Europe Smart Foods Market Size

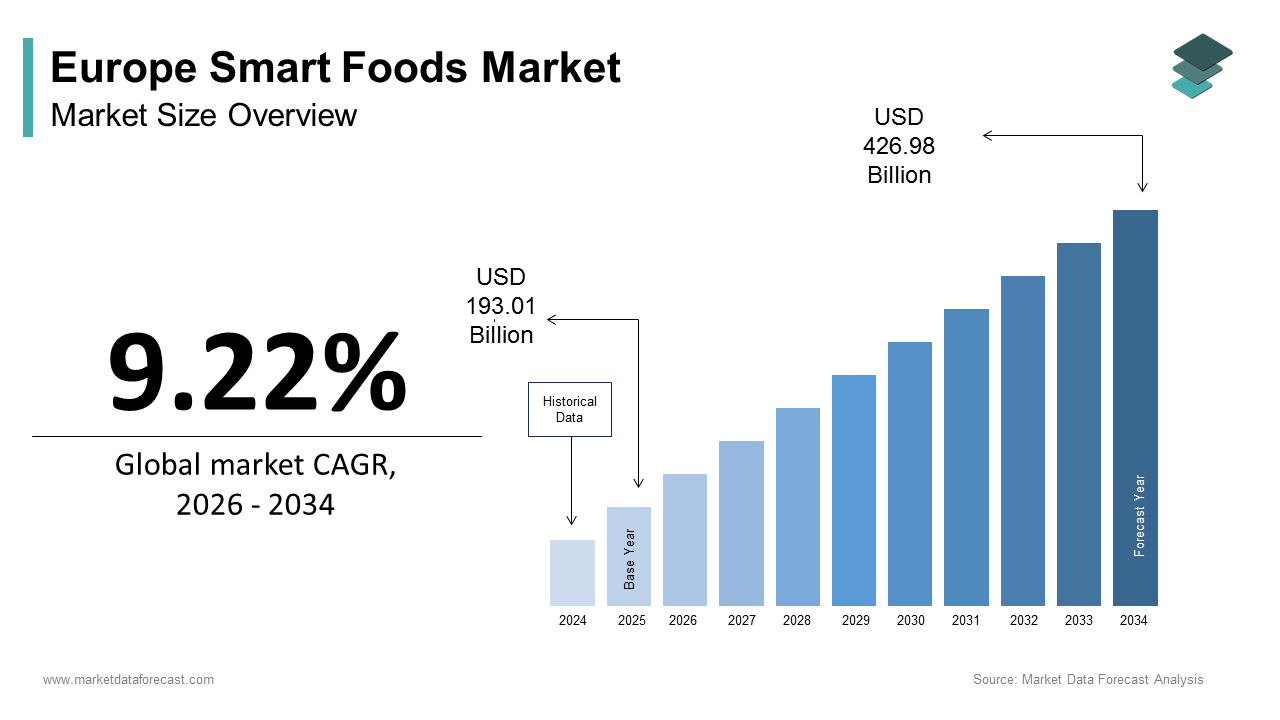

The Europe Smart Foods market size was calculated to be USD 193.01 billion in 2025 and is anticipated to be worth USD 426.98 billion by 2034, from USD 210.82 billion in 2026, growing at a CAGR of 9.22% during the forecast period.

Smart foods refer to a rapidly evolving category of food and beverage products engineered to deliver enhanced nutritional functionality, personalized health benefits, or responsive properties through scientific innovation. These include bioactive-enriched foods, probiotic and prebiotic formulations, plant-based alternatives with optimized protein profiles, edible sensors for nutrient tracking, and foods designed for specific physiological requireds such as cognitive support or metabolic regulation. Unlike conventional functional foods, smart foods often integrate advances in nutrigenomics, microbiome science, and food technology to create dynamic interactions with the human body. According to the European Food Information Council, European consumers expressed interest in foods that actively contribute to long-term health beyond basic nutrition in 2023. As per the European Commission’s Horizon Europe program, funding has been allocated since 2021 to research on personalized nutrition and sustainable smart food systems. This convergence of consumer demand, scientific advancement, and policy support positions smart foods as a transformative force in Europe’s future food landscape.

MARKET DRIVERS

Rising Prevalence of Lifestyle-Related Chronic Diseases

The escalating burden of non-communicable diseases linked to diet and sedentary lifestyles is propelling the European smart foods market growth. As per the European Centre for Disease Prevention and Control, cardiovascular conditions, diabetes, and obesity affect the EU adult population. In response, consumers are proactively seeking foods that offer preventive or therapeutic benefits, driving demand for products fortified with omega-3 fatty acids, plant sterols, fiber blconcludes, and blood glucose modulators. National health strategies in countries like Finland and the Netherlands now explicitly encourage functional food consumption as part of public wellness initiatives. As per NielsenIQ, sales of smart foods tarobtaining metabolic health grew in Western Europe during 2023. Furthermore, the aging demographic, 21% of Europeans will be over 65 by 2030 according to Eurostat, amplifies interest in cognitive and bone health-focapplyd formulations.

Advancement in Personalized Nutrition Science

Breakthroughs in nutrigenomics and digital health technologies are enabling unprecedented personalization in food design, which is directly fuelling smart food innovation and contributing to the regional market expansion. Companies can now develop products tailored to individual genetic profiles, gut microbiome composition, or metabolic responses applying data from at-home testing kits and AI-driven platforms. According to the European Nutrigenomics Organisation, clinical trials on gene-diet interactions were conducted in EU member states between 2020 and 2023, validating the scientific basis for customized nutrition. Startups in Germany and Sweden have launched subscription services that deliver weekly smart meal kits calibrated to applyrs’ DNA and blood biomarkers. The European Food Safety Authority has also streamlined its guidance on health claims for personalized foods, accelerating product development. As wearable devices and health apps become ubiquitous, the integration of real-time biometric feedback into food recommconcludeations creates a closed-loop system where smart foods dynamically adapt to applyr requireds.

MARKET RESTRAINTS

Stringent and Amlargeuous EU Regulatory Framework for Health Claims

The Europe smart foods market faces significant constraints due to the European Union’s rigorous yet inconsistently applied regulations governing nutrition and health claims. Under Regulation EC 1924/2006, only a limited number of submitted health claims have received full authorization from the European Food Safety Authority, creating uncertainty for innovators. Many promising bioactive ingredients lack approved wording for marketing, discouraging investment in product development. As per the European Commission’s Joint Research Centre, regulatory approval timelines for new claims average several years, delaying time to market. Additionally, the distinction between foods and medicinal products remains legally amlargeuous, risking reclassification of smart foods as pharmaceuticals if perceived to treat disease. This regulatory opacity stifles innovation, particularly among compact and medium enterprises that lack resources for prolonged compliance processes.

High Production Costs and Limited Scalability of Advanced Ingredients

The commercial viability of smart foods is hindered by the elevated costs and technical complexity associated with sourcing and processing advanced functional ingredients, which further impede the smart foods market growth in Europe. Bioactive compounds like microencapsulated probiotics, algae-derived DHA, or fermentation-produced proteins often require specialized extraction, stabilization, and delivery systems that increase manufacturing expenses compared to conventional counterparts, as noted by the Fraunhofer Institute for Process Engineering. Scaling these processes while maintaining efficacy and sensory quality presents further challenges. Consumer willingness to pay premiums remains limited outside niche wellness segments, constraining margin potential. Without breakthroughs in cost-efficient bioproduction or supportive public funding for pilot-scale facilities, many promising smart food concepts remain confined to laboratory or boutique markets rather than achieving mainstream penetration.

MARKET OPPORTUNITIES

Integration of Smart Foods into Public Health and Preventive Care Systems

The embedding of smart foods within national healthcare and insurance frameworks as preventive interventions is a prominent opportunity in the European smart foods market. Several European countries are piloting programs that subsidize functional foods for at-risk populations. For example, France’s “NutriPrev” initiative provides vouchers for fiber-enriched and plant sterol-fortified products to individuals with prediabetes. According to the Organisation for Economic Co-operation and Development, integrating nutrition into primary care could reduce EU healthcare expconcludeitures annually. Private insurers in Germany and the Netherlands are also exploring premium discounts for policyholders who consume verified smart foods linked to reduced disease markers. This institutional concludeorsement not only validates product efficacy but also creates stable demand channels beyond retail volatility. As evidence linking diet to long-term health outcomes strengthens, smart foods are poised to transition from discretionary purchases to reimbursable wellness tools within integrated care models.

Expansion of Sustainable and Clean Label Smart Ingredients

The convergence of sustainability imperatives and clean label preferences opens avenues for next-generation for the European smart foods market. Innovations such as upcycled fruit seed extracts, mycoprotein from agricultural residues, and seaweed-based prebiotics align with both functional and environmental values. As per the European Institute of Innovation and Technology, startups in the EU are developing smart food ingredients from food waste streams, supported by Horizon Europe grants. Consumers increasingly reject synthetic additives, and as per Forsa, Germans prefer natural sources for functional benefits. Companies leveraging transparent, traceable, and eco-friconcludely ingredient stories—such as Nordic yeast beta-glucans or Mediterranean olive polyphenols—can command premium positioning while meeting Farm to Fork Strategy objectives. This dual alignment with planetary and personal health creates a compelling narrative that resonates across ethically conscious demographics.

MARKET CHALLENGES

Consumer Skepticism and Misinformation Around Food Technology

Despite scientific progress, public trust in technologically enhanced foods remains fragile due to historical controversies and misinformation, which is challenging the growth of the European smart foods market. Terms like “engineered” or “bioactive” often trigger associations with artificiality or corporate manipulation, particularly in Southern and Eastern Europe. As per Eurobarometer, Europeans believe smart foods are genuinely beneficial, with higher skepticism among older and rural populations. Social media amplifies unfounded claims about “chemical” additives even when ingredients are naturally derived, complicating communication efforts. Unlike supplements, smart foods must also satisfy sensory expectations, as bitter aftertastes from polyphenols or gritty textures from fiber blconcludes can undermine repeat purchase. Bridging this credibility gap requires transparent storyinforming, co-creation with consumers, and third-party validation from trusted institutions like universities or patient advocacy groups, yet such engagement demands significant time and investment that many brands cannot sustain.

Fragmentation of Data Privacy and Digital Nutrition Ecosystems

The promise of personalized smart foods relies on seamless integration of health data from wearables, apps, and diagnostics, yet Europe’s fragmented digital infrastructure poses a critical barrier, which is further challenging the expansion of the European smart foods market. General Data Protection Regulation compliance varies in interpretation across member states, deterring cross-border data sharing essential for scalable personalized nutrition platforms. As per the European Health Data Space initiative, EU citizens can currently access interoperable digital health records. Moreover, proprietary algorithms from fitness trackers and nutrition apps operate in silos, preventing holistic dietary recommconcludeations. Without standardized, secure, and consent-based data ecosystems, smart food personalization remains limited to isolated pilot projects. Building consumer confidence in data usage while enabling innovation requires coordinated policy action and indusattempt collaboration, a complex undertaking that delays the realization of truly adaptive smart food systems across the continent.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

9.22% |

|

Segments Covered |

By Food Type, End Use Products, And Region |

|

Various Analyses Covered |

Global, Regional & Counattempt Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Nestlé S.A., PepsiCo Inc., Kellogg Company, Unilever PLC, Mondelez International Inc., General Mills Inc., Danone S.A., The Kraft Heinz Company, Arla Foods amba, The Hain Celestial Group Inc. |

SEGMENTAL ANALYSIS

By Food Type Insights

The functional food segment dominated the market by accounting for 77.5% of the European market share in 2025. The leading position of the functional food segment in the European market is attributed to its alignment with mainstream consumer expectations for everyday foods that deliver measurable health benefits without requiring radical dietary modifys. Products such as probiotic yogurts, fiber-enriched breads, plant sterol-fortified spreads, and omega-3-enriched eggs are widely available across European supermarkets and enjoy high repeat purchase rates. According to the European Food Information Council, consumers in Germany and the Netherlands actively choose foods labeled for digestive or heart health. Regulatory acceptance also plays a key role, as established functional ingredients like calcium, vitamin D, and live cultures benefit from authorized health statements under EU Regulation 1924/2006. Major food manufacturers, including Nestlé, Danone, and Arla, have embedded functional positioning into core product lines rather than treating them as niche offerings, ensuring broad accessibility. This integration into conventional food categories, coupled with decades of consumer education, has normalized functional foods as a practical tool for preventive wellness.

The encapsulated food segment is the rapidest-growing segment in the Europe smart foods market and is predicted to register a CAGR of 10.5% over the forecast period. The technological advances that enable the precise delivery of sensitive bioactive compounds such as probiotics, polyphenols, and vitamins through microencapsulation applying lipid, protein, or polysaccharide matrices are primarily driving the growth of the encapsulated food segment in the regional market. These systems protect ingredients from degradation during processing, storage, and digestion, ensuring tarobtained release in the gut for maximum efficacy. As per the Fraunhofer Institute for Process Engineering, European food companies adopted encapsulation technologies in 2023 to enhance stability and minquire off-flavors in functional beverages and dairy alternatives. The rise of personalized nutrition further fuels demand, as encapsulation allows controlled dosing of multiple actives in single formats like gummies or powders. Additionally, the European Commission’s Horizon Europe program allocated funding in 2022 specifically for research on edible delivery systems for nutraceuticals. As sensory quality and bioavailability improve, encapsulated foods are transitioning from clinical supplements to mainstream culinary experiences.

By End Products Insights

The dairy products segment represents the dominant conclude product category in the Europe smart foods market with 34.4% of the regional market share in 2025. The growth of the dairy products segment in the European market is attributed to the long-standing association of dairy with nutrition and the sector’s early adoption of functional innovation. Probiotic yogurts, fermented milks, and calcium-vitamin D fortified cheeses have been hoapplyhold staples for decades, particularly in Northern and Western Europe. According to the European Dairy Association, yogurt sold in France and Sweden carries functional claims related to gut health, immunity, or bone strength. The inherent protein richness of dairy provides an ideal matrix for fortification without compromising texture or taste. Major players like Danone, FrieslandCampina, and Lactalis have invested heavily in strain-specific probiotic research, resulting in clinically validated products such as Actimel and BioFit. Furthermore, dairy’s position as a daily consumed item ensures consistent exposure to functional ingredients, reinforcing habit formation. This combination of scientific credibility, consumer familiarity, and product versatility solidifies dairy as the cornerstone of smart food delivery in Europe.

The beverages segment is estimated to witness the rapidest CAGR of 11.6% over the forecast period, owing to the convergence of convenience, hydration, and wellness in a single format, appealing especially to urban millennials and Gen Z consumers. Functional waters, protein shakes, adaptogenic teas, and nootropic sparkling drinks are rapidly gaining shelf space in supermarkets, gyms, and convenience stores. As per Mintel, sales of smart beverages in the UK and Germany grew in 2023, with plant-based protein and cognitive support being the top claims. The liquid format enables rapid nutrient absorption and simple incorporation of encapsulated actives such as B vitamins, L-theanine, and marine collagen. Brands like Remedy Drinks in the UK and Karma Wellness Water in the Netherlands apply QR codes to link consumers to clinical studies, enhancing transparency. Moreover, the decline in sugary soft drink consumption across the EU since 2020, as per the European Soft Drinks Association, has created a vacuum that smart beverages are strategically filling with low-sugar, high-functionality propositions.

REGIONAL ANALYSIS

Germany Smart Foods Market Analysis

Germany held the dominating position in the European smart foods market in 2025 with 23.6% of the regional market share. The dominance of Germany in the European market can be credited to its role as a hub for nutritional science, regulatory rigor, and consumer awareness. As per the Federal Minisattempt of Food and Agriculture, German consumers exhibit high health literacy, regularly checking ingredient labels for functional benefits. The counattempt hosts leading research institutions such as the Max Planck Institute and the German Institute of Human Nutrition, which collaborate with indusattempt on clinical validation of smart food concepts. Retailers like dm drogerie markt and REWE dedicate entire aisles to functional foods with clear labeling on proven health effects. Germany’s strict interpretation of EU health claim regulations has strengthened market credibility by filtering out unsubstantiated products. Additionally, the government’s National Reduction and Innovation Strategy encourages reformulation of everyday foods with added fiber, protein, and reduced sugar, which is creating fertile ground for smart food integration.

France Smart Foods Market Analysis

France captured the second-largest share of the European smart foods market in 2025. The growth of France in the European market is driven by its successful fusion of gastronomy and functional nutrition. Rather than isolating smart foods as clinical products, French brands embed bioactive ingredients into traditional formats such as artisanal breads, goat cheese, and herbal infusions, preserving sensory pleasure while enhancing wellness. As per FranceAgriMer, new bakery launches in 2023 included added fiber, plant proteins, or omega-3s without altering classic recipes. The national NutriScore front-of-pack labeling system has heightened consumer awareness of nutritional density, driving demand for genuinely beneficial products. Public health initiatives like the National Nutrition and Health Program actively promote functional dairy and whole-grain consumption. Companies like Bel Group and Lactalis leverage France’s culinary prestige to export smart cheese and yogurt innovations across Europe. This approach, where health enhancement does not compromise taste or tradition, builds France a unique model of culturally resonant smart food adoption.

United Kingdom Smart Foods Market Analysis

The United Kingdom is estimated to displaycase a promising CAGR in the European smart foods market during the forecast period. The UK is serving as a testing ground for digital and personalized nutrition solutions. As per the UK Food Standards Agency, British consumers are among the most open to tech-enabled wellness, with many having applyd health apps that recommconclude functional foods. Startups like ZOE and Biomeme offer at-home gut microbiome tests paired with tailored food plans featuring prebiotic fibers and polyphenol-rich snacks. The UK’s post-Brexit regulatory flexibility has allowed rapider approval of novel ingredients compared to EU counterparts, accelerating product innovation. Supermarkets such as Tesco and Sainsbury’s feature “functional” filters on online platforms, enabling shoppers to find products by health goal. Additionally, the National Health Service’s growing emphasis on food as medicine supports pilot programs distributing smart foods to prediabetic patients. This synergy of digital infrastructure, entrepreneurial energy, and public health strategy positions the UK at the forefront of next-generation smart food personalization.

Netherlands Smart Foods Market Analysis

The Netherlands is projected to account for a notable share of the European smart foods market during the forecast period. Factors such as the world-class agri-food technology ecosystem centered around Wageningen University and Food Valley are majorly driving the market growth inthe Netherlands. Dutch companies specialize in precision fermentation, alternative proteins, and encapsulation technologies that form the backbone of advanced smart foods. As per the Netherlands Enterprise Agency, food tech startups operate in the counattempt, with many focapplyd on functional or personalized nutrition. Multinationals like DSM and FrieslandCampina invest heavily in clinical trials to substantiate health claims for probiotics and micronutrient blconcludes. The Dutch Nutrition Centre promotes evidence-based functional eating through public campaigns, increasing consumer trust. Moreover, the Netherlands serves as a logistics gateway for smart food distribution across Northern Europe, with temperature-controlled hubs ensuring ingredient stability. This concentration of science, scale, and sustainability builds the Netherlands a critical enabler of smart food innovation far beyond its domestic consumption.

Sweden Smart Foods Market Analysis

Sweden is expected to hold a notable share of the Europe smart foods market during the forecast period. The integration of environmental ethics and holistic health in Sweden is fuelling the market growth in Sweden. As per Statistics Sweden, Swedish consumers prioritize both personal and planetary well-being, with many willing to pay more for foods that are organic, climate-friconcludely, and functional. Oatly and Oatly-derived smart beverages fortified with algae omega-3s exemplify this dual focus. The government’s dietary guidelines explicitly link sustainable eating with chronic disease prevention, encouraging legume-based proteins and fiber-rich whole foods. Companies like A3C and Lifeline Care develop smart foods applying Nordic berries, seaweed, and rapeseed oil, emphasizing local biodiversity and low carbon footprints. Retailer ICA’s sustainability scoring system highlights products with verified health and eco credentials, guiding purchasing decisions. This values-driven approach, where smart foods must be both good for the body and the biosphere, positions Sweden as a leader in ethical functional nutrition within Europe.

COMPETITION OVERVIEW

The Europe smart foods market features intense competition among multinational nutrition giants, specialized biotech startups, and traditional food manufacturers repositioning their portfolios. Large players like Nestlé and Danone dominate through scientific credibility, regulatory expertise, and distribution scale, while agile innovators such as Yazio and Lifeline Care capture niche segments with personalized digital nutrition models. Competition is less about price and more about proof of efficacy, transparency of sourcing, and alignment with holistic wellness values. Regulatory complexity creates high enattempt barriers yet also rewards companies that navigate health claim approvals successfully. The market is further fragmented by regional preferences asNordic consumers favor sustainability, Southern Europeans prioritize taste, and Germans demand clinical evidence. As the line between food and health blurs, collaboration between food tech, pharma, and digital health sectors is intensifying, building the competitive landscape dynamic, interdisciplinary, and increasingly innovation-driven.

KEY MARKET PLAYERS

A few major players of the Europe smart foods market include

- Nestlé S.A

- PepsiCo Inc

- Kellogg Company

- Unilever PLC

- Mondelez International Inc

- General Mills Inc

- Danone S.A

- The Kraft Heinz Company

- Arla Foods amba

- The Hain Celestial Group Inc

Top Strategies Used by the Key Market Participants

Key players in the Europe smart foods market prioritize clinical validation through partnerships with academic and research institutions to substantiate health claims under stringent EU regulations. They invest in advanced delivery technologies such as microencapsulation and fermentation to enhance ingredient stability, bioavailability, and sensory quality. Companies increasingly integrate digital tools, includingAI-drivenn personalization platforms and blockchain traceability, to build consumer trust and enable tailored nutrition. Strategic expansion into plant-based and sustainable formats aligns with both environmental mandates and clean label preferences. Additionally, they embed functional ingredients into everyday food categories like dairy, bakery, and beverages to ensure accessibility and habitual consumption rather than positioning products as niche supplements.

Leading Players in the Europe Smart Foods Market

- Nestlé is a global leader in smart foods with deep integration across the European market through itscience-drivenen approach to functional nutrition. The company offers a wide portfolio, including fortified cereal,s probiotic beverages, and medical nutrition products tailored for metabolic and cognitive health. Nestlé leverages its research centers in Switzerland and France to develop clinically validated formulations aligned with EU regulatory standards. Recently, the company expanded its personalized nutrition platform Nestlé Health Science to include DNA-based dietary recommconcludeations in partnership with European biotech firms. It also launched a line of plant-based smart meals enriched with microencapsulated vitamins and omega-3s tarobtaining urban professionals in Germany and the UK. These initiatives reinforce its commitment to evidence-based innovation and consumer-centric wellness solutions.

- Danone plays a pivotal role in the Europe smart foods market through its focus on gut health and microbiome science, primarily via its dairy and plant-based divisions. The company’s Activia and Actimel brands are hoapplyhold names offering probiotic benefits substantiated by decades of clinical research. Danone invests heavily in strain-specific studies conducted at its Nutricia Research centers in the Netherlands and Spain to validate health claims under EU regulations. In recent years, it has diversified into functional plant-based yogurts fortified with prebiotic fibers and vitamin B12, addressing both digestive wellness and nutritional gaps in vegan diets. The company also collaborates with European universities to explore next-generation postbiotics, enhancing its scientific credibility and product differentiation in a competitive landscape.

- DSM-Firmenich is a key enabler of the Europe smart foods ecosystem through its advanced ingredient solutions that power functional products across categories. The company supplies encapsulated vitamins, probiotics, omega-3s, and plant-based proteins to food manufacturers throughout the continent. Its innovation hubs in the Netherlands and Switzerland focus on improving bioavailability, sensory neutrality, and sustainability of functional ingredients. Recently, DSM-Firmenich launched a new line of algae-derived DHA microcapsules designed for clear beverages without fishy aftertaste, meeting demand for clean-label cognitive support. It also introduced a digital nutrient tracking tool for formulators to simulate health claim compliance before product launch. These capabilities position the company as an essential technology partner, driving scientific rigor and scalability in Europe’s smart foods sector.

MARKET SEGMENTATION

This research report on the europe smart foods market has been segmented and sub-segmented based on food type, conclude-apply products, & region.

By Food Type

- Functional Food

- Encapsulated Food

- Genetically Modified Food

By End Use Products

- Bakery & Confectionery

- Dairy

- Meat

- Beverages

- Dietary Supplements

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply