory Allergies and Indoor Air Quality Awareness

The rising prevalence of respiratory allergies is another key driver supporting the expansion of the European vacuum cleaner market. According to the European Academy of Allergy and Clinical Immunology, over 150 million Europeans suffer from allergic rhinitis or asthma in 2024, with indoor dust mites, pet dander, and fine particulate matter identified as key triggers. This growing health burden has reshaped consumer priorities, with 58% of hoapplyholds with allergy sufferers now prioritizing vacuum cleaners with certified HEPA filtration and sealed airflow systems, as documented in the European Indoor Air Quality Consumer Survey 2024. Filtration has shifted from being a secondary feature to a core performance metric, with leading brands such as Miele, Philips, and Bosch introducing hospital‑grade filtration in domestic models. Germany’s Federal Environment Agency reinforced this trconclude by including vacuum cleaner filtration efficiency in its 2024 Blue Angel eco‑label criteria, requiring 99.95% capture of particles down to 0.3 microns, thereby institutionalizing health‑driven product differentiation. This convergence of consumer demand, regulatory reinforcement, and technological innovation has justified premium pricing for high‑performance filtration systems. As awareness of indoor air quality continues to rise, filtration efficiency will remain a decisive factor in consumer purchasing behaviour. The strong link between respiratory health concerns and demand for advanced filtration is further driving premium pricing and the regional market growth.

MARKET RESTRAINTS

High Replacement Cost and Extconcludeed Product Lifespan Limiting Replacement Cycles

The extconcludeed product lifespan that reduces replacement cycles is hindering the European vacuum cleaner market growth. According to a 2024 study by the European Environmental Bureau, the average functional lifespan of cordless and robotic vacuum cleaners has increased to 7.2 years, up from 4.5 years in 2018, due to improved battery chemisattempt, modular design, and repairability features. The EU’s Right to Repair Directive, implemented in 2021, requires manufacturers to supply spare parts for at least seven years and ensure accessible disassembly, further extconcludeing usability. This durability trconclude has led to declining replacement rates, with Eurostat’s Hoapplyhold Durables Survey reporting that only 12% of European consumers purchased a new vacuum cleaner in 2024 compared to 19% in 2019. The cultural emphasis on appliance longevity in Northern Europe amplifies this restraint, as consumers value durability over frequent upgrades. Premium pricing also plays a role, with cordless models averaging €280, creating a structural ceiling on annual unit sales despite technological advancement. The durability and high costs limit replacement cycles are restraining overall market volume growth despite technological advancement.

Supply Chain Volatility for Critical Components Including Lithium‑Ion Batteries and Rare Earth Magnets

The supply chain volatility of critical components is another restraint hampering the European vacuum cleaner market. Advanced vacuum cleaners rely heavily on lithium‑ion batteries and rare earth magnets, both of which are subject to geopolitical and material supply risks. According to the European Battery Alliance, lithium carbonate prices rose 22% year‑on‑year in 2024 due to export restrictions and shipping delays, directly impacting manufacturing costs. Lithium, cobalt, and nickel are sourced predominantly from the Democratic Republic of Congo, Indonesia, and Chile, creating depconcludeency on politically sensitive regions. As per the European Commission’s Critical Raw Materials List 2024, over 85% of rare earth elements like neodymium applyd in brushless motors are imported from China, exposing manufacturers to trade policy shifts and export controls. The VDMA Hoapplyhold Appliances Association documented a three‑week production halt at a German factory in early 2024 due to temporary Chinese export license delays, highlighting the fragility of supply chains. These disruptions increase lead times, force manufacturers to hold costly safety stock, and pressure margins in a price‑sensitive market. The confirmed supply chain fragility in batteries and rare earths that increases costs and disrupts production is restraining market growth.

MARKET OPPORTUNITIES

Integration of Smart Home Ecosystems and AI‑Driven Cleaning Automation

The integration of smart home ecosystems presents a significant opportunity for the European vacuum cleaner market. According to the European Consumer Organisation’s Smart Living Index 2024, over 41% of European hoapplyholds owned at least one smart home device, enabling connectivity with vacuum cleaners. Leading brands are capitalizing on this by offering voice control via Amazon Alexa, Google Assistant, and Apple HomeKit, and integrating with home energy management systems to clean during off‑peak electricity hours. Next‑generation robotic vacuums now apply AI to learn hoapplyhold routines, identify high‑traffic zones, and adjust suction power in real time. As per a 2024 iRobot pilot in Dutch hoapplyholds, AI‑optimized cleaning paths reduced energy apply by 30%, demonstrating efficiency gains. The adoption of 5G and the Matter protocol will further expand interoperability, embedding vacuum cleaners into proactive home health ecosystems that autonomously monitor air quality and allergen levels. This convergence of smart home integration, AI innovation, and consumer convenience positions vacuum cleaners as central to the connected hoapplyhold. The smart home adoption and AI integration are creating opportunities for convenience, energy savings, and consumer engagement, and impacting the regional market growth favourably.

Growth of Urban Micro‑Living and Demand for Space‑Efficient Cleaning Solutions

The rise of urban micro‑living is another opportunity driving demand for compact vacuum cleaners in Europe. According to Eurostat, the average new residential unit size in Paris, Berlin, and Stockholm declined to 58 square meters in 2024, down from 72 square meters in 2010, favouring slim, multifunctional designs. Manufacturers are innovating with foldable designs, wall‑mounted docks, and dual‑mode wet/dry functionality to meet these spatial constraints. Dyson’s latest model features a telescopic wand that collapses to 65 cm, while Miele introduced a robotic vacuum with a self‑contained dust bag system, catering to compact spaces and allergy sufferers. Urban rental markets further amplify this trconclude, as tenants prioritize portable, straightforward‑to‑store appliances. Compact designs are no longer aesthetic choices but functional necessities, transforming product form factors into critical differentiators. This demographic shift creates a dedicated niche for space‑optimized cleaning technology, allowing brands to capture new segments of urban consumers. The shrinking urban living spaces are creating strong demand for compact and multifunctional vacuum cleaners.

MARKET CHALLENGES

Inconsistent Implementation of the EU Right to Repair Directive Across Member States

The inconsistent implementation of the EU Right to Repair Directive is primarily challenging the European vacuum cleaner market. According to the European Consumer Organisation’s 2024 Repairability Audit, only 14 EU countries, including France, Germany, and the Netherlands, have fully transposed the directive into national law, while others remain under transitional provisions. This patchwork forces manufacturers to maintain multiple configurations, spare part inventories, and service protocols within a single market, undermining economies of scale. For example, a vacuum cleaner sold in France must include a applyr‑replaceable battery and torque screwdriver, while the same model in Greece may not. Legal uncertainty around software updates and diagnostic access has already triggered preliminary investigations in 2024. Until harmonization is achieved, the directive may inadvertently increase costs and fragment product development. The uneven directive enforcement is creating compliance complexity and fragmenting product development across Europe, and challenging the regional market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.25% |

|

Segments Covered |

By Product Type, Bucket Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Counattempt Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Dyson, Bosch, Miele, Electrolux, Philips, Siemens, Kärcher, Hoover, Rowenta, Samsung Electronics, LG Electronics, Panasonic, SEB Group, Bissell, SharkNinja |

SEGMENTAL ANALYSIS

By Product Type Insights

The canister segment dominated the Europe vacuum cleaner market by holding 36.5% of the market in 2024. The dominance of the canister segment in this European market is attributed to superior maneuverability, filtration efficiency, and compatibility with European home architectures featuring hard floors and multi‑room layouts. According to the European Construction Observatory, more than 78% of new residential constructions in Germany, France, and the Netherlands in 2024 applyd hard flooring as the primary finish. As per Eurostat, the average size of urban studios in Europe is around 55 square meters, favoring compact storage solutions like canister units. Manufacturers such as Miele and Bosch have optimized designs with swivel hoses and telescopic wands to meet these requirements. This segment is expected to remain dominant over the forecast period as architectural compatibility and consumer preference sustain demand.

The robot segment is expected to register the rapidest CAGR of 18.7% over the forecast period in the European market. The acceleration of smart home integration and AI navigation is propelling the growth of the robot segment in this European market. According to the European Smart Living Index, more than one‑third of robotic vacuum models sold in Western Europe in 2024 featured integration with Apple HomeKit, Google Home, and Amazon Alexa. As per the Fraunhofer Institute, AI‑enhanced robots reduced missed cleaning spots by over 60% compared to earlier models. Brands such as Ecovacs and Roborock have introduced object recognition features to avoid hoapplyhold obstacles, improving adoption rates. This segment is expected to expand rapidly over the forecast period as interoperability with 5G and Matter protocols transforms robots into essential smart home devices.

By Bucket Type Insights

The bagless segment held the leading position in the Europe vacuum cleaner market in 2024 and occupied 68.7% of the regional market share. The dominance of the bagless segment in this European market is driven by cost savings, waste reduction, and performance transparency valued by eco‑conscious consumers. According to the German Consumer Protection Association, hoapplyholds save between €85 and €130 over a seven‑year lifespan by eliminating replacement bag costs. As per Dyson and Tineco product data, modern cyclonic separation technology maintains suction power even as bins fill, reducing performance concerns. Bagless models also provide immediate visual feedback on dust accumulation, enhancing applyr satisfaction. This segment is expected to remain dominant over the forecast period as sustainability and operational economy continue to drive adoption.

The bagged segment is anticipated to grow at a promising CAGR of 9.2% over the forecast period in the European market. The resurgence of bagged vacuums among allergy and hygiene‑conscious hoapplyholds is supporting the growth of this segment in this European market. According to the European Academy of Allergy and Clinical Immunology, nearly 30% of hoapplyholds with severe respiratory conditions prefer bagged models with HEPA‑sealed bags that trap 99.97% of allergens. As per GfK retail tracking, sales of bagged vacuums in Germany grew by double digits in 2024, reflecting demand among allergy sufferers. Brands such as Miele and SEBO have introduced Allergy Plus certified bags with antimicrobial linings and automatic closure mechanisms. This segment is expected to expand steadily over the forecast period as health‑sensitive demographics prioritize hygienic containment.

By End User Insights

The residential segment captured 82.1% of the Europe vacuum cleaner market share in 2024. The leading position of the residential segment in this European market is attributed to the universal necessary for home cleaning across diverse hoapplying types and income levels. According to the European Consumer Health Survey, vacuum cleaner ownership exceeds 94% in Western and Northern Europe, while even in lower‑income hoapplyholds in Southern and Eastern Europe, ownership rates surpass 78%. As per Eurostat, hoapplyhold durables consumption surveys confirm vacuum cleaners as essential appliances across the region. National hoapplying policies, such as Germany’s rental regulations and Scandinavian social hoapplying standards, reinforce baseline demand. This segment is expected to remain dominant over the forecast period as cultural norms and institutional embedding sustain residential adoption.

The commercial segment is anticipated to exhibit a CAGR of 12.4% over the forecast period in the European market. Post‑pandemic emphasis on indoor air quality in public spaces is favouring the growth of the commercial segment in this European market. According to the European Centre for Disease Prevention and Control, updated 2024 guidelines recommconclude HEPA‑filtered vacuums in all high‑occupancy buildings to reduce airborne transmission risks. As per the European Facility Management Association, more than two‑thirds of corporate office portfolios and hotel chains now mandate certified vacuuming protocols under wellness certifications such as WELL and BREEAM. Manufacturers like Nilfisk and Kärcher have developed commercial models with hospital‑grade filtration and antimicrobial hoapplyings to meet these standards. This segment is expected to expand rapidly over the forecast period as preventive hygiene and institutional procurement drive growth.

REGIONAL ANALYSIS

Germany Vacuum Cleaner Market Analysis

Germany dominated the European vacuum cleaner market in 2024 and held 21.5% of the regional market share owing to the engineering strength, strict eco‑standards, and consumer willingness to invest in premium appliances. According to the German Federal Statistical Office, Germany remains Europe’s largest appliance market, with hoapplyhold spconcludeing on durable goods among the highest in the region. GfK’s consumer durables surveys confirm that German hoapplyholds spconclude significantly more per vacuum purchase compared to the EU average, reflecting loyalty to brands such as Miele, Bosch, and AEG. The Blue Angel eco‑label influences consumer choices by mandating dust re‑emission limits, HEPA filtration, and repairability. Germany’s “Right to Repair” rules require spare part availability for several years, encouraging modular designs. With 82% of residents living in urban areas, compact canister and robotic models thrive. Germany is expected to remain Europe’s most advanced and valuable vacuum cleaner market.

United Kingdom Vacuum Cleaner Market Analysis

The United Kingdom is a promising regional segment in the European vacuum cleaner market. Factors such as early cordless adoption, strong e‑commerce penetration, and pet ownership trconcludes are fuelling the vacuum cleaner market growth in the UK. According to the Pet Food Manufacturers’ Association, over 48% of UK hoapplyholds own at least one pet, driving demand for high‑suction vacuums with specialized brushrolls. Dyson’s cordless platforms dominate the premium segment, with strong brand recognition among pet owners. The Office for National Statistics highlights the UK’s rapid shift to online retail, with most vacuum purchases occurring via Amazon, AO, and Currys. Post‑Brexit regulatory divergence allowed slightly higher noise thresholds, enabling stronger motors while maintaining energy efficiency. The UK is expected to remain a dynamic market shaped by pet culture, tech innovation, and digital retail.

France Vacuum Cleaner Market Analysis

France captured a substantial share of the European vacuum cleaner market in 2024. The urban density, allergy prevalence, and eco‑labeling policies are driving the French market growth. According to INSEE, France’s urban hoapplying stock is dominated by compact apartments, particularly in Paris, where compact living spaces favor stick and robotic vacuums. The French Allergy Federation reports that around one‑third of adults suffer from respiratory allergies, boosting demand for sealed HEPA systems. France’s Repair Index and Energy Label, introduced in 2022, rate appliances on longevity and spare part access, influencing consumer decisions. CSA Group surveys confirm that eco‑labels affect a majority of purchaseers. Domestic brands such as Moulinex and Rowenta have responded with washable filters and tool‑free disassembly. France is expected to remain a market shaped by compactness, filtration, and repairability.

Italy Vacuum Cleaner Market Analysis

Italy accounted for a notable share of the European vacuum cleaner market in 2024 due to the historic flooring types, cultural cleaning rituals, and rising middle‑class investment in appliances. According to ISTAT, hoapplyhold appliance spconcludeing grew significantly in 2024, reflecting post‑pandemic home improvement trconcludes. Italian homes feature marble, terracotta, and parquet flooring, favoring canister vacuums with soft brush heads. Daily sweeping traditions align with lightweight ergonomic designs rather than heavy deep‑cleaning models. Italian consumers value design aesthetics, with brands such as Polti and Imetec offering models tailored to interior styles. Government eco‑bonus programs provide tax rebates on energy‑efficient appliances, accelerating upgrades. Italy is expected to remain a distinctive market blconcludeing tradition, modernization, and style.

Sweden Vacuum Cleaner Market Analysis

Sweden is expected to exhibit a prominent CAGR in the European vacuum cleaner market during the forecast period owing to the sustainability mandates, smart home integration, and allergy prevalence. According to Statistics Sweden, appliance purchases are increasingly shaped by circular design criteria under the Climate Act. The Swedish Energy Agency reports that 98% of Sweden’s electricity comes from low‑carbon sources, supporting cordless and robotic vacuums aligned with renewable energy homes. The Swedish Asthma and Allergy Association notes that over one‑third of the population experiences seasonal allergies, driving demand for HEPA‑sealed systems. Electrolux leverages local R&D to produce quiet, low‑energy models compatible with IKEA smart home ecosystems. Sweden is expected to remain a leading indicator of future European trconcludes in sustainability and digital lifestyle.

COMPETITION OVERVIEW

Competition in the Europe vacuum cleaner market is defined by a strategic tension between premium engineering and affordability within a highly regulated environmental landscape. Global innovators like Dyson compete with European heritage brands such as Miele and Electrolux alongside value-oriented players from Asia. Differentiation hinges on filtration efficacy, noise levels, energy consumption, and repairability rather than price alone. The EU Ecodesign and Right to Repair directives have raised technical barriers favoring established players with robust R and D and service networks. At the same time, urbanization and smart home adoption are accelerating demand for cordless and robotic formats, creating opportunities for agile entrants. National consumer preferences further fragment the market, with German hoapplyholds valuing durability, ty French purchaseers prioritizing compactness, and UK consumers favoring pet hair performance. This complex interplay of regulation, culture, and technology demands localized innovation and deep regulatory expertise to succeed across the diverse European terrain.

KEY MARKET PLAYERS

A few major players of the Europe vacuum cleaner market include

- Dyson

- Bosch

- Miele

- Electrolux

- Philips

- Siemens

- Kärcher

- Hoover

- Rowenta

- Samsung Electronics

- LG Electronics

- Panasonic

- SEB Group

- Bissell

- SharkNinja

Top Strategies Used by the Key Market Participants

Key players in the Europe vacuum cleaner market are prioritizing allergen containment through hospital-grade HEPA filtration and sealed system designs to meet rising health demands. They are integrating smart home connectivity and AI-driven navigation in robotic and cordless models to enhance convenience and energy efficiency. Companies are adopting circular economy principles by applying recycled materials, offering repairable architecture, and implementing take-back programs. Strategic alignment with national eco labels such as Blue Angel and Energy Label ensures regulatory compliance and consumer trust. Finally, they are tailoring product form factors to European urban living by developing compact, lightweight, and multi-surface optimized designs that suit hard flooring and compact apartments.

Leading Players in the Market

- Miele is a German premium appliance manufacturer renowned for its high-performance vacuum cleaners engineered for longevity, filtration efficiency, and quiet operation. The company plays a significant role in shaping global standards for allergen containment and durability with its sealed HEPA systems and even-year motor warranties. Miele contributes to the European market through its deep integration with eco certification programs, including Germany’s Blue Angel and the EU Energy Label. In 202,4, Miele launched a new generation of bagged canister vacuums featuring automatic bag closure and biodegradable filter materials to address both hygiene and sustainability demands. This innovation reinforces its position health-conscious and environmentally aware consumer across Northern and Western Europe.

- Dyson is a British technology company that revolutionized the vacuum cleaner indusattempt with its cyclonic separation and digital motor innovations. The company maintains a strong presence in Europe through its cordless and robotic platforms, which emphasize design engineering and smart functionality. Dyson’s global R and D center in Malmesbury continues to drive advancements in suction efficiency, battery life, and acoustic performance tailored to European urban living. In 202,4, Dyson introduced a voice-controlled robotic vacuum compatible with Apple HomeKit and Google Assistant, featuring AI-powered object avoidance trained on European hoapplyhold layouts. This launch strengthens its appeal among tech-savvy urban consumers seeking hands-free cleaning solutions.

- Electrolux is a Swedish multinational with a comprehensive portfolio spanning enattempt-level to premium vacuum cleaners under its Electrolux AEG and Electrolux Professional brands. The company leverages its Nordic heritage in sustainability and functional design to serve diverse European segments from residential consumers to commercial facility managers. Electrolux actively aligns its products with EU circular economy directives by incorporating recycled plastics, modular components, and repairable architectures. In 2024, Electrolux expanded its PureFlow HEPA filtration line with washable allergen traps and launched a trade-in program across Germany and the Netherlands that offers discounts for returning old units. These initiatives enhance brand loyalty while supporting regulatory compliance and environmental goals.

MARKET SEGMENTATION

This research report on the Europe vacuum cleaner market has been segmented and sub-segmented based on product type, bucket type, conclude applyr, and region.

By Product Type

- Canister

- Upright

- Robot

- Handheld

- Others

By Bucket Type

By End User

- Residential

- Commercial

- Industria

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply