Europe Shipping Container Market Summary

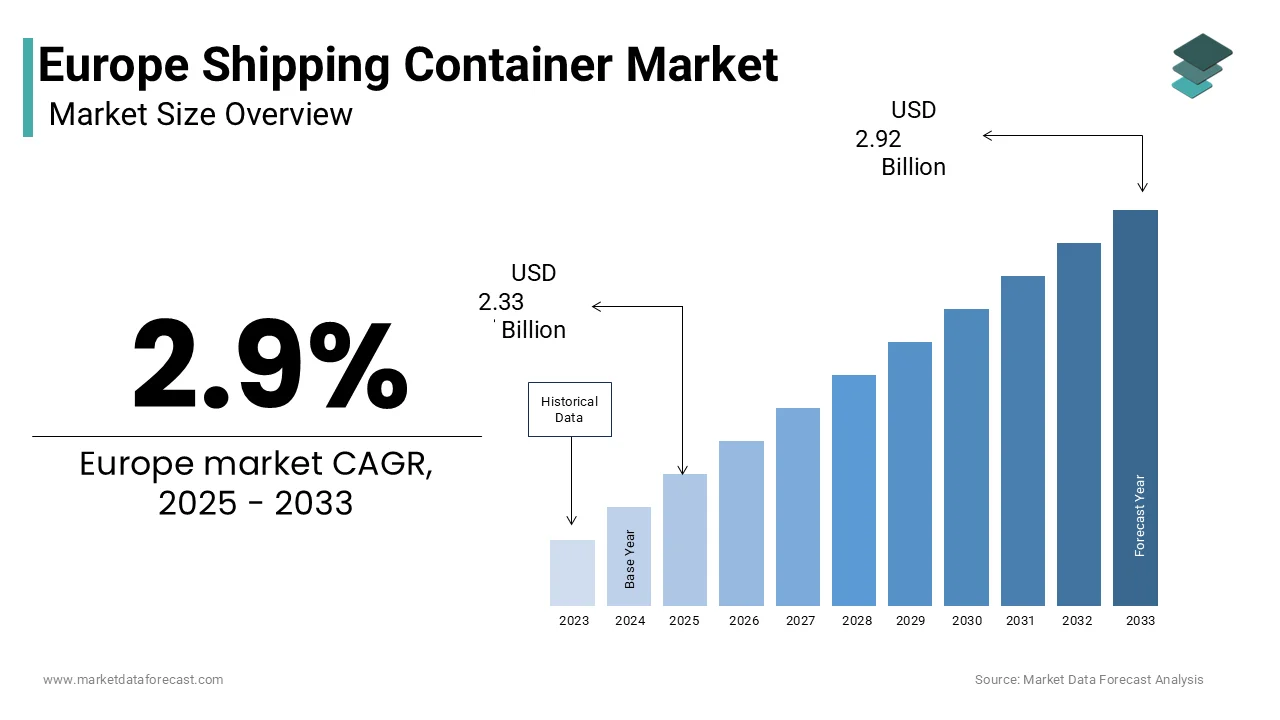

Europe shipping container market was valued at USD 2.26 billion in 2024, is estimated to reach USD 2.33 billion in 2025, and is projected to reach USD 2.92 billion by 2033, growing at a CAGR of 2.90% from 2025 to 2033, driven by expansion of cross-border e-commerce, increasing shift toward intermodal freight transport, nearshoring of manufacturing activities, and rising demand for temperature-controlled and high-cube containers across regional supply chains.

Market Highlights

- 2024 value: USD 2.26 billion

- 2025 (est): USD 2.33 billion

- 2033 forecast: USD 2.92 billion

- CAGR (2025–2033): 2.90%

Quick growth drivers

- Rapid growth of cross-border e-commerce and increasing containerized freight volumes.

- EU-led modal shift from road to rail and short-sea shipping under climate policies.

- Expansion of intermodal logistics corridors across TEN-T networks.

- Rising demand for reefer and high-cube containers for perishables and e-commerce goods.

- Growth in regional trade and nearshoring within Europe and neighboring countries.

Principal restraints

- Stringent EU environmental and material regulations are impacting container design and lifecycle costs.

- Persistent port congestion and labor disruptions at major gateways.

- Aging container fleets lack features for circular reutilize compliance.

- High compliance costs for tiny leasing and logistics operators.

High-value opportunities

- Repurposing decommissioned containers for modular hoapplying and infrastructure projects.

- Growth in nearshoring and reshoring is boosting short-haul container relocatements.

- Adoption of smart containers with IoT tracking for compliance and visibility.

- Expansion of cold-chain logistics for pharmaceuticals and fresh food exports.

Key operational challenges

- Shortage of certified container repair depots, especially in Southern and Eastern Europe.

- Rising steel price volatility is affecting container manufacturing and leasing economics.

- Limited automation adoption at ports due to labor and retrofit constraints.

- Increasing repositioning costs cautilized by depot and repair bottlenecks.

Fastest-growing segments

- High-cube containers: 6.8% CAGR — volumetric efficiency for e-commerce and light goods.

- Refrigerated containers: 9.3% CAGR — pharmaceuticals, food, and biologics.

- Intermodal rail-based containers: quickest growth mode under EU green freight initiatives.

Regional leadership & dynamics

- Netherlands (19.4% share): Europe’s primary container gateway via Port of Rotterdam.

- Germany: strong industrial exports and dense intermodal rail connectivity.

- Spain & Italy: Mediterranean transshipment hubs and cold-chain export growth.

- Rest of Europe: rising regional container flows driven by nearshoring.

What wins commercially

Integrated port–rail–inland depot networks enabling quick container turnaround.

- Compliance with EU sustainability, emissions, and circular-economy regulations.

- Deployment of digital container tracking and IoT-enabled monitoring.

- Flexible fleets optimized for regional, high-frequency container relocatements.

Top strategic question for executives

Invest in intermodal connectivity, smart container technologies, certified repair infrastructure, and sustainable fleet upgrades to align with EU climate policy and shifting regional trade patterns.

Leading players

Maersk · MSC · CMA CGM · Hapag-Lloyd · COSCO Shipping · Evergreen · ONE · ZIM · Textainer · Triton International · Seaco Global · Florens Container Services

Europe Shipping Container Market Size

The europe shipping container market was valued at USD 2.26 billion in 2024, is estimated to reach USD 2.33 billion in 2025, and is projected to reach USD 2.92 billion by 2033, growing at a CAGR of 2.9% from 2025 to 2033.

The shipping container is the deployment, circulation, and management standardised intermodal freight container utilized across maritime, road and rail transport networks within and beyond the European continent. These containers serve as enablers of just-in-time supply chains linking manufacturing hubs with consumer markets. As of 2025, Europe handles approximately 1.7 billion tons of seaborne freight annually, according to Eurostat. As per the European Commission, TEN T Core Network includes 34 major container ports, including Rotterdam and Hamburg, which collectively process more than half of the EUcontainerisedzed cargo. Environmental regulations are increasingly shaping container logistics as the EU’s Fit for 55 package mandates a forty% reduction in maritime transport emissions by 2030 compared to 2015 levels. These structural and regulatory dynamics position the shipping container not merely as a cargo unit but as a linchpin of Europe’s sustainable and integrated freight ecosystem.

MARKET DRIVERS

Expansion of E-Commerce Drives Demand for Containerised Logistics

The rapid growth of cross-border e-commerce has intensified reliance on standardised container transport for predictable and scalable delivery operations. The expansion of e-commerce is substantially propelling the growth of Europe shipping container market. This surge necessitates high-frequency containerised shipments from centralised fulfilment centres in logistics hubs like the Netherlands and Poland to regional distribution points. DHL Supply Chain reported that e-commerce-related container volumes entering the Port of Rotterdam rose by 33% in 2024 compared to the previous year. Retailers such as Zalando and ASOS now operate dedicated container trains between Asian manufacturing clusters and inland European warehoutilizes to maintain inventory velocity. The European Retail Round Table estimates that all cross-border e-commerce parcels in the EU originate from goods shipped in 220-footequivalent units. Furthermore, the necessary for temperature-controlled and secure containers has grown as consumers order perishable and high-value goods online. This digital commerce wave transforms containers from passive cargo carriers into active nodes in responsive digital supply chains.

Shift Toward Intermodal Freight Transportation Reduces Road Depconcludeency

European policy and infrastructure investments are accelerating the transfer of containerised freight from road to rail and short sea shipping to alleviate congestion and meet climate tarobtains. The shift toward intermodal freight transportation reduces road depconcludeency, which is additionally propelling the growth of Europe shipping container market. As per the European Court of Auditors, freight over distances exceeding 300 kilometres in the EU still travels by road despite rail being 3 times more energy efficient per ton-kilometre. In response, the EU’s Alternative Fuels Infrastructure Regulation mandates that all TEN-T rail corridors must support electric and automated container shuttles by 2030. The Port of Hamburg reported that rail-borne container volumes increased by 21% in 2024, driven by new dedicated freight corridors to Prague and Vienna. Similarly, the Mediterranean Short Sea Shipping Corridor now relocates many containers annually between Spain, Italy, and Greece, applying low-emission vessels, according to the European Maritime Safety Agency.

MARKET RESTRAINTS

Regulatory Pressure on Container Emissions and Materials Restricts Flexibility

Stringent EU environmental directives are imposing new constraints on container design usage and conclude-of-life management that challenge traditional logistics models. The regulatory pressure oncontainer emissions and materials is quietly degrading the growth of Europe shipping container market. The European Chemicals Agency has classified certain anti-corrosion coatings utilized in container manufacturing as substances of very great concern under REACH regulation,s requiring costly reformulation. Additionally, the EU Packaging and Packaging Waste Regulation proposed in 2023 includes provisions for reusable transport packaging, which may compel operators to retrofit containers with tracking and return mechanisms. According to the European Container Owners Association, the current European container fleet was manufactured before 2020 and lacks the structural features necessaryed for circular reutilize systems. Certification under the new EU EcoDesign for Sustainable Products Regulation will require containers to disclose embedded carbon and recyclability metrics by 2027. This regulatory layer increases compliance complexity and capital expconcludeiture, particularly for tinyer leasing companies.

Port Congestion andLabourrr Disruptions Delay Container Turnaround

Persistent operational bottlenecks at major European gateways continue to disrupt container fluidity and increase dwell times. This factor is also hampering the growth of tEuropeanope shipping container market. In 2024, the Port of Rotterdam recorded an average container turnaround time of 58 hours, up from 42 hours in 2022, due to chronic shortages of certified crane operators and customs inspectors, according to the study. Similarly, intermittent strikes by dockworkers in Antwerp and Barcelona during peak seasons cautilized container backlog surges, as documented by the European Transport Workers Federation. These delays cascade through inland networks as rail and truck operators face unpredictable pickup windows. Automation efforts remain partial due to union resistance and high retrofit costs, ts with less than 15% of quay cranes in southern Europe equipped with remote operation capabilities.

MARKET OPPORTUNITIES

Repurposing Containers for Modular Infrastructure Unlocks Alternative Revenue

The surplus and aging container inventory in Europe is increasingly being converted into sustainable modular structures for hoapplying, ing health, care and educ, whichation, which is attributed to bolstering new opportunities for the growth of Europe shipping container market. According to the European Construction Sector Observatory, many decommissioned shipping containers were repurposed in the EU in 2024 for social infrastructure projects. In Spain, the Minisattempt of Hoapplying approved a program applying refurbished containers to build temporary shelters for flood-affected communities, reducing deployment time by 60% compared to conventional methods. The Urban Resilience Facility will support container conversion projects that meet Euroclass fire safety and thermal insulation standards. This adaptive reutilize not only addresses waste management concerns but also transforms containers into rapid response assets aligned with circular economy principles.

Growth of Nearshoring Stimulates Regional Container Demand

Reshoring and nearshoring trconcludes are reshaping European trade flows by increasing short-haul container relocatements between neighbouring countries rather than transoceanic routes. The growth of nearshoring stimulates regional container is another attribute leveraging the growth of Europe shipping container market. This shift generates consistent demand for tiny batch container shipments on rail and barge networks connecting industrial zones in Poland, Slovakia, and Romania with Western European assembly plants. The Czech Minisattempt of Indusattempt reported a year-on-year increase in containerised auto parts imports from neighbouring EU states in 2024. Similarly, Turkish container exports to the EU rose by 27%, driven by electronics and textile manufacturers serving just-in-time contracts, according to Eurostat. Thesregionaliseded supply chains favour frequent deployments of 20-foot containers over 40-foot units, optimising for flexibility over volume. This structural realignment sustains container utilisation even as global trade growth moderates.

MARKET CHALLENGES

Shortage of Certified Repair and Depots Limits Container Availability

The certified container maintenance infrastructure across Southern and Eastern Europe is constraining fleet readiness and increasing repositioning costs. The shortage of certified repair and depots limits container availability, which is a significant challenge for the growth of the European shipping container market. According to the International Institute of Container Lessors, fewer than 35 facilities in the EU hold the latest ISO and CSC reinspection certifications required for cross-border container operation. In Greece and Portugal, over 50% of containers arriving from Asia require structural or door seal repairs, but must be trucked over 1000 kilometres to certified depots in Germany or the Netherlands. The European Maritime Safety Agency estimates that this repair bottleneck adds an average of nine days and 22 euros per container to logistics costs. Additionally, the EU’s 2024 Maritime Labour Convention amconcludements mandate enhanced worker safety protocols at repair sites, resulting in temporary closures of non-compliant yards in Italy and Croatia.

Volatility in Steel Prices Affects Container Production and Leasing Economics

Fluctuations in European steel costs directly impact the capital expconcludeiture cycles of container lessors and shipping lines due to themetal-intensivee nature of container manufacturing. Since a standard 220-footdry container contains approximately 2.2 tons of steel, this price surge increased new build costs by over 16%. Major lessors such as Triton International have delayed fleet renewal plans, citing unpredictable input costs while extconcludeing the operational life of existing units beyond the typical 13 year horizon. The European Commission’s Carbon Border Adjustment Mechanism also adds variable tariffs on imported container steel, further distorting procurement economics. This financial uncertainty discourages long term investment in specialised containers, such as those with refrigeration or hazardous material certification, limiting supply responsiveness to emerging demand segments.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Container Size, Container Type, End Use, and Region. |

|

Various Analyses Covered |

Global, Regional, and Counattempt-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

A.P. Moller – Maersk A/S (Maersk Line), Mediterranean Shipping Company S.A. (MSC), CMA CGM Group, Hapag-Lloyd AG, Evergreen Marine Corporation, COSCO Shipping Lines Co., Ltd., Yang Ming Marine Transport Corporation, Ocean Network Express (ONE), ZIM Integrated Shipping Services Ltd., Hamburg Süd (Maersk Group), Kawasaki Kisen Kaisha, Ltd. (K Line), Nippon Yutilizen Kabushiki Kaisha (NYK Line), HMM Co., Ltd., Seaco Global Ltd., Textainer Group Holdings Ltd., Triton International Ltd., CAI International, Inc., Florens Container Services Company Ltd., Singamas Container Holdings Ltd., Dong Fang International Asset Management Ltd. |

SEGMENTAL ANALYSIS

By Container Size Insights

The large containers segment accounted in holding 58.25 of the European shipping container market share in 2024, with its optimal balance of cargo capacity and transport efficiency on deep sea and intermodal routes. A standard 40-foot container can carry nearly double the volume of a 20-foot unit while requiring only marginally more fuel per voyage. As per the survey, 73% of all loaded containers entering the port in 2024 were 40-foot units, reflecting shipper preference for economies of scale. Additionally, European liner operators, such as MSC and CMA, CGM, have optimised their stowage plans to prioritize 40 foot slots on vessels serving Asia and Europe trade lanes. The European Commission’s Green Freight Corridors initiative also favours larger containers as they reduce emissions per ton-kilometre by up to 22% compared to tinyer alternatives, according to the European Environment Agency. These operational, economic, ic and environmental advantages solidify tforty-footoot container as the backbone of Europe’s containerised logistics.

The high cube containers segment is likely to witness the quickest CAGR of 6.8% throughout the forecast period. This expansion stems from rising demand for volumetric efficiency in lightweight but bulky cargo, such as furniture, automotive parts ane-commercece goods. According to Eurostat, over 46% of European imports from Southeast Asia in 2024 consisted of low-density consumer products, where cube utilisation outweighs weight constraints. Major retailers, including IKEA and Decathlon,n have mandated high cube containers for inbound shipments to maximise pallet stacking. The Port of Antwerp noted a 31% year on year increase in high cube handling volume in 2024, driven by e-commerce fulfilment centres in Belgium and the Netherlands. Additionally, new EU rail gauge clearance upgrades under the TEN-T program now accommodate high cube containers on all major North-South corridors, enabling seamless intermodality. These structural and commercial shifts position high cube units as the preferred choice for modern just-in-time supply chains.

By Container Type Insights

The dry storage containers segment was the largest by holding a prominent share of the European shipping container market in 2024, due to its versatility, suitability for non-perishable general cargoes,o and compatibility with global handling infrastructure. Nearlyall manufactured goods, including electronic, machinery, textile and packaged consumer products, are transported in dry containers due to theirweatherproofproof, and corner fittings. Furthermore, dry containers are the most cost-effective to produce, maintain,n and depot with lifecycle costs up to 40% lower thaspecialiseded variants, as per the source. Their modular design also enables straightforward repurposing for temporary storage or construction utilizes when retired from maritime service.

The refrigerated containers segment is likely to grow at the quickest CAGR of 9.3% from 2025 to 2033 by escalating demand for temperature-controlled transport of pharmaceuticals, perishable food,s and biologics. The European Commission’s Farm to Fork Strategy aims to reduce food waste by 20,30 requiring robust cold chain integrity from origin to retail. As a result, reefer container imports of fresh produce into the EU rose in 2024 compared to 2022, as stated by Eurostat. Pharmaceutical logistics temperature-sensitive vaccine shipments are now shifting in active refrigerated containers. Ports like Zeebrugge and Algeciras have expanded reefer plug capacity since 2023 to accommodate this growth. Additionally, new EU regulations mandate real-time temperature logging for all medical shipments, further accelerating the adoption of smart reefer units with IoT connectivity.

COUNTRY LEVEL ANALYSIS

Netherlands Shipping Container Market Analysis

The Netherlands was the top performer of the European shipping container market by holding 19.4% of the share in 2024, with the Port of Rotterdam,m which handled over fifteen million TEUs in 20,24 creating it the busiest container port in Europe. The counattempt serves as Europe’s premier logistics gate,w with all containers entering the EU transiting through Dutch terminals before onward distribution via b,,arge rail, and truck. The government’s National Logistics Agconcludea has invested 2.3 billion euros since 2022 in inland waterway upgrades and automated container stacking yards. Additionally, the Netherlands hosts Europe’s largest refrigerated container hub with over 25000 reefer plugs at Maasvlakte II.

Germany Shipping Container Market Analysis

Germany’s shipping container market is likely to experience significant growth opportunities in the coming years. Over 70% of Germany’s containerised exports originate from industrial clusters, which are directly connected to the ports of Hamburg and Bremerhaven via dedicated rail shuttles. In 2024, Hamburg processed over 9 million TEUs with a 22% increase in high cube container volumes driven by automotive spare parts exports. The German government’s “Logistics 2030” initiative has allocated 1.8 billion euros to expand intermodal terminals along the Rhine corridor. Additionally, Germany leads in container depot density with over 120 certified repair facilities ensuring high fleet availability. This integration of production, transport,t and maintenance infrastructure cements Germany’s central role in European container flows.

Spain Shipping Container Market Analysis

Spain’s shipping container market growth is likely to grow with the strategic location as the southern gateway to Europe, with major ports in Algeciras, Valencia, and Barcelona handling transhipmenttraffic between Asia t, the Americas and Northern Europe. The government’s Spain Logistics 2025 Plan has upgraded rail links between ports and Madrid, Zaragoza, and Bilbao to support nearshoring. Additionally, Spanish ports are adopting digital twin technology to optimise container yard operation, reducing truck turnaround time by up to 30%.

Italy Shipping Container Market Analysis

Italy’s shipping container market growth is driven by the activity centred on the ports of Gioia Tauro, La Spezia, and Genoa, which toobtainher handled over 7 million TEUs in 2024. Italy’transhipmentt node for Mediterranean trade, with over 60% of containers destined for Southern and Eastern Europe passing through Italian terminals. A key growth driver is the expansion of cold chain logistics for its premium food export,s including wine, cheese, and olive oil, which require temperature-controlled containers. Additionally, Italy is investing in the Tyrrhenian Corridor to improve rail connectivity between ports and industrial zones in Milan and Turin. The Port of Trieste is also emerging as a gateway for Central European trade with dedicated container trains to Austria and Hungary.

COMPETITIVE LANDSCAPE

Competition in theEuropeane shipping container market is defined by a convergence of logistical efficiency, regulatory cocompliance and sustainability leadership. Global carriers such as Maer,s SkMSC and CMA CGM dominate through integrated port terminal and inland transport networks but face growing pressure to align with Europe’s green and digital agconcludeas. Differentiation increasingly hinges on the ability to ofconclude-to-conclude conclude visibility, carbon-transparent services, and flexible container solutions for regionalised supply chains. Smaller regional operators compete by specialising in niche corridors or container types such as refrigerated or modular units. Regulatory frameworks, including the EU Fit for 55 package and Packaging Waste Regulation,s compel all players to innovate in container design, maintenance,e and conclude-of-life management.

KEY MARKET PLAYERS

Some of the companies that are playing a dominating role in the global europe shipping container market include

- Maersk Line (A.P. Moller – Maersk A/S)

- Mediterranean Shipping Company S.A. (MSC)

- CMA CGM Group

- Hapag-Lloyd AG

- Evergreen Marine Corporation (Evergreen Group)

- COSCO Shipping Lines Co., Ltd.

- Yang Ming Marine Transport Corporation

- ONE (Ocean Network Express)

- ZIM Integrated Shipping Services Ltd.

- Hamburg Süd (a Maersk company)

- K Line (Kawasaki Kisen Kaisha, Ltd.)

- NYK Line (Nippon Yutilizen Kabushiki Kaisha)

- HMM Co., Ltd. (formerly Hyundai Merchant Marine)

- Seaco Global Ltd.

- Textainer Group Holdings Ltd.

- Triton International Ltd.

- CAI International, Inc.

- Florens Container Services Company Ltd.

- Singamas Container Holdings Ltd.

- Dong Fang International Asset Management Ltd.

TOP LEADING PLAYERS IN THE MARKET

- Maersk is a leading global integrated logistics company with extensive operations across the European shipping container market. The company manages one of the world’s largest container fleets and provides conclude-to-conclude shipping and logistics solutions connecting European ports with global trade lanes. In recent actions, Maersk has expanded its inland container depot network in Poland and Spain to support nearshoring trconcludes and introduced carbon-neutral container services applying biofuel blconcludes on key Europe-Asia routes. It also launched a digital container tracking platform compliant with EU data sovereignty rules, enhancing supply chain transparency for European shippers. These initiatives reinforce Maersk’s commitment to sustainability, digitalisation,n and regional supply chain resilience within Europe.

- MSC is a major force in the European shipping container market, offering comprehensive container transport and terminal services across the continent. The company operates dedicated services linking Mediterranean and Northern European ports with manufacturing hubs in Asia and the Americas. Recently,y MSC accelerated its investment in European port infrastructure, re including a new container handling facility at the Port of Valencia and a strategic partnership with Deutsche Bahn to boost rail intermodality in Germany. It also introduced a fleet of next-generation containers with embedded IoT sensors for real-time condition monitoring. These relocates strengthen MSC’s ability to deliver reliable, flexible,e and technologically advanced container logistics tailored to European regulatory and commercial expectations.

- CMA CGM plays a pivotal role inthe Europeane shipping container market through its extensive liner services and integrated logistics offerings. Headquartered in France, the companyemphasisess European industrial integration and green logistics. In recent developments, CMA CGM enhanced its container repair and maintenance capabilities at its Rotterdam depot to meet new EU safety standards and launched a fleet of LNG-powered container vessels serving the North Europe Mediterranean corridor. It also partnered with French agricultural cooperatives to develop reusable container solutions for perishable exports.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Key players in the European shipping container market adopt several strategic approaches to maintain a competitive advantage. They are investing in digital container tracking and Internet of Things-enabled monitoring to enhance cargo visibility and comply with EU transparency mandates. Companies are expanding inland depot and rail intermodal networks to support modal shift and nearshoring supply chains. Sustainability is central with initiatives including biofuel adoption, container lightweighting,g and circular reutilize programs. Strategic partnerships with national rail operators, port authorities, and industrial clusters strengthen regional integration. Additionally, firms are retrofitting container fleets to meet evolving EU safety, environmental anddata governance standards,s ensuring long term operational compliance and customer trust.

MARKET SEGMENTATION

This research report on the europe shipping container market is segmented and sub-segmented into the following categories

By Container Size

- Small Containers (20 ft)

- Large Containers (40 ft)

- High Cube Containers

By Container Type

- Dry Storage Containers

- Refrigerated Containers

- Tank Containers

- Special Purpose Containers

By End Use

- Food & Beverages

- Consumer Goods

- Healthcare & Pharmaceuticals

- Industrial Products

- Automotive

- Others

By Counattempt

- Netherlands

- Germany

- Spain

- Italy

- France

- Rest of Europe

Leave a Reply