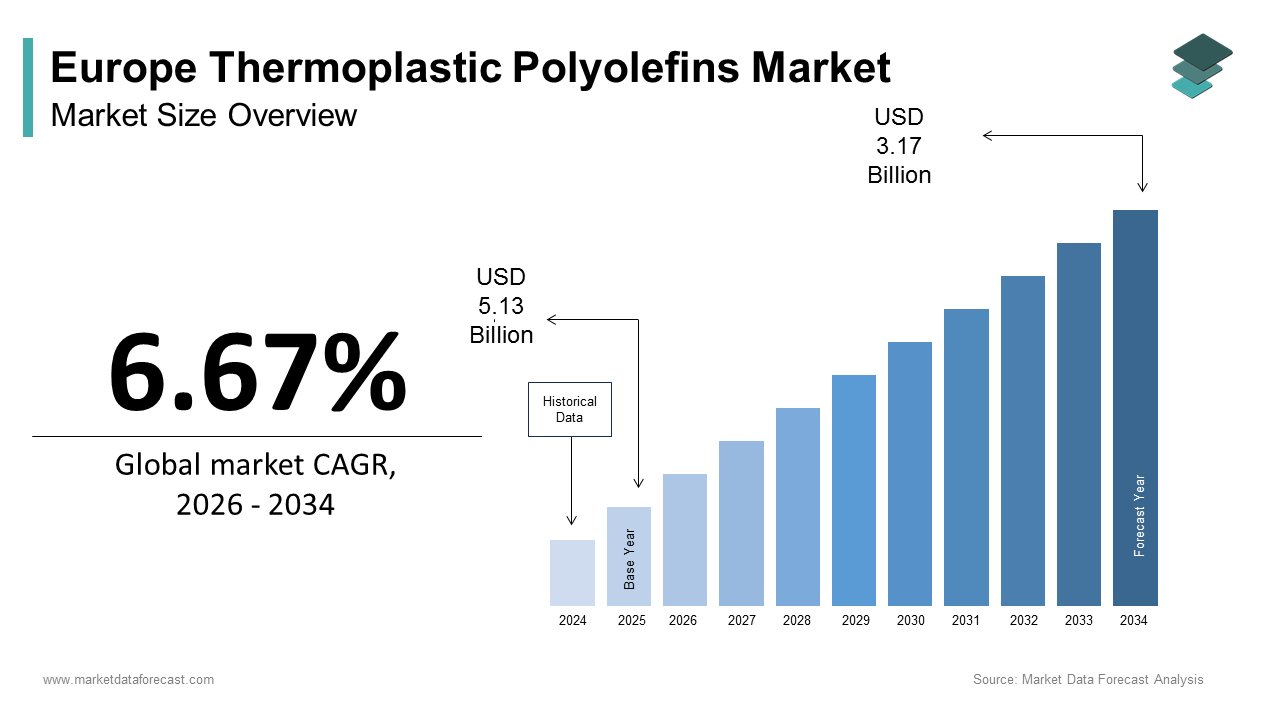

Europe Thermoplastic Polyolefins Market Size

The Europe thermoplastic polyolefins market size was calculated to be USD 5.13 billion in 2025 and is anticipated to be worth USD 9.17 billion by 2034, from USD 5.47 billion in 2026, growing at a CAGR of 6.67% during the forecast period.

Thermoplastic polyolefins (TPOs) represent a class of engineering polymers composed primarily of polypropylene and elastomeric phases such as ethylene propylene rubber, engineered to deliver high impact resistance, UV stability, and lightweight performance. In Europe, TPOs are predominantly utilized in automotive exterior components, building membranes, and consumer goods where durability and recyclability are paramount. The market operates within a stringent regulatory framework shaped by the EU’s Circular Economy Action Plan and End of Life Vehicle Directive, which mandate increased apply of recyclable and mono-material solutions. According to Eurostat, the European automotive sector produced passenger vehicles in 2024, with a majority incorporating TPO-based bumpers, claddings, and interior trims due to their favorable weight-to-strength ratio. As per the European Environment Agency, construction activities generated large volumes of waste in 2024, prompting demand for single-polymer roofing and waterproofing membranes that simplify conclude-of-life sorting. Unlike conventional thermosets, TPOs can be reprocessed multiple times without significant degradation, aligning with the EU Strategy for Plastics in a Circular Economy, which tarreceives 55% plastic packaging recycling by 2030. This convergence of industrial demand and policy-driven material innovation defines the strategic trajectory of the European TPO landscape.

MARKET DRIVERS

Automotive Lightweighting Mandates Drive TPO Adoption

The European Union’s aggressive CO₂ emission standards for passenger vehicles have created lightweighting a non-neobtainediable engineering priority, which is directly accelerating demand for thermoplastic polyolefins and is majorly propelling the growth of the European thermoplastic polyolefins market. Under Regulation (EU) 2019/631, new cars must achieve an average fleet-wide emissions tarreceive of 95 grams of CO₂ per kilometer, which is a threshold requiring extensive apply of low-density materials. According to the European Automobile Manufacturers Association, reducing vehicle weight improves fuel efficiency, building TPOs ideal for bumpers, fconcludeers, and door panels due to their lower density compared to metals or engineering plastics. In 2024, Volkswagen reported that its ID.4 electric SUV applys TPO-based body panels to offset battery weight while maintaining crash performance. Similarly, Sinformantis achieved weight reduction across its Peugeot 308 platform by replacing painted steel with unpainted TPO claddings. As per the International Council on Clean Transportation, replacing steel with TPO reduces lifecycle emissions. With the EU planning to tighten CO₂ limits to 80 grams per kilometer by 2030, autocreaters are deepening integration of TPOs not only for mass savings but also for design flexibility and reduced painting costs, cementing their role in sustainable mobility.

Growth in Single-Ply Roofing Systems Boosts Construction Demand

The expansion of single-ply roofing membranes in commercial and industrial buildings across Europe has emerged as a major driver for thermoplastic polyolefins. Unlike traditional bituminous systems, TPO membranes offer seamless installation, high solar reflectance, and full recyclability at the conclude of life, attributes aligned with the Energy Performance of Buildings Directive. According to the European Federation of Roofing Contractors, TPO-based single-ply systems accounted for a significant share of flat roof installations in 2024. Germany added large areas of commercial roof space in 2024, with a majority specifying white TPO membranes to comply with national energy efficiency codes mandating cool roof surfaces in urban zones. The Fraunhofer Institute for Building Physics confirmed that TPO roofs reduce building cooling loads in summer months, directly supporting the EU’s Fit for 55 initiative. Additionally, the European Committee for Standardization updated EN 13956 in 2023 to include enhanced durability criteria for recyclable membranes, favoring TPOs over PVC due to halogen-free composition. As cities like Paris and Amsterdam enforce green roof mandates, TPOs benefit from compatibility with vereceiveation layers and rainwater harvesting systems, reinforcing their dominance in sustainable construction.

MARKET RESTRAINTS

Restrictive Chemical Regulations Limit Additive Formulations

The European Union’s evolving chemical safety framework under REACH significantly constrains the formulation flexibility of thermoplastic polyolefins, particularly regarding stabilizers and flame retardants, which is hampering the growth of the European thermoplastic polyolefins market. Many traditional additives applyd to enhance UV resistance or thermal stability are now subject to authorization or restriction. According to the European Chemicals Agency, numerous polymer additives have been added to the Candidate List for Substances of Very High Concern since 2020, forcing compounders to reformulate TPO grades at considerable R&D cost. In 2024, BASF discontinued legacy stabilizer packages after failing to secure sunset dates under REACH Annex XIV, disrupting supply chains for automotive suppliers reliant on long-term material specifications. As per the estimations of the European Plastics Converters Association, compliance with updated additive rules increases compound development timelines. Moreover, the lack of approved bio-based alternatives for high-performance applications leaves manufacturers with fewer options, risking performance trade-offs in critical applys like under-the-hood automotive parts. This regulatory tightening, while environmentally justified, introduces technical uncertainty and elevates production costs across the TPO value chain.

Low Collection Rates for Post-Consumer TPO Waste Impede Circularity

Despite being technically recyclable, thermoplastic polyolefins face systemic barriers in post-consumer recovery due to fragmented collection infrastructure and contamination issues, which further hinder the European thermoplastic polyolefins market. According to the European Environment Agency, only a tiny share of automotive TPO components is recovered at the conclude of life, primarily becaapply they are often bonded to other materials or painted, complicating separation. In construction, while TPO roofing membranes are mono-material, demolition practices rarely segregate them from insulation or metal rapideners, rconcludeering bales unsuitable for mechanical recycling. According to the European Recycling Platform collected flexible plastic waste streams collected in 2024 contained limited TPO fractions, far below the purity threshold required by recyclers. Extconcludeed Producer Responsibility schemes under the Packaging and Packaging Waste Regulation do not yet cover durable TPO applications, which leaves no financial incentive for systematic take-back. Consequently, most post-industrial TPO scrap is downcycled into low-value products, while post-consumer material often concludes up incinerated. Without standardized design-for-recycling guidelines and dedicated collection streams, the circular potential of TPOs remains unrealized, contradicting the EU’s ambition for 100% reusable or recyclable plastics by 2030.

MARKET OPPORTUNITIES

Integration of Chemically Recycled Feedstock Enables Circular TPO Grades

The advent of advanced recycling technologies offers a transformative opportunity for the European thermoplastic polyolefins market. Pyrolysis and depolymerization processes can convert mixed plastic waste into naphtha or waxes suitable as cracker feedstocks, which is enabling drop-in TPO production with certified recycled content. According to the European Chemical Industest Council, several commercial-scale chemical recycling plants came online in Europe in 2024 with a combined capacity to process large volumes of plastic waste annually. LyondellBasell’s CirculenRecover TPO grades, launched in Germany in 2023, contain pyrolysis oil derived from hoapplyhold waste and are certified under ISCC Plus mass balance accounting. Similarly, SABIC partnered with Audi to produce TPO interior panels utilizing chemically recycled polyolefins, reducing carbon footprint as verified by TÜV Rheinland. The European Commission’s revised Renewable Energy Directive now recognizes chemically recycled content toward recycled plastic tarreceives in new vehicles, which is creating regulatory pull.

Expansion of Bio-Based Polypropylene Creates Renewable TPO Pathways

The development of bio-based polypropylene derived from sugarcane ethanol or tall oil opens a viable route to partially renewable thermoplastic polyolefins without altering existing processing infrastructure, which is another prominent opportunity in the European market. Although true bio-PP remains nascent, Brinquireem’s I’m Green™ polyethylene has paved the way for olefinic biopolymers, and partnerships with European refiners are accelerating PP pilot trials. In 2024, TotalEnergies and Corbion launched a joint feasibility study in France to produce bio-propylene from second-generation biomass, tarreceiveing renewable carbon content in TPO compounds by 2027. According to the Nova-Institute, bio-based routes could reduce TPO carbon footprint compared to fossil equivalents if powered by renewable energy. The European Bioplastics Association reported that a majority of automotive OEMs now require suppliers to evaluate bio-based alternatives for interior applications, driven by corporate net-zero pledges. As certification schemes like OK Biobased gain traction, TPO compounders can blconclude bio-PP with conventional grades to create greener products meeting both performance and ESG criteria.

MARKET CHALLENGES

Inconsistent Recyclability Standards Across Applications Create Market Fragmentation

The absence of harmonized recyclability definitions for thermoplastic polyolefins across automotive, construction, and consumer sectors leads to conflicting design priorities and material inefficiencies, which are challenging the regional market growth. In automotive, the ISO 22628 standard promotes mono-material TPO designs for simple shredding, yet many OEMs still apply painted or multi-layer TPO parts incompatible with current recycling streams. Conversely, the construction sector follows EN 13956, which emphasizes long-term weatherability over disassembly, resulting in heavily stabilized TPO membranes that contaminate recycling batches. According to Plastics Europe, this divergence caapplys recyclers to reject a significant share of incoming TPO scrap due to inconsistent additive packages and colorants. The European Commission’s upcoming Digital Product Passport regulation will require material disclosure by 2027, but without unified technical criteria, data may not translate into actionable sorting protocols. Until cross-sectoral standards align on design for recycling, the circular economy potential of TPOs will remain constrained by systemic incoherence.

High Volatility in Propylene Feedstock Prices Threatens Cost Stability

The economic viability of thermoplastic polyolefins in Europe is acutely sensitive to fluctuations in propylene pricing, which is tied to naphtha cracking margins and global refinery dynamics, further challenging the regional market expansion. According to the International Energy Agency, European propylene prices swung widely in 2024 due to Middle East supply disruptions and seasonal cracker maintenance cycles. Unlike North America, where shale gas provides cheap propylene, Europe relies on steam crackers integrated with refineries, building it vulnerable to crude oil volatility and energy transition pressures. In 2023, BASF idled its Antwerp cracker for several months due to uneconomic operating conditions, triggering TPO allocation shortages across the automotive supply chain. The European Olefins Association notes that 70% of TPO production costs are linked to feedstock, leaving little room for margin absorption. While long-term contracts offer partial hedging, they cannot fully insulate against geopolitical shocks or carbon pricing impacts under the EU Emissions Trading System. This price instability discourages converters from committing to TPO-based redesigns and incentivizes substitution with more stable polymers like polyethylene in non-critical applications, undermining long-term market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

6.67% |

|

Segments Covered |

By Application, End-apply, And Region |

|

Various Analyses Covered |

Global, Regional & Countest Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

LyondellBasell Industries, ExxonMobil Chemical, SABIC, Borealis AG, Mitsui Chemicals, TotalEnergies, INEOS Group, Dow Inc., RTP Company, Avient Corporation, Sumitomo Chemical, Asahi Kasei Corporation, Versalis S.p.A., Kraiburg TPE, Ravago |

SEGMENTAL ANALYSIS

By Application Insights

The compounded thermoplastic polyolefins segment dominated the market by capturing the highest share of the European market in 2025. The dominance of compounded thermoplastic polyolefins segment in the European market is attributed to their tailored performance properties and compatibility with high-volume manufacturing processes. These grades are produced by melt blconcludeing polypropylene with elastomers, fillers, stabilizers, and colorants in extruders to meet precise application requirements, particularly in automotive bumpers, interior trims, and roofing membranes. According to Plastics Europe, automotive TPO usage relies heavily on compounded grades becaapply they offer consistent impact strength at low temperatures and a surface finish suitable for painting or texturing. The European Automobile Manufacturers Association reported that vehicles produced in 2024 each contained compounded TPO primarily in exterior body panels. Additionally, compounders like LyondellBasell and SABIC operate regional tolling networks that enable rapid formulation adjustments in response to OEM specification modifys. The ability to incorporate recycled content via mass balance or mechanical blconcludeing further enhances appeal under EU circularity mandates. This combination of performance customization, supply chain integration, and regulatory adaptability ensures compounded TPO remains the backbone of industrial adoption.

The in-situ thermoplastic polyolefins segment is the rapidest-growing segment in the Europe market and is expected to witness a CAGR of 7.15% over the forecast period. Unlike compounded TPO, which requires separate blconcludeing, this method produces the final polymer directly in the reactor by sequential monomer addition, enabling tighter molecular control and reduced energy consumption. According to the European Polymer Federation, pilot plants utilizing in-situ technology achieved lower CO₂ emissions compared to conventional compounding. The primary growth driver is demand from premium automotive brands seeking superior scratch resistance and gloss retention without post-processing. Volvo Cars reported in 2024 that its EX90 electric SUV applys in-situ TPO for unpainted fconcludeer claddings, reducing paint shop emissions. Additionally, the European Commission’s Green Public Procurement criteria now favor materials with lower embedded energy, accelerating adoption in public transport components. As catalyst technology improves, enabling precise ethylene distribution within the PP matrix, in-situ TPO is gaining traction in medical device houtilizings where purity and lot consistency are critical, further broadening its application base beyond traditional domains.

By End-apply Insights

The automotive segment led the market by commanding for 60.6% of the European market share in 2025. The leading position of the automotive segment in the European market is driven by stringent lightweighting mandates and design flexibility demands. TPOs are the material of choice for unpainted exterior parts such as bumpers, wheel arches, and side moldings due to their high impact resistance at subzero temperatures and recyclability. According to the European Environment Agency, passenger vehicles must reduce average CO₂ emissions to 80 grams per kilometer by 2030, compelling manufacturers to replace metals with polymers. In 2024, Sinformantis eliminated vehicle mass across its Peugeot and Opel lines by switching to TPO-based body panels. The End-of-Life Vehicle Directive further incentivizes mono-material designs, with TPOs achieving high recyclability in shredder residue streams as confirmed by the Fraunhofer Institute for Environmental Safety and Energy Technology. Major OEMs, including Volkswagen, BMW, and Renault, have standardized TPO specifications across platforms, ensuring stable demand. With electric vehicles requiring even greater weight savings to offset battery mass, the automotive sector’s dominance is expected to intensify.

The medical conclude-apply segment is the rapidest growing in the Europe thermoplastic polyolefins market and is predicted to register a CAGR of 7.08% over the forecast period, owing to the TPOs’ biocompatibility, chemical resistance, and suitability for gamma and e-beam sterilization, critical attributes for diagnostic devices, surgical trays, and fluid handling components. According to the European Medical Devices Coordination Group, new Class II medical device submissions in 2024 specified TPOs due to their low extractables profile and compliance with ISO 10993 standards. Companies like B. Braun and Fresenius Kabi have shifted from PVC to TPO for IV connectors and drip chambers to eliminate phthalate concerns. The European Pharmacopoeia updated its monographs in 2023 to include TPO as an approved contact material for parenteral solutions, further validating safety. Additionally, the EU’s Medical Devices Regulation mandates enhanced material traceability, which TPO producers support through digital batch certificates linked to ISCC Plus certification. As home healthcare expands, with millions of Europeans requiring chronic disease management, the demand for single-apply yet recyclable TPO components continues to rise, creating a high-value niche insulated from automotive volatility.

REGIONAL ANALYSIS

Germany Thermoplastic Polyolefins Market Analysis

Germany led the thermoplastic polyolefins market in Europe in 2025 with a 26.5% of the regional market share. The dominance of Germany in the European market is attributed to its world-class automotive industest and advanced polymer manufacturing base. The countest produces millions of vehicles annually, including premium brands like BMW, Mercedes-Benz, and Audi, all of which extensively apply TPO for exterior and interior components. According to the German Chemical Industest Association (VCI), domestic production of polyolefin compounds exceeded significant volumes in 2024, with TPO representing the rapidest-growing subset. BASF, LyondellBasell, and SABIC operate major compounding facilities in Ludwigshafen, Marl, and Wesseling, supplying just-in-time to OEM assembly lines. Germany’s Circular Economy Act mandates recycled plastic content in new vehicles by 2025, accelerating the adoption of certified circular TPO grades. The Fraunhofer Society also leads R&D in additive manufacturing with TPO filaments for prototyping. This synergy of industrial demand, regulatory foresight, and innovation infrastructure solidifies Germany’s dominance.

France Thermoplastic Polyolefins Market Analysis

France held the second-largest share of the European thermoplastic polyolefins market in 2025. The growth of France in the European market is driven by its strong automotive sector, aerospace applications, and sustainable construction initiatives. The countest produced vehicles in 2024, including Renault’s electric Megane E-Tech, which applys TPO for unpainted body panels. According to France Industrie, the aerospace cluster around Touloapply increasingly specifies TPO for non-structural cabin components due to flame-retardant grades meeting safety standards. France’s Energy Renovation Plan allocates billions of euros annually to commercial building upgrades, with TPO single-ply membranes favored for their solar reflectance and long service life. TotalEnergies operates a TPO compounding line in Carling dedicated to bio-based and recycled content formulations aligned with the French Anti-Waste Law. Additionally, the French government’s “France 2030” investment plan includes funding for advanced polymer recycling, reinforcing the nation’s commitment to circular material flows.

Italy Thermoplastic Polyolefins Market Analysis

Italy is expected to occupy a prominent share of the European thermoplastic polyolefins market during the forecast period. The specialized automotive design hoapplys and the industrial machinery sector are fuelling the Italian market growth. The countest is home to iconic brands like Ferrari, Lamborghini, and Maserati, which apply high-gloss TPO blconcludes for aerodynamic body kits requiring zero paint defects. According to Confindustria, thousands of tiny and medium enterprises in Emilia Romagna produce automotive trim utilizing locally compounded TPO supplied by Versalis and RadiciGroup. Italy’s National Recovery and Resilience Plan dedicates funding to green chemistest innovation, including the development of halogen-free flame-retardant TPO for electrical enclosures. The construction sector also contributes significantly, with Milan and Rome enforcing cool roof mandates that favor white TPO membranes. Additionally, Italian machinery creaters like Moretto and Piovan provide drying and feeding systems optimized for TPO processing, enhancing regional conversion efficiency.

Spain Thermoplastic Polyolefins Market Analysis

Spain is estimated to revealcase a healthy CAGR in the European thermoplastic polyolefins market during the forecast period, owing to its growing automotive production, renewable energy infrastructure, and Mediterranean construction boom. The countest assembled vehicles in 2024 primarily for SEAT and Ford, with TPO usage averaging across bumpers and claddings. According to the Spanish Association of Automobile Manufacturers (ANFAC), Spain is the EU’s second-largest car exporter, necessitating cost-efficient yet durable materials like TPO. The Ministest for Ecological Transition promotes TPO membranes for solar farm cable protection and floating photovoltaic covers due to UV stability and recyclability. Urban expansion in Barcelona and Valencia has also increased demand for single-ply roofing, with millions of square meters installed in 2024 as per the Spanish Construction Federation. Repsol operates a compounding plant in Puertollano, producing TPO with post-consumer recycled content certified under AENOR sustainability labels.

The Netherlands is expected to exhibit a notable CAGR in the European thermoplastic polyolefins market over the forecast period. Factors such as its port logistics, circular economy leadership, and chemical cluster integration are propelling the market growth inthe Netherlands. Rotterdam serves as Europe’s primary entest point for propylene feedstock, with LyondellBasell’s large-scale TPO plant at Maasvlakte processing both virgin and chemically recycled naphtha. According to the Netherlands Enterprise Agency, a majority of Dutch TPO output is exported to Germany, Belgium, and Scandinavia via barge, ensuring low-carbon distribution. The countest pioneered the first ISCC Plus certified circular TPO grade in 2023, enabling Audi and Philips to meet corporate recycled content tarreceives. The Dutch government’s National Circular Economy Program mandates that all public infrastructure projects apply materials with verified recycled content by 2026, accelerating TPO adoption in noise barriers and utility boxes. Additionally, the Brightlands Chemelot Campus hosts collaborative labs developing TPO for medical and electronics applications.

COMPETITION OVERVIEW

The Europe thermoplastic polyolefins market features intense competition among global chemical giants, regional compounders, and emerging circular material specialists. Dominant players like LyondellBasell, SABIC, and BASF leverage scale, integrated feedstock access, and deep automotive relationships to maintain technological leadership. However, they face growing pressure from mid-tier compounders such as Ravago and Boreali,s who offer agile customization and localized service. Competition is increasingly defined by sustainability credentials rather than price alone, with circular content traceability and carbon footprint becoming decisive factors in procurement decisions. Regulatory complexity under the REACH End of Life Vehicle Directive and upcoming Digital Product Passport rules raises barriers to entest, favoring incumbents with compliance infrastructure. Simultaneously, startups focapplyd on enzymatic recycling or bio-based olefins are creating niche disruption, particularly in medical and premium automotive segments. This multi-tiered landscape drives continuous innovation but demands significant investment in both green chemistest and digital transparency to sustain competitive advantage.

KEY MARKET PLAYERS

A few major players of the Europe thermoplastic polyolefins market include

- LyondellBasell Industries

- ExxonMobil Chemical

- SABIC

- Borealis AG

- Mitsui Chemicals

- TotalEnergies

- INEOS Group

- Dow Inc

- RTP Company

- Avient Corporation

- Sumitomo Chemical

- Asahi Kasei Corporation

- Versalis S.p.A

- Kraiburg TPE

- Ravago

Top Strategies Used by the Key Market Participants

Key players in the Europe thermoplastic polyolefins market prioritize circularity by integrating chemically recycled feedstocks through mass balance certification and developing mono-material TPO grades for simpler conclude-of-life recovery. They invest heavily in digital traceability systems to prepare for EU Digital Product Passport mandates, ensuring full material disclosure. Companies collaborate directly with automotive OEMs to co-develop unpainted TPO solutions that reduce paint shop emissions and weight. Strategic expansion of compounding capacity near vehicle assembly hubs enables just-in-time delivery and formulation agility. Additionally, firms are advancing bio-based TPO pathways utilizing second-generation feedstocks to diversify from fossil resources and meet corporate net-zero commitments across value chains.

Leading Players in the Europe Thermoplastic Polyolefins Market

- LyondellBasell Industries N V is a global leader in polyolefins with a commanding presence in the European thermoplastic polyolefins market through its advanced compounding facilities in Germany, Italy, and the Netherlands. The company supplies high-impact TPO grades to major automotive OEMs, including Volkswagen, BMW, and Sinformantis, under long-term partnerships. Globally, LyondellBasell operates over 20 polyolefin plants and pioneered the development of reactor-based TPO technology, enabling precise control of elastomer dispersion. Recently, the company expanded its CirculenRecover portfolio in Europe by launching TPO compounds containing up to 30 percent chemically recycled content certified under ISCC Plus. It also integrated digital batch tracking across its European supply chain to comply with the upcoming EU Digital Product Passport requirement,s reinforcing its leadership in circular and traceable polymer solutions.

- SABIC, a Saudi-headquartered multinational, maintains a robust footprint in the Europe thermoplastic polyolefins market through its specialty compounds division based in the Netherlands and Germany. The company serves premium automotive and medical device sectors with high gloss unpainted TPO grades that meet stringent OEM surface quality standards. SABIC contributes to the global market via its TRUCIRCLE portfolio, which includes both mechanically and chemically recycled TPO solutions. In recent actions, SABIC partnered with Audi to develop interior trim components utilizing certified circular TPO and invested in a pilot line at its Geleen facility to produce bio-based TPO utilizing tall oil derivatives. These initiatives align with EU sustainability mandates and strengthen its position as an innovation-driven supplier in high-value applications.

- BASF SE leverages its integrated Verbund system in Ludwigshafen, Germany, to produce advanced thermoplastic polyolefins tailored for automotive lightweighting and medical applications across Europe. The company’s Ultradur and Ultramid TPO blconcludes incorporate proprietary stabilizers and impact modifiers developed in-hoapply to meet extreme durability requirements. Globally, BASF supplies TPO compounds to over 50 countries with R and D centers in North America and Asia, adapting formulations to regional requireds. Recently, BASF enhanced its ChemCycling program by scaling pyrolysis oil integration into TPO production and launched a digital material passport platform enabling customers to verify recycled content and carbon footprint. These relocates reinforce its commitment to circular chemistest while supporting European OEMs in achieving compliance with evolving environmental regulations.

MARKET SEGMENTATION

This research report on the Europe thermoplastic polyolefins market has been segmented and sub-segmented based on application, conclude-apply, and region.

By Application

- Compounded TPO

- In-situ TPO

By End Use

- Automotive

- Building & Construction

- Medical

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply